Apple's iPhone remains the key to earnings recovery for the next two years

Analysts at Piper Sandler are predicting an incredible year for Apple financially and an even better one in 2024, all driven by strong iPhone purchases.

Apple Park

Ahead of Apple announcing its second fiscal quarter of 2023 on May 4, Piper Sandler has issued predictions for then and for the year as a whole.

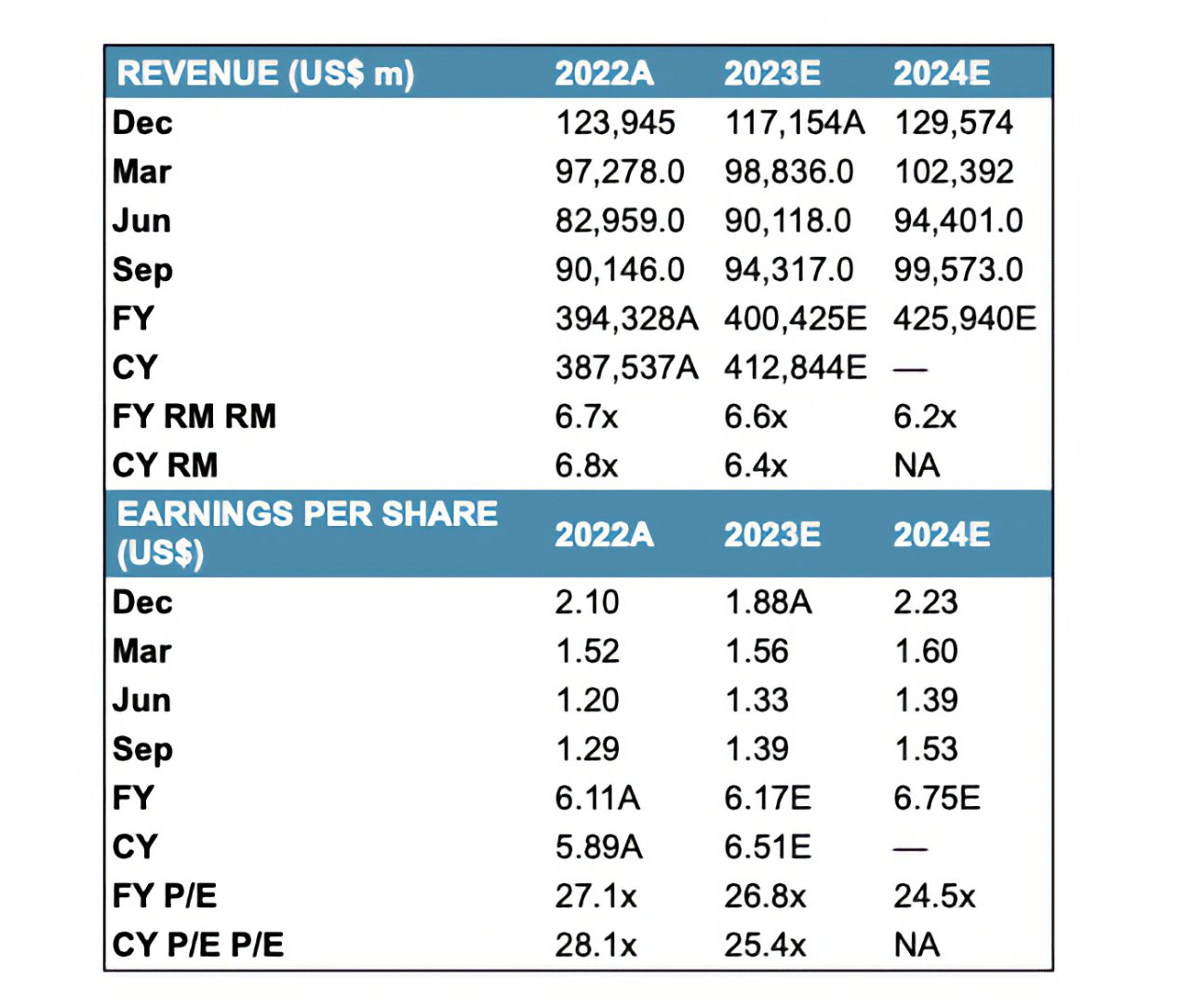

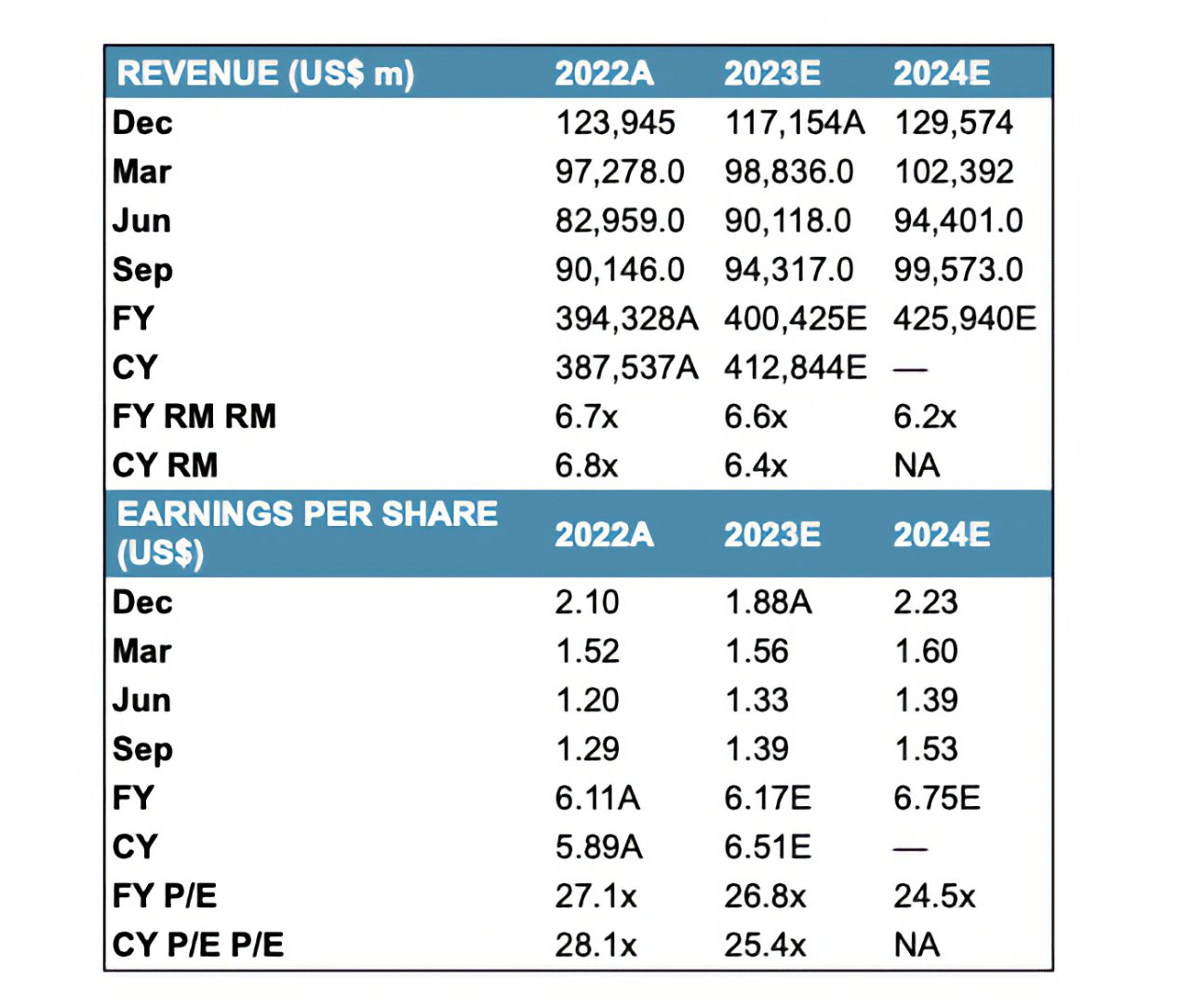

For the second quarter of 2023, Piper Sandler predicts Apple's revenue to be $98.836 billion. That's a rise of $1.558 billion over the same period in 2022, and above Wall Street consensus.

Over the financial year 2023, the analysts estimate that Apple's revenues will climb from $394.33 billion, to $400.43 billion. Piper Sandler sees that as a comparatively small increase, but it predicts a rise to $425.94 billion for 2024.

Source: Piper Sandler

The investment bank appears to be leaning heavily on research results from its recent consumer survey.

"Apple's share of smartphone ownership remains near record highs in Piper Sandler's Taking Stock with Teens Spring 2023 survey," say the analysts in this new note. "In addition, the iPhone could return to record highs due to the 88% purchase intention among teens."

"We note over 25% of teens plan to upgrade to an iPhone 14 this Spring/Summer," they continue. "This is slightly ahead of the 24% purchase intention for the iPhone 14 last fall."

"Apple's other hardware metrics also showed strong results, with more than 35% of teens already owning an Apple Watch and 73% owning AirPods, both new records," it says.

"Overall," concludes Piper Sandler, "we view the survey results as a sign that Apple's place as the dominant device brand among teens remains well intact."

The new revenue estimate continues Piper Sandler's overall optimistic expectations following Apple's most recent earnings report.

Read on AppleInsider

Apple Park

Ahead of Apple announcing its second fiscal quarter of 2023 on May 4, Piper Sandler has issued predictions for then and for the year as a whole.

For the second quarter of 2023, Piper Sandler predicts Apple's revenue to be $98.836 billion. That's a rise of $1.558 billion over the same period in 2022, and above Wall Street consensus.

Over the financial year 2023, the analysts estimate that Apple's revenues will climb from $394.33 billion, to $400.43 billion. Piper Sandler sees that as a comparatively small increase, but it predicts a rise to $425.94 billion for 2024.

Source: Piper Sandler

The investment bank appears to be leaning heavily on research results from its recent consumer survey.

"Apple's share of smartphone ownership remains near record highs in Piper Sandler's Taking Stock with Teens Spring 2023 survey," say the analysts in this new note. "In addition, the iPhone could return to record highs due to the 88% purchase intention among teens."

"We note over 25% of teens plan to upgrade to an iPhone 14 this Spring/Summer," they continue. "This is slightly ahead of the 24% purchase intention for the iPhone 14 last fall."

"Apple's other hardware metrics also showed strong results, with more than 35% of teens already owning an Apple Watch and 73% owning AirPods, both new records," it says.

"Overall," concludes Piper Sandler, "we view the survey results as a sign that Apple's place as the dominant device brand among teens remains well intact."

The new revenue estimate continues Piper Sandler's overall optimistic expectations following Apple's most recent earnings report.

Read on AppleInsider

Comments

The EU might be a tough sell as inflation is hitting hard and especially the active population with mortgages.

And much of the target customer base for $1000+ phones don't have mortgages, or debt. Nor are they concerned about inflation affecting the cost of a necessary tool.

All very interesting, but like the man said...show me the money.

I wonder, are these 25% of teens planning on getting the latest iPhones nepo babies, or just in debt lol?

Ah well, this is why I buy more of the stock than the products these days, maybe one day the dividends will pay for the new iPhones every year 😁