Goldman Sachs dodges questions about its relationship with Apple

Following reports of financial firm Goldman Sachs's deteriorating relationship with Apple, the company's CEO has avoided saying anything about wanting to pull out of its Apple Card and Apple Savings deals.

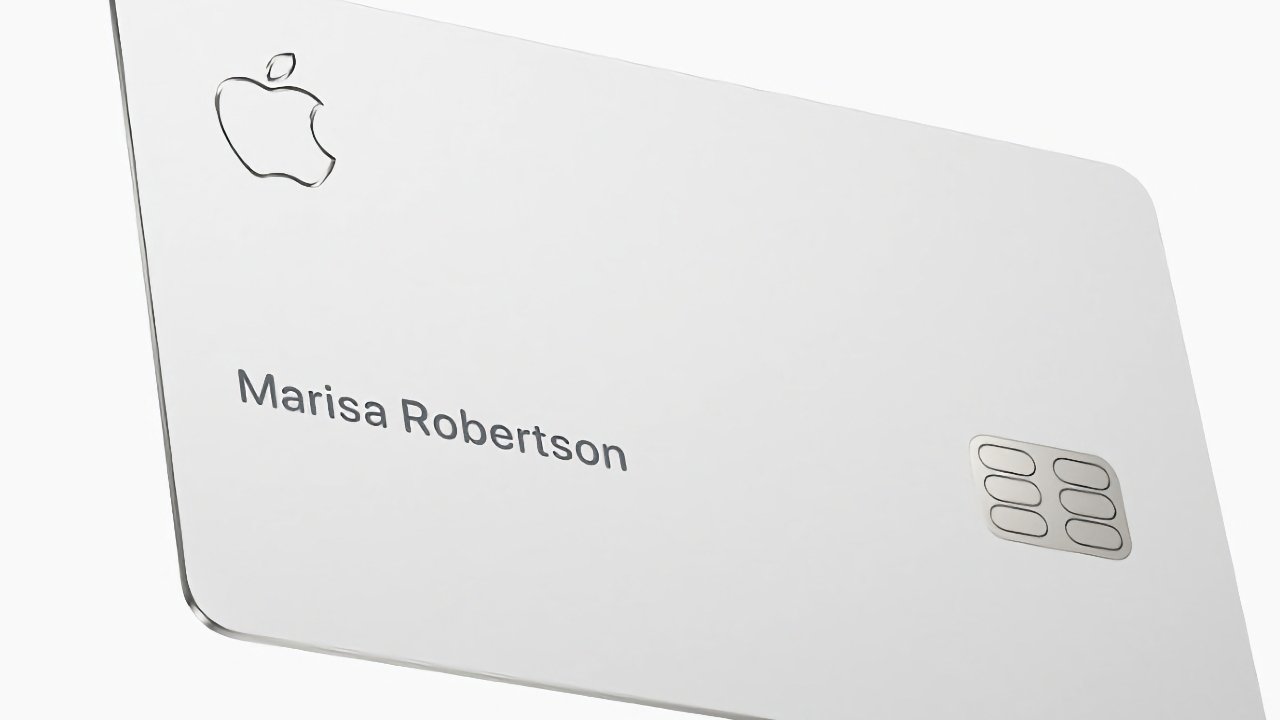

Apple Card

Goldman Sachs has lost so much money -- $1.2 billion in 2022 -- on Apple Card, that it reportedly has tried to sell the deal to American Express. It's also been accused, and cleared, of credit line bias, plus its whole consumer credit portfolio is being investigated.

Then following its April launch of Apple Savings, an executive at the finance firm reportedly even said that "we should never have done this f****** thing."

Consequently, CEO David Solomon was asked about Apple -- and a similar situation with General Motors -- during its latest earnings call with investors and analysts.

"Our partnerships with Apple and GM are long-term contracts, and we don't have the unilateral right to exit those partnerships," he said, according to a transcript by Seeking Alpha. "So our focus at the moment is on managing them better, getting rid of the drag and bringing them to profitability."

"And we're making progress, both in the way we run them and against the cost base that we put against them," he continued. "We'll continue as we go forward to work constructively with our partners and examine what's best in the long run for Goldman Sachs."

"But our core focus is on reducing the drag over the course of the next 12 to 24 months," he said, "and ensuring we operate them better."

The business of "ensuring we operate them better" is a clear enough commitment to the deals that Goldman Sachs does not "have the unilateral right to exit."

However, one way to "reduce the drag" would of course be to find a way to get out of the deals. Separately, one option that has reportedly been raised but not at the highest levels, is that Apple could take on some or more of the financial arrangement.

Read on AppleInsider

Comments

A mere four years ago they cost taxpayers billions of dollars with their dodgy investments in toxic assets and then dodged their responsibility by refusing to take ownership of the problem.

I would suggest that a great many taxpayers wanted out the sub prime mortgage crap and couldn't just exit the arrangement while Goldman Sachs sailed off into the sunset.

Solomon said the only thing he could have. There's no way the CEO could slam Apple. GS signed the contract which was an opportunity, a responsibility, and a risk (among other things). As CEO he is expected to do his due diligence in risk assessment.

And if the entire consumer finance operations is losing money, well it's not Apple's fault.

As covered before, US consumer finance regulations are very strict, much more than the consumer electronics business. Apple has zero desire to submit their business to this level of regulatory scrutiny which is also why Apple has never creating their own banking arm. And the future promises more regulatory control not less.

Apple wrote a contract that is more favorable to themselves. And Goldman Sachs signed it.

This was not a sworn testimony situation. He was not compelled to answer the question directly.

But his avoidance of a direct answer could easily be interpreted by some.

If Person A asks Person B "Do you like the color blue?" and Person B doesn't answer, one might make assumptions.

You don't understand any of these important real-world communication contexts. More than anything, that's truly inane.

As I mentioned before this CEO answered in pretty much the only acceptable way to placate shareholders. Saying anything more would probably put him under more scrutiny (which he doesn't need). His company is navigating troubled waters. He needs to say something to calm the stomachs of those onboard. You have understood none of this.

My question was "How did he dodge the question?" To know how someone dodged a question you really need to know what the question was, right? You seemed to have missed this but Apple Insider never actually quoted the question that Solomon was asked.

I can think of two reasons for not actually quoting the question that Solomon was asked. Either it is sloppy wiring or it was intentionally omitted because it would undermine the conclusion of the article. Apple Insider does some pretty sloppy writing at times and also likes to engage in clickbait. So it is a coin toss on which of those it was.