What to expect from Apple's Q3 2023 earnings report

Apple's third fiscal quarter results will be issued later today, accompanied by the usual call with analysts. Here's what to expect from the results, and what Wall Street thinks of is coming.

Apple confirmed its quarterly results will be released on August 3 back on July 10. As is typical for the event, it will be followed by a call hosted by CEO Tim Cook and CFO Luca Maestri, with the results released at around 4:30 PM ET and the call itself starting from 5:00 PM ET.

Some Apple guidance

As has been typical of the financial results from Apple itself since early 2020, the company has declined to offer firm numbers in its forward-looking guidance. However, during the second quarter earnings call, Maestri did offer up some details to consider.

According to Maestri, revenue for the quarter is expected to trend similarly year-on-year to Q2, so long as the macroeconomic outlook doesn't worsen. Foreign exchange was also predicted to remain a headwind at 400 basis points, though Services should continue to see similar growth to the March quarter.

Maestri also said the gross margin for the third quarter should rest at 44% to 44.5% with operating costs ranging from $13.6 billion to $13.8 billion. The strength of the Gross Margin can also be attributed to the flat foreign exchange rate, the CFO added.

YoY: Q3 2022 figures

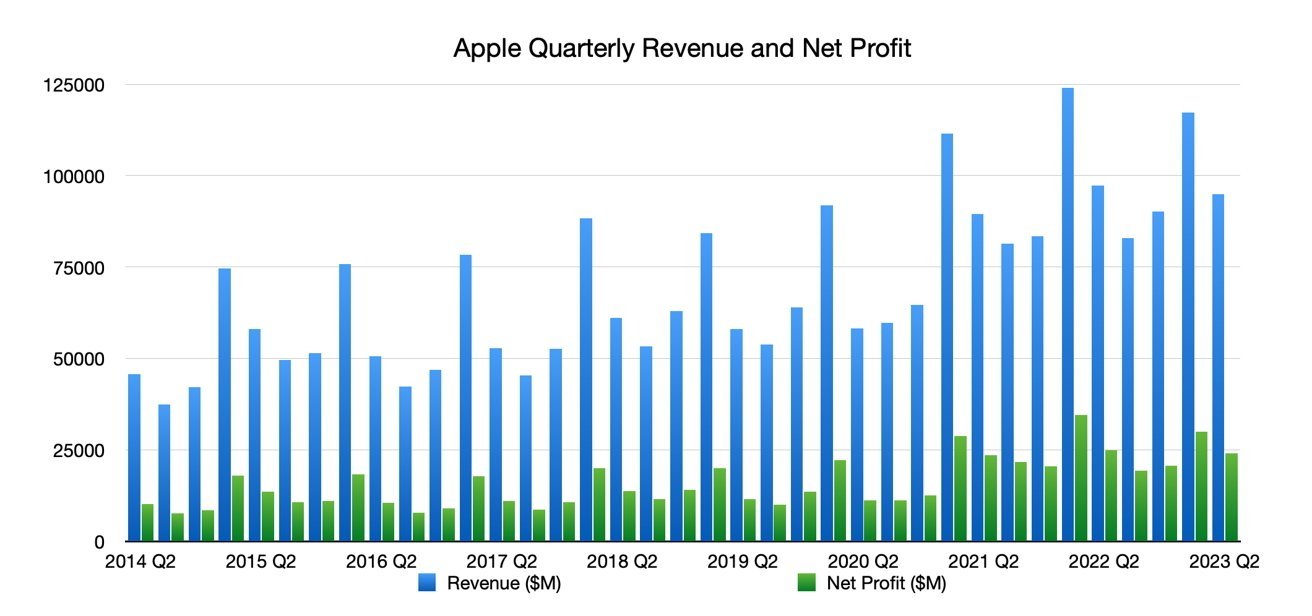

The third quarter is typically the lowest of Apple's annual cycle of results, with it typically earning less revenue than all of the other quarters in the year. Even so, Apple does continue to see improvements in the quarter's results compared to the previous year's report.

For Q3 2022, Apple saw a 2% YoY increase in revenue to $83 billion, with iPhone revenue up slightly at $40.6 billion, iPad revenue slightly down at $7.22 billion, and Mac revenue also down to $7.38 billion. Wearables, Home, and Accessories saw a slight reduction to $8.08 billion, but Services continued to see growth to $19.6 billion.

Quarter releases

Q3 will be the first full quarter of sales for some of Apple's product line, including the M2 and M2 Pro Mac mini, as well as upgraded 14-inch MacBook Pro and 16-inch MacBook Pro models. They were also joined by the second-generation HomePod.

Surfacing late in the quarter are updates to the Mac Studio and Mac Pro, and the introduction of a 15-inch MacBook Air. None of these products will make a material impact on the quarter, but should do well for the Q4 figures.

What Wall Street thinks

Using figures sourced from Yahoo Finance,a consensus of analysts have put forward the idea that Apple's revenue will be $90.29 billion, based on the reports of 25 analysts. The total range was from a low of $82.81 billion to a high of $97.17 billion.

The earnings per share is reckoned to be about $1.36, based on opinions from 28 analysts. That includes a low estimate of $1.17 and a high of $1.51.

Individual analysts on Apple

Wedbush

On July 30, Wedbush said Apple could "flex the muscles" during the results, citing high demand for the iPhone 14 Pro in China. With a "clear uptick in demand" in China, the high iPhone revenue in China could be a high point, especially this late in the iPhone product cycle.

With roughly 25% of the current install base not upgrading their iPhone for four years or more, and the prospect of an "anniversary edition" iPhone 15, Wedbush feels there could be a "steadier transition" from iPhone 14 to iPhone 15 compared to earlier generational switches.

Services is also an "underappreciated asset" by Wall Street, with an acceleration in growth back to double digits anticipated in the coming quarters.

Wedbush maintained an "Outperform" rating for Apple, as well as a $200 price target.

Morgan Stanley

In a July 25 note, Morgan Stanley believes Apple will have an as-expected June quarter, with revenue trending similarly year-on-year to Q2. That means an earnings per share of about $1.19 and $81.7 billion in sales.

These may change if the macroeconomic outlook doesn't worsen. Foreign exchange is predicted to stay as a headwind at 400 basis points.

Indeed, Morgan Stanley was more enthusiastic about the fourth quarter in September, insisting it could be "5-10% above Consensus." Year-on-year revenue growth is also expected for the first time in four quarters, the report claimed, with iPhone and Services being the main accelerators.

Morgan Stanley reiterated its price target of $220.

Goldman Sachs

Expecting no surprises, the July 25 Goldman Sachs note is similarly enthusiastic about the September quarter, but stayed somewhat on topic about the June quarter.

An EPS of $1.21 is expected, driven by "outperformance in Mac and Services." Mac revenue of $9.4 billion is expected, versus the year-ago quarter harmed by supply chain issues, while Services could reach $21.8 billion over App Store spending.

On September's quarter, Goldman Sachs proposes the launch of the iPhone 15 is "promising" as the "relatively weaker performance in iPhone 14 to-date suggests that a larger share of the installed base may want to upgrade." The analysts temper expectations by warning of reports of production issues that "may result in a delayed launch or limited availability at the time of release."

Deutsche Bank

On July 24, Deutsche Bank raised its price target for Apple from $180 to $210, and reiterated its "Buy" rating for the stock.

The Deutsche Bank note anticipates Q3 results to be in line or slightly better than Wall Street estimates, with upsides on iPhone, Mac, and Services. It also believes that, while the Street expects a 5% YoY decline on iPhone, Apple could still see growth in the area.

Foreign exchange dynamics, which previously had a negative effect on growth and gross margins, may see some improvement, in turn increasing the EPS.

Deutsche Bank views Apple "favorably given its high quality of earnings and strong balance sheet."

Piper Sandler

On July 31, Piper Sandler offered a middling forecast for Apple's results, with a feeling that "Apple will be able to execute in its key segments and markets for the June quarter."

This execution would involve Apple narrowly missing the Wall Street revenue estimate of $81.7 billion by being "slightly lower." There will also be a miss on Street EPS expectations of $1.19 by between $0.02 and $0.04.

Piper Sandler was more interested in the September quarter, with iPhone "gaining meaningful share" in China despite signs of a slowdown. With "positive momentum" over the last three quarters, the analysts think Chinese citizens are "selectively choosing iPhones over Android devices."

The company increased its price target from $200 to $220.

TD Cowen

On August 1, TD Cowen's note to investors followed the group by saying Apple's revenues for the quarter won't be mind-blowing and will be down 2% year-on-year.

While iPad, Mac, AirPods, and Apple Watch will be enduring muted seasonality, iPhone demand will remain stable thanks to demand in China and India.

Services will see 5% year-on-year growth, but is primed for a return to double-digit growth in the future. Apple's experience in AI with its use of the Neural Engine is also seen as a benefit for future AI trends.

Preiously at $195, TD Cowen used the opportunity to increase the price target to $220, with an "Outperform" rating.

Read on AppleInsider

Comments

Here are some relevant quotes from the second greatest investor of all time (after his friend Warren Buffett), Peter Lynch, who outperformed the S&P index the entire time he managed the Magellan Fund, the largest fund in the world at that time: