Apple's batterygate settlement fund didn't have enough money to pay a $92.17 check

So much for being the world's most valuable company. An iPhone "batterygate" settlement check has bounced and allegedly because of insufficient funds.

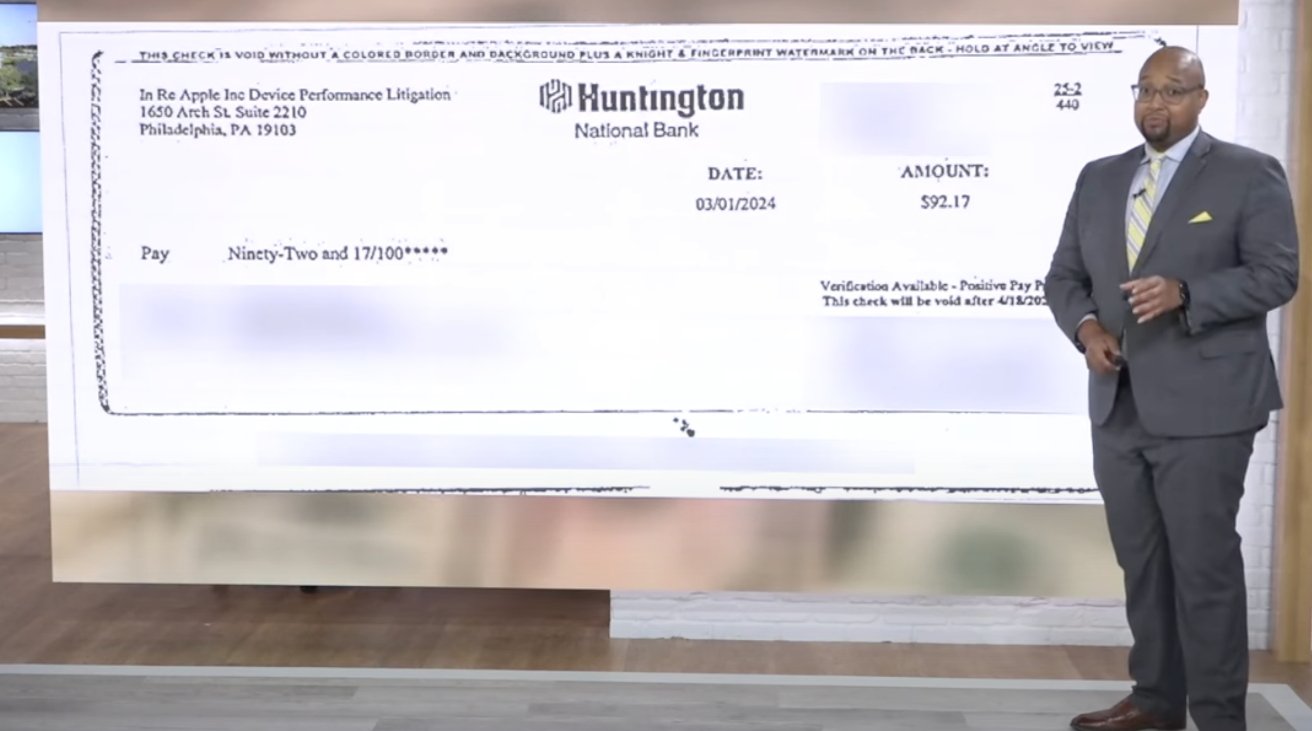

The bounced check that will bring down Apple. (Source: First Coast News)

Maybe those falling sales in China are worse than we think. When Tim Cook and CFO Luca Maestri next announce Apple's earnings on August 1, 2024, perhaps they're going to have to own up to some devastatingly bare coffers.

For according to Florida's First Coast News, Clay County resident Desiree McNeil had some bad news from her credit union. She was one of the many iPhone users included in Apple's settlement of the so-called batterygate case, and the checks from that began being sent out in January 2024.

When McNeil deposited her check for $92.17, it was returned unpaid because of to insufficient funds.

The key word there, though, is "when." The check, labeled "In Re Apple lnc Device Performance Litigation," was dated January 3, 2024, but McNeil deposited it on April 1.

"By April 3rd, my credit union returned the check because for insufficient funds, they said that the litigants didn't pay it," said McNeil.

The crack team at First Coast News first confirmed that Apple really was sending out such checks. This should have been pretty easy, since they reported on it themselves.

They then contacted the credit union. Reportedly, they were told that the check was now too old.

"According to the front of the check she had until April 18th before it would become void," reported news anchor Anthony Austin.

The credit union directed Austin to the check's issuer, Huntington Bank, who then shuffled him off to some administrator of the account. That's as far as the hot investigation has led, for now.

Read on AppleInsider

Comments

A bit surprised that US banks still handle checks at all.

I agree, It is strange about cheques there. Here everything is transfer, either through a service (like Bizum) or by IBAN.

We also have a news story and a quote that says, "my credit union returned the check because for insufficient funds."

Something else is odd. I seriously doubt the check would only be valid for a month and a half. I've seem 3-months, 6-months or a year, but nothing that short.

This is not a pro-Trump posting. Just noting the usage of his name as compared to the original post.

Why is this article on this site if it isn't for the purposes of "clickbait?"

This should be embarrassing, but not for Apple.