Ming-Chi Kuo says Apple's 'sweetheart deal' with TSMC is no such thing

Analyst Ming-Chi Kuo claims that reports Apple has an exclusive arrangement where TSMC absorbs the cost of failed processors is not true.

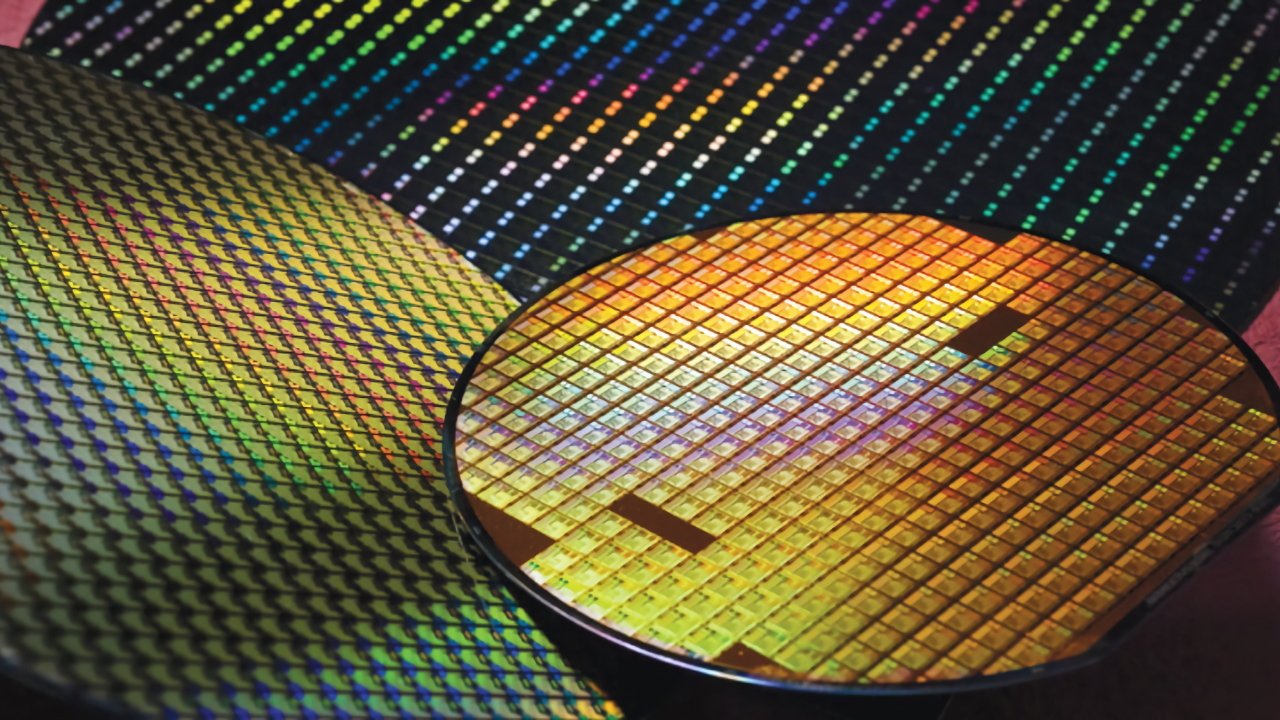

Processors are made in wafers. (Source: TSMC)

The recent report of a so-called "sweetheart deal" between Apple and TSMC claimed that it was an exclusive arrangement concerning the pricing of processors. Where all other companies pay for a complete wafer, including some failed processors, Apple does not.

Instead, it was claimed that TSMC absorbed the cost of any such yield failures, and Apple only paid for functioning ones. Apple was said to benefit from this to the tune of many billion dollars per year, and TSMC benefited in turn from Apple being willing to back its development of new processors.

Now analyst Ming-Chi Kuo says that the idea this is an exclusive arrangement is not true.

Apple3nm

(finished goods buy) (wafer buy)-- (Ming-Chi Kuo) (@mingchikuo)

"There are two ways that customers buy chips from TSMC: finished goods buy and wafer buy," he writes in the full X post. "The vast majority of deals are wafer-buy because TSMC's yields are good enough to ignore the cost of defective chips."

"But Apple is a special case," he continues. "Apple has always asked TSMC to provide the world's latest advanced node production services."

"Because the latest advanced node has many defective chips in the early stage of production, Apple has always purchased finished goods," says Kuo. "And TSMC allocates most of the cost of defective chips to the selling price of each finished chip."

"The best evidence is that the cost of the new processor used in new iPhones increases significantly every year," concludes Kuo, "and this year's A17 is no exception."

Alongside any increase in the cost to Apple of the A17 processor, the forthcoming iPhone 15 range is expected to include a price rise for at least the iPhone 15 Pro Max.

Read on AppleInsider

Comments

I'd equate to the person buying a new car with a sticker price of $40K. The negotiate to $36K and get $10K for the trade. They also could have felt good about themselves if they paid $38K, but got $12K for the trade. The dealer does not care how the numbers work so long as they get what they need.

I rememberApple made the deal with TSMC after Intel had backed out of a 3nm deal with TSMC. So what's going with yield could be why Intel backed out they could see this coming. Apple depended on the Intel TSMC deal because the Intel was the money needed by TSMC to ramp up on 3nm fabrication. Intel backing out meant Apple wasn't going to get the 3nm chips they were planning on. So Apple goes into negotiations with TSMC so TSMC would have funds to make 3nm chips. Whole lot to the business side of the Apple TSMC deal.

If Apple Pay for the finished good price, that fee per working chip will likely be based on expected yields over the lifetime of the chip. Cost will be initially high but then reduce as efficiency and pass rate improve. TMSC margins will be lower initially but will improve over time.

Intel nowadays tend to be the follower. It seems to me that they have lost their edge in chip fab innovation. It's been like that for years and they can't keep up with TMSC.

https://www.electronicsweekly.com/news/business/intel-cancels-n3-orders-tsmc-pares-back-n3-expansion-2022-08/

https://www.tomshardware.com/news/intel-15th-gen-arrow-lake-tsmc-delay

the Apple-TSMC development and production partnership is one huge advantage that Apple can effectively manage.

More generally, there are a ton of products being sold on planet Earth today that have CPUs fabbed on even older processes. That "new" $11 billion fab TSMC is building in Germany will be using 12/16 nm processes for industrial customers like automakers. Sure -- you could swap out the chip that controls your anti-lock brakes for something fabbed on 5nm and save a few watts of power over the life of your car, but there's no way that it's worth it.

The iPhone isn't to the point of the Watch or the microcontrollers in a car -- it does still benefit from process improvements, especially for processing related to the camera and on-device AI/ML. But the benefit isn't of the same magnitude as it used to be. Apple could (and for many models of the iPhone likely will) stick with 5/4nm for another year or two. But I suspect the existence of lower volume products that would benefit from 3nm is a part of their calculation in pushing the iPhone to 3nm this year. (just to be clear, this is in no way a criticism -- I think it's smart and good that Apple is doing this)

It's kind of like this sweetheart deal I have at a local restaurant -- I go there a lot, spend a lot of money, and they are nicer to me than they are to most other customers.

You need volume to make anything cost effective. The iPhone is what gives Apple the scale needed to make designing their own silicon viable. Apple's main interest in any next generation node process is more about efficiency than it is about performance. Yes, the Vision Pro will benefit from the 3nm node, but so will all of Apple's products eventually.

Apple has also been known to front cash and equipment to suppliers to get priority.