iPhone display orders decline 39% year-over-year

A display shipment report from Apple's supply chain shows iPhone 14 display orders decreased sharply when compared to the iPhone 13 in the same timeframe.

iPhone display orders decline YoY

The iPhone 14 release cycle has seen a lot of turbulence thanks to initial supply issues and waning demand into 2023. Despite that, the more expensive pro models are driving sales as customers seek to upgrade.

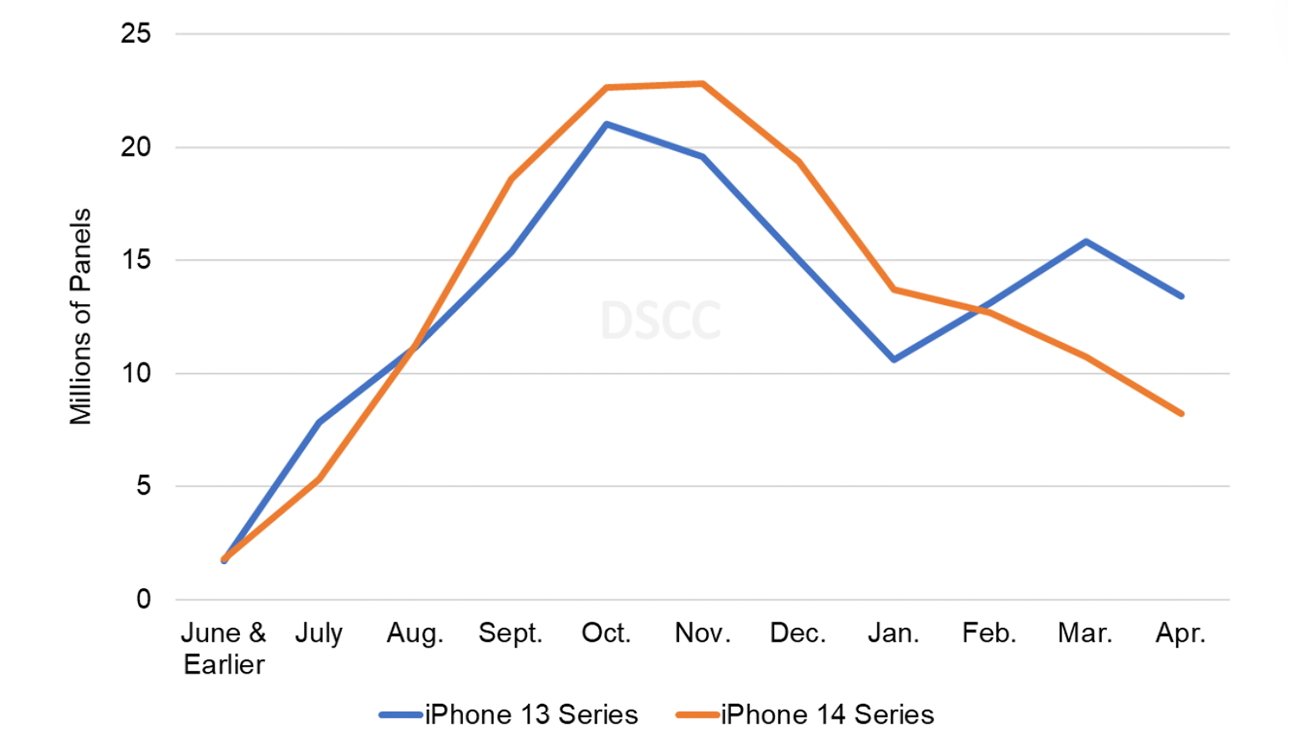

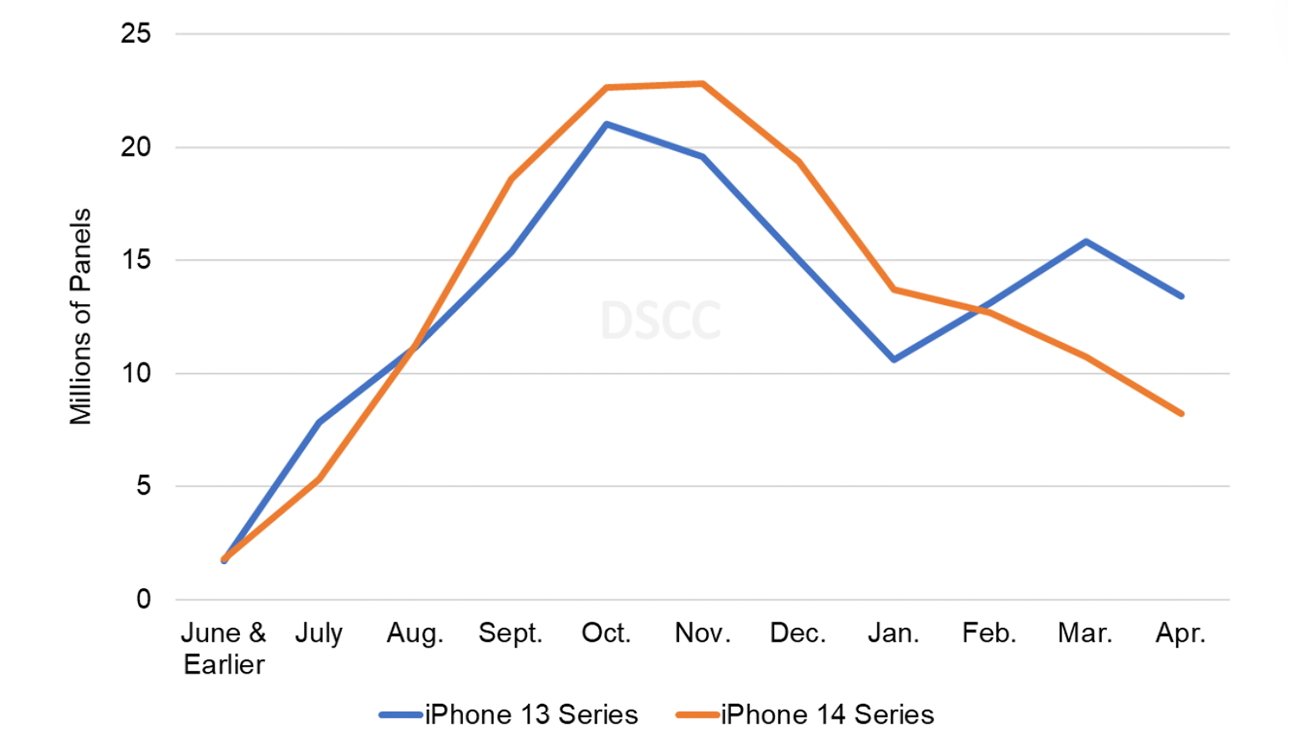

According to a report from Display Supply Chain Consultants, the iPhone 14 series has seen a 39% decline in display orders versus the iPhone 13 through April, year-over-year. Display orders were also down 23% from March to April for the iPhone 14 series.

The report attributes these declines to industry inventory corrections, macroeconomic headwinds, inflationary pressures, and softening demand. The demand outlook also remains weak since Apple guided the March quarter will remain similar to the December quarter.

Breaking down the supply chain report by model shows the iPhone 14 Pro and iPhone 14 Pro Max panel shipments are outperforming the iPhone 13 Pro models by 22% and 23%, respectively. This is due to the higher demand for those models thanks to the improved feature set.

One interesting pull from this data is the iPhone 13 mini versus iPhone 14 Plus. Display shipments for the newer plus model are up 59% by comparison, indicating more demand for that model versus the iPhone 13 mini.

Apple's iPhone 14 Series vs. iPhone 13 Series Procurement Over 11 Months. Source: DSCC

Outside of the macroeconomic conditions and supply chain issues, the first half of the year tends to show weaker demand for iPhones. Sales are usually boosted by Chinese New Year in the first quarter, and a new color released in the second quarter. However, the overall trend for that first half is downward.

Also, individual component shipment information, like what is provided by this report, only provides a snippet of detail. Component orders and product demand may be correlated but not always direct indicators of each other.

For example, if a single supplier sees fewer orders from Apple for a specific component, the supplier might see that as a decrease in demand. What may actually be the case is that Apple could have filled its inventory for that component.

However, it can be useful to gauge trends using supply chain data. Other sources have reported similar trends in iPhone sales and the high demand for pro models.

Read on AppleInsider

iPhone display orders decline YoY

The iPhone 14 release cycle has seen a lot of turbulence thanks to initial supply issues and waning demand into 2023. Despite that, the more expensive pro models are driving sales as customers seek to upgrade.

According to a report from Display Supply Chain Consultants, the iPhone 14 series has seen a 39% decline in display orders versus the iPhone 13 through April, year-over-year. Display orders were also down 23% from March to April for the iPhone 14 series.

The report attributes these declines to industry inventory corrections, macroeconomic headwinds, inflationary pressures, and softening demand. The demand outlook also remains weak since Apple guided the March quarter will remain similar to the December quarter.

Breaking down the supply chain report by model shows the iPhone 14 Pro and iPhone 14 Pro Max panel shipments are outperforming the iPhone 13 Pro models by 22% and 23%, respectively. This is due to the higher demand for those models thanks to the improved feature set.

One interesting pull from this data is the iPhone 13 mini versus iPhone 14 Plus. Display shipments for the newer plus model are up 59% by comparison, indicating more demand for that model versus the iPhone 13 mini.

Apple's iPhone 14 Series vs. iPhone 13 Series Procurement Over 11 Months. Source: DSCC

Outside of the macroeconomic conditions and supply chain issues, the first half of the year tends to show weaker demand for iPhones. Sales are usually boosted by Chinese New Year in the first quarter, and a new color released in the second quarter. However, the overall trend for that first half is downward.

Also, individual component shipment information, like what is provided by this report, only provides a snippet of detail. Component orders and product demand may be correlated but not always direct indicators of each other.

For example, if a single supplier sees fewer orders from Apple for a specific component, the supplier might see that as a decrease in demand. What may actually be the case is that Apple could have filled its inventory for that component.

However, it can be useful to gauge trends using supply chain data. Other sources have reported similar trends in iPhone sales and the high demand for pro models.

Read on AppleInsider

Comments

Some people don't want a larger sized phone, and certainly not most female iPhone lovers, and even many men here in Japan prefer a smaller phone too. And yet, if you ask most people if they could do more with a vastly better camera or some of the fancy features that will be exclusive to the largest sized phones, they would say yes.

So Apple's moves are in the best interest of Apple only, and not really in the best interest of consumers. A consumer oriented line would offer the same great feature set across a wide range of display sizes.

”2% HIGHER”

” As we approach the end of March, our latest survey of supply chain data shows that panel shipments for the iPhone 14 Series are tracking 2% higher than the iPhone 13 Series during the same time period of April – April. This continued decline in growth is the result of weakening demand, inventory corrections and macroeconomic turbulence.”

how does 2% higher translate to a “continued decline”?

It allows the batteries to function at far lower voltages too.

The problem is a different one. Apple's smaller phones are typically its cheaper ones. That isn't where you would expect to see a new battery technology but it isn't for technical reasons, only economic.

Despite that, the one "big" exception to Japan's "love of smallness" rule is when it comes to cars. For the life of me, even though I have lived in Japan since 1994, I cannot figure out why so many young couples with kids in Japan break the smallness-love rule by purchasing Toyota Voxy or Noah or Alphard cars. Those cars are quite large, harder to park in Japan's small parking spaces, and really aren't necessary at all when the average family has only 1 child. I have two children but never had the desire at all to purchase a larger passenger vehicle like that. Then again, we also broke the trend of putting a ridiculous "Baby on Board" sticker on the back of our car too. Our family tends to Think Different. :-)

All said, Japan loves its larger boxy cars, but not necessarily large screen smartphones.