Apple's suppliers have so far spent $16 billion to move from China

New research says that Apple's suppliers including iPhone manufacturer Foxconn have invested $16 billion since 2018, in an increasing plan to move or reshore manufacturing away from over-reliance on China.

Foxconn is one of many Apple suppliers working to move away from China

Apple and most or all technology firms that have previously been entirely dependent on China, have been working to move away from that reliance, in part because of continued US/China trade tensions. In at least Apple's case, there have also been major delays in production because of China's COVID measures and its problems with power supply.

New research by investment bank TD Cowen seen by AppleInsider estimates that Apple's loss of earnings because of China are considerable, and in part are behind its suppliers moving, or reshoring, to other countries.

"Over the last four years since the start of the pandemic, we estimate Apple's revenues have been impacted by over $30 billion," says TD Cowen in the note. This comes from "undersupplying the market due to production disruptions stemming from component supply, available labor pool, and/or government-mandated movement restrictions."

TD Cowen's analysts believe that because of this impact on its manufacturing chain, Apple and its 188 major suppliers are all investing to reshore as quickly as possible -- and that they will continue to do so.

"We believe these risks are ongoing in nature and that unforeseen environmental disasters could also be included as a non-trivial factor to monitor," write the analysts. "We think the current geographic and labor supply diversification can materially reduce the impact of future production disruptions, which at the peak reduced Apple's revenues by $4-8B per quarter."

So there is a cost to reshoring, and TD Cowen estimates that Apple's suppliers have spent around "$16B for diversifying production assets away from China to India, Mexico, the US, and Vietnam," since 2018.

"While supplier reshoring does entail higher costs near-term, we believe there are benefits to the product costs long-term once the ex-China capacity is fully at scale," continues the report. "We envisage a multi-year process before Apple sees full operating margin benefits as... partners leverage the local labor pool."

"We believe the higher manufacturing costs are partly borne by Apple," claim the analysts, "though this has not been fully evident in recent profit trends..."

Having "analyzed over 1,000 financial filings" from key firms such as Foxconn, TD Cowen estimates that "iPhone production is still captive to China [although] India's Tata Electronics has potential as a future iPhone exporter."

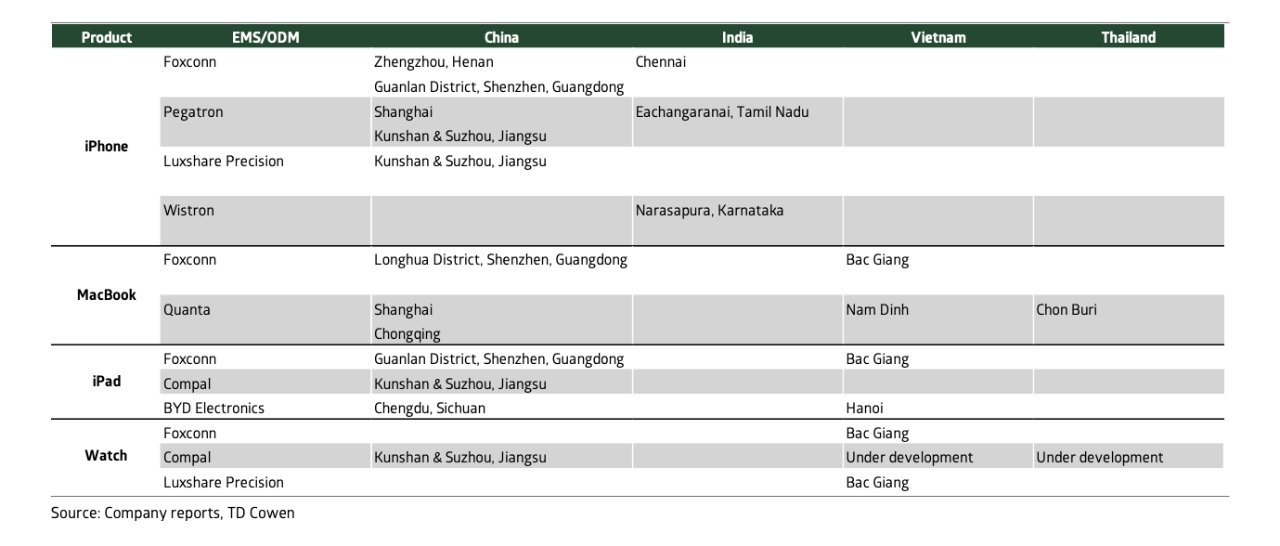

Countries where Apple devices are made (Source: TD Cowen)

"For the iPhone, the majority of production remains centered in China but recent investments... in India are just starting to create a new manufacturing hub where the company could export large volumes to the US," say the analysts. "India is quickly becoming a top consumer of the iPhone and this local production not only reduces distribution logistics costs but also improves affordability as import tariffs do not apply."

There are limits on how much iPhone production can move away from China, though.

Reshoring will take years

"We believe current capacity at Indian facilities can support annual output of ~25M units," says TD Cowen. "This supports local demand of ~10M and potentially ~20% of the 70M+ units in annual US iPhone demand (~30% of global demand)."

"[By contrast,] Mac and iPad make good reshoring headway with new Southeast Asia capacity," continues the report. "Our supply chain field work suggests Vietnam has evolved into a major production hub for computers in recent years and small volumes of MacBooks, iPads, and the Apple Watch are already being manufactured there."

"We estimate that Vietnam capacity can support ~40% of annual US Mac/iPad demand," it says. "While this is good headway and additional capacity is still required to meet US consumption, diversification of production to non-Chinese suppliers is still needed to achieve reshoring."

TD Cowen estimates that it takes up to 18 months for a company to establish a new manufacturing plant, and potentially even longer to organize the whole supply chain. "If even one critical component cannot be produced away from the region that the supply chain is de-risking from," say the analysts, "then reshoring will only be partial."

Apple has not commented on this report, or on plans to reduce its over-reliance on China. However, during the Chinese production difficulties that delayed the iPhone 14 range, Apple did issue a rare statement about the problems.

Read on AppleInsider

Comments

This seems more like a warning shot to the Chineese government, rather than re-shoring, which will not end well for Apple in the future 😏

They have learned nothing from History.

The democracies have also been put on notice to invest in their defense manufacturing base.

So I think the probability of a Taiwan invasion in the next decade has dropped from maybe 80 percent to 50 percent.