Apple-led ARM computer sales resilient, as PC industry declines

New research says that ARM-based computers including Apple Silicon are doing fairly well in a collapsing global PC market, as the market does a slow shift away from Intel-based processors.

Apple began its move to ARM-based M1 and M2 processors in 2020, abandoning Intel and dramatically improving the Mac. Since that launch, ARM has seen a buyout offer proposed then abandoned. Later, an initial public offeringwas proposed and potentially blocked.

ARM is still working toward that possible IPO in 2023. In the meantime Counterpoint Research says that the use of the company's technology is going to increase -- and also be more "resilient" than the rest of the industry.

"The global PC market has been experiencing a demand downtrend after the cooling down of COVID-19 in 2022," wrote the company's William Li in a blog post. "The market saw its shipments decline 15% YoY in 2022 and is expected to see another high single-digit decline in 2023, according to Counterpoint Research's data."

"However," continued Li, "among all the PC sub-sectors, Arm-based laptops are expected to show a comparatively resilient demand throughout the coming quarters thanks to Apple's success with the MacBook series, increasing ecosystem support and vanishing performance gap with x86 offerings."

According to Counterpoint Research, Apple had 90% of the ARM laptop market in 2022. Also, since the launch of Apple Silicon, the market share of ARM-based laptops has grown from 2% to over 12%.

Consequently, says Counterpoint, "Apple's migration to its self-designed CPU has proved to be a shot in the arm for vendors" who had previously been uncertain about "developing Arm-based solutions."

Based on their existing work with ARM in smartphones, Counterpoint expects Qualcomm and MediaTek to deliver on their expressed interest in the technology.

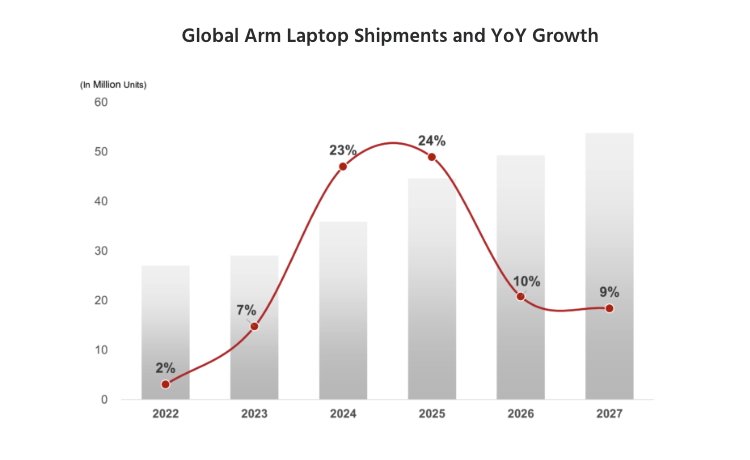

"The two chip design giants are expected to launch ARM-based laptop solutions no later than 2024," says the research company. "We expect Qualcomm and MediaTek's solutions to see over 50% growth YoY on ARM laptops in 2024-2025."

Global ARM shipments. Source: Counterpoint Research

"Based on our forecasts, we believe Arm could ultimately take around 25% share of the laptop market by the end of 2027," writes Li. "On the other hand, as the largest vendor in the PC market, Intel will suffer the most, losing almost 10% share to Arm solutions in five years."

"But it will still dominate the PC market with over 60% share," he concludes.

As late as September 2022, Intel was still blustering that it hopes to get Apple back despite the success of Apple Silicon. However, that came after the news in August 2022 that -- aside from the Mac Pro -- Apple has now removed all traces of Intel products in its devices.

Read on AppleInsider

Apple began its move to ARM-based M1 and M2 processors in 2020, abandoning Intel and dramatically improving the Mac. Since that launch, ARM has seen a buyout offer proposed then abandoned. Later, an initial public offeringwas proposed and potentially blocked.

ARM is still working toward that possible IPO in 2023. In the meantime Counterpoint Research says that the use of the company's technology is going to increase -- and also be more "resilient" than the rest of the industry.

"The global PC market has been experiencing a demand downtrend after the cooling down of COVID-19 in 2022," wrote the company's William Li in a blog post. "The market saw its shipments decline 15% YoY in 2022 and is expected to see another high single-digit decline in 2023, according to Counterpoint Research's data."

"However," continued Li, "among all the PC sub-sectors, Arm-based laptops are expected to show a comparatively resilient demand throughout the coming quarters thanks to Apple's success with the MacBook series, increasing ecosystem support and vanishing performance gap with x86 offerings."

According to Counterpoint Research, Apple had 90% of the ARM laptop market in 2022. Also, since the launch of Apple Silicon, the market share of ARM-based laptops has grown from 2% to over 12%.

Consequently, says Counterpoint, "Apple's migration to its self-designed CPU has proved to be a shot in the arm for vendors" who had previously been uncertain about "developing Arm-based solutions."

Based on their existing work with ARM in smartphones, Counterpoint expects Qualcomm and MediaTek to deliver on their expressed interest in the technology.

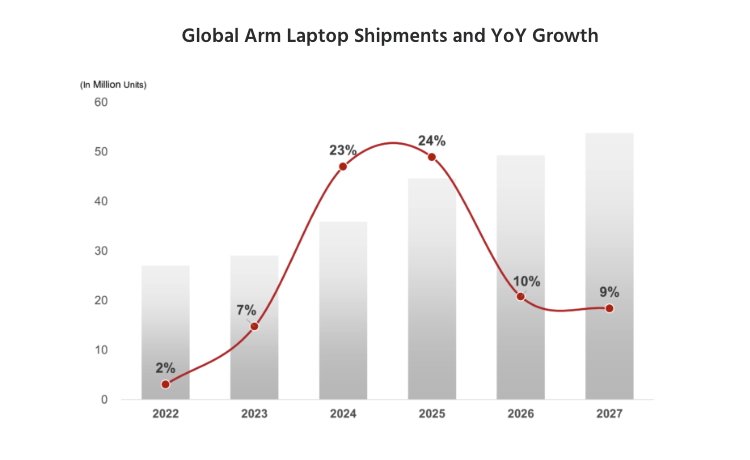

"The two chip design giants are expected to launch ARM-based laptop solutions no later than 2024," says the research company. "We expect Qualcomm and MediaTek's solutions to see over 50% growth YoY on ARM laptops in 2024-2025."

Global ARM shipments. Source: Counterpoint Research

The future of ARM-based laptops

Counterpoint notes that the global PC market "exited the expansion cycle in 2022," or in other words that sales are now going to decline. This means that any market share gained by ARM devices "will inevitably come at the expense of mainly two other vendors in the market -- Intel and AMD.""Based on our forecasts, we believe Arm could ultimately take around 25% share of the laptop market by the end of 2027," writes Li. "On the other hand, as the largest vendor in the PC market, Intel will suffer the most, losing almost 10% share to Arm solutions in five years."

"But it will still dominate the PC market with over 60% share," he concludes.

As late as September 2022, Intel was still blustering that it hopes to get Apple back despite the success of Apple Silicon. However, that came after the news in August 2022 that -- aside from the Mac Pro -- Apple has now removed all traces of Intel products in its devices.

Read on AppleInsider

Comments

I had the same thought with this sentence...

Just like the high end custom big iron processors of yesteryear were replaced by the plucky Intel utilitarian CPU the

move to high efficient processing platforms has eradicated the need for high wattage CPU.

The chasm between productivity computing and gaming has never been larger. The gaming sector alone is propping up

Dinosaurs like ATX cases, replete with numerous fans.

Businesses are well covered by SFF computing (NUC and the like). Intel has been counseled for years about the need to

field a strong ARM competitor and they've just not enough headway.

I'm honestly more excited about the Raspberry Pi 5 (whenever it comes out) than I am about Intel's latest CPU releases (I know sample size but heh)

Meanwhile, Qualcomm has the Nuvia tech, which (if they ever ship a product with it) could also give Intel fits both in benchmarks and in actual product design.

Intel's best hope is to recapture process leadership and beat TSMC in the high-end foundry space. x86 is a dead man walking.

Maybe Microsoft hasn't pushed it too enthusiastically, but that's probably because the performance hasn't been there. Microsoft has no desire to lose more share to the Mac and I'm sure they will continue to support Windows on ARM. Now.... they might not support it with the same focus and intensity as Apple support MacOS, since obviously Apple is all-in on ARM in a way that Microsoft never will be. But still, I bet they'll support it enough to make it viable. Maybe the big question is games....

Obviously, given the state of the world, sales will slant towards laptops (work from home, mobile office, etc.) though this trend isn’t new. Also, people are going to be more picky about how they spend their diminishing purchasing power. A computer is an important tool for most people, so it might not be an expense they can skip, but they’ll be looking more at foundational needs, quality, & longevity. Apple delivers a lot of that (if they don’t lose on software compatibility).

It's about the nature of computing. For laptops especially, but for all portable computing devices, users want

- Low weight

- Long battery life

- Enough processing power to do what they want

- Applications to enable what they want

The x86 and Windows world has only focussed on the last two items, being somewhat sensitive to device weight but indifferent to battery life. Apple has for several decades prioritised battery life and weight, being more likely to compromise on the processing power and application availability.The difference for laptops is that they remain at the mercy of enterprise IT - which for a period of time was able to declare that all computing devices needed to fit a particular set of behaviours so that they could cost-effectively manage them. The popularity of iOS devices has meant that the tools corporate IT relies upon have had to evolve to support iOS and now macOS, which means IT departments have fewer excuses to not support Apple devices.

The fact that the chip architecture of Macs is now ARM rather than x86 is less important than the growing acceptance of Apple devices in the corporate world and the growing recognition by the Wintel crowd that factors other than raw performance are more important to end users, and that end users provide the demand and are thus more important than the suppliers. If this situation continues, then yes we could well see some growth in "ARM-powered" laptops from manufacturers other than Apple and the x86 market share reducing.

But it's not about reducing all this to a simple check-box, of making it a feature list that manufacturers should be paying attention to. It's about recognising the customer needs and predicting where that puck will be in a little while.

Much of the non-Microsoft apps for Windows are games, and those developers are moving to cross-platform Unity or Unreal Engine. Those games COULD be ported to Windows Arm, but with Qualcomm's current Arm chips, why bother? Gamers won't buy Windows Arm devices until they're faster and cheaper than AMD and Nvidia.