iPhone 16 struggles to catch on while Pro models hold strong

Apple's iPhone 16 launch is off to a slow start, with early sales suggesting that buyers might be more interested in 2023's models than the latest upgrades.

iPhone 15 and iPhone 16

According to early data, the iPhone 16 models, released in September 2024, appear to be off to a slower start compared to last year's iPhone 15 lineup. Unlike recent years, the 2024 release aligns closely with Apple's typical pre-pandemic launch schedule, providing a comparable look at year-over-year performance.

Reports, including one from Consumer Intelligence Research Partners (CIRP), reveal that the iPhone 16's initial sales haven't matched the swift uptake of the iPhone 15 lineup from the same period in 2023.

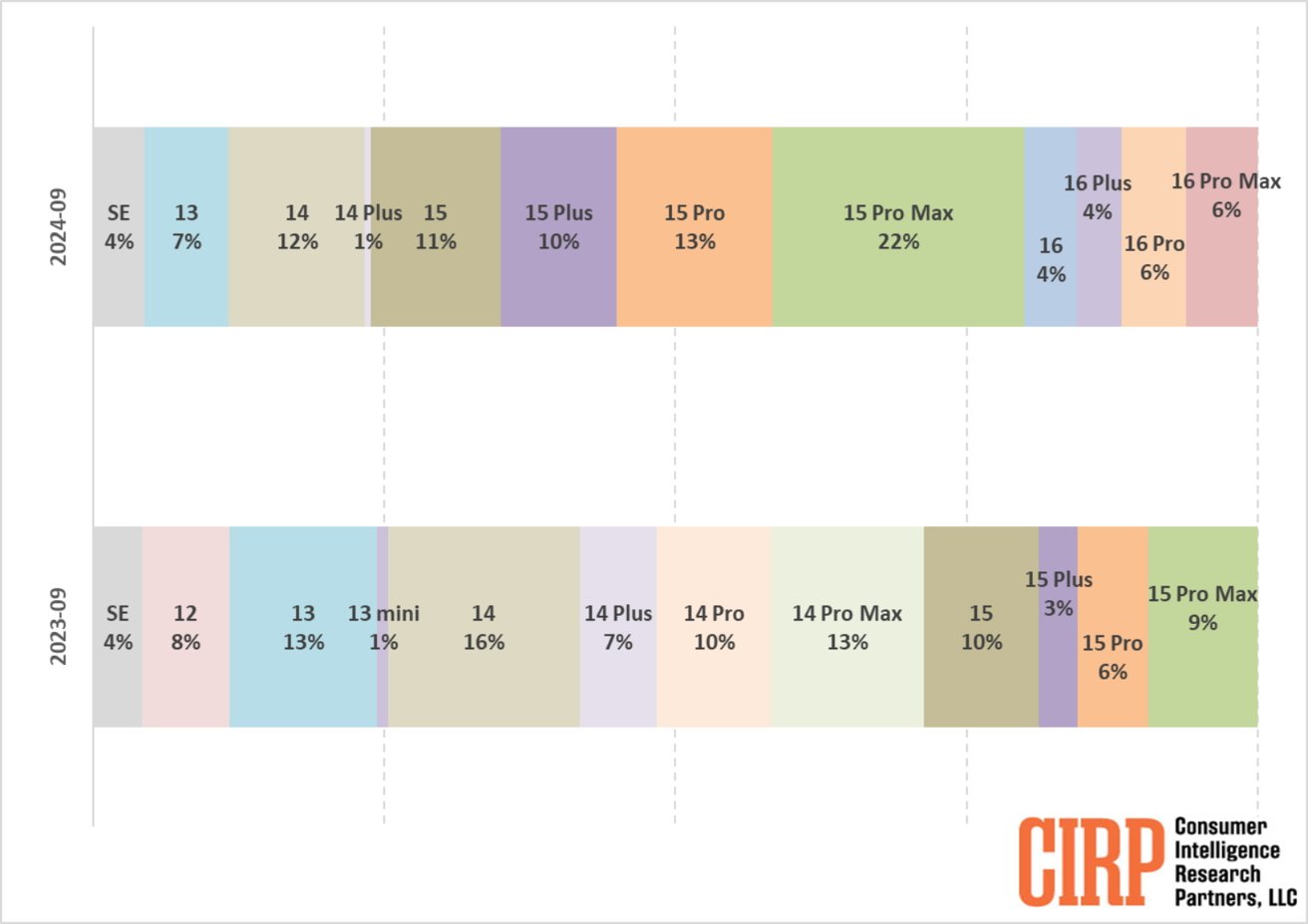

During their first two weeks of sales, these models collectively represented a 20% share of U.S. iPhone sales. In contrast, the iPhone 15 series captured a significantly higher 29% share during the same timeframe in 2023, indicating a noticeable drop in early adoption for the latest models.

This difference becomes even more apparent when examining the high-end models. In September 2024, the iPhone 16 Pro and Pro Max constituted 12% of total iPhone sales, down from the iPhone 15 Pro and Pro Max's 15% share in the same period a year prior.

Given Apple's continued sales of its legacy models alongside new ones, the shift in consumer interest from the latest releases to last year's models is particularly noteworthy.

iPhone model distribution (quarters ending in September 2024 and September 2023). Image credit: CIRP

The persistence of older models in the market provides further context to this trend. In September 2023, iPhone 13 and older models accounted for around 26% of U.S. sales, whereas in 2024, iPhone 14 and older models contributed to 24% of sales, indicating a relatively steady preference for older devices over the years.

The consistency contrasts with the noticeable shift toward year-old models in 2024. In 2023, iPhone 15 models accounted for 56% of sales in the September 2024 quarter, a notable increase from the 46% share the iPhone 14 models held in 2023.

The 10% increase in demand for the old models suggests a reluctance among consumers to upgrade to the latest releases immediately.

Analyst perspectives on future performance

Analysts have noted adjustments in Apple's production strategy to accommodate these dynamics. JP Morgan reported that while demand for the iPhone 16 series is stable, it slightly trails the iPhone 15 series in availability and shipping times.

Notably, U.S. shipping times for the iPhone 16 Pro Max have shortened from 21 days in 2023 to 15 days in 2024, indicating Apple's efforts to efficiently manage supply for its premium models.

Meanwhile, analyst Ming-Chi Kuo observed that demand for the iPhone 16 Pro models has met Apple's expectations, prompting the company to maintain production even during China's National Day holiday to fulfill orders. However, demand for the iPhone 16 and 16 Plus has been more subdued, leading Apple to cautiously scale back on some component orders for these baseline models by an estimated 3% to 5%.

While the reduction reflects the tepid demand for non-Pro models, it's unlikely to significantly impact overall production levels, as Apple maintains steady output for the high-demand Pro models.

As the holiday season approaches, Apple may see renewed interest, especially in the iPhone 16 Pro models. The period could prompt a reevaluation of the positioning and appeal of the standard iPhone 16 and 16 Plus, potentially setting a new direction for future product cycles.

Read on AppleInsider

Comments

If someone has been holding off upgrading or not and is buying an iPhone that they know will need more power than usual to support Apple Intelligence. Then why in the world would they buy a non Pro model. It's not like past years where "you know what, this model is good enough"

But I guess we'll all find out tomorrow.

Q4 results will be a solid indicator of the new generation’s popularity. Those earnings results should be announced in late January 2025.

The rest of us are saving, waiting for refurbs, or hoping against hope for another iPhone Mini, because the regular model is still too friggin big.

Also: we can't discount the unprecedented and weird circumstances surrounding iPhone 16 with its singular marquee feature--Apple Intelligence--unavailable from launch through nearly all of October, and even then, only slowly rolling out in dribs and drabs over the next 5-6 months. Remember last year's "TITANIUM" campaign for the 15 Pro models? Imagine if they had debuted with no titanium, just the usual stainless steel band, with the promise that by the end of October, the top part of the band would be titanium, and they'd add Ti gradually after that so that by end of March of the following year, the whole band would be titanium. Sounds ridiculous, I know, but that's what we've got with Apple Intelligence.

FY2025Q1 reports February 2025.

https://investor.apple.com/investor-relations/

I am very pleased with my iPhone 15 Pro. There just wasn't enough in the iPhone 16 Pro to warrant the extra $1000 it would have cost less the trade-in.

I am very keen to see Apple's line up for the iPhone 17 Air.

And the USA is not the largest iPhone market. And hasn't been for well over a decade.

Remember that only ~3.5% of the world's population are Americans.