Apple savings account for Apple Card has arrived -- here's how to get started

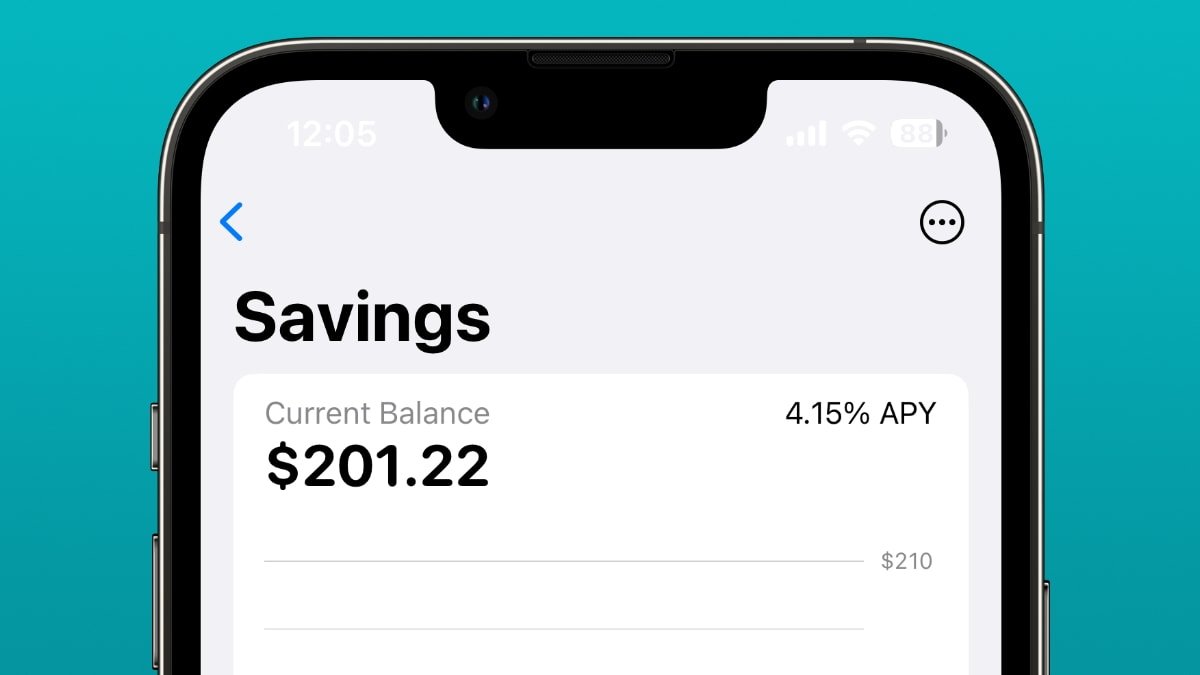

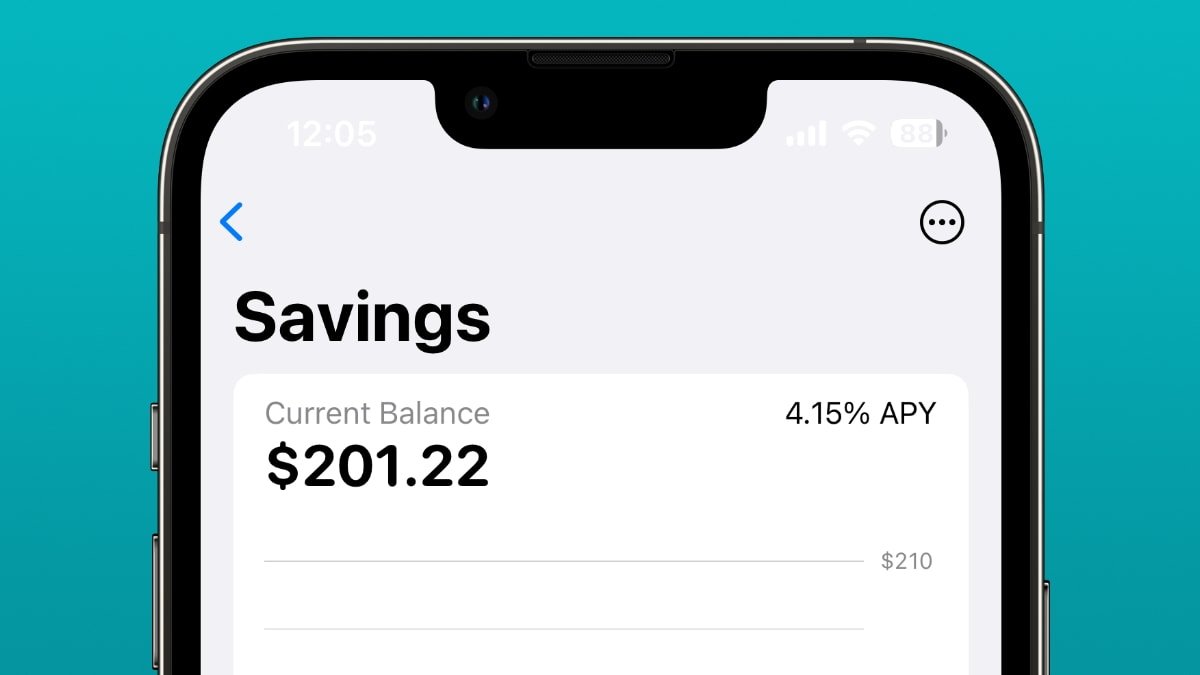

After an announcement months ago, Apple Savings is available for Apple Card users to transfer Daily Cash rewards into a high-yield savings account. Here's how to get started.

Apple's first savings account for customers

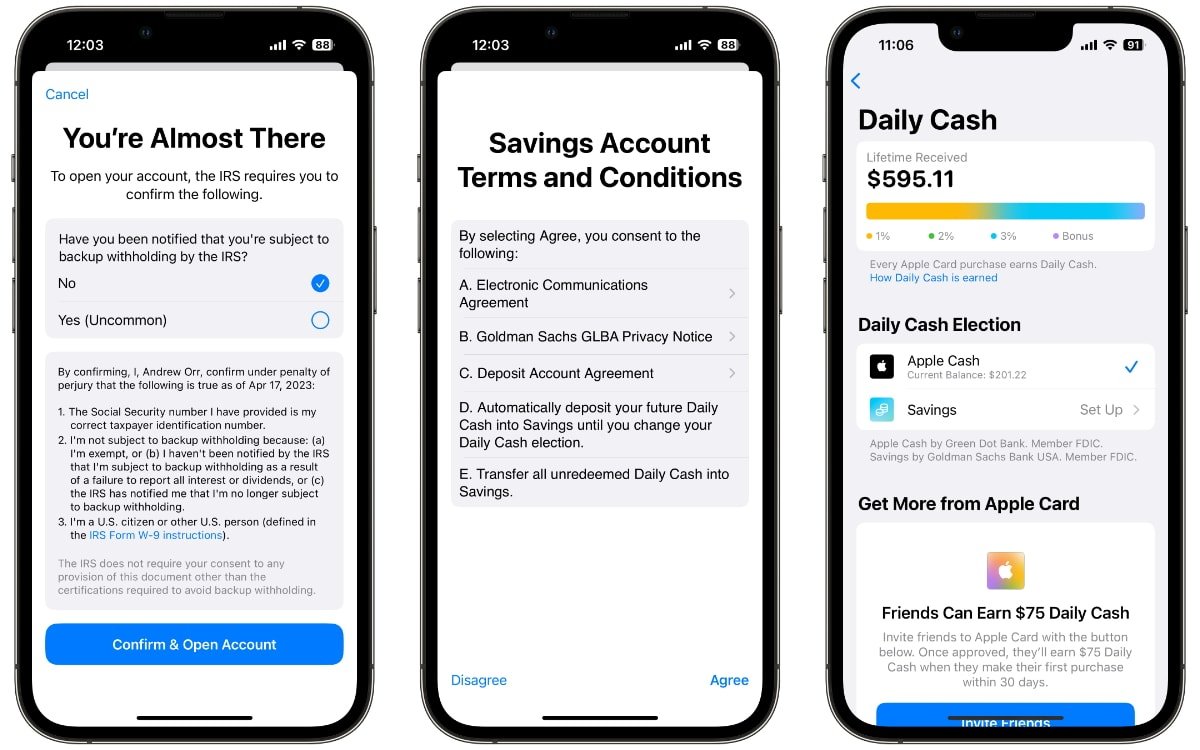

With no fees, minimum deposits, or balance requirements, Apple Savings can hold cash-back rewards or money transferred from a different bank. Like the Apple Card, Goldman Sachs manages the Savings account and offers a 4.15% APY.

Apple Savings appears after an October 2022 announcement and a silent period until March 2023 when a clause referencing Apple Savings was added to the terms and conditions of the Apple Card. The April 17 launch was discovered when someone inspected the code from Apple's servers.

After that announcement, various bits of news appeared that shed light on some of Goldman Sachs' financial activity. The bank has faced some troubles with its consumer-facing business, as it had traditionally served corporations, financial institutions, and governments as an investment bank.

It partnered with Apple to help launch the Apple Card, a consumer credit card and the bank's first credit card offering. Although Goldman CEO David Solomon called its partnership with Apple "the most successful credit launch ever," it wasn't without difficulty.

A report from January showed that Goldman Sachs posted over $1.2 billion in losses in the first nine months of 2022, driven mainly by loan-loss provisions and the Apple Card. The bank invested the money into building a system to support Apple Card transactions and has yet to have a return on its investment.

The Federal Reserve had also opened an investigation into Goldman Sachs to determine if the bank's consumer credit division had enough consumer protections. However, that is more about the Marcus savings account to see if it had appropriate oversight or management problems.

That, and another investigation from the Consumer Financial Protection Bureau (CFPB), cast doubt on whether the Apple Savings account would be launched. But launched it has, and Apple Card owners can now open a savings account with Goldman Sachs through the Wallet app.

As a savings account, spending money or making purchases in Savings directly from the Apple Card or Apple Pay is impossible. Instead, users must transfer money from Savings into Apple Cash or a linked external bank account.

There are some conditions to opening and maintaining an Apple Savings account.

That is the standard limit for consumers to have their funds insured by the Federal Deposit Insurance Corporation (FDIC). And the Apple Savings account is FDIC-insured.

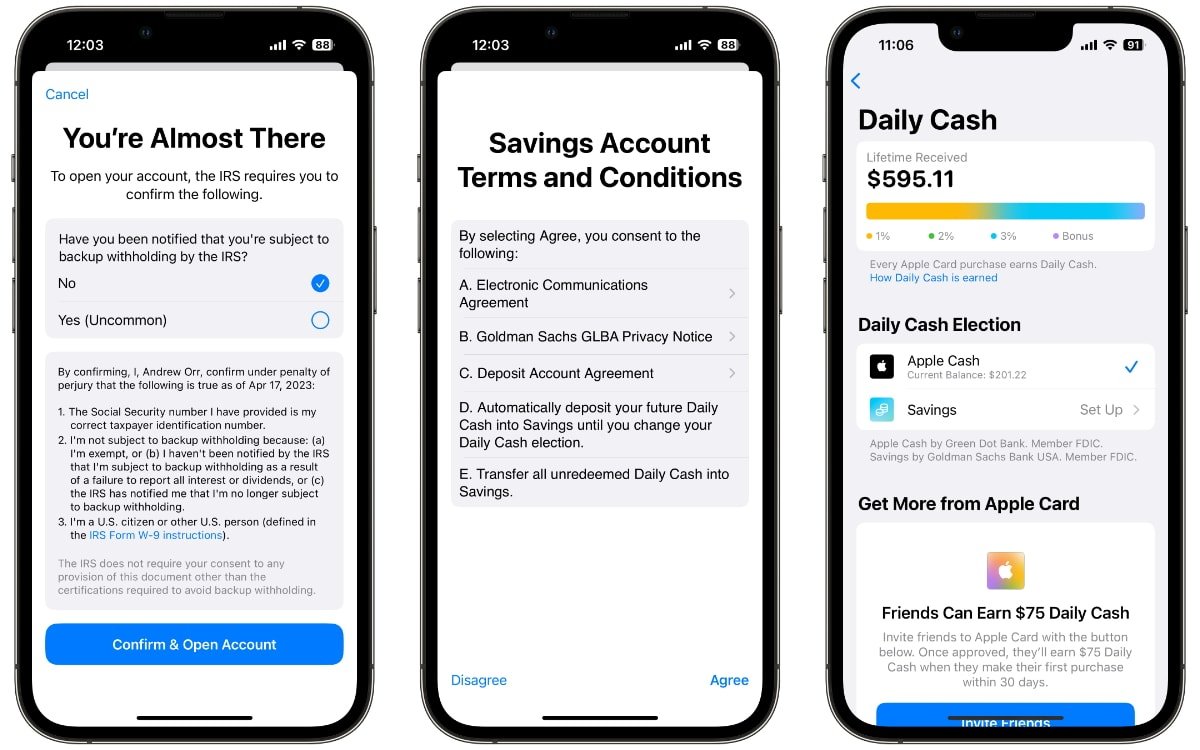

A backup withholding is an amount of tax the IRS may require a person to withhold a percentage of specific payments to report them on an information return. It's an uncommon occurrence, and most Apple Card users will be able to select "No" when asked.

After users set up an Apple Savings account, it will automatically receive further Daily Cash rewards. Apple Card owners can also go back into the Daily Cash section in the Wallet app and change the destination back to Apple Cash if they desire.

Read on AppleInsider

Apple's first savings account for customers

With no fees, minimum deposits, or balance requirements, Apple Savings can hold cash-back rewards or money transferred from a different bank. Like the Apple Card, Goldman Sachs manages the Savings account and offers a 4.15% APY.

Apple Savings appears after an October 2022 announcement and a silent period until March 2023 when a clause referencing Apple Savings was added to the terms and conditions of the Apple Card. The April 17 launch was discovered when someone inspected the code from Apple's servers.

Apple Savings -- The beginning

When Apple first announced the savings account, it didn't give a specific timeframe for when Apple Card customers could access it. Instead, in typical Apple secrecy, it only said that it would be available in "the coming months."After that announcement, various bits of news appeared that shed light on some of Goldman Sachs' financial activity. The bank has faced some troubles with its consumer-facing business, as it had traditionally served corporations, financial institutions, and governments as an investment bank.

It partnered with Apple to help launch the Apple Card, a consumer credit card and the bank's first credit card offering. Although Goldman CEO David Solomon called its partnership with Apple "the most successful credit launch ever," it wasn't without difficulty.

A report from January showed that Goldman Sachs posted over $1.2 billion in losses in the first nine months of 2022, driven mainly by loan-loss provisions and the Apple Card. The bank invested the money into building a system to support Apple Card transactions and has yet to have a return on its investment.

The Federal Reserve had also opened an investigation into Goldman Sachs to determine if the bank's consumer credit division had enough consumer protections. However, that is more about the Marcus savings account to see if it had appropriate oversight or management problems.

That, and another investigation from the Consumer Financial Protection Bureau (CFPB), cast doubt on whether the Apple Savings account would be launched. But launched it has, and Apple Card owners can now open a savings account with Goldman Sachs through the Wallet app.

Apple Savings -- Terms & Conditions

Apple specifically markets the account as a destination for Daily Cash rewards, although customers can transfer money into Apple Savings from a different savings account.As a savings account, spending money or making purchases in Savings directly from the Apple Card or Apple Pay is impossible. Instead, users must transfer money from Savings into Apple Cash or a linked external bank account.

There are some conditions to opening and maintaining an Apple Savings account.

- Be an owner or co-owner of an active Apple Card account and add Apple Card to your iPhone.

- Be at least 18 years or older.

- Have a social security number or individual taxpayer identification number.

- Be a US resident with a valid US address.

- Set up two-factor authentication for your Apple ID and update to the latest version of iOS. Savings is available with iOS 16.4 and later.

That is the standard limit for consumers to have their funds insured by the Federal Deposit Insurance Corporation (FDIC). And the Apple Savings account is FDIC-insured.

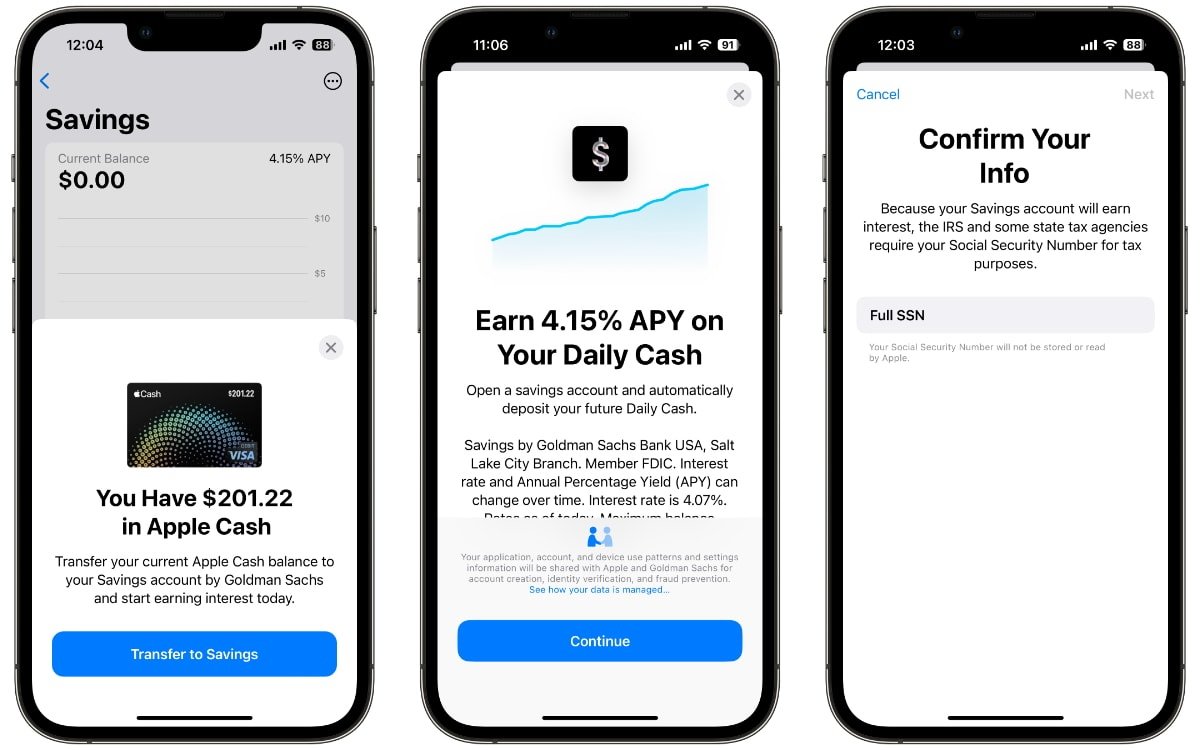

How to set up Apple Savings

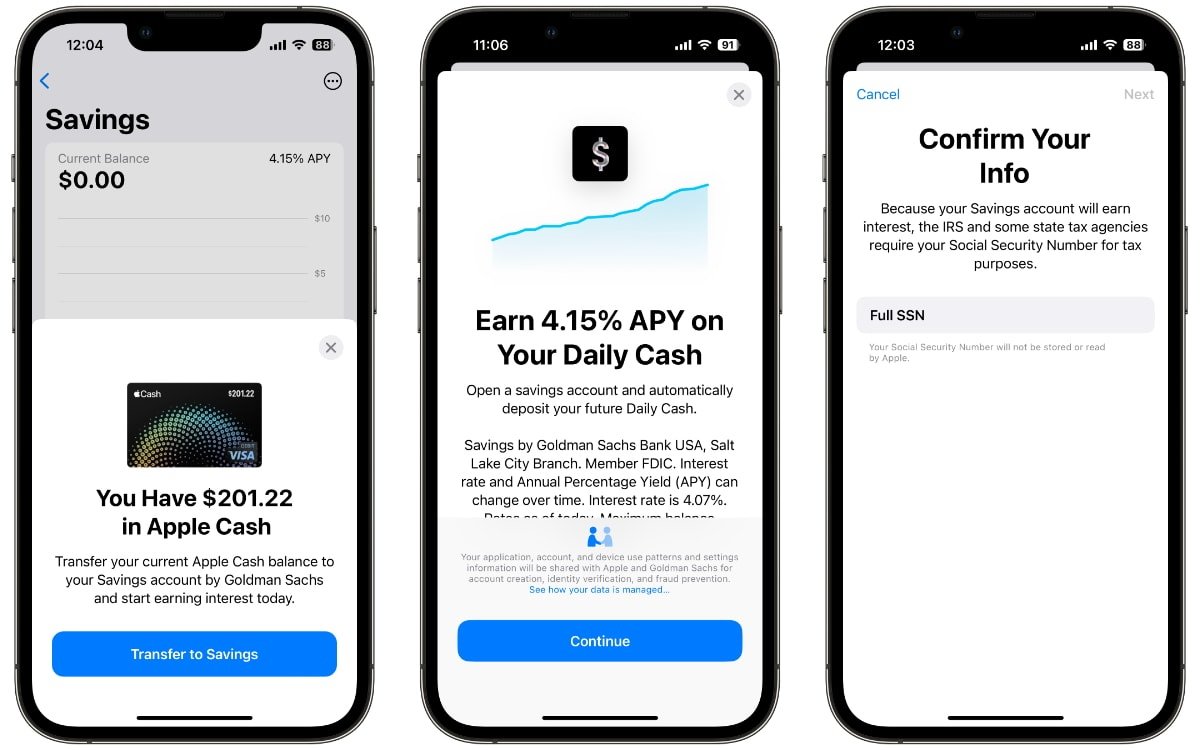

These instructions involve entering your full Social Security Number which Apple doesn't store or read, and agreeing to the terms and conditions. Finally, the IRS needs to confirm whether you're subject to backup withholding.- Open the Wallet app on an iPhone.

- Tap the Apple Card.

- Next, tap the three-dot "More" button and select Daily Cash.

- Tap Set Up next to Savings and follow the onscreen instructions.

A backup withholding is an amount of tax the IRS may require a person to withhold a percentage of specific payments to report them on an information return. It's an uncommon occurrence, and most Apple Card users will be able to select "No" when asked.

After users set up an Apple Savings account, it will automatically receive further Daily Cash rewards. Apple Card owners can also go back into the Daily Cash section in the Wallet app and change the destination back to Apple Cash if they desire.

Read on AppleInsider

Comments

I think Apple can do better and probably should be looking for a new partner for Apple Card, Pay, Cash and now Savings.

Update: I was able to create the savings account by clicking on "View Card Benefits" and following through. After the account is created, View Card Benefits must be followed to view the status of the account, add money, etc.

for the sweet interface alone it’s worth the transfer to Apple savings

have been trying to apply for a card to get savings account but no luck, seems like server getting slammed

anyone have same tissue?

Face it, the U.S. is populated by entitled idiots who can’t read, want everything done for them. There is no hope.

I view this as one of those ‘automatic savings accounts,’ not terribly unlike the ‘round up’ programs that some banks have. You automatically make deposits in the savings account via the AppleCash bonus every time you make a purchase and get a good return on the money.

Doesn’t show up for me. Went to the AppleCard, clicked the 3 dots and Daily Cash and all I see is lifetime cash earned and a bonus for referring friends. Tried going to Card Details and clicking View Apple Card Benefits - that took me to a web site but when I clicked on the link on the web site it just took me back to the Wallet app with no options.