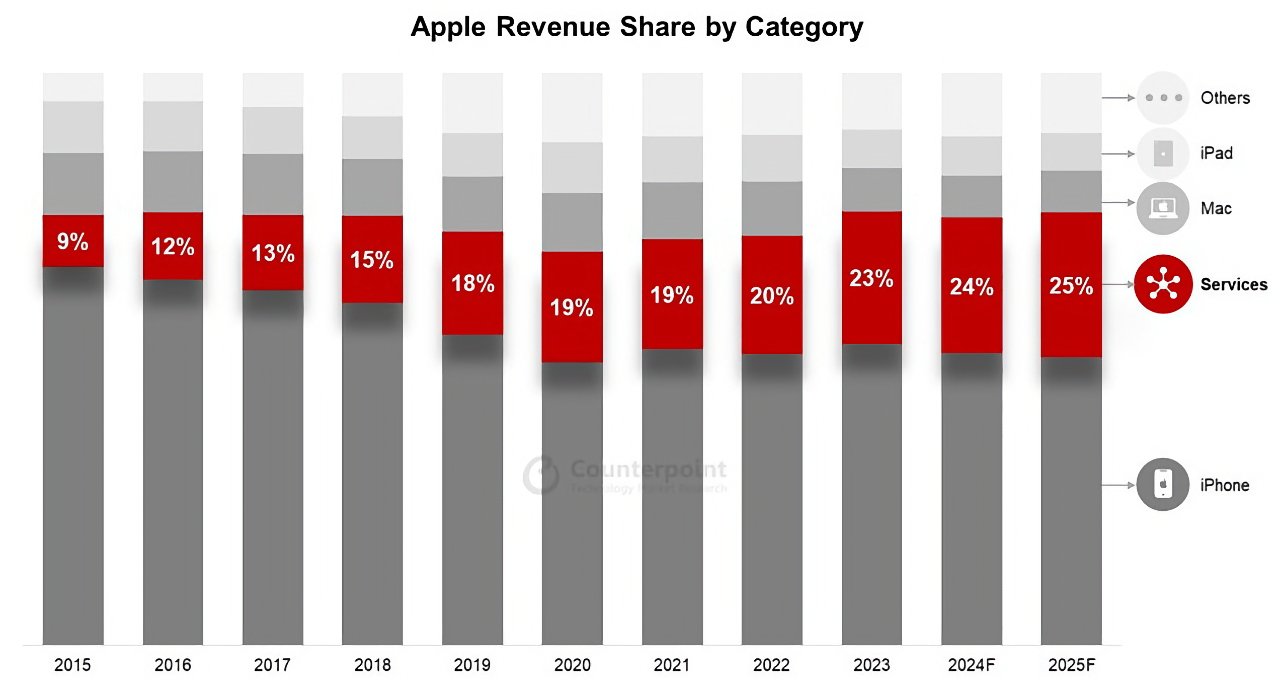

A quarter of Apple's revenue will come from Services by 2025

New research predicts that the success of the Apple One bundle will lead to Services accounting for more of Apple's revenue than any other category bar the iPhone.

Apple Services are bundled in various tiers of Apple One

While analysts are concentrating on iPhone demand declining, and regulatory pressures on Apple only increasing, Counterpoint Research sees a strong future for Apple Services. Specifically, its predictions include Services accounting for 25% of Apple's total revenue by 2025.

That would mean Services growing to over $100 billion in revenue annually for the first time. Counterpoint also expects that Apple's overall revenue will have grown to $400 billion annually -- despite regulatory issues.

This is because legal and regulatory concerns are likely to take many years to complete, and in the meantime Apple's growing iPhone user base is increasing the market for Services.

"We know there is risk, but it is early stages right now," said Counterpoint research director Jeff Fieldhack in a statement. "So, we are not expecting any impact to monetization of the iPhone installed base, at least not in the medium term."

How Apple Services revenue is growing into a quarter of Apple's earnings

Describing Apple's two billion active users as having created a flywheel effect, Counterpoint says that Services such as Apple Music, AppleCare+, and the App Store have seen commensurate growth. Its analysts say that by 2025, the single greatest contributor to Services revenue will be the Apple One bundle.

Counterpoint does also say that Apple One began in 2023, though, when actually it launched in late 2020. The analysts may instead have been referring to when the price of Apple One was raised in November 2023.

Read on AppleInsider

Comments

I do understand the difference. Some people like me have many Apple devices. But other households share Apple devices like HomePods, Apple TVs, and even iPads between family members. They’re definitely extrapolating from the one somewhat deterministic data point to one that is far less deterministic. They could have been more clear about their size being an estimate or approximation, but with such a large magnitude number it may be irrelevant to identifying the scope of the opportunity for growth.

TV+ —- love it, watch a lot

arcade — hate it, don’t use

music — it’s fine

iCloud — if’s fine

News — it’s fine

whatever else — fine.

If they could move Arcade and News into the “love it” category— and I think that should be feasible if they’d try — then Apple One would be in the same league as Apple devices. But I’m not holding my breath

Settle DoJ case, stock plummets. Use war chest of cash to buy back and retire shares at the discounted price.

1 year afterwards everything is fine as people realize opening up the platform to other stores and all that is actually good for the larger business and Apple is making more money than ever.