US finance regulator plans 'very careful look' at Apple Pay Later, similar services

The head of the US Consumer Financial Protection Bureau (CFPB) says the agency has concerns about Apple Pay Later and other Big Tech offerings entering the "buy now, pay later" (BNPL) lending business.

CFPB is already examining the BNPL market, with five existing players all now required to submit detailed information to the agency. Now according to the Financial Times, CFPB director Rohit Chopra, says that the regulator will also "have to take a very careful look [at] the implications of Big Tech entering this space."

The publication says that his comments were intended as a warning shot to Silicon Valley, specifically because of Apple's launch of its Apple Pay Later service.

Asked about the Apple launch, Chopra said that the entry of any Big Tech firm into short-term lending "raises a host of issues," particularly around the customer data that gets gathered.

"Is it being combined with browsing history, geolocation history, health data, other apps?" he said. "Big Tech's ambitions when it comes to 'buy now, pay later' are inextricably linked to the desire to dominate the digital wallet."

"Any tech giant that has a lot of control over a mobile operating system is going to have unique advantages to exploit data and ecommerce more broadly," he continued. Any such firm will keep pushing further into financial services, "to gain even deeper insights on consumer behavior."

China is a market that is already dominated by Big Tech firms offering financial services, such as Alipay and WeChat Pay. Chopra said he concerned that such services "intrusively" gain an "extraordinary window" into consumer behavior.

"I generally worry that we are lurching toward that type of system," he said.

The CFPB's initial report into the BNPL market players before Apple's entry, will be published in September.

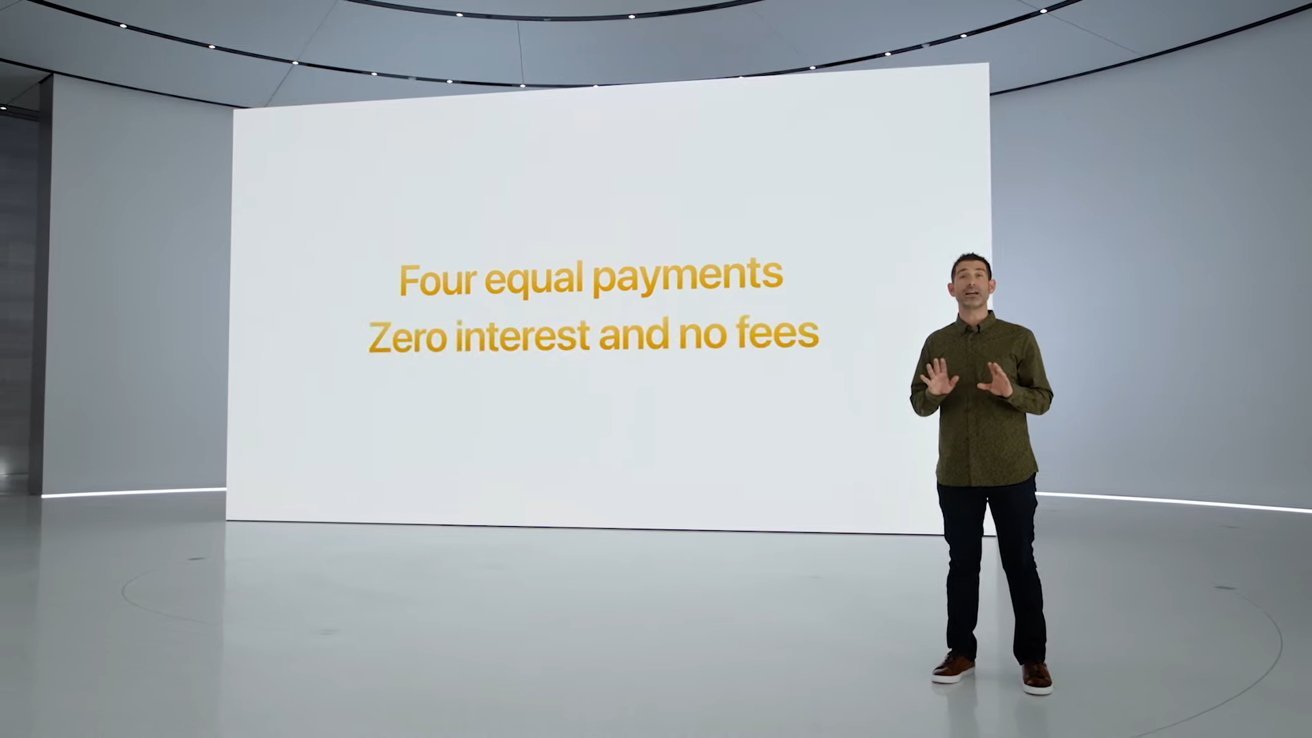

Apple's services has been made part of its Apple Pay offering, with users able to split the cost of a transaction into four payments over six weeks.

Read on AppleInsider

CFPB is already examining the BNPL market, with five existing players all now required to submit detailed information to the agency. Now according to the Financial Times, CFPB director Rohit Chopra, says that the regulator will also "have to take a very careful look [at] the implications of Big Tech entering this space."

The publication says that his comments were intended as a warning shot to Silicon Valley, specifically because of Apple's launch of its Apple Pay Later service.

Asked about the Apple launch, Chopra said that the entry of any Big Tech firm into short-term lending "raises a host of issues," particularly around the customer data that gets gathered.

"Is it being combined with browsing history, geolocation history, health data, other apps?" he said. "Big Tech's ambitions when it comes to 'buy now, pay later' are inextricably linked to the desire to dominate the digital wallet."

"Any tech giant that has a lot of control over a mobile operating system is going to have unique advantages to exploit data and ecommerce more broadly," he continued. Any such firm will keep pushing further into financial services, "to gain even deeper insights on consumer behavior."

China is a market that is already dominated by Big Tech firms offering financial services, such as Alipay and WeChat Pay. Chopra said he concerned that such services "intrusively" gain an "extraordinary window" into consumer behavior.

"I generally worry that we are lurching toward that type of system," he said.

The CFPB's initial report into the BNPL market players before Apple's entry, will be published in September.

Apple's services has been made part of its Apple Pay offering, with users able to split the cost of a transaction into four payments over six weeks.

Read on AppleInsider

Comments

BNPL may not have late fee policies, return policies, dispute policies.

CFPB points out that BNPL has similar markings to the old lay-away plans, but the difference are while layaway plans were typically used for the infrequent large purchases, BNPL encourages small quick purchases, ill-considered, encouraging accumulated debts.

Apple's offering is likely to be better than other systems as 1) their customer base is on the high end consumer, 2) they know a reasonable amount about their customers Apple debt level, 3) with the Apple Card, they dynamically keep their customers aware in the Wallet how much accumulating debt they have.

I have no idea about the other BNPL companies: Affirm, AfterPay, Klarna, PayPal, Zip, but I doubt their users have the ability track their debt load.

Seriously, every business has to have an advantage by some parameters over the competition, otherwise we wouldn’t need the diversity in business at all. Why is it such a big concern if a company has an advantage? Why? Why? Why?

In this case, does Apple bear the cost for non-payment? I believe the extra zeros in Apple's Trillions of dollars of assets listing covers any losses without any percentage change.

Actually not. Your account and balance is shared with the credit agencies. Your individual loans are not.

This is also why escrow for homeowner's insurance and property taxes is a bad idea. These are generally paid yearly, but escrow accounts generally don't bear interest. Put the insurance and property tax payments into an interest-bearing account instead. You'll accumulate interest on the partial payments the whole time until you pull the money out to pay the bill.

Bingo. We've learned over millennia that when left to their own devices, companies offering financial services revert to deeply unethical behavior. Combine that with just how many tech companies' main innovation seems to be a depth-first algorithm for finding all the laws they can break before someone stops them (Airbnb, Uber, Lyft, WeWork). Regulators are absolutely right to be concerned.

They are included in the article headline;

They are included in the body of the article;

Something similar currently exists in AAA gaming Apple will end doing the same thing rolling up it’s sleeves. (Note: when it happens the crying will ensue from the existing players in the gaming industry).