Breaking down Apple's tricky, 'gravity defying' $83 billion June quarter

Apple again beat Wall Street expectations despite a tough macroeconomic environment and supply chain issues. Here's what analysts thought after the call, and how the earnings compare to pre-pandemic Apple.

Financial header image

The iPhone maker reported $83 billion in revenue, a 2% year-over-year increase. The company's Q3 2022 revenue also came in slightly ahead of Wall Street's consensus, which was closer to the $81 billion to $82 billion range.

Although Apple's Q3 2022 revenue was only 2% higher than the year-ago quarter, it still marked record-breaking revenue and the Cupertino tech giant's best June quarter yet.

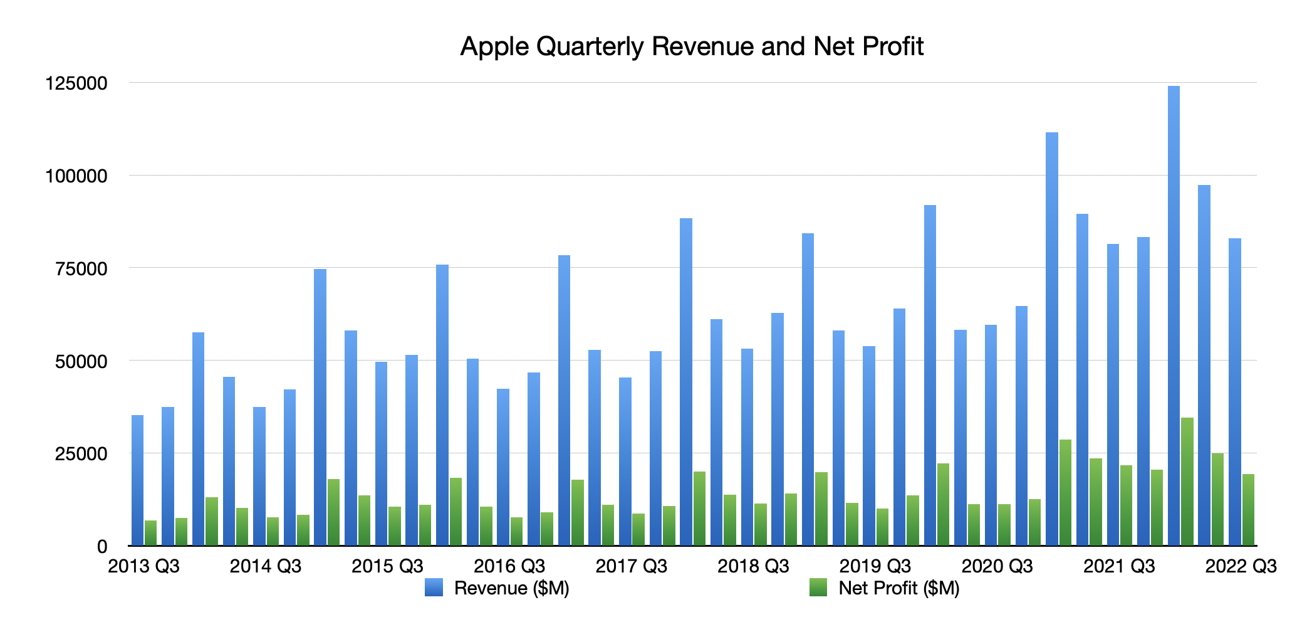

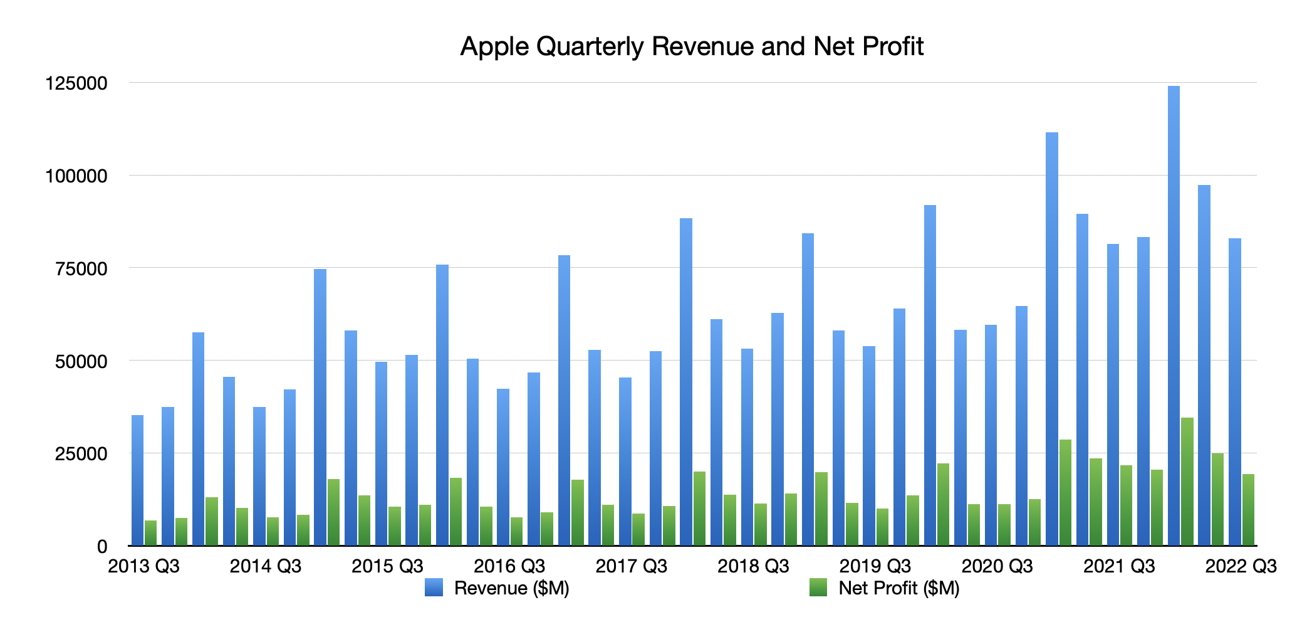

Apple quarterly revenue and net profit.

Net profit took a slight dip to $19.4 billion, down from $21.7 billion in Q3 2021.

Importantly, supply headwinds that Apple warned about earlier in 2022 came in lower than it expected. Apple had warned of a $4 billion to $8 billion revenue hit because of ongoing chip shortages and Covid-related lockdowns in China.

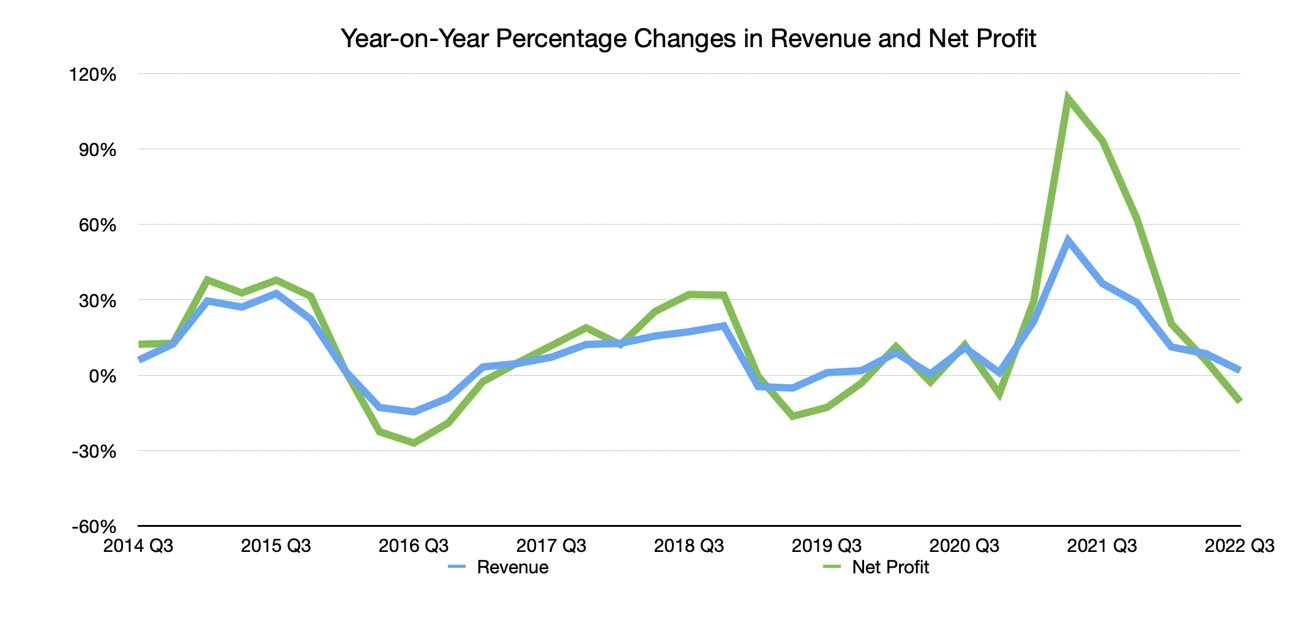

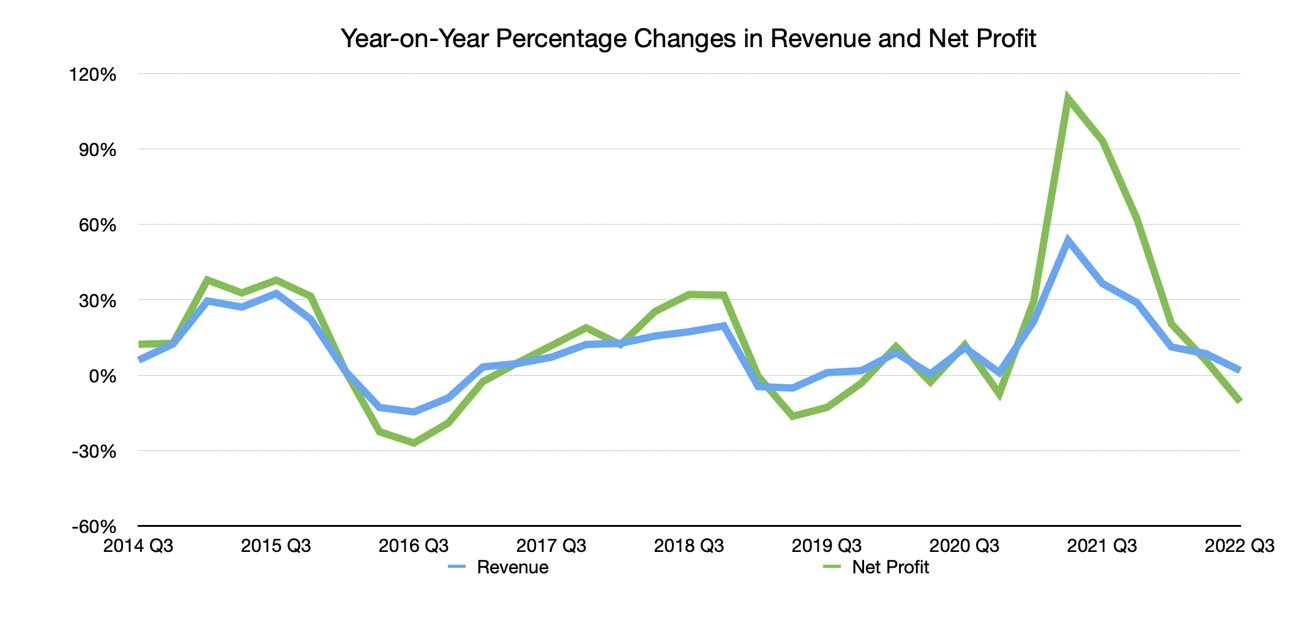

Year-on-year change in Apple revenue and net profit

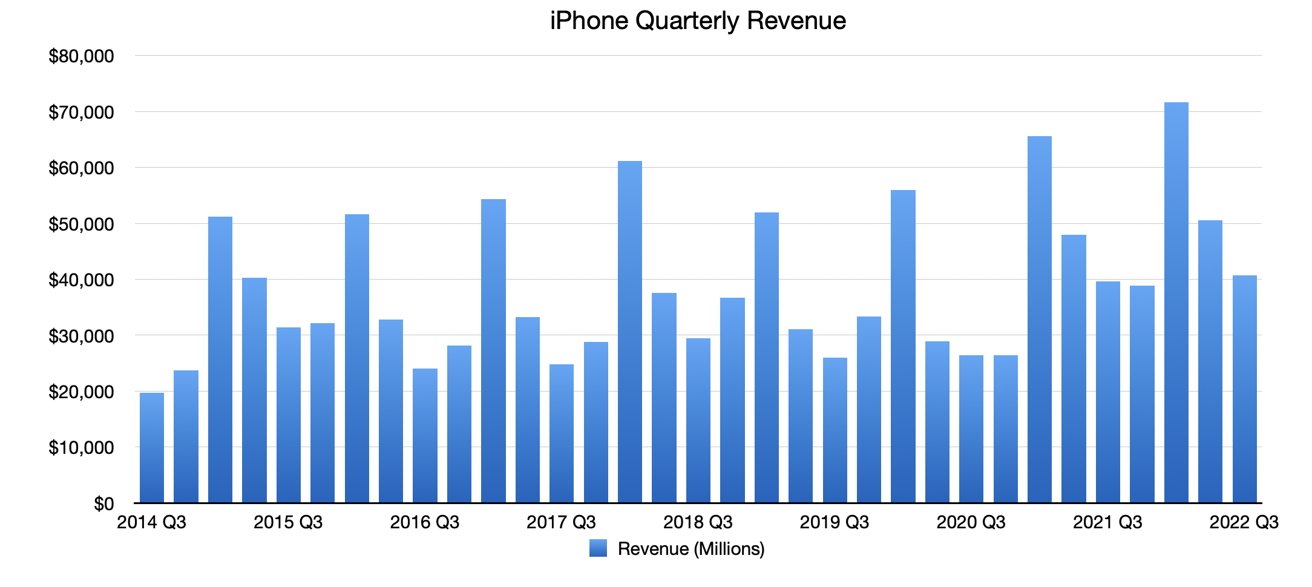

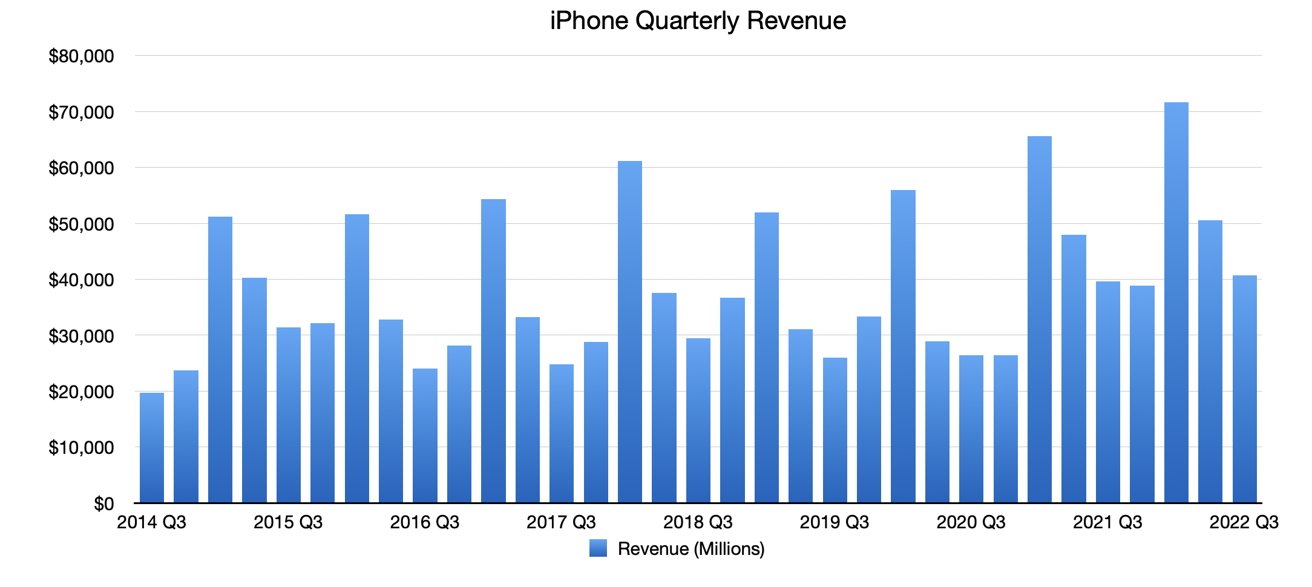

Apple's iPhone maintained its revenue dominance in the June quarter, raking in $40.6 billion in revenue compared to $39.5 billion in Q3 2021.

Quarterly iPhone revenue

The company's other products -- including the Mac and iPad -- were more severely impacted by chip constraints and supply issues.

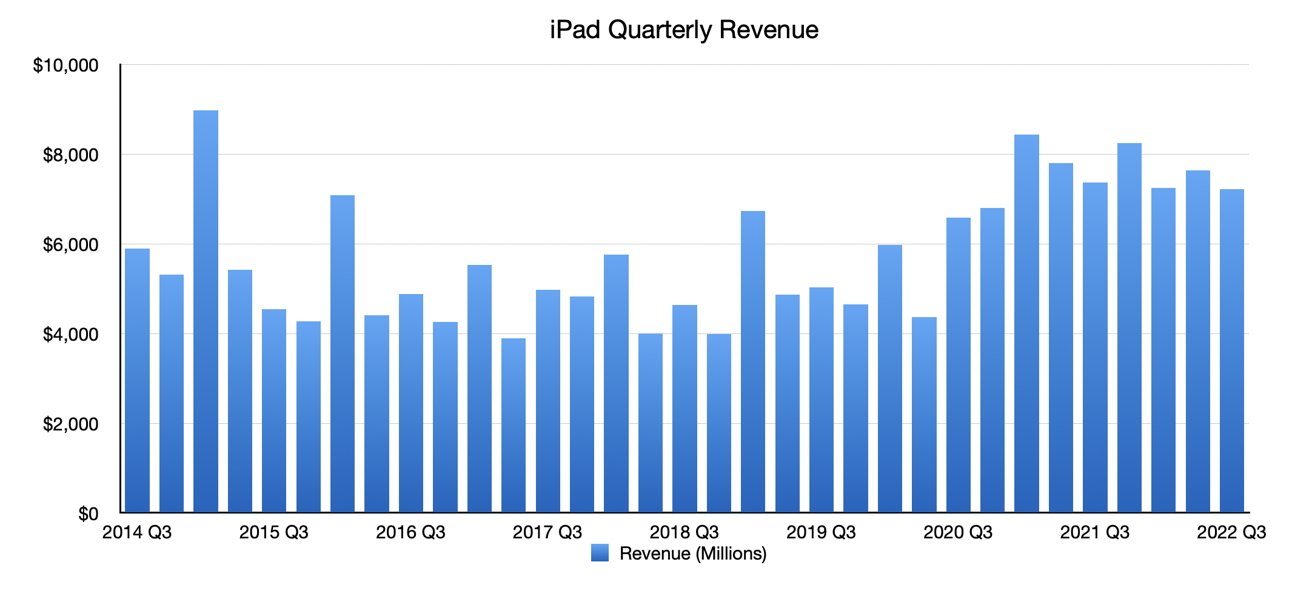

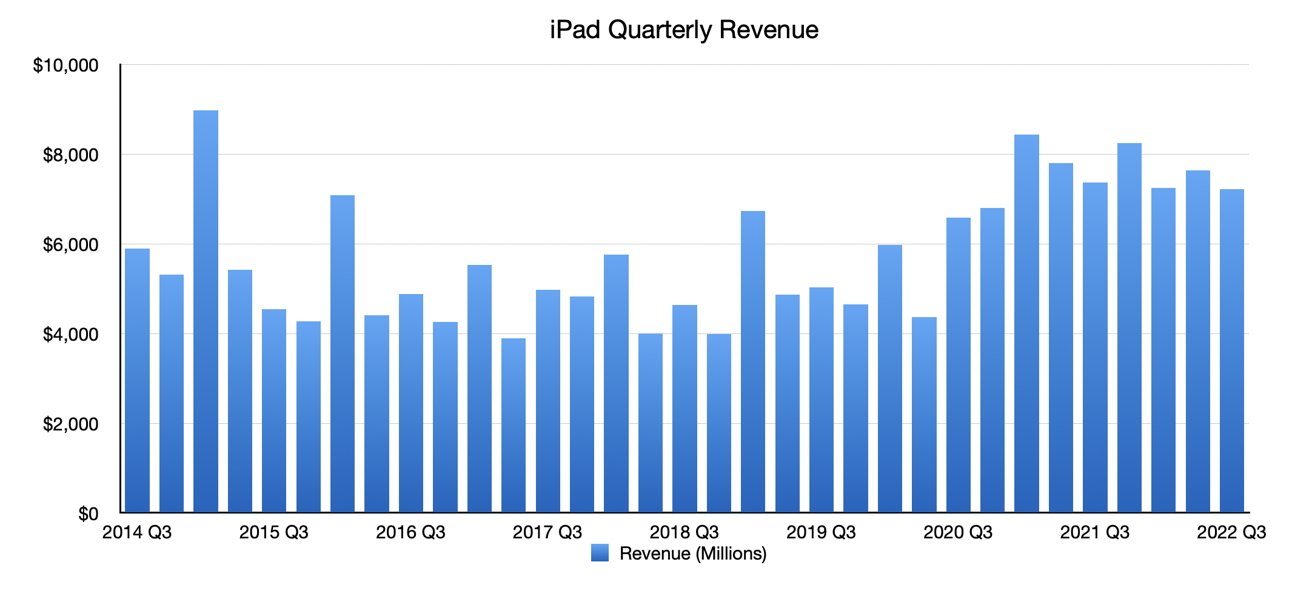

The iPad dropped to $7.2 billion in revenue, only a slight decrease from $7.3 billion in Q3 2021.

Quarterly iPad revenue

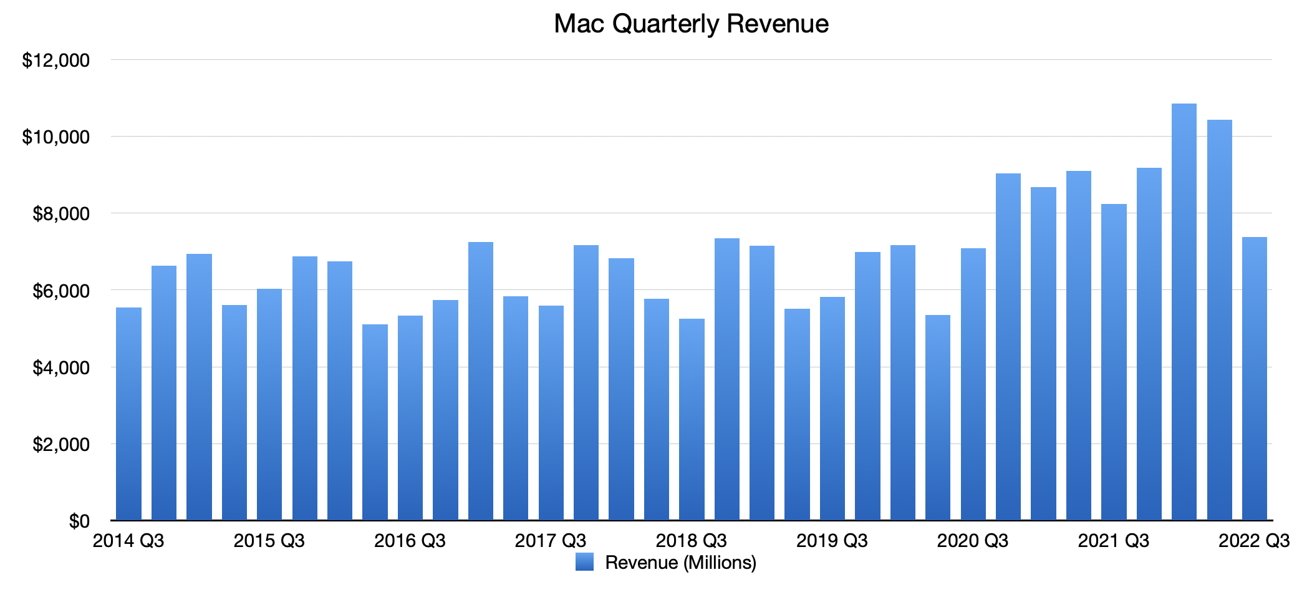

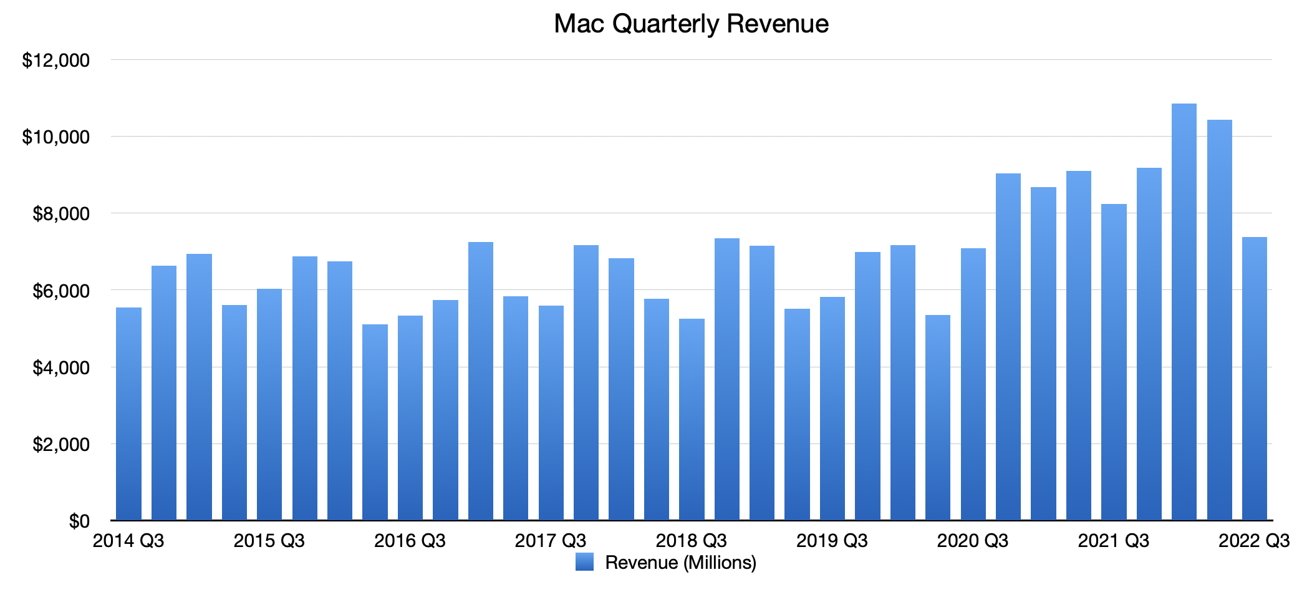

Apple's Mac category dropped to $7.3 billion in revenue, down from $8.2 billion in the year-ago quarter.

Quarterly Mac revenue.

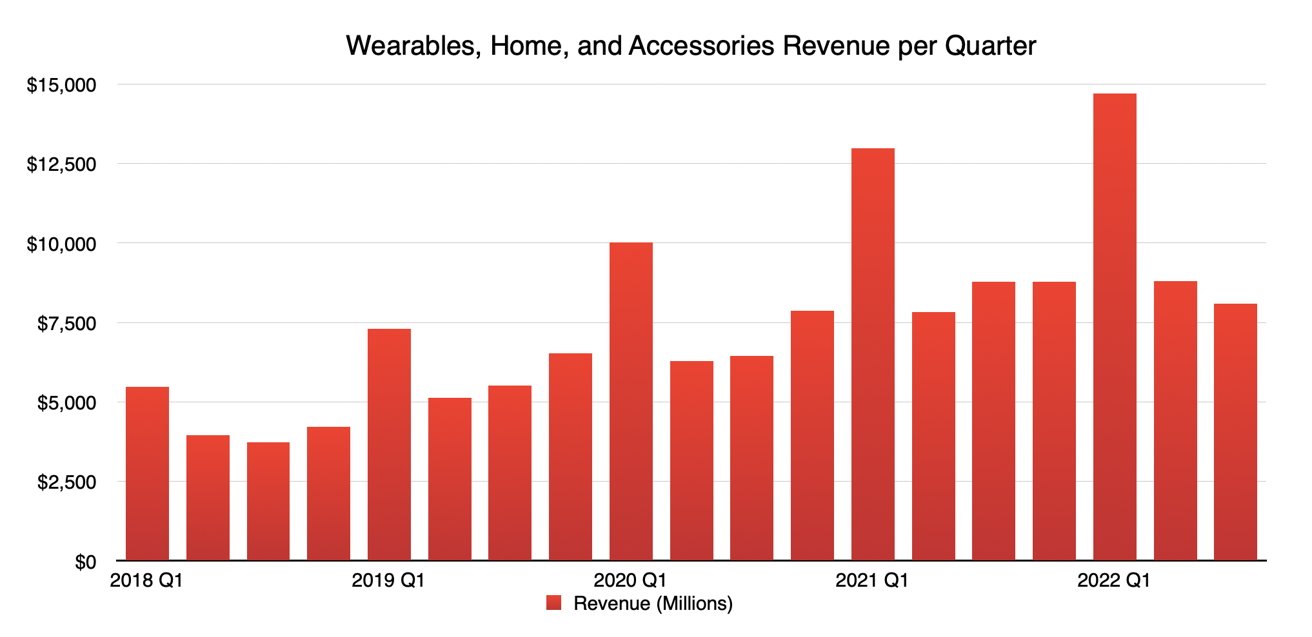

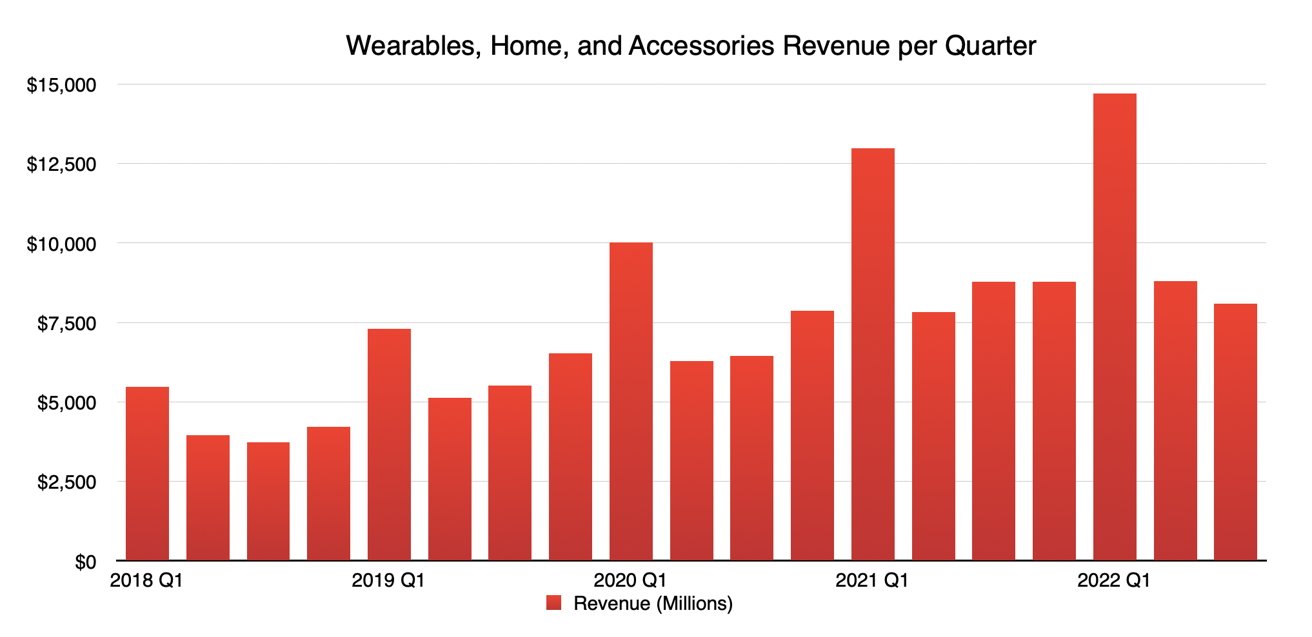

As far as Wearables, Home, and Accessories, Apple saw revenue of $8.08 billion in Q3 2022. That's down from $8.7 billion that the category made in Q3 2021.

Quarterly Wearables, Home, and Accessories revenue

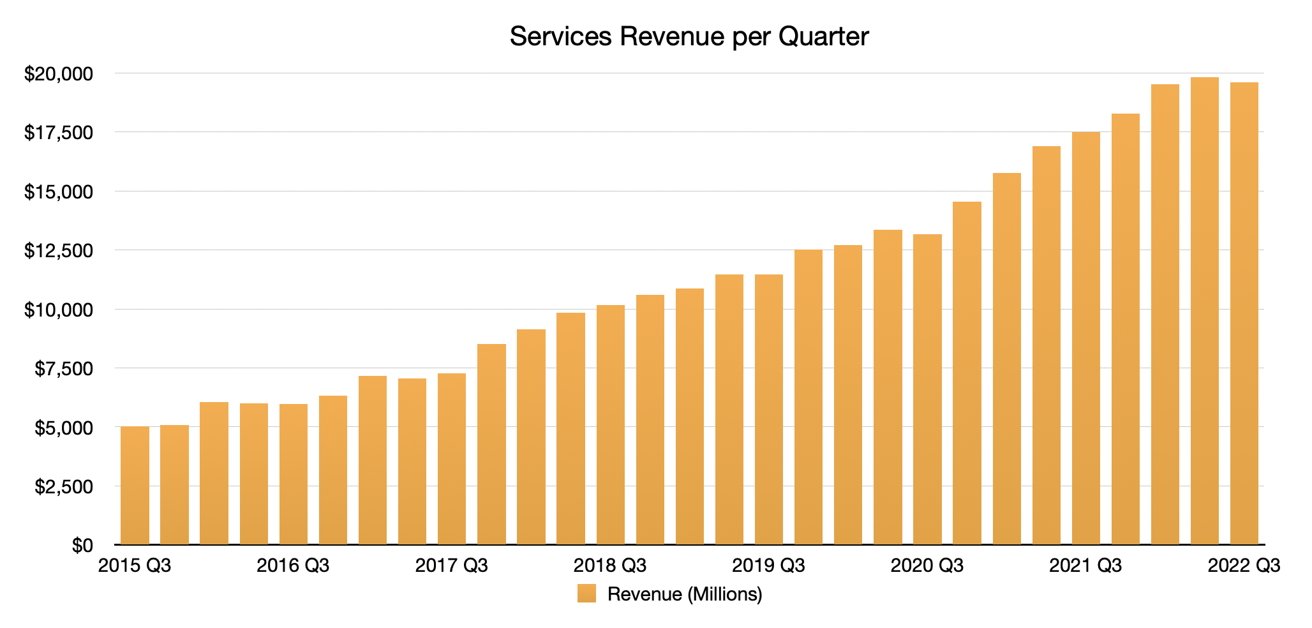

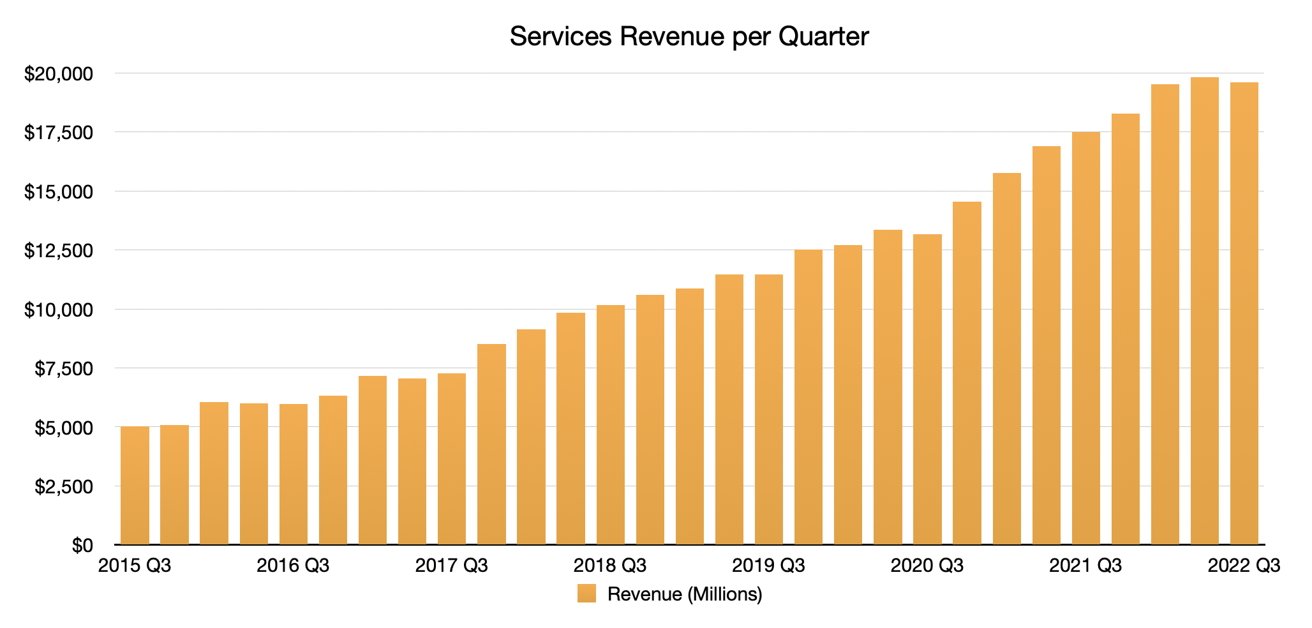

Services continued to be a strong revenue driver. The category brought in $19.6 billion in revenue during the quarter, up year-over-year from $17.4 billion.

Quarterly Services revenue

Here's what analyst thought about Apple's better-than-expected performance.

The analyst believes that Apple continues to be a save haven investment, particularly as iPhone revenues continue to grow and Services maintains its position as a predictable and resilient measure of earnings and revenue for the company.

Chatterjee maintains his 12-month Apple price target of $200.

Ives also spent time focusing on Apple's performance in China. The company made $14.60 billion, down only slightly from $14.76 billion in Q3 2021 despite Covid shutdowns and other constraints. He believes Apple is well-positioned to benefit from a strong installed base over the next six to 12 months.

The analyst maintains his 12-month Apple price target of $200.

Kumar also shines a light on the fact that the current macroeconomic environment has had "no meaningful impact" on Apple's iPhone revenue. Apple also set a record for installed base, which Kumar believes is evidence of brand loyalty and the company's strong performance.

The analyst maintains his 12-month Apple price target of $195.

The analyst has not changed any of his September quarter estimates, and believes that Apple's relatively conservative guidance is justified given the macro environment. He also highlights Apple's gorse margins of 43.3%, which beat out his forecast by 80 basis points and management's guidance of 30 bis points.

Woodring maintains his 12-month Apple price target of $180.

Taking a broader view, Munster believes that Services growth was basically in-line with expectations and that the Mac headwind will be a temporary one. Going forward, he believes Apple's upcoming stacked lineup -- which could include health, AR/VR, and other products -- will be a positive for the company's multiple in future years.

Munster maintains his 12-month Apple price target of $250.

Going forward, the analyst believes that Apple will benefit from abating supply shortages in the September quarter. Although the macro environment provides a modest headwind to Services, he still believes the company will continue to deliver long-term growth.

Sankar maintains his 12-month Apple price target of $200.

Read on AppleInsider

Financial header image

The iPhone maker reported $83 billion in revenue, a 2% year-over-year increase. The company's Q3 2022 revenue also came in slightly ahead of Wall Street's consensus, which was closer to the $81 billion to $82 billion range.

Although Apple's Q3 2022 revenue was only 2% higher than the year-ago quarter, it still marked record-breaking revenue and the Cupertino tech giant's best June quarter yet.

Apple quarterly revenue and net profit.

Net profit took a slight dip to $19.4 billion, down from $21.7 billion in Q3 2021.

Importantly, supply headwinds that Apple warned about earlier in 2022 came in lower than it expected. Apple had warned of a $4 billion to $8 billion revenue hit because of ongoing chip shortages and Covid-related lockdowns in China.

Year-on-year change in Apple revenue and net profit

Apple's iPhone maintained its revenue dominance in the June quarter, raking in $40.6 billion in revenue compared to $39.5 billion in Q3 2021.

Quarterly iPhone revenue

The company's other products -- including the Mac and iPad -- were more severely impacted by chip constraints and supply issues.

The iPad dropped to $7.2 billion in revenue, only a slight decrease from $7.3 billion in Q3 2021.

Quarterly iPad revenue

Apple's Mac category dropped to $7.3 billion in revenue, down from $8.2 billion in the year-ago quarter.

Quarterly Mac revenue.

As far as Wearables, Home, and Accessories, Apple saw revenue of $8.08 billion in Q3 2022. That's down from $8.7 billion that the category made in Q3 2021.

Quarterly Wearables, Home, and Accessories revenue

Services continued to be a strong revenue driver. The category brought in $19.6 billion in revenue during the quarter, up year-over-year from $17.4 billion.

Quarterly Services revenue

Here's what analyst thought about Apple's better-than-expected performance.

Samik Chatterjee, JP Morgan

Samik Chatterjee, lead analyst at JP Morgan, has left his revenue and earnings forecasts largely unchanged in the wake of Apple's solid execution in the June quarter.The analyst believes that Apple continues to be a save haven investment, particularly as iPhone revenues continue to grow and Services maintains its position as a predictable and resilient measure of earnings and revenue for the company.

Chatterjee maintains his 12-month Apple price target of $200.

Dan Ives, Wedbush

Wedbush analyst Daniel Ives believes that Apple gave a performance in "Top Gun Maverick Fashion" during the June quarter. Ives believes that the results will be a focus among tech industry watchers, and is a "major positive" for both Cupertino and beyond.Ives also spent time focusing on Apple's performance in China. The company made $14.60 billion, down only slightly from $14.76 billion in Q3 2021 despite Covid shutdowns and other constraints. He believes Apple is well-positioned to benefit from a strong installed base over the next six to 12 months.

The analyst maintains his 12-month Apple price target of $200.

Harsh Kumar, Piper Sandler

Harsh Kumar of Piper Sandler believes that Apple's results are impressive, and he highlights the fact that Apple believes its other revenue growth will accelerate in the September quarter.Kumar also shines a light on the fact that the current macroeconomic environment has had "no meaningful impact" on Apple's iPhone revenue. Apple also set a record for installed base, which Kumar believes is evidence of brand loyalty and the company's strong performance.

The analyst maintains his 12-month Apple price target of $195.

Erik Woodring, Morgan Stanley

According to Morgan Stanley's Erik Woodring, Apple's iPhone and Services segments were more than enough to offset quarterly weakness in the iPad and Mac categories. Overall, he concedes that Apple's June quarter results were better than he expected.The analyst has not changed any of his September quarter estimates, and believes that Apple's relatively conservative guidance is justified given the macro environment. He also highlights Apple's gorse margins of 43.3%, which beat out his forecast by 80 basis points and management's guidance of 30 bis points.

Woodring maintains his 12-month Apple price target of $180.

Gene Munster, Loup Ventures

Gene Munster, an analyst and partner at Loup Ventures, believes that Apple is "defying gravity and powering through the early stages of the macro downturn." He attributes the company's strength to the iPhone, which he believes is now an essential product and not a luxury item.Taking a broader view, Munster believes that Services growth was basically in-line with expectations and that the Mac headwind will be a temporary one. Going forward, he believes Apple's upcoming stacked lineup -- which could include health, AR/VR, and other products -- will be a positive for the company's multiple in future years.

Munster maintains his 12-month Apple price target of $250.

Krish Sankar, Cowen

Krish Sankar highlighted Apple's upside and strong performance during the June quarter -- and its strong iPhone revenue despite a shaky economy. Sankar points out that Apple's performance came amid concerns about the supply chain and smartphone weakness.Going forward, the analyst believes that Apple will benefit from abating supply shortages in the September quarter. Although the macro environment provides a modest headwind to Services, he still believes the company will continue to deliver long-term growth.

Sankar maintains his 12-month Apple price target of $200.

Read on AppleInsider

Comments

https://www.macrumors.com/2022/07/28/apple-860-million-paid-subscribers/

I expect the minimum monthly subscription would be around $5/month. This is around $12b/quarter. Apple said they paid $60b to App Store developers in 2021. This means they made around $25b in fees for the year or roughly $6b/quarter.

860 million is a high number for the content services as it would eclipse Netflix, Spotify and AAA game subscriptions so that number is more likely due to AppleCare+ and iCloud+ taken out with iPhones, iPads and Macs. Apple News is popular too though:

https://appleinsider.com/articles/20/04/30/apple-news-now-has-125-million-monthly-active-users

Paid subs will be less, maybe 25 million. Apple Music passed 60 million subs in 2019, probably 80 million by now. Apple TV+ is likely around 30-40 million. Apple Arcade is unknown but it could easily be 20 million, same with Fitness+. That's a low estimate and adds up to 175 million subs. This would be $2.6b/quarter at $5/m, likely higher as the average subscription will be higher.

Say 1/5th of iPhone users are on AppleCare+, that covers 300 million and similarly 1/5th on iCloud plans. That's 600 million subs.

I'd say breakdown of $20b/q services would be roughly 30% App Store fees ($6b), 45% device services ($9b), 25% software/content services ($5b).

”supply headwinds that Apple warned about earlier in 2022 came in lower than it expected. Apple had warned of a $4 billion to $8 billion revenue hit because of ongoing chip shortages and Covid-related lockdowns in China.”

I believe that Goldman seeds disinformation to throw retail and other investors off. Most of the time when you see a story that quotes Goldman, the investing action they recommend taking is no longer valid or out of date. Their paying customers were given that information long before it was released publicly. Goldman saying Apple is headed to $100 has to be seen as misdirection.

If there was an entity or a person who could "assign" values to shares, that entity or person would be filthy rich in a matter of days.

As an example: I live in a place where both fuel and housing costs (rental as well as mortgage-holders) are some of the highest in the country due to various reasons, including taxes. Housing costs here have increased notably faster than inflation since I moved to the area in 2005. Being single and working in tech enable more budget for housing and fuel than most without such an income. I’m not remotely close to earning top tech wages with my current role. That being said, there are a lot of people (likely more than half the area population) that don’t have as high of an income, and likely are forced to make a devil’s bargain choice of living out where housing costs a bit less but wasting their time in commutes daily that would make a used Toyota Prius the best car for cost-efficiency because you’re often at crawling or dead-stop speeds, or you avoid the commutes for the most part by trying to live closer. I’ve optimized for the latter, also trying to always have as much as I can be walkable for my daily/weekly routines/needs. The gas taxes and prices here as a result don’t make a huge dent in my regular travel budget, but that does compound in especially food price inflation, but as I’m a single person to feed, that still doesn’t hugely stress my budgets, especially since I know how to and do regularly cook my own food. But then you go to a family with (perhaps) more than one car, and all their longer-distance commuting (hard to arrange both working the same shift at the same place) and the food cost multiplied, and their income is already notably lower than mine as a family than mine as an individual, and their available discretionary/disposable spending is greatly reduced and possibly wiped out completely by the inflation, as their jobs likely don’t increase their pay fast enough to keep up. This is a longer-term headwind for a company like Apple that sells a lot of higher-end things that can be made to last longer as needed due to budget concerns, because they’ve not broken down, and are still sufficiently current. Software doesn’t degrade just because it’s old code, unless software is changed either for its code or its operating environment, it is a static and still works. Hardware always degrades, it’s only a matter of timescale and amount of usage, but it’s generally not nearly as fast as the common iPhone refresh cycle (2-3 years for many, others, more frequent, some, longer) and with that, it’s reasonable to expect hardware refresh frequency cycles to be stretched out by the portion of customers most squeezed by inflationary pressures. The fun part of that is even if Apple knew their incomes, I don’t see a way Apple could know enough about their overall finances to accurately forecast that, and that’d be an interesting exercise in statistics to guess at.

I do know this much from the tight margin aspect: the exact numbers have changed, but it’s been around 75-80% of those in the US couldn’t financially handle a $1000 emergency. TBD how long this inflation persists, and if it becomes full-blown stagflation as I remember growing up with, where costs rose faster than income, and lots of financial belt-tightening had to be done.