Stripe adds Apple Pay Later as a default option for merchants

Stripe now supports Apple Pay Later, which lets customers pay for something up to $1,000 over six weeks.

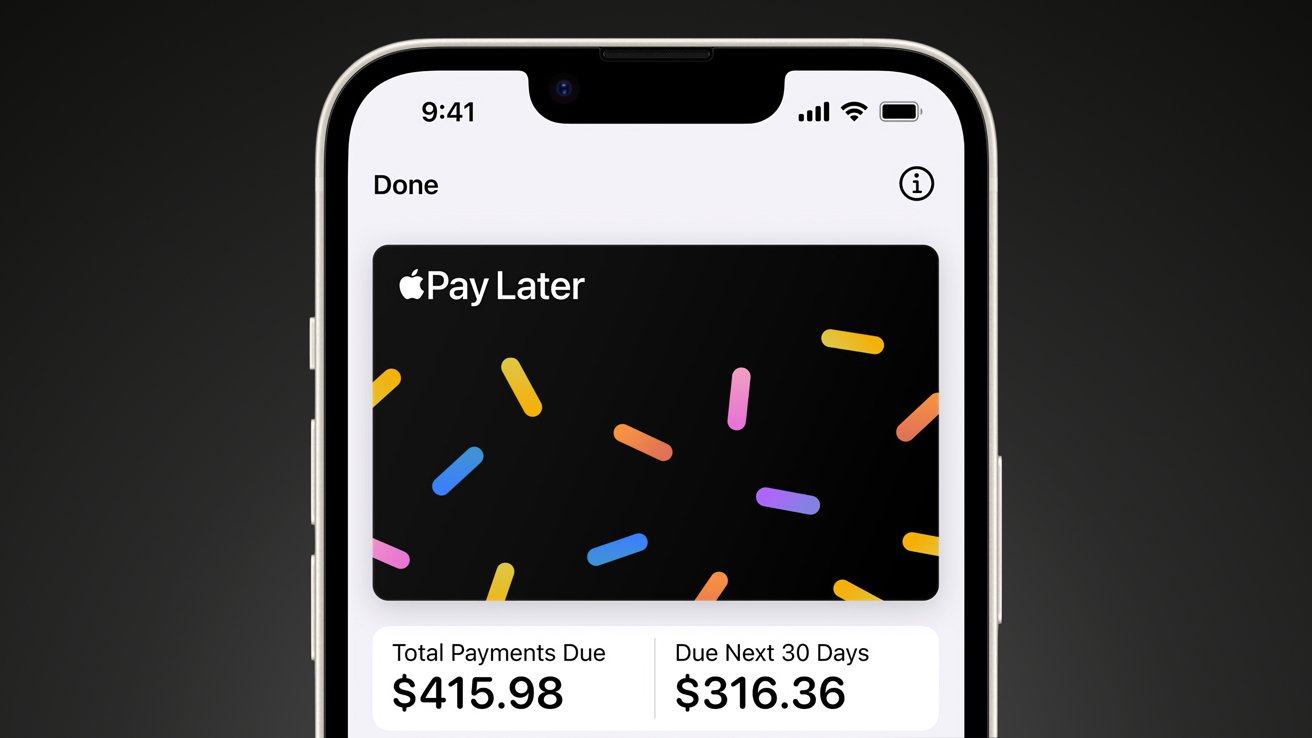

Apple Pay Later is a buy now, pay later service

Apple Pay Later is a buy now, pay later service backed by Apple and served on the Mastercard network. It allows customers with good standing to pay for products between $75 and $1,000 over six weeks in four equal payments.

Stripe is the latest payment platform to adopt Apple Pay Later. It is enabled by default for merchants that accept Apple Pay.

The update was first reported by 9to5Mac, which points out that Apple Pay Later was already available to select merchants before this official release. Stripe has been rolling out the feature since March.

Merchants that don't want to support Apple Pay Later can opt-out using different methods detailed on Stripe's support page.

Apple Pay Later is available only in the United States. Customers apply for an Apple-backed loan at checkout, which won't affect their credit score but will show up on credit reports.

Read on AppleInsider

Comments

How can you truly not wait those 6 weeks? Save up that money you think you'd otherwise have to pay off the loan, and buy it in a normal transaction. A month and a half is not that long to wait to buy whatever nonessential item you think you need right away.

How exactly do you think these companies are making money on these short term loans? From the majority of their lower income customers being late or defaulting on payments and incurring huge fees and interest. These schemes are bad for consumers and it's truly a shame that Apple ever got into it.