Apple's $119B Q1 2024 revenue a bounce back from 2023 dip

Apple reported revenue of $119.58 billion in its first-quarter results for the 2024 fiscal year, with earnings rebounding from the year-ago quarter.

The first quarter of the 2024 fiscal calendar, and one typically assisted by holiday sales, Apple issued its financial results on Thursday, ahead of the usual conference call that CEO Tim Cook and CFO Luca Maestri has with industry analysts.

For the first quarter, Apple achieved $119.58 billion in revenue, up from the $117.15 billion reported for Q1 2023. The earnings per share of $2.18 is up from the $1.88 from the year-ago quarter.

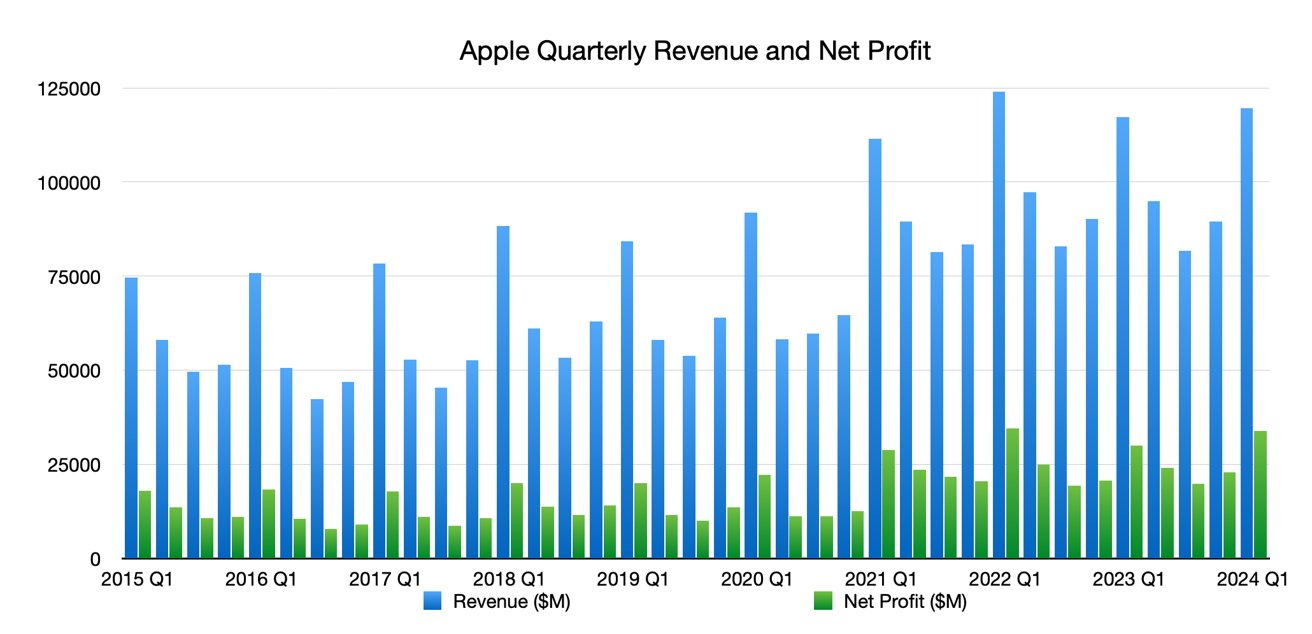

Apple quarterly revenue and net profit as of Q1 2024

The quarter benefited from the release at the end of the previous quarter of the iPhone 15 lineup, the Apple Watch Series 9, Apple Watch Ultra 2, and updated AirPods Pro 2. During the quarter, Apple brought out M3 Macs, including the 24-inch iMac, 14-inch MacBook Pro, and 16-inch MacBook Pro.

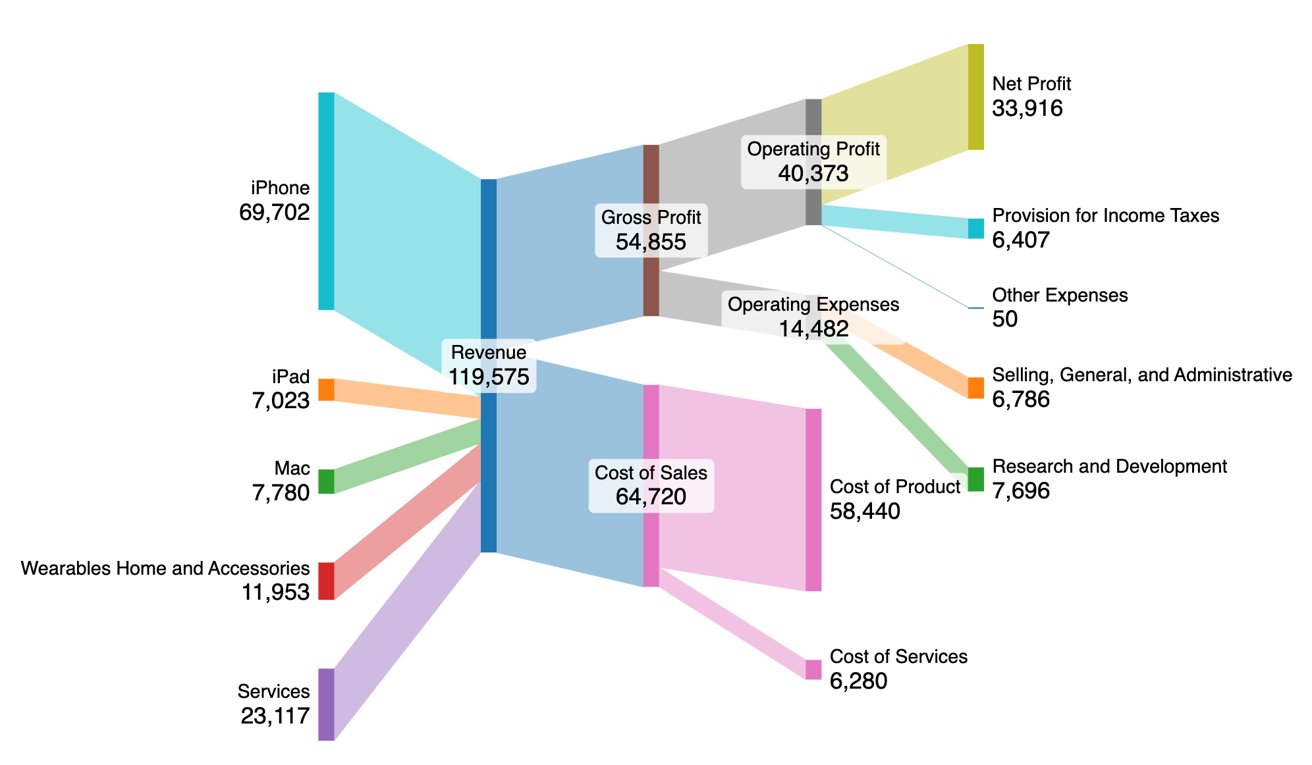

Broken down into segments, Apple's iPhone revenue of $69.7 billion is up from the $65.78 billion of the year-ago period.

Mac revenue is up at $7.78 billion compared to Q1 2023's $7.74 billion. Revenue from iPad sales fell from $9.4 billion one year prior to $7.023 billion this quarter.

A Sankey Chart for Apple's Q1 2024 financial results

Wearables, Home, and Accessories managed $11.95 billion, down year-on-year from $13.48 billion. Services, a typically reliable growth arm for the company, saw its finances go from $20.77 billion in Q1 2023 to $23.117 in the latest results.

Apple's board of directors has issued a cash dividend of $0.24 per share of common stock, payable on February 15 to shareholders of record as of the close of business on February 13.

"Today Apple is reporting revenue growth for the December quarter fueled by iPhone sales, and an all-time revenue record in Services," said CEO Tim Cook. "We are pleased to announce that our installed base of active devices has now surpassed 2.2 billion, reaching an all-time high across all products and geographic segments."

On the latest launch, Cook comments "as customers begin to experience the incredible Apple Vision Pro tomorrow, we are committed as ever to the pursuit of groundbreaking innovation -- in line with our values and on behalf of our customers."

"Our December quarter top-line performance combined with margin expansion drove an all-time record EPS of $2.18, up 16 percent from last year," said CFO Luca Maestri. "During the quarter, we generated nearly $40 billion of operating cash flow, and returned almost $27 billion to our shareholders. We are confident in our future, and continue to make significant investments across our business to support our long-term growth plans."

Additional information about Apple's quarter will be revealed during the analyst call.

This story is breaking. Refresh for the most current information.

Read on AppleInsider

Comments

AAPL will underperform in this year.

This is the moment where AAPL shareholders get jelly at META (+12%!!!) and AMZN (+6%!!!!).

so what you are saying is that you wrong when you said it would “tank”?

It does not matter.

AAPL will underperform in this year.

Tim Cook indicated weak iPhone sales for this year during the earning webcast.

For fiscal Q4 2024, Meta earned $5.33 per share, an increase of 202.8% from $1.76 per share a year ago.

Revenue grew 24.65% to $40.1 billion from $32.17 billion a year ago.

Compare that to Apple's 2.05% revenue growth and EPS growth of 15.96% ($2.18 vs $1.88 a year ago).

I don´t know where those similar performances should come from at AAPL.

I do not see any significant improvement from AAPL for this year.

Among "Magnifcant Seven", TSLA and AAPL seem to be the biggest losers in this year.

I am not referring to any "guess-timated" statements from analysts, but if you could listen to Tim Cook during the earning webcast today, he indiciated indirectly that Greater China is still a challenge and remains as a challenge for this year. He sounded pessimistic and not confident at all.

Some days ago, Ming-Chi Kuo claimed that iPhone sales will decrease in 2024. And he seems to be right.

About AI: LLMs (Large Language Models) are called like that because they are large.

Large means that these models have billions of parameters and require plenty of Gigabytes or TB for running the models.

But LLMs have nothing to do with smartphones, because mobile phone´s memory is not large enough to run those LLMs.

The video memory is too limited.

What AAPL tries to do with iOS 18 is nothing, but what Google Pixel phones already have which is dedicated Machine Learning hardware and ML models that run on the phones to do things like real time transribing, image recognition etc.

It sounds really crazy and maybe ridiculous to others, but maybe, it is about time to replace Tim Cook, because we are basically in a very early phase to break into another innovative world from Mobile (PC --> Mobile --> ?? AI maybe?).

I am not saying that Tim Cook is a poor CEO. He is an excellent operator, but the times, which allowed an excellent operator to run an excellent company, seem to be over.

Now comes the time, where a pure innovation is required. AAPL needs to drive it.

Beautiful.

Meanwhile, Apple looks to continue as the marketshare, revenue, and profit leader in smartphones worldwide, as if innovation alone is the actual driving force in a mature industry.

As for China, that economy is in severe trouble. Really severe trouble.

I'm guessing that you are attempting here at AI to drive the stock price down to a level that makes sense for you to enter at...

Does it not matter? If you want to sell people your or prognostication prowess your track record does kind of matter and right now you have gotten zero out of one right.