Following a great launch quarter, China iPhone sales are pretty bad so far in 2024

After the second-best iPhone launch quarter Apple has ever had in China, new sales estimates claim that Apple also had the biggest quarterly drop it has ever had.

iPhone 15 Pro

Figures from Counterpoint Research have already claimed that Apple's iPhone sales for Q1 2024 in China were down 19.1% year over year. Now Canalys says that sales were significantly worse with a 25% drop.

Apple's decline was the worst amongst the top five vendors, selling 10 million iPhones, dropping from a 20% market share to a 15% one. That compares to the top reseller, Huawei, which shipped 11.7 million smartphones, rising to 17% share from 10% in Q1 2023.

Canalys says that Apple's decline also came as the Chinese market rebounded after years of continuous decline.

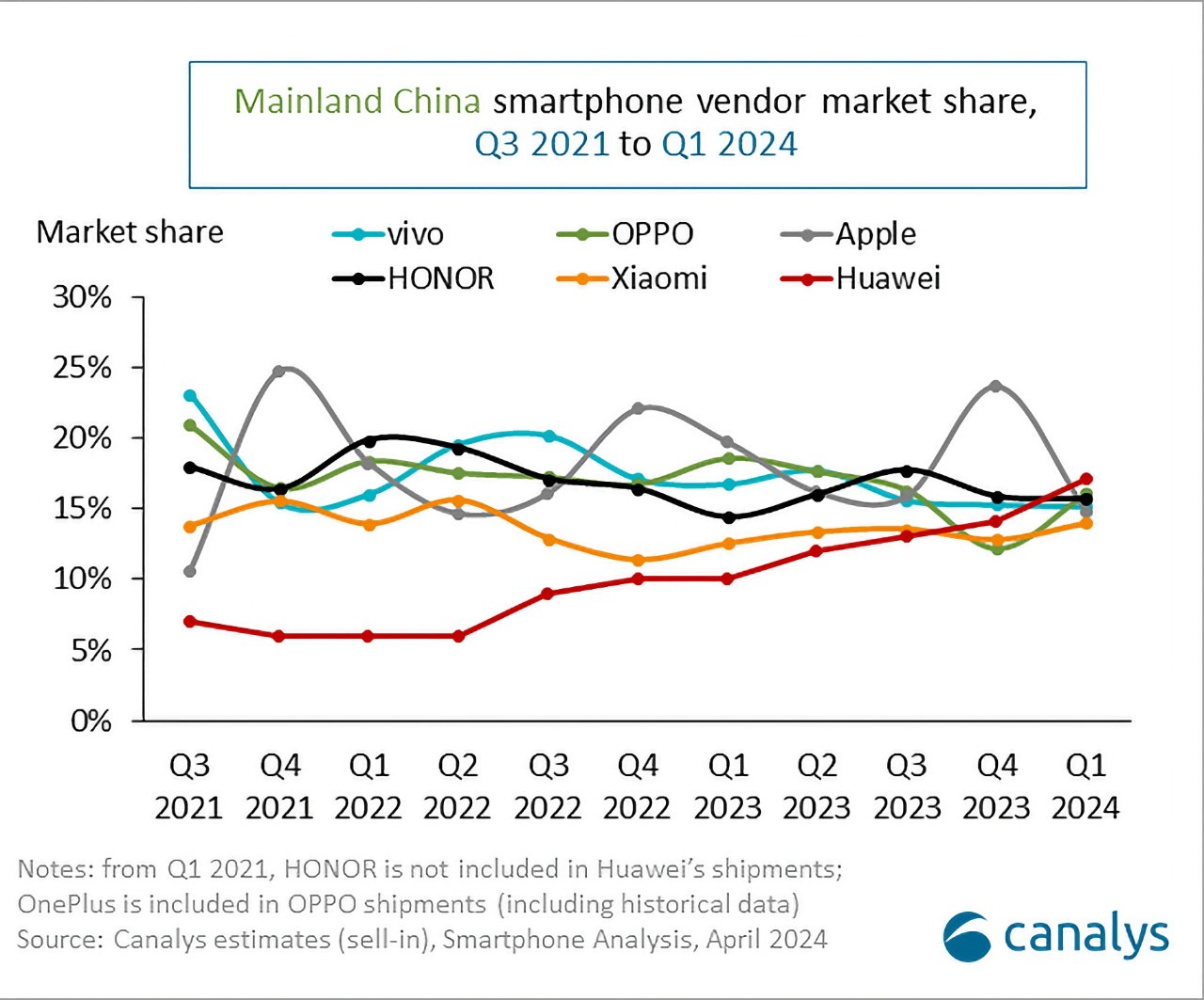

However, Canalys's chart of sales from Q3 2021 to Q1 2024 shows that the iPhone 15 peaked higher than the iPhone 14 the year before. Then just as with analysts such as Morgan Stanley, Canalys expects AI to boost smartphone sales -- but it thinks that will benefit China's own brands.

Smartphone market share in mainland China (Source: Canalys)

"The Gen AI-capable smartphone presents important opportunities for Chinese vendors to differentiate in the high-end in 2024 to challenge Apple [further]," said Lucas Zhong, Canalys Research Analyst. "Canalys forecasts Gen AI-capable smartphones will reach 12% of shipments in 2024 in mainland China, ahead of the global average of 9%."

In February 2024, Apple reported that China sales were down 13% year over year, but this still amounted to just over $20 billion in iPhone sales in the country.

Read on AppleInsider

Comments

HONOR also saw double-digit growth.

Apple’s sales were subdued during the quarter as Huawei’s comeback has directly impacted Apple in the premium segment."

Counterpoint also indicates that weekly sales of iPhones are edging up. AFAIK, Apple hasn't increased its discounting efforts beyond what has been widely reported so perhaps they've decided to weather the storm and wait for September in the case of China.

It is true that phones with AI marketing are gaining traction and Honor, Huawei and Samsung have all released recent phones to keep momentum going.

New folding options are on the horizon too.

It all adds up to reduce the appeal of iPhones in China at the moment.

When the company launched the Osborne 1 —maybe, the first transportable computer—… immediately announced the Osborne 2:… much better… So people did not buy the Osborne 1!

So… who will buy an iPhone now with all the news about AI in the next one?