Apple Pay Later is getting killed in favor of third-party loan integration

Apple has announced that it will be ending its Apple Pay Later program, roughly one year after it launched it.

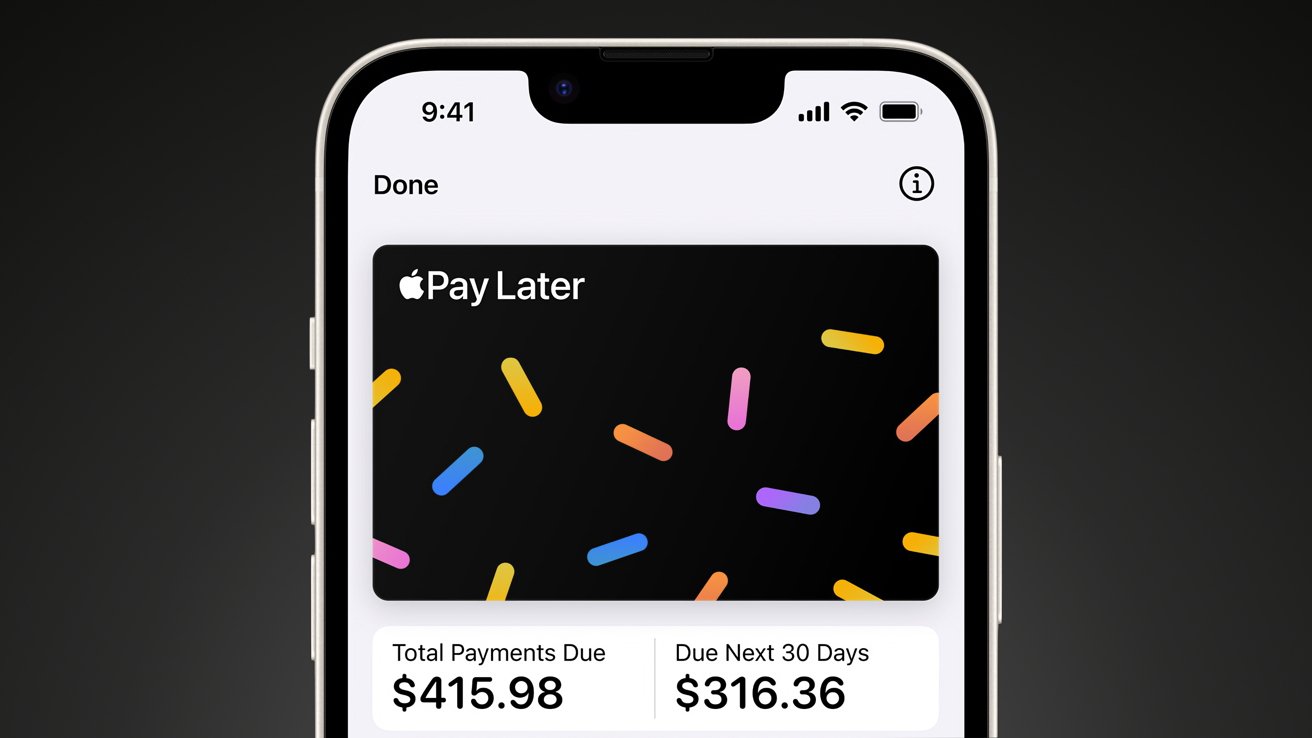

Apple Pay Later

in October 2023, Apple Pay Later was Apple's stab at offering Apple users a short-term financing solution that spread payments over six weeks.

Now, despite its success, it seems that the tech giant is killing off the program in favor of new features being launched later this year.

Apple provided a statement to 9to5Mac that said the company would instead be working with existing short-term loan programs, such as Affirm, to integrate those into Apple Pay.

Apple likely decided it didn't want to be in the short-term loan game, for reasons known only to itself right now. While Goldman Sachs issued the Mastercard payment credential, Apple Pay Later loans were actually backed by the tech giant itself.

Users with active Apple Pay Later plans can still manage and pay their loans through the Wallet app. Installment purchase plans for Apple hardware are unrelated, and are unaffected by the closure at this time.

Gains or losses from Apple Card and Apple Pay Later are embedded in Apple's Services revenue reporting. It's never been clear how many Apple Pay Later loans were issued.

In early June, Apple had announced that it would roll out new Apple Pay features in the fall. The announcement even telegraphed that Apple may be preparing to exit the short-term loan space.

The company said Apple Pay would offer greater flexibility and choice for checking out online and in-app. It would allow users to redeem rewards and access installment loan offerings from eligible credit or debit cards when purchasing online or in-app with iPhone and iPad.

The announcement also pointed out that Apple Pay users can apply for pay-later loans directly through Affirm when checking out with Apple Pay.

Read on AppleInsider

Comments

Apple should work on health instead of making it easy to spend without a line of credit.

two, perhaps Apple wants to offer this product in other countries than the USA. The old model could not get agreement for the provincial behaving banking sector elsewhere.