Apple Savings launch is imminent after signs of life spotted in code

Apple's high-yield Savings account could launch soon since the service is now active on the backend.

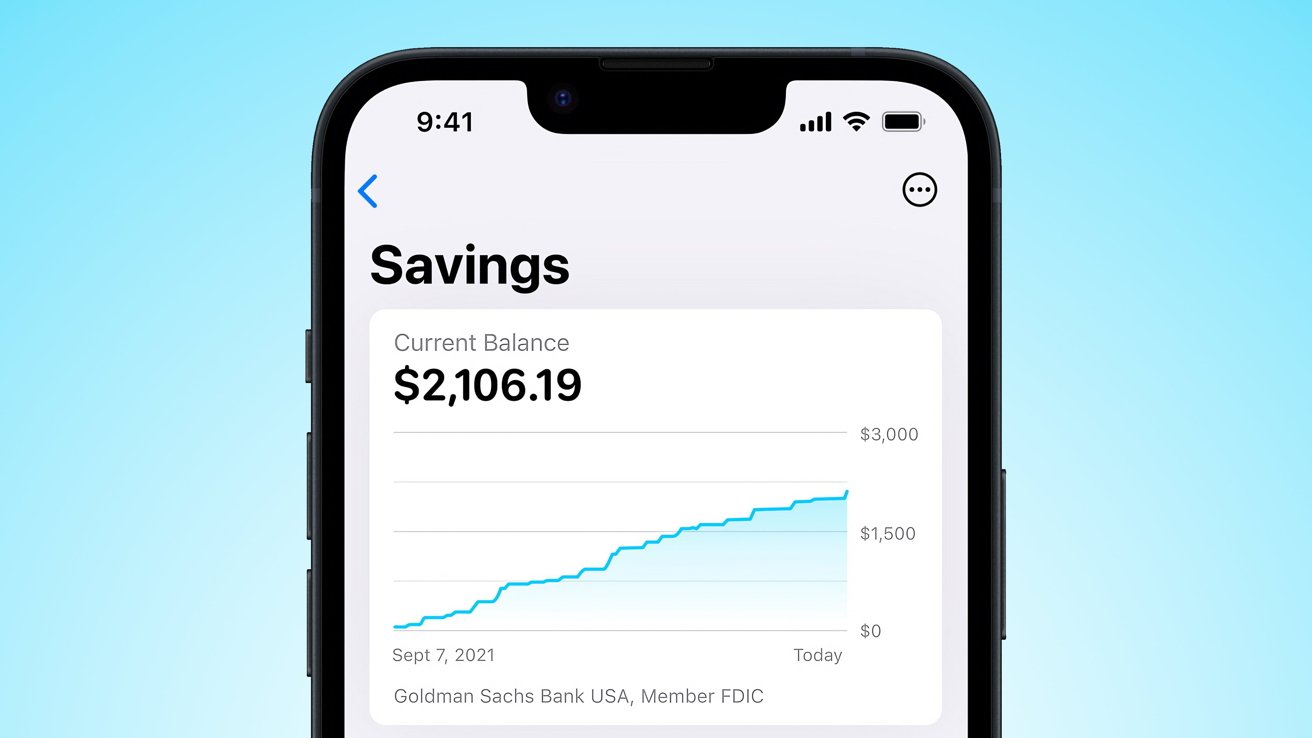

Apple Savings account

Apple announced the Apple Savings account in October 2022 with a wide release window of "the coming months." Nothing happened until March 2023 when Apple included the Savings account in its terms and conditions for Apple Card -- inching it closer to release.

On Wednesday, a code sleuth known as @aaronp613 on Twitter shared that the Savings account backend is now active. That means Apple is taking the final steps to launch the service for users.

It isn't clear when the Savings account will launch. Apple could take it through a short testing period similar to what it did with Apple Pay Later.

Once launched, users will be able to direct their Daily Cash rewards earned from Apple Card in Apple Wallet into the high-yield account. Like the Apple Card, the Savings account will be provided by Goldman Sachs.

Apple could launch the Savings account at any time, as it likely won't be tied to a specific version of iOS. It is one of the last features announced in 2022 that has yet to release.

Read on AppleInsider

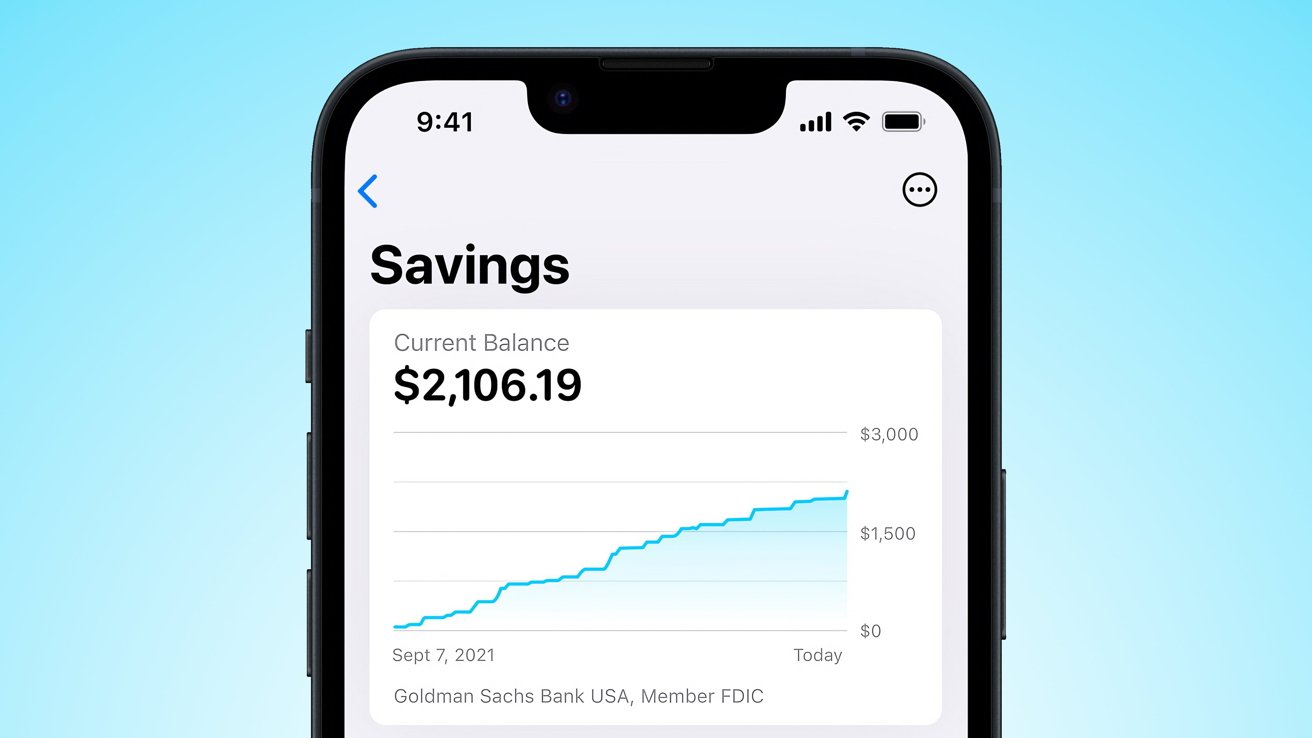

Apple Savings account

Apple announced the Apple Savings account in October 2022 with a wide release window of "the coming months." Nothing happened until March 2023 when Apple included the Savings account in its terms and conditions for Apple Card -- inching it closer to release.

On Wednesday, a code sleuth known as @aaronp613 on Twitter shared that the Savings account backend is now active. That means Apple is taking the final steps to launch the service for users.

It isn't clear when the Savings account will launch. Apple could take it through a short testing period similar to what it did with Apple Pay Later.

Once launched, users will be able to direct their Daily Cash rewards earned from Apple Card in Apple Wallet into the high-yield account. Like the Apple Card, the Savings account will be provided by Goldman Sachs.

Apple could launch the Savings account at any time, as it likely won't be tied to a specific version of iOS. It is one of the last features announced in 2022 that has yet to release.

Read on AppleInsider

Comments

My useless input for the day... The Marcus product was named after Marcus Goldman, who founded the bank in 1869.

Yes, many of them have minimum deposits. Some of them have other restrictions.

I didn't say there were 5% interest savings accounts with no restrictions, I didn't say there were 5% savings accounts that meet your exact needs. What I said was there were several banks offering 5% savings accounts and you know what? There are ... and it seems you found them.

You may as well claim that the MacBook Pro is an overpriced piece of shit when there are laptops for $400 with 1TB of storage in them, even if that's a shitty laptop with an HDD and not an SSD. Details matter.