EU Apple Pay antitrust action is complete, after NFC opened to competitors

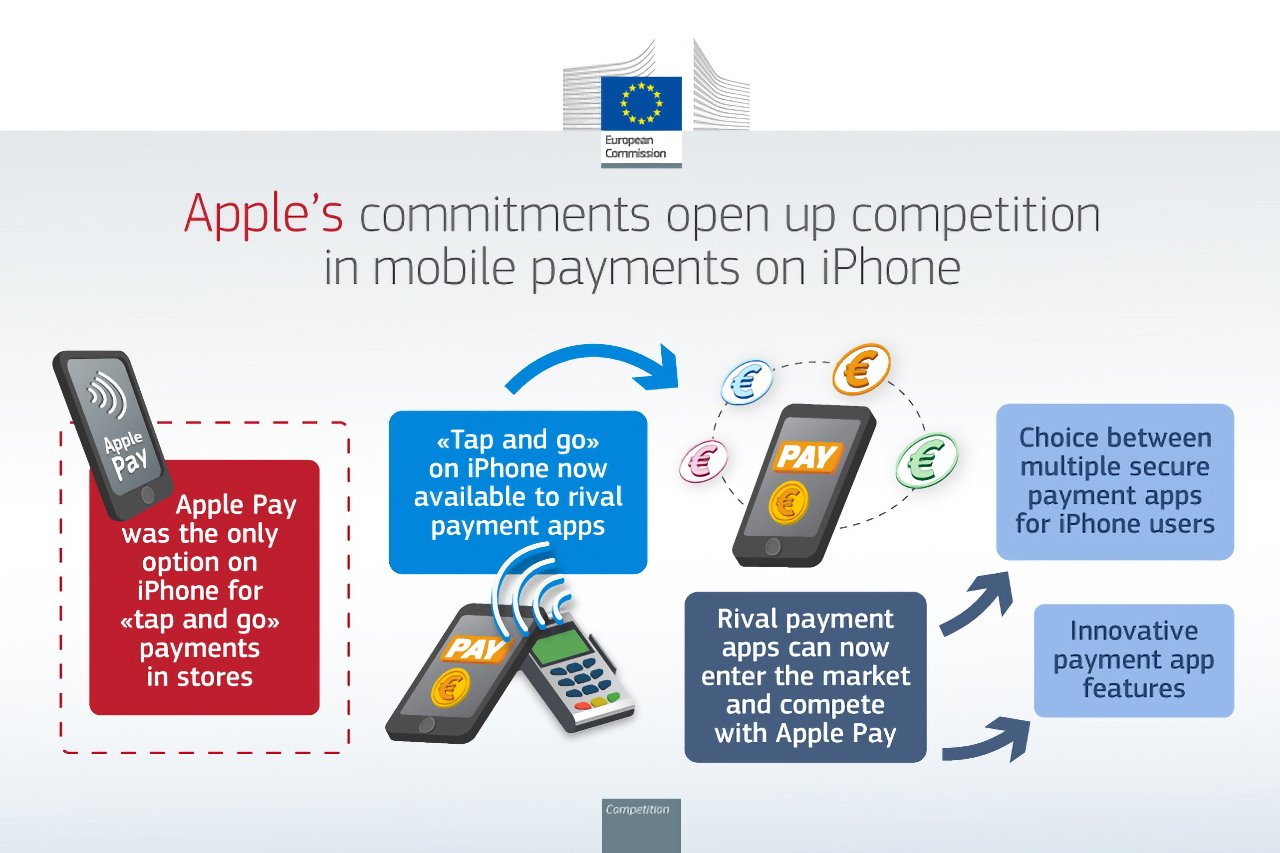

The European Union has formally accepted Apple's response to its antitrust concerns over Apple Pay, and iPhones will now allow rival firms to use the technology.

Apple is opening up its NFC APIs to rivals in the EU

The EU had threatened Apple with fines of up to $40 billion for how it reserved iPhone NFC technology solely for its own Apple Pay. Apple agreed to open it up to rivals within the EU, but it has taken some months for the regulators to accept the details.

The EU says that the time was spent testing Apple's commitments, and consulting with rivals over them. After some adjustments, the EU has now accepted Apple's commitments, and is making them legally binding for the next ten years.

"Apple has committed to allow rivals to access the 'tap and go' technology of iPhones," said antitrust chief Margrethe Vestager, in a statement. "Today's decision makes Apple' commitments binding. It opens up competition in this crucial sector, by preventing Apple from excluding other mobile wallets from the iPhone's ecosystem."

The EU's visual description of what its changes mean to customers

"From now on, competitors will be able to effectively compete with Apple Pay for mobile payments with the iPhone in shops," she considered. "So consumers will have a wider range of safe and innovative mobile wallets to choose from."

Broadly, Apple's revised commitments to the EU include:

- Supporting Host Card Emulation (HCE) payment credentials stored online instead of on the phone

- Removing a requirement for developers to be licensed Payment Service Providers

- Allowing developers to prompt users to change their default payment app

- Shorten deadlines for resolving disputes

In short, iPhone users in the EU will be able to replace Apple Pay and Apple's Wallet with offerings from other firms. In May 2024, the London-based digital wallet firm Curve said that it was only waiting for the EU to resolve final technical details before launching its alternative payment system on iPhones Europe-wide.

Read on AppleInsider

Comments

That hasn’t created a freedom for me as a customer to choose a wallet. Instead they will have to have a Walmart wallet, a MacDonalds wallet etc in addition to Apple Wallet. I’m enforced to use several different wallets. In theory I will have to have a wallet app for wvery store I shop in. This is a freedom for the companies to create their own wallets, and I will have to use multiple wallets, NOT a freedom for me to choose one wallet that I can use everywhere.

It's freedom of choice.

You decide. All McDonald's wants is your money. Put your card onto Apple Wallet/Pay and see if McDonald's rejects it.

Translation, "we've consulted with the people bribing us properly to see if they're happy with the changes."

The reality is we are more likely to see banks that already have Wallet/Payment systems on Android moving to iPhones.

If they haven't had security issues on Android, their is little to no reason to believe they will have issues on iPhones.

Then you should never have bought an iPhone.

i am aware that other people may have other preferences, but for me the less apps the better

Before making decisions like this they should have made a though analysis of the consequences, which they apparently have not done. At least not a proper and thorough analysis.

Then I need a Norwegian wallet to by airplane tickets, an Ikano card alley to shop at IKEA, an ICA wallet to shop in ICA stores etc. Unless EU will force them to support all wallets from other companies, while ch would be very costly, my guess is that each one of them will require you to use their own wallet. This means I will have to install multiple wallets, and can not freely choose one wallet for all my purchases.

And to be clear, Apple didn't invent NFC, nor were they the first company to put it in a phone, so for them to use their power to 'gatekeep' this from business' and iPhone users should be removed I think.

No Apple did not invent NFC. No one ever claimed they did. However the tokenization they brought with Apple Pay added a great deal of security. I think especially in the US where using PINs with credit cards was a very slow adoption. And yes I know others have brought tokenization to their wallets, but I am fine with Apple Pay and if they take a small charge to make my transactions secure, merchants can add that to my bill. They seem to be good at passing on every other cost.