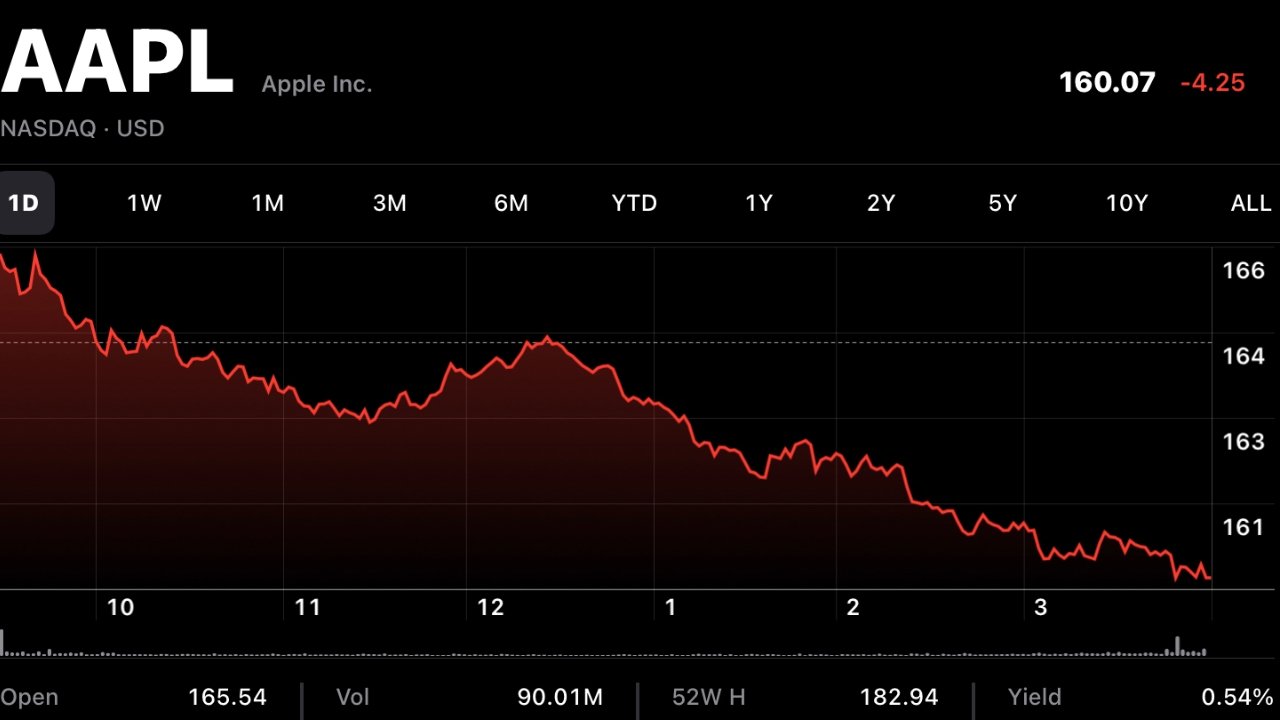

Apple & Big Tech stocks hammered overnight as Russian invasion breeds uncertainty

The Russian invasion of Ukraine has sparked a "Black Swan" event in the stock market, and a sell-off of Apple, other big tech stocks, and Bitcoin is continuing on Thursday morning.

AAPL tumbles upon Russia invasion news

As the United States and Europe prepare to launch more sanctions against Russia, the stock market is seeing the effects of the invasion. Any stock belonging to futures indexes like Dow or NASDAQ are seeing a big impact due to what is likely an approaching bear market.

Apple saw its stocks open around 2.6% down, which is in line with the drop in NASDAQ. Microsoft and Amazon both opened around 3% down as well, but Google is seeing a less drastic drop at about 1.5%.

There is also the potential effects of sanctions on Russia. If the United States government forbids any hardware or software sale to Russia, it will impact any company that does business in the country. For example, Apple wouldn't be able to sell the iPhone, provide operating system updates, or continue managing the App Store.

Sanctions go beyond consumer goods, it would mean that companies like TSMC, Samsung, and other semiconductor manufacturers would no longer be able to do business in Russia with any products made on US soil or in other markets with sanctions. This could lead to a spike in prices to cover a loss in business with an entire country, trickling down to consumer goods.

After the stock open, Apple sits at 3.3% down with a declining trend and heavy trade volume. This is in line with expectations as the greater market decreases at a slower rate, with NASDAQ down only 2.3%. Apple has bled its gains after its blockbuster earnings report in the last five days.

Microsoft and Amazon have seen a slight correction at market open, both around 1.3% down. Google remains strong at 0.6% down and increasing.

Big tech is not the only thing that has been impacted. While not at its low for the year, Bitcoin saw losses of about 6% overnight on the news.

Read on AppleInsider

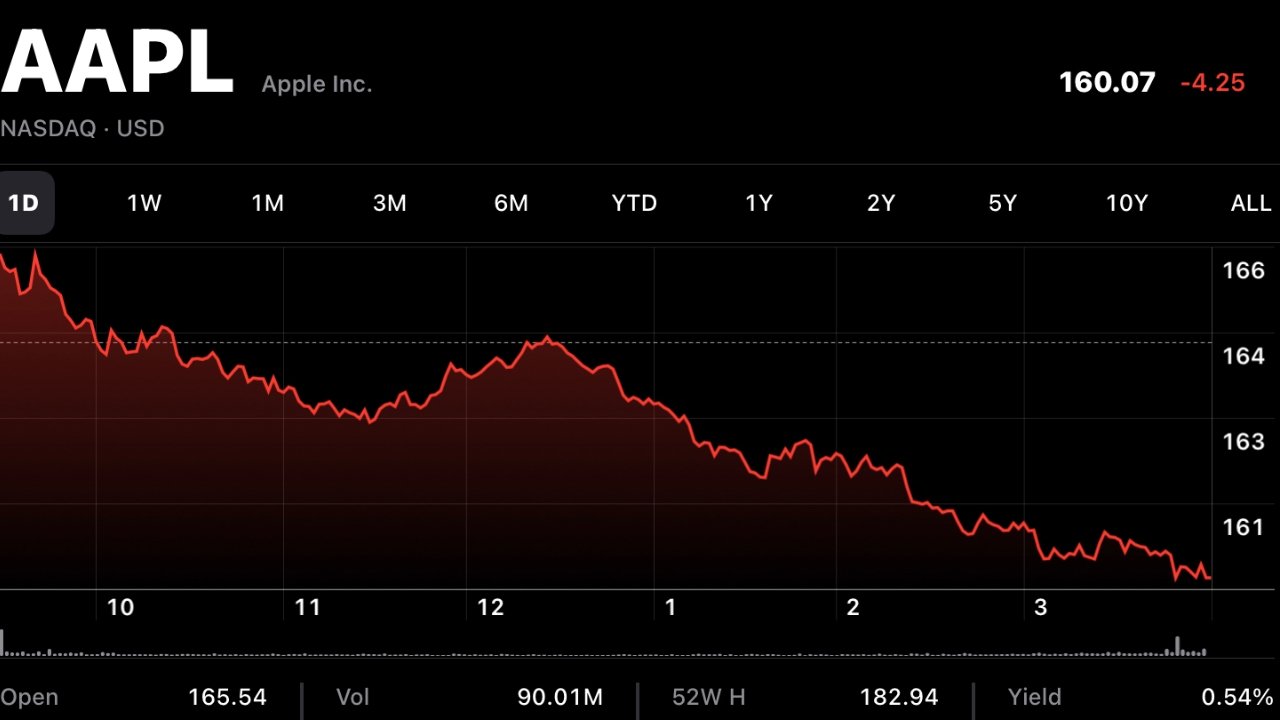

AAPL tumbles upon Russia invasion news

As the United States and Europe prepare to launch more sanctions against Russia, the stock market is seeing the effects of the invasion. Any stock belonging to futures indexes like Dow or NASDAQ are seeing a big impact due to what is likely an approaching bear market.

Apple saw its stocks open around 2.6% down, which is in line with the drop in NASDAQ. Microsoft and Amazon both opened around 3% down as well, but Google is seeing a less drastic drop at about 1.5%.

There is also the potential effects of sanctions on Russia. If the United States government forbids any hardware or software sale to Russia, it will impact any company that does business in the country. For example, Apple wouldn't be able to sell the iPhone, provide operating system updates, or continue managing the App Store.

Sanctions go beyond consumer goods, it would mean that companies like TSMC, Samsung, and other semiconductor manufacturers would no longer be able to do business in Russia with any products made on US soil or in other markets with sanctions. This could lead to a spike in prices to cover a loss in business with an entire country, trickling down to consumer goods.

After the stock open, Apple sits at 3.3% down with a declining trend and heavy trade volume. This is in line with expectations as the greater market decreases at a slower rate, with NASDAQ down only 2.3%. Apple has bled its gains after its blockbuster earnings report in the last five days.

Microsoft and Amazon have seen a slight correction at market open, both around 1.3% down. Google remains strong at 0.6% down and increasing.

Big tech is not the only thing that has been impacted. While not at its low for the year, Bitcoin saw losses of about 6% overnight on the news.

Read on AppleInsider

Comments

If you want to get rich quick, see if you can make any friends who work in blood donation centers in China.

I remember when Bush I argued for bombing the crap out of Iraq, throwing much shit against the wall to see what stuck, Bush I made the point that war against Iraq would mean more American jobs. Of course, the lie of Weapons of Mass Destruction was the biggest pretext, but jobs was up there.

We've been in a constant hot war in the middle east for 3 decades, under Bush I, Bush II, Clinton, Obama, Trump (this is called being at Peace according to American definition).

Now, of course, the war involving Ukraine and Russia (or is it Peace), will benefit the US financially, as American financial system is a safe haven, so billions of dollar will be flowing into the US from outside.

I'm not worried at all. Financially. I'll make out because my investment values will be stable if not increase. War is good for business.