Apple edges out Wall Street, with weak iPhone sales saved by Services surge

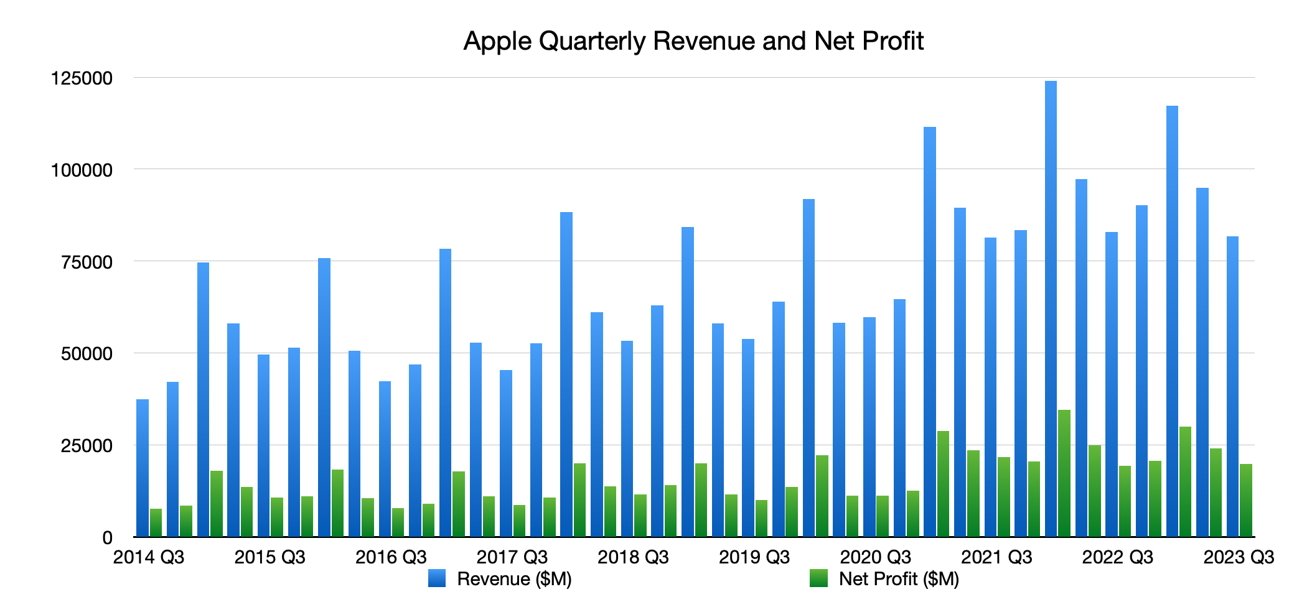

Apple has reported its results for the third quarter of 2023 with Services making up for weak iPhone sales, both driving a total revenue of $81.8 billion.

Apple CEO Tim Cook

Traditionally the quietest quarter in Apple's fiscal year, the results of the third quarter of 2023 were announced by Apple on Thursday, ahead of its usual conference call with analysts. The Q3 2023 revenue of $81.80 billion is down 1% year-on-year compared to the $82.9 billion reported one year ago.

As part of the results announcement, Apple reported there was an earnings per share of $1.26.

Analyst expectations put Apple at around $81.3 billion in revenue, with an earnings per share for the quarter of $1.19.

The release list for the quarter was slim, consisting of the introduction of the M2 Max and M2 Ultra versions of the Mac Studio, the long-awaited Mac Pro with Apple Silicon, and the popular 15-inch MacBook Air. During WWDC, the Apple Vision Pro was introduced as a mixed-reality platform, but one that won't make a monetary impact to Apple's revenue until early 2024.

"We are happy to report that we had an all-time revenue record in Services during the June quarter, driven by over 1 billion paid subscriptions, and we saw continued strength in emerging markets thanks to robust sales of iPhone," said CEO Tim Cook. "From education to the environment, we are continuing to advance our values, while championing innovation that enriches the lives of our customers and leaves the world better than we found it."

CFO Luca Maestri said the June quarter's YoY business performance improved from the March quarter, with the install base of active devices now at an all-time high in every geographic segment. "During the quarter, we generated very strong operating cash flow of $26 billion, returned over $24 billion to our shareholders, and continued to invest in our long-term growth plans."

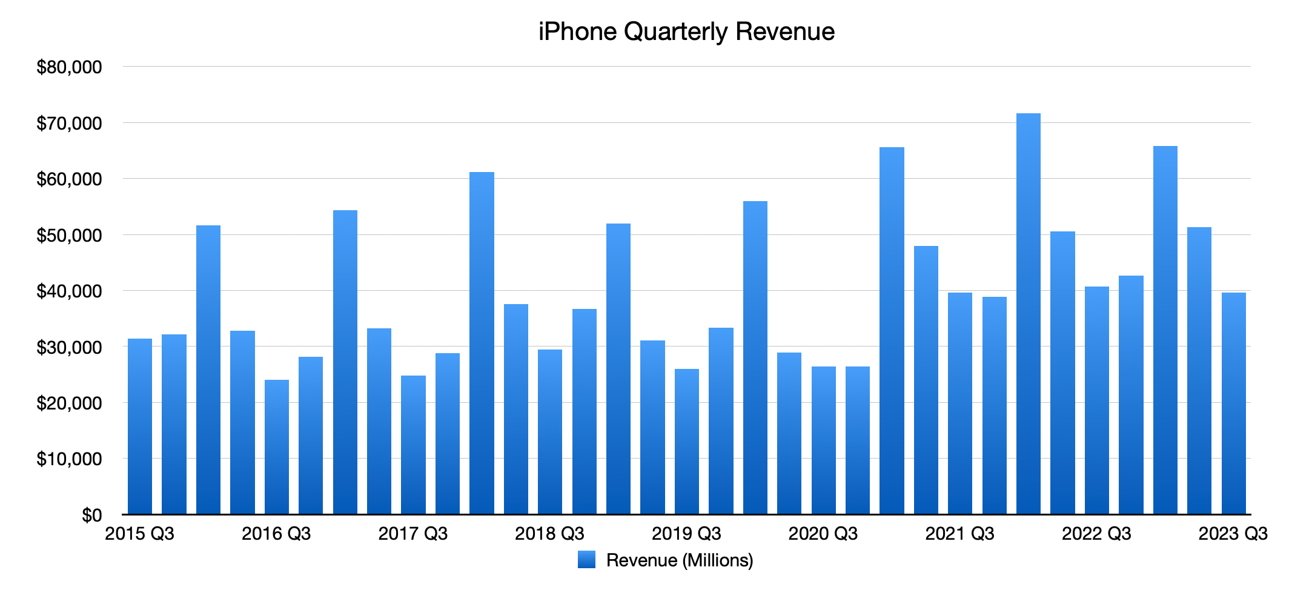

Revenue stemming from iPhone reached $39.67 billion, down 2% from $40.6 billion reported one year ago. iPad revenue is down 20% to $5.79 billion from $7.22 billion in Q3 2022.

Mac revenue is down 7% to $6.84 billion from the year-ago $7.38 billion. Wearables, Home, and Accessories saw an increase/decrease to $8.28 billion, up 2% from $8.08 in the same period last year.

Services continues to be a growth driver for Apple, hauling in $21.21 in revenue for the June quarter. This is up 8% from the $19.6 billion reported last year.

Shareholders are to receive a cash dividend of $0.24 per share.

As usual for Apple since the start of the pandemic, the company has declined to provide formal guidance for the September quarter.

Read on AppleInsider

Comments

It's difficult to buy into an expensive phone right now and Apple chose to use the previous years chip in some models. That may have taken some sheen off eagerness to upgrade. Then there is the 'drip feeding' feature set proposition which tries to cajole users into more expensive models.

It's hard to achieve that right now but 2% is nothing in the bigger scheme of things.

Things could get worse but that will depend on prices/features for the upcoming models.

This quarter's drop in iPhone revenue was due to currency exchange rates and the strong dollar not because unit sales dropped. Apple also claimed that the number of people switching to the iPhone from Android was at an all time high. Given the iPhone has a lower marketshare than Android there is still room for growth even thought he smartphone market is saturated. That said, that growth will mostly come outside of the U.S.

One other good/bad thing about the quarter is the smaller number of Mac’s sold, maybe this will light a fire underneath Apple to update the entire line of Mac computers, in a more timely manner, in particular the 24 inch iMac, and a bigger screen iMac using an M2 processor, you have no chance of making a sale if you don’t release something to the public.

A reluctant MacHeadroom Mac buyer by the end of this month.

But iPhones only have 23% of that mobile phone market. Only 5% in India. They have much more room to grow if they can convince some of the 75% of Android users to switch. And the number of "switchers" (of new iPhone sales) have been back in the low double digit lately. Android phones on the other hand can only lose market share. Over 85% of new iPhone purchases are from users that already own an iPhone. There are much less iPhones users to convince to switch.

The most determining factors now, in regards to iPhone sales, is the economy and the upgrade cycle. With the economy, both Android and iPhones have taken a hit. Global mobile phone sales is down (YoY) in the low teens. Much bigger hit in the Android phone market. Having only a 2% loss in iPhone sales (this Q, YoY) is a testament of how popular the iPhone still is.

https://www.techradar.com/news/mobile-phone-sales-have-fallen-once-again-despite-some-signs-of-recovery

The upgrade cycle is more of a factor for iPhone sales. The economy will recover but with iPhone users holding on to their iPhones longer with every new iPhone sold, potential new sales gets more delayed. It use to be about every two years that the average iPhone users would upgrade their iPhones to the latest one. Those were the days when mobile services subsidized a new mobile phone, with the signing of a two year contract. Now, with less subsidy incentives over the years, the average user upgrade cycle have increased to over three years and sill increasing. Along with how long Apple support their older iPhones with software and security updates, there's less of an incentive to upgrade, unless one needs/wants the newest features in the latest iPhones. But with over 1B iPhone users and a loyalty rating of nearly 85%, that comes to about 750M new iPhones sales that Apple can almost count on, over every 3-4 years. (figuring in there's still a good percentage that will hold on to their iPhones for over 4 years or until its end of life in 8-10 years.)

Note that gross margin is higher than last year. Impressive cost control on the product side while investing in services and broader R&D. Likely a lot of cash is going into Vision Pro and the refresh of products for next couple of quarters going into the holiday period.

My feeling is that the emerging market story of growth is akin to the early hockey stick growth of the services division. In the early days of services it was a curiosity but over time became an increasingly highlighted item in the results. The upside in emerging markets is incredible as the population is increasing in affluence and Apple products being aspirational and relatively accessible compared to other aspirational and status products.

The enterprise story for Apple is something they have been successful in growing but still feels like a hobby in Apple’s go to market vs a concerted push. End users are more responsible for their inroads than their strategy. Apple could likely offer a cybersecurity value add managed service for Apple centric firms that could help the SME segment immensely. This would likely goose the gross margins quite materially. Cybersecurity is the fastest growing segment for Microsoft as a comparison. Apple does a lot of good in security, but mostly transparent to the end customer.

My wish for apple is to make their platform strategy more multi-polar and make the Home and Watch first class citizen sub platforms and thus equal peers to the iPhone and iPad.

Apple’s push of manufacturing into India is a fantastic move and will incentivize India’s authorities to make Apple’s expansion there successful. They can likely take many pages out of their China playbook and implement in India to a similar effect of growth over time. Many emerging market countries called out in the earnings call are high population growth countries with young populations that provides a glide path for growth of the TAM in these countries.

(it’s nearly full as I’m a heavy user of photo & video editing and live in an area of slow internet so offloading to iCloud is too slow hence the high onboard storage).

Another side issue is I use an app called Ravebox101 by Blippin Studios, which has been removed from the App Store. I have it on my phone but no way to transfer it to another device so I’m going to need to keep my current device as long as possible (and hope I don’t lose it).

Face it. The smartphone market is mature and every slab phone from every vendor is only subtly different. When Apple introduces a new capability the Androids are sure to follow, and to a much lesser degree, Apple eventually comes around to adopting anything that’s proven to be worthwhile on the Android side, like buggy size phones and customizable home screens. The folding models bring in some new variation, but they’re still out of reach for many buyers because of their extravagant prices.

Apple’s market strength is heavily bolstered by its large installed base of exclusive and loyal customers. I’d bet that Apple captures a lot more new adopters than they lose to competing platforms. Apple’s not sharing customers with other platform players because they are the one and only player on their platform. Apple can tap into their steadily growing, loyal, stable, and some may save captive, installed base to pull in significant revenue from services and subscriptions. Apple’s installed base also provides them opportunities to sell adjacent services like Apple TV+, credit services, banking services, etc., to a willing audience that’s already invested in the Apple ecosystem and eager to consider anything Apple is trying to sell them.