Apple Pay processes $6 trillion annually, edges out Mastercard

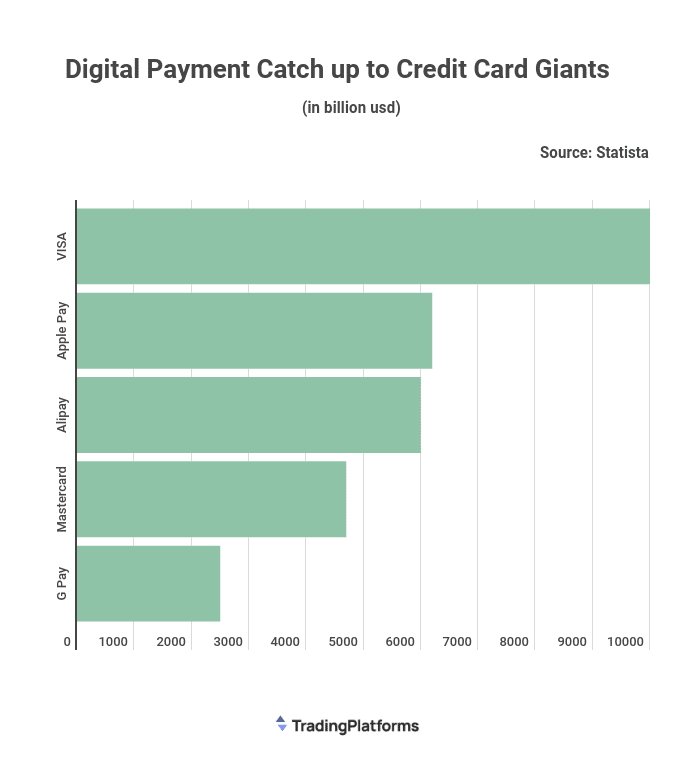

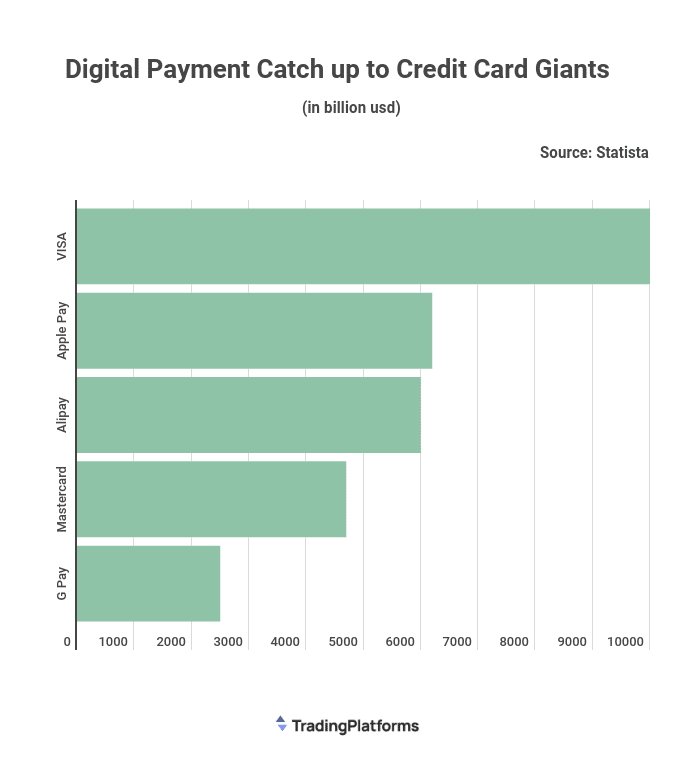

New research claims that Apple Pay has surpassed Mastercard in the dollar value of transactions annually, with its $6 trillion total meaning it's over halfway to equaling Visa.

Since its launch in 2013, Apple Pay has seen rising adoption by users, banks, and retailers, until in 2021 it accounted for 92% of all mobile wallet debit transactions.

Now, according to comparison site TradingPlatforms, Apple Pay is the second most popular digital payment system, beaten only by Visa. The top-ranking Visa processes approximately $10 trillion worth of transactions per year, with Apple Pay on over $6 trillion.

It means that for the first time, Apple Pay has a whole -- including Apple Card -- has overtaken Mastercard, which processes approximately $4.8 trillion worth of transactions. Apple Pay has also beaten Alipay, which reportedly processes exactly $6 trillion worth of transactions.

Google's G Play is said to be in fifth place, with around $2.5 trillion worth of transactions.

"Apple Pay is increasingly becoming the go-to payment method for consumers and businesses alike," said Edith Reads, who is cited as a TradingPlatforms' finance expert. "The fact that it has now processed more transactions than Mastercard is a testament to its popularity."

"Apple Pay has an undue advantage and benefits from their monopoly on iPhone NFC hardware," she continued. "We expect to see Apple Pay continue to grow in popularity and market share in the coming years."

Source: Statista via TradingPlatforms.

The data presented appears to be in the ballpark, at least, given what we know about Apple's financial results and transaction fees. The other companies other than Google are more transparent about transaction volume, and those appear to be approximately correct as well.

On top of that, the description of Apple beating Mastercard is likely to be valid because they and the other three companies appear to have been compared over the same period. However, while the data is said to be via Statista and be drawn from "annual transactions," TradingPlatforms does not specify what period that is.

Consequently, it's not clear from whether this is in the last 12 calendar months, or during some unspecified financial year.

The TradingPlatforms' press release reporting on its research is credited to writer Edith Muthoni. But the LinkedIn page for the finance expert she quotes here and in previous articles, Edith Reads, has the same bio photo that Muthoni uses.

Read on AppleInsider

Since its launch in 2013, Apple Pay has seen rising adoption by users, banks, and retailers, until in 2021 it accounted for 92% of all mobile wallet debit transactions.

Now, according to comparison site TradingPlatforms, Apple Pay is the second most popular digital payment system, beaten only by Visa. The top-ranking Visa processes approximately $10 trillion worth of transactions per year, with Apple Pay on over $6 trillion.

It means that for the first time, Apple Pay has a whole -- including Apple Card -- has overtaken Mastercard, which processes approximately $4.8 trillion worth of transactions. Apple Pay has also beaten Alipay, which reportedly processes exactly $6 trillion worth of transactions.

Google's G Play is said to be in fifth place, with around $2.5 trillion worth of transactions.

"Apple Pay is increasingly becoming the go-to payment method for consumers and businesses alike," said Edith Reads, who is cited as a TradingPlatforms' finance expert. "The fact that it has now processed more transactions than Mastercard is a testament to its popularity."

"Apple Pay has an undue advantage and benefits from their monopoly on iPhone NFC hardware," she continued. "We expect to see Apple Pay continue to grow in popularity and market share in the coming years."

Source: Statista via TradingPlatforms.

The data presented appears to be in the ballpark, at least, given what we know about Apple's financial results and transaction fees. The other companies other than Google are more transparent about transaction volume, and those appear to be approximately correct as well.

On top of that, the description of Apple beating Mastercard is likely to be valid because they and the other three companies appear to have been compared over the same period. However, while the data is said to be via Statista and be drawn from "annual transactions," TradingPlatforms does not specify what period that is.

Consequently, it's not clear from whether this is in the last 12 calendar months, or during some unspecified financial year.

The TradingPlatforms' press release reporting on its research is credited to writer Edith Muthoni. But the LinkedIn page for the finance expert she quotes here and in previous articles, Edith Reads, has the same bio photo that Muthoni uses.

Read on AppleInsider

Comments

Apple Pay sits on top of Mastercard, Visa and other processing network. Apple does not do any processing

https://www.federalreserve.gov/paymentsystems/fednow_about.htm

I have no idea how FedNow will affect credit card systems like Apple Pay, MasterCard, Visa, if any. But, I'm sure the issues will be addressed as the implementation date approaches.

(You'd really need to add In Discover, Amex, JCB, and Union Pay to the total to get the real denominator)

Read below

Once again a USA government granted monopoly the market isn’t open, however Apple may one day stick a pin in it, but today ain’t that day….

Both Visa and Mastercard go far above and beyond Apple in any market Apple is in they are in fact a monopoly.

Debit card swipe fee price fixing[edit]

Both Mastercard and Visa have paid approximately $3 billion in damages resulting from a class-action lawsuit filed in January 1996.[33] The litigation cites several retail giants as plaintiffs, including Wal-Mart, Sears, Roebuck & Co., and Safeway.[34]

Antitrust settlement with U.S. Justice Department[edit]

In October 2010, Mastercard and Visa reached a settlement with the U.S. Justice Department in another antitrust case. The companies agreed to allow merchants displaying their logos to decline certain types of cards (because interchange feesdiffer), or to offer consumers discounts for using cheaper cards.[35]

Payment card interchange fee and merchant discount antitrust litigation[edit]

On November 27, 2012, a federal judge entered an order granting preliminary approval to a proposed settlement to a class-action lawsuit[36] filed in 2005 by merchants and trade associations against Mastercard and Visa. The suit was filed due to alleged price-fixing practices employed by Mastercard and Visa. About one-fourth of the named class plaintiffs have decided to opt-out of the settlement. Opponents object to provisions that would bar future lawsuits and prevent merchants from opting out of significant portions of the proposed settlement.[37]

Plaintiffs allege that Visa Inc. and Mastercard fixed interchange fees, also known as swipe fees, that are charged to merchants for the privilege of accepting payment cards. In their complaint, the plaintiffs also alleged that the defendants unfairly interfere with merchants from encouraging customers to use less expensive forms of payment such as lower-cost cards, cash, and checks.[37]

A settlement of $6.24 billion has been reached and a court is scheduled to approve or deny the agreement on November 7, 2019.[38]