Switchers away from Android boosted Apple marketshare in still-collapsing smartphone marke...

The US smartphone market remained tough for manufacturers in the first calendar quarter of 2023, but Apple's market share grew as Android users moved to iOS.

iPhone shipments fell but Apple's market share grew anyway

Once again, Apple was the only company to see growth during a smartphone market contraction. As a result, it took the top place for global smartphone market share, and it also grew in the US, according to Counterpoint Research.

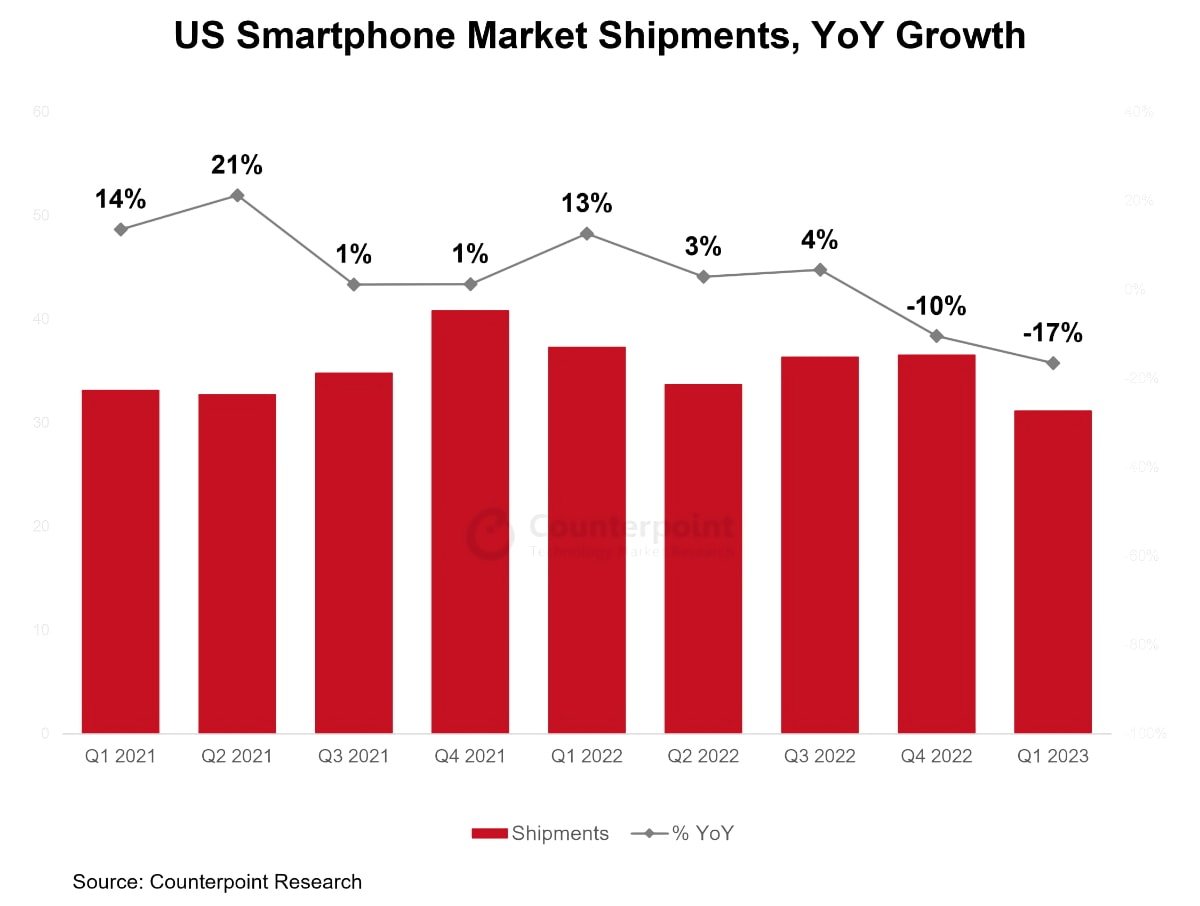

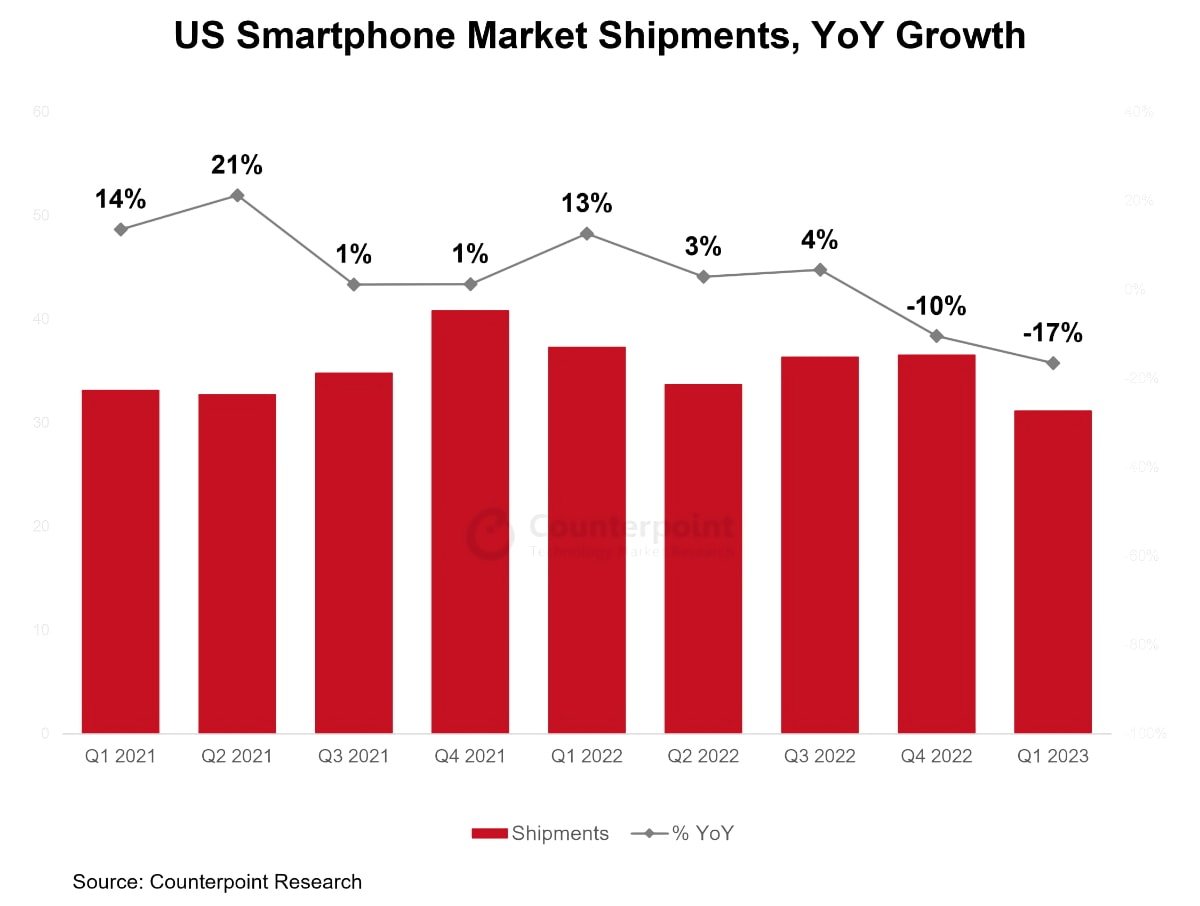

In the first quarter of 2023, smartphone shipments in the US fell by 17% compared to the same period in 2022. The decline occurred due to manufacturers' correction of high channel inventory and a decrease in consumer demand. All major manufacturers experienced a drop in shipments after a robust first quarter in 2022.

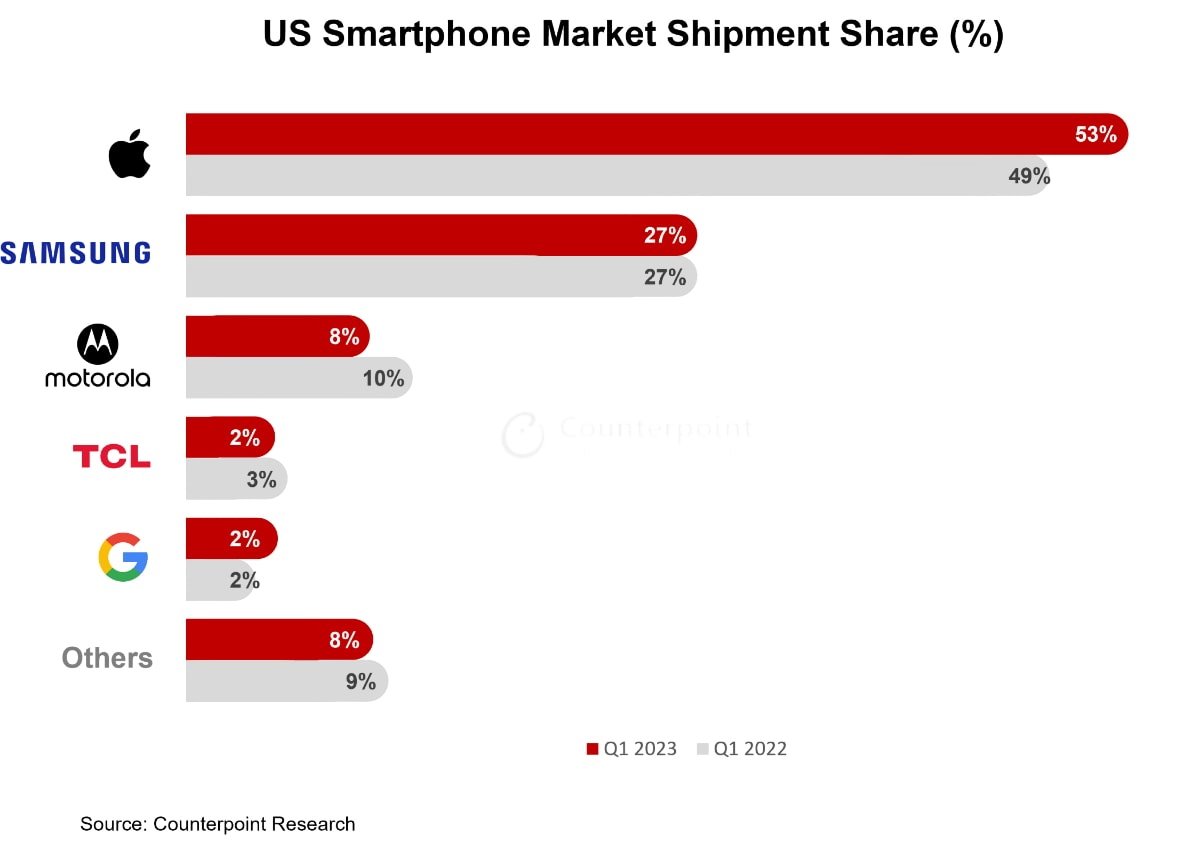

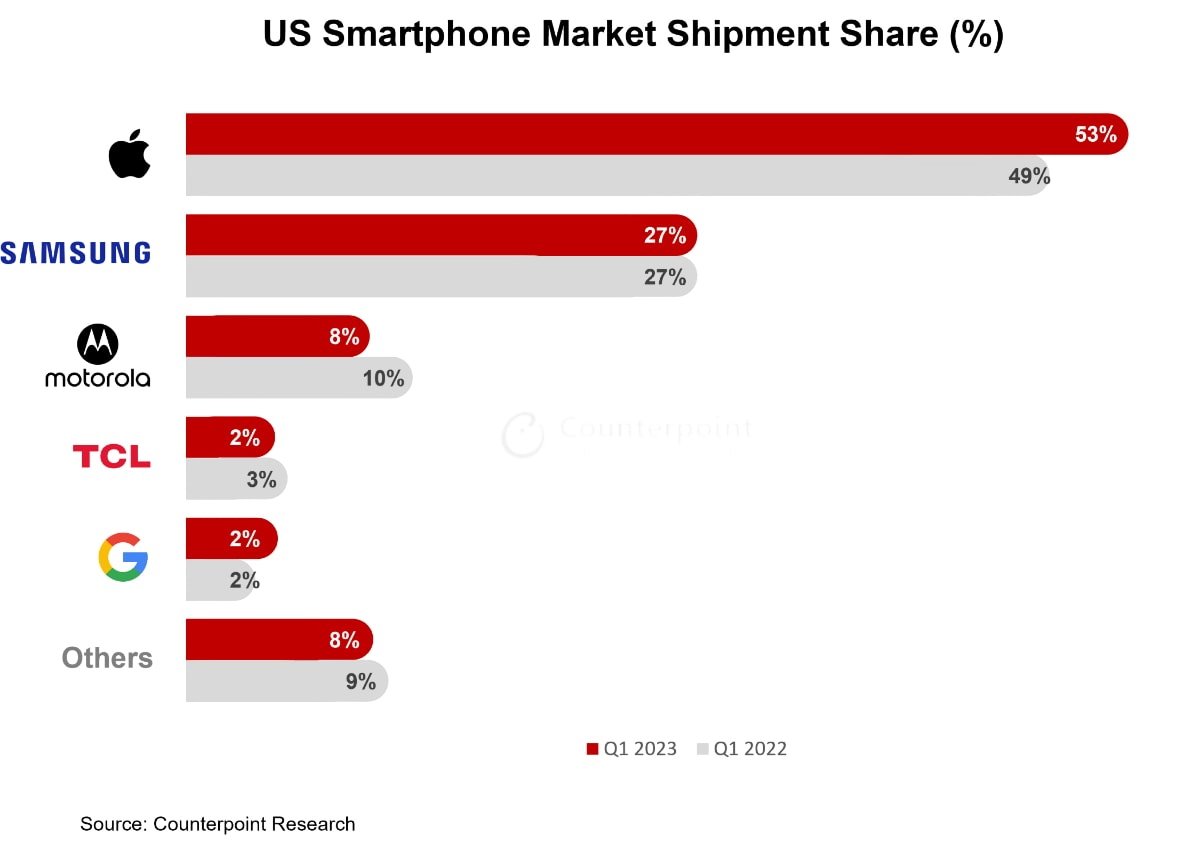

But Apple managed to grow its market share to 53% in the first quarter, up from 49% in the first quarter of 2022, although it saw a yearly decline in shipments. Samsung and Google were flat at 27% and 2%, respectively, neither growing nor declining in shipments.

Meanwhile, Motorola dropped from 10% to 8%, and TCL declined to 2% from 3%, year-over-year.

As is typical, the decrease in sales can be attributed to reduced consumer demand brought about by economic uncertainties like rising inflation. As a result, consumers refrained from buying new devices, especially in the prepaid market.

Analysts noted that young and first-time smartphone users propel the shift from Android to iOS and remain a significant challenge for Android manufacturers. However, some niche categories, such as foldable smartphones, may continue to perform well despite overall weakness.

Read on AppleInsider

iPhone shipments fell but Apple's market share grew anyway

Once again, Apple was the only company to see growth during a smartphone market contraction. As a result, it took the top place for global smartphone market share, and it also grew in the US, according to Counterpoint Research.

In the first quarter of 2023, smartphone shipments in the US fell by 17% compared to the same period in 2022. The decline occurred due to manufacturers' correction of high channel inventory and a decrease in consumer demand. All major manufacturers experienced a drop in shipments after a robust first quarter in 2022.

But Apple managed to grow its market share to 53% in the first quarter, up from 49% in the first quarter of 2022, although it saw a yearly decline in shipments. Samsung and Google were flat at 27% and 2%, respectively, neither growing nor declining in shipments.

Meanwhile, Motorola dropped from 10% to 8%, and TCL declined to 2% from 3%, year-over-year.

As is typical, the decrease in sales can be attributed to reduced consumer demand brought about by economic uncertainties like rising inflation. As a result, consumers refrained from buying new devices, especially in the prepaid market.

Analysts noted that young and first-time smartphone users propel the shift from Android to iOS and remain a significant challenge for Android manufacturers. However, some niche categories, such as foldable smartphones, may continue to perform well despite overall weakness.

Read on AppleInsider

Comments

https://gs.statcounter.com/vendor-market-share/mobile/japan

And when you look on China you see share jumped 10 % withing month

https://gs.statcounter.com/vendor-market-share/mobile/china

and therefore share in whole Asia.

https://gs.statcounter.com/vendor-market-share/mobile/china

Also, if we take a peek at the Chinese market and include that information, it breaks the claim from the main article that 'Apple was the only company to see growth during a smartphone market contraction' as Counterpoint data indicates that Huawei Chinese sales were up 41% during the same period.

That claim is only valid in the context of the article which is limited to the US market.