Morgan Stanley sees AAPL earnings as clearing event to refocus investors

Investment bank Morgan Stanley says Apple's forthcoming earnings call will be "a clearing event," that stops short term concerns and gets investors looking at the company's signs of future growth.

An Apple Store sign

Ahead of Apple's holiday quarter earnings report on February 1, 2024, Morgan Stanley has maintained its $220 price target, but continues to expect growth overall in the longer term.

"[Near-term] Product demand remains uneven, while Services is outperforming," says Morgan Stanley, "which we believe will result in a healthy December quarter beat, but March quarter guide down."

Morgan Stanley analysts now forecast around $119 billion revenue for the December 2023 quarter, which is 1% to 2% ahead of the market's consensus. For the March 2024 quarter, however, it predicts revenue of $93.4 billion, which is between 0% and 3% below consensus.

The analysts believe that the FY24 consensus is too high, but that therefore, "we see earnings next Thursday as a "clearing event" that will help to 1) reset NTM [Next Twelve Months] estimates lower and 2) allow investors to turn their attention towards what we believe will be a positive inflection in fundamentals in FY25..."

For 2025, Morgan Stanley believes growth will be "driven by an underappreciated Edge AI refresh cycle... and sustained gross margin and Services strength.

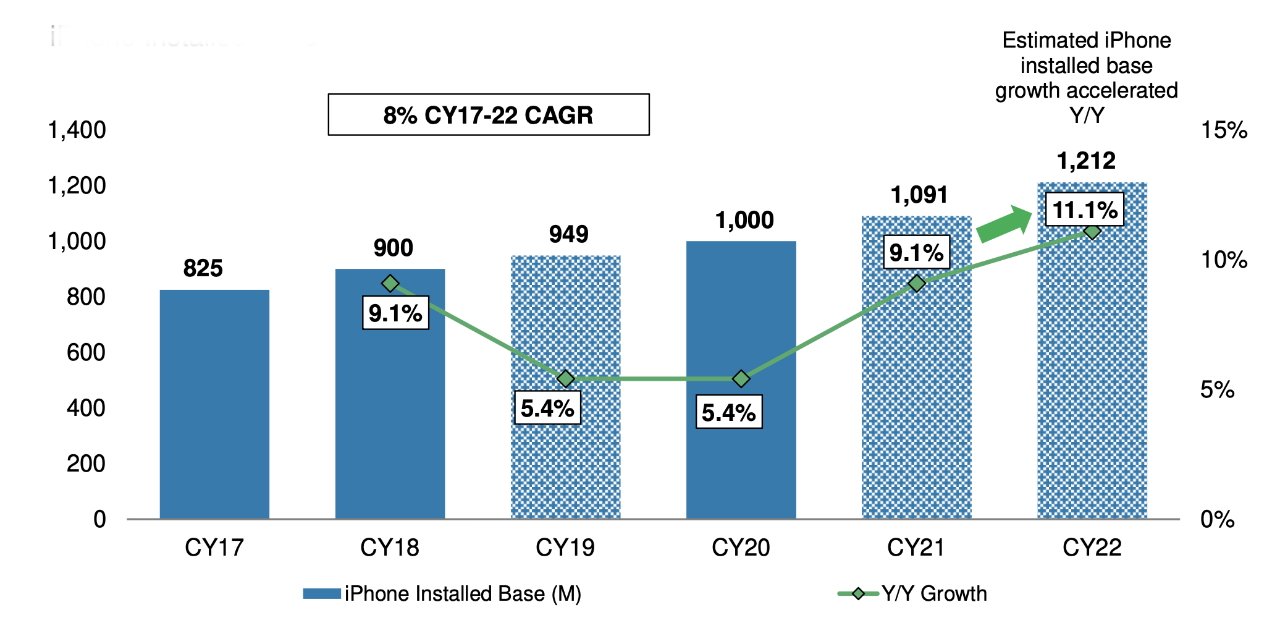

"We believe Apple's business model is shifting from maximizing unit growth to maximizing installed base monetization," say the analysts, "with 1) installed base growth, and 2) spend per user (Product/ Services) the two most important metrics underlying this shift."

Installed base of iPhone useres (Source: Morgan Stanley)

"We'd argue this shift [to a more positive market expectation' has already begun," continue the analysts, "as Apple shares have outperformed the market by 5 points in the last 5 trading days, and sit just 2% off their all-time highs.

Read on AppleInsider

Comments

It is hard to see how he mathematically even gets to $93B. Especially given probability of new iPad and Mac releases hitting 2H of March and $400-$500M of Vision Pro revenue. Something has to materially turn negative - either iPhone or Services growth evaporates

I think Wall Street would hate this result and narrative