In 2022, the European smartphone market hit its lowest point in a decade

Researchers claim that as smartphone shipments drastically declined in Europe in 2022, the iPhone 14 was Apple's weakest seller since 2012's iPhone 5.

iPhone 14 (left) and the iPhone 14 Pro (right)

Counterpoint Research previously described 2021 as a rollercoaster year in smartphone sales, but at least Apple hit its highest European market share then. But now in its latest research, the company reports EU smartphone shipments in 2022 were bad for all manufacturers, including Apple.

The research claims that overall, the EU smartphone market declined by 17% in 2022 compared to 2021. About 176 million smartphones were shipped in the year, which is the lowest total since 2012.

"Yes, the traditional Christmas boost meant quarterly shipments increased compared to Q3, but consumer demand remained muted," said Jan Stryjak, Counterpoint Research associate director. "Apple's usual strong end to the year was weaker than expected, allowing Samsung to maintain its leadership of the European market."

Nonetheless, says Counterpoint, despite Apple's iPhone 14 seeing the weakest EU launch for a decade, it still helped smartphone shipments overall grow by 6% in Q4 2022, compared to Q32022. It's not clear if the researchers mean the iPhone 14 itself, or the entire annual lineup including the iPhone 14 Pro family, and the iPhone 14 Plus.

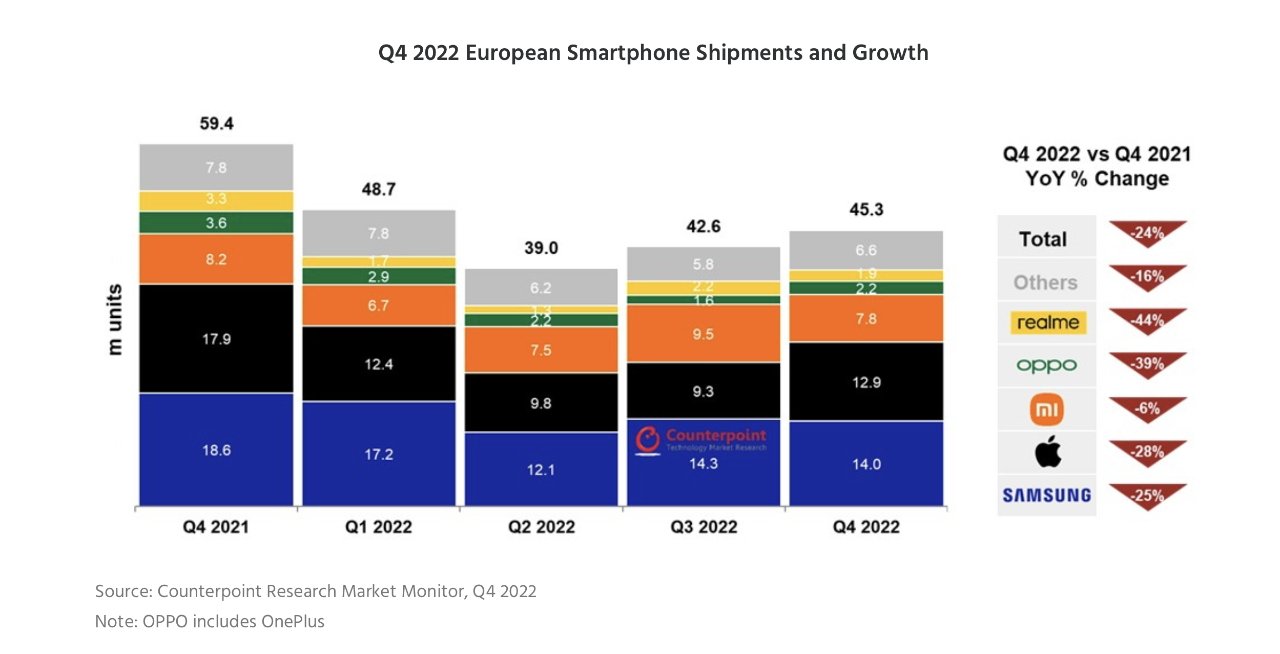

Q4 2022 saw some improvement, but not enough to lift the year. Source: Counterpoint

Stryjak ascribes the overall falling shipment numbers to how "there was no let up for European consumers in Q4 as the cost of living remained at record levels."

Initially, things are not likely to improve as Stryjak says that "the challenging macro climate and ongoing geopolitical tensions will continue into 2023 and potentially get worse initially as the cost-of-living crisis deepens through Winter."

Counterpoint expects the first half of 2023 to see "weakened consumer demand and high inventory levels," especially as "some countries are likely to fall into recession."

"However, inflation has stabilised and wholesale energy prices have dropped, leading to hopes of interest rate and energy bill cuts later in the year," says Stryjak. "This should boost consumer confidence and spur demand, leading to a better second half of the year."

Read on AppleInsider

iPhone 14 (left) and the iPhone 14 Pro (right)

Counterpoint Research previously described 2021 as a rollercoaster year in smartphone sales, but at least Apple hit its highest European market share then. But now in its latest research, the company reports EU smartphone shipments in 2022 were bad for all manufacturers, including Apple.

The research claims that overall, the EU smartphone market declined by 17% in 2022 compared to 2021. About 176 million smartphones were shipped in the year, which is the lowest total since 2012.

"Yes, the traditional Christmas boost meant quarterly shipments increased compared to Q3, but consumer demand remained muted," said Jan Stryjak, Counterpoint Research associate director. "Apple's usual strong end to the year was weaker than expected, allowing Samsung to maintain its leadership of the European market."

Nonetheless, says Counterpoint, despite Apple's iPhone 14 seeing the weakest EU launch for a decade, it still helped smartphone shipments overall grow by 6% in Q4 2022, compared to Q32022. It's not clear if the researchers mean the iPhone 14 itself, or the entire annual lineup including the iPhone 14 Pro family, and the iPhone 14 Plus.

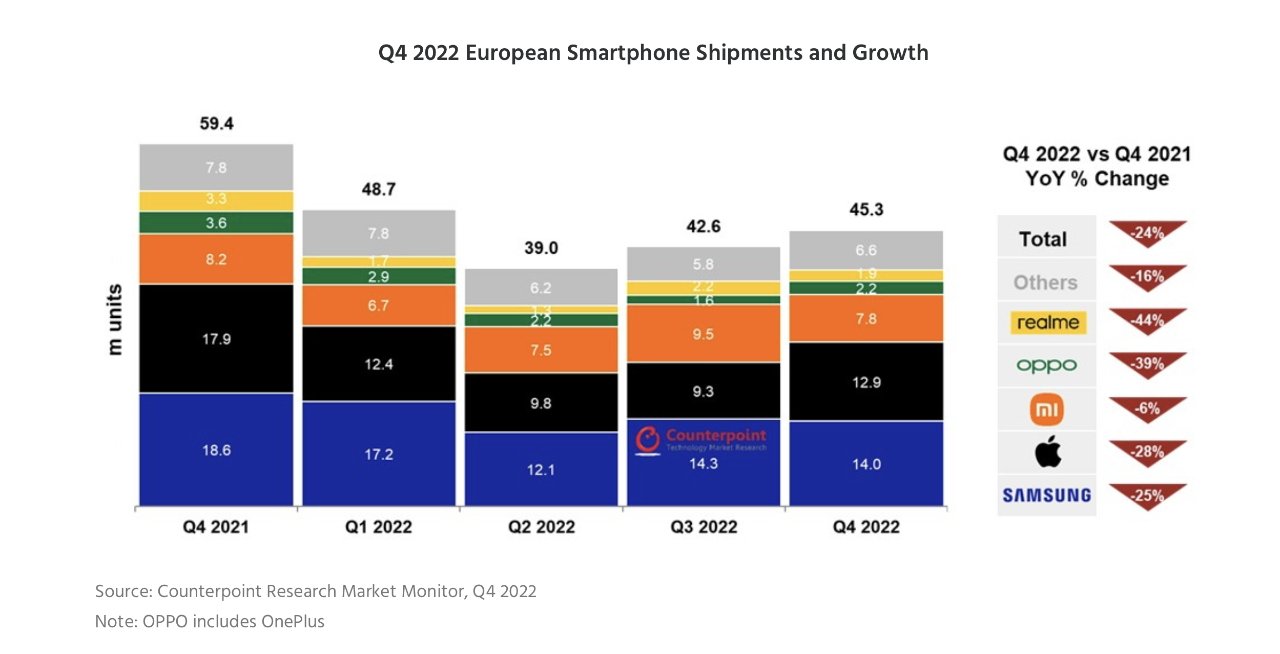

Q4 2022 saw some improvement, but not enough to lift the year. Source: Counterpoint

Stryjak ascribes the overall falling shipment numbers to how "there was no let up for European consumers in Q4 as the cost of living remained at record levels."

Initially, things are not likely to improve as Stryjak says that "the challenging macro climate and ongoing geopolitical tensions will continue into 2023 and potentially get worse initially as the cost-of-living crisis deepens through Winter."

Counterpoint expects the first half of 2023 to see "weakened consumer demand and high inventory levels," especially as "some countries are likely to fall into recession."

"However, inflation has stabilised and wholesale energy prices have dropped, leading to hopes of interest rate and energy bill cuts later in the year," says Stryjak. "This should boost consumer confidence and spur demand, leading to a better second half of the year."

Read on AppleInsider

Comments

90%+ of users don't really care about camera upgrades

cameras are already better than what most users need

whats the incentive to upgrade?

other than to help apples share price

i Can guarantee you if apple gets over their making it thinner all the time.

and make a slightly thicker phone with double the battery life

they would see more sales

the number one complaint i here all the time (about all phones, not just iPhones) is I wish the battery would last longer

Q1: Revenue up 11 percent year-over-year

Q2: Revenue up nine percent year-over-year

Q3: Revenue up two percent year-over-year

Q4: Revenue up eight percent year-over-year

Do any of you really think Apple could have achieved these results if European sales had plummeted?

The Asian people are , especially Japan, China and Taiwan are where Apple should be focused on

Europeans ( plural, more than one ) are largely cheap Android ground ( What does that mean ? ) anyway ( singular ). Largely stupid, cheap people who somehow are ( plural, more than one ) happy to live under unelected ( no hyphen required ) commie like regulators like the EU?

Asia, especially Japan, China and Taiwan, is ( singular, only one Asia ) where Apple should be focusing on.

Corrected by a dyslexic European, you're welcome.

People buy what they want, if they want Apple they buy it, if they don't then they buy Android.

Who are you to say they are stupid ?

Bearing in mind Europeans invented the mobile phone, and the chips inside them.

However, Bell Labs in the US was working on mobile/cell phones and a network in the late 1960s, and Martin Cooper of Motorola in Chicago actually invented the first Dynatac cell phone in the early 1970s.

As for Steve Jobs and his return to Apple, it wasn't long before this campaign was run, and specifically referring to marketshare:

https://www.macworld.com/article/161179/manifesto.html