Apple launches Apple Pay Later, but only for selected users

The delayed Apple Pay Later service has begun in the US, with Apple saying it will invite users onto the service which gives them the ability to pay for goods in four installments at 0% interest.

Apple Pay Later was announced in mid-2022, but immediately faced a series of delays. Now Apple has announced that it is introducing the service, but at first it is in a very limited way.

"Starting today, Apple will begin inviting select users to access a prerelease version of Apple Pay Later," said the company in a press release, "with plans to offer it to all eligible users in the coming months."

"There's no one-size-fits-all approach when it comes to how people manage their finances," Jennifer Bailey, Apple's vice president of Apple Pay and Apple Wallet said. "Apple Pay Later was designed with our users' financial health in mind, so it has no fees and no interest, and can be used and managed within Wallet, making it easier for consumers to make informed and responsible borrowing decisions."

Once invited, users can get started with Apple Pay Later by first applying for a loan within the Wallet app. The loan application does not affect a user's credit score, and if approved they will then see the Pay Later option whenever they use Apple Pay.

The users invited on to what Apple is calling "early access to a prerelease version of Apple Pay Later," are to be selected randomly.

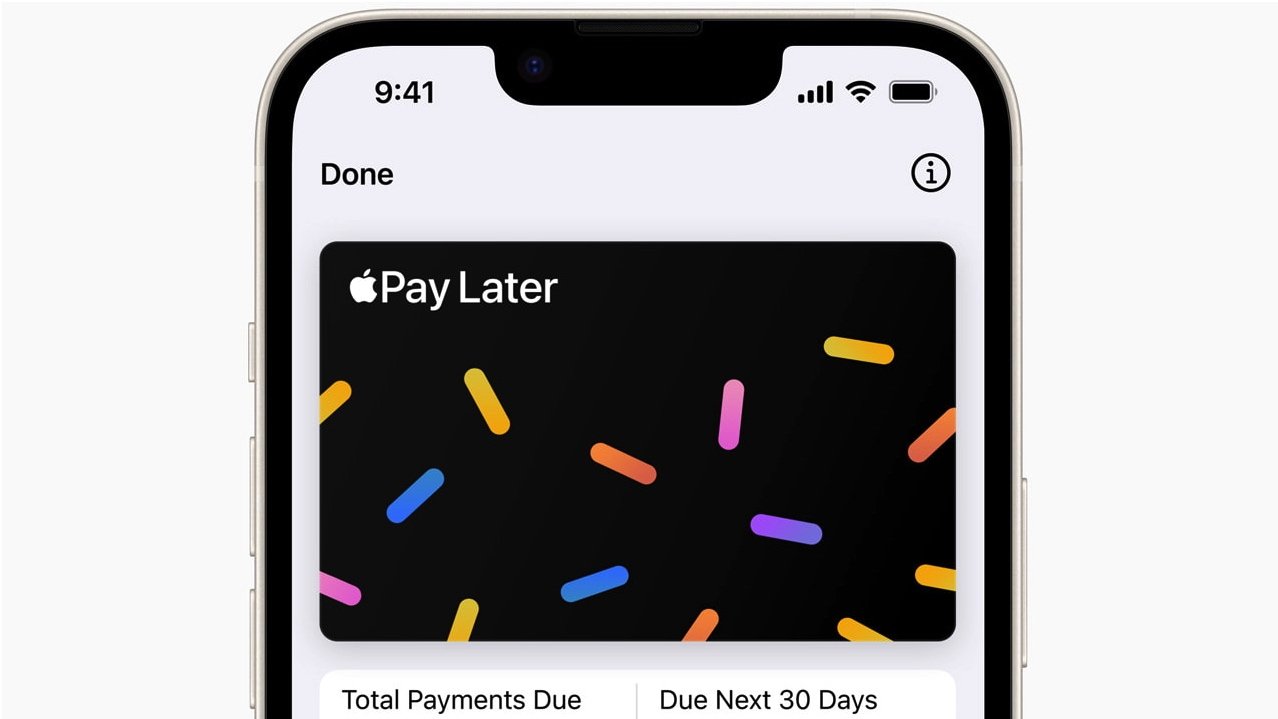

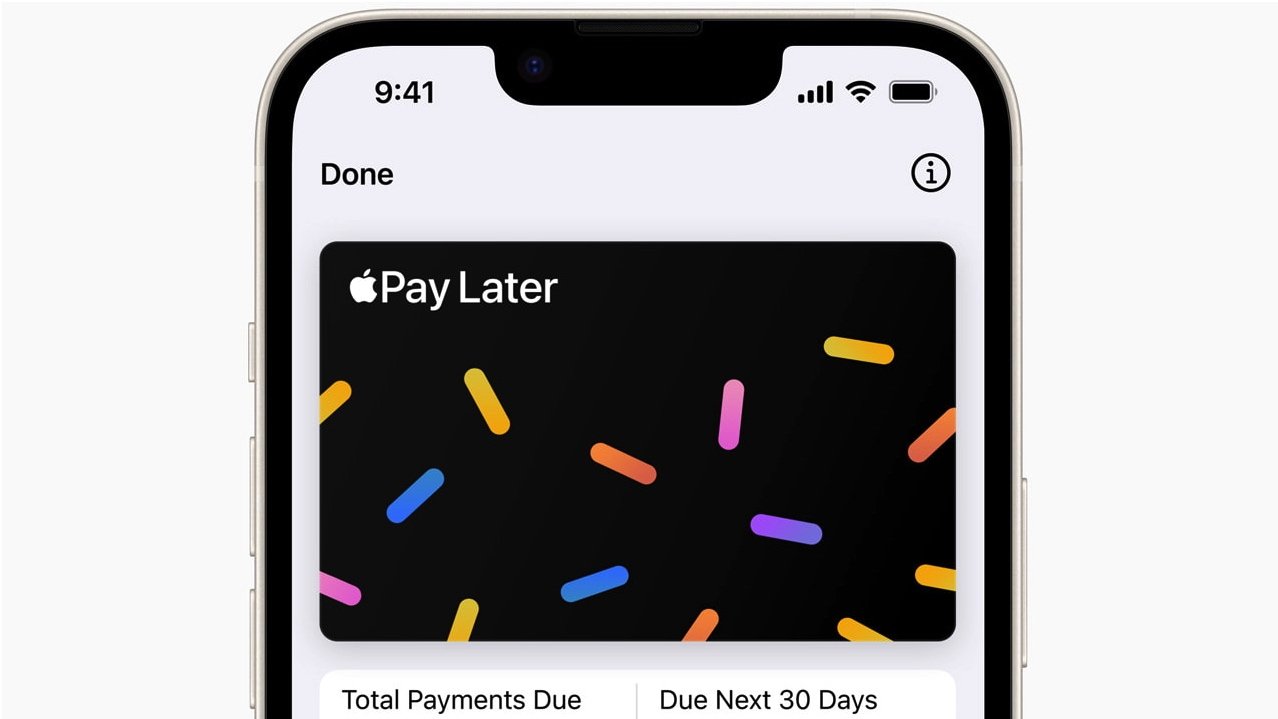

Applying for the loan and later paying it back is all done within the Wallet app. Apple says that the Wallet will show the total amount due overall, plus the amount due in the next 30 days.

Their payment schedule can also be seen in the Wallet's calendar view, and users will get notifications when payments are due.

Those payments have to be via a debit card. Apple says that "to help prevent users from taking on more debt to pay back loans, credit cards will not be accepted."

At present, the loans can be from $50 to $1,000. It works through the Mastercard Instalment program.

Merchants who currently accept Apple Pay will see an Apple Pay Later option for their customers during checkout.

It's previously been reported that Apple formed a subsidiary company specifically to finance all of the lending that Apple Pay Later will create. The Mastercard network connectivity is still being provided by Goldman Sachs.

Read on AppleInsider

Apple Pay Later was announced in mid-2022, but immediately faced a series of delays. Now Apple has announced that it is introducing the service, but at first it is in a very limited way.

"Starting today, Apple will begin inviting select users to access a prerelease version of Apple Pay Later," said the company in a press release, "with plans to offer it to all eligible users in the coming months."

"There's no one-size-fits-all approach when it comes to how people manage their finances," Jennifer Bailey, Apple's vice president of Apple Pay and Apple Wallet said. "Apple Pay Later was designed with our users' financial health in mind, so it has no fees and no interest, and can be used and managed within Wallet, making it easier for consumers to make informed and responsible borrowing decisions."

Once invited, users can get started with Apple Pay Later by first applying for a loan within the Wallet app. The loan application does not affect a user's credit score, and if approved they will then see the Pay Later option whenever they use Apple Pay.

The users invited on to what Apple is calling "early access to a prerelease version of Apple Pay Later," are to be selected randomly.

How it works

Apple says that the application process lets the company do "a soft credit pull... to help ensure the user is in a good financial position before taking on the loan."Applying for the loan and later paying it back is all done within the Wallet app. Apple says that the Wallet will show the total amount due overall, plus the amount due in the next 30 days.

Their payment schedule can also be seen in the Wallet's calendar view, and users will get notifications when payments are due.

Those payments have to be via a debit card. Apple says that "to help prevent users from taking on more debt to pay back loans, credit cards will not be accepted."

At present, the loans can be from $50 to $1,000. It works through the Mastercard Instalment program.

Merchants who currently accept Apple Pay will see an Apple Pay Later option for their customers during checkout.

It's previously been reported that Apple formed a subsidiary company specifically to finance all of the lending that Apple Pay Later will create. The Mastercard network connectivity is still being provided by Goldman Sachs.

Read on AppleInsider

Comments

Did you ever consider "what if someone can't wait 4 months—which is an odd duration since the payments will be completed in just under 1.5 months—for a transaction to be had?" I certainly don't have a use for this kind of financing but I could see someone, say, needing to get access to a plane or bus ticket who doesn't have the credit or cash to pay for it up front, but will be able to pay for it over 3 bi-weekly paychecks.

Do you really not think that's better than going to a payday or title loan place that charge several hundred percent per year? I certainly do.

PS: What's the big deal about doing a temporary unfreeze of your credit for each of the bureaus. It takes about 60 seconds per bureau to set that for a day. In fact, I keep the specific Freeze link in my password manager (along with their main URL) specifically to speed up their process when I do need to allow a service to access my credit.

Why wouldn't someone qualify who is trying to get on a Greyhound bus to go see family across the country, for instance?

Per Apple's website:

"Loans are made by Apple Financing LLC, NMLS #2154940"

"Apple Financing LLC, a subsidiary of Apple Inc"

The loan isn't provided by Goldman, it's provide by an Apple owned subsidiary.

The only involvement by Goldman is the issuing of the Mastercard payment credentials, again from Apple.

"Goldman Sachs is the issuer of the Mastercard payment credential used to complete Apple Pay Later purchases."

If you are going to offer your opinion on the product at least take the time to read the press release about it rather than just making things up.

I'll go with economics. Economics is the social science that studies the production, distribution, and consumption of goods and services and has literally nothing to do with what entity is providing the loan or which is doing a credit check. Economics is entirely irrelevant to the discussion.

"Issuing a MasterCard payment credential means G-S deems you an acceptable risk, doesn't it???"

No, this is about access to the MasterCard payment network, transferring funds from one account to another. This has nothing to do with credit worthiness.

"And how are you going to get an Apple MasterCard if G-S turns you down for one?"

There is no product called Apple MasterCard. There is AppleCard which is a revolving line of credit backed by Goldman. Apple Pay Later isn't a credit card or a revolving line of credit. It's an installment loan. Credit cards/revolving lines of credits and installment loans are different financial instruments. You don't need an AppleCard to use Apple Pay Later, Goldman backed cards aren't relevant.

"And when G-S turns you down, Apple will blacklist you as a risk for "steal now, pay never."

No, as Apple has stated they do the determination of risk via their subsidiary. They have an article on how applications are evaluated here. Goldman isn't involved.

"Then there's this: "Apple says that the application process lets the company do "a soft credit pull... to help ensure the user is in a good financial position before taking on the loan."" Guess you didn't read/understand that part. It means, no credit, bad credit, no interest-free loan."

I did read it, I said Goldman doesn't do credit checks for Apple Pay Later, I didn't say credit checks weren't done. Nowhere in there does it say Goldman does a credit check, and as I have pointed out, there are multiple places where Apple says that they do the credit check. Thanks for backing me up with the quote!

And this: "Those payments have to be via a debit card. Apple says that "to help prevent users from taking on more debt to pay back loans, credit cards will not be accepted.

This isn't even relevant. You said Goldman was doing credit checks. I'll quote what you said because you seem to have forgotten;

"Goldman Sachs is going to run your credit."

This is demonstrably false. I have cited relevant documentation that shows that Goldman isn't the entity doing the credit checks. You have offered nothing that backs your claim and brought up all kinds of incorrect and extraction points in attempt to save face. Just admit you made a mistake and move on because on your currently trajectory you just look silly.

*Side not, I am not a he. I thought the handle gave that away as it is a reference to a woman. So making things up seems to be a bit of theme with you.

They is the correct gender neutral pronoun. And to cut off the whole "they is plural" thing, "They" has been used as a singular pronoun since at least the 1300s. "They" like "you" was formally plural and now singular. Citation. That you defaulted to "he" is latent misogyny showing.

So fragile.