Apple beats Wall Street predictions with record-breaking iPhone sales revenue

Apple has reported its results for the fourth quarter of 2024, with revenue of $94.93 beating Wall Street expectations mostly on the strength of iPhone sales.

Apple CEO Tim Cook [left] and outgoing CFO Luca Maestri [right]

The final quarter of Apple's fiscal year, Thursday saw Apple release its results for the three-month period that concluded at the end of September. As the end-of-year results, it was also the opportunity for Apple to report its full-year results.

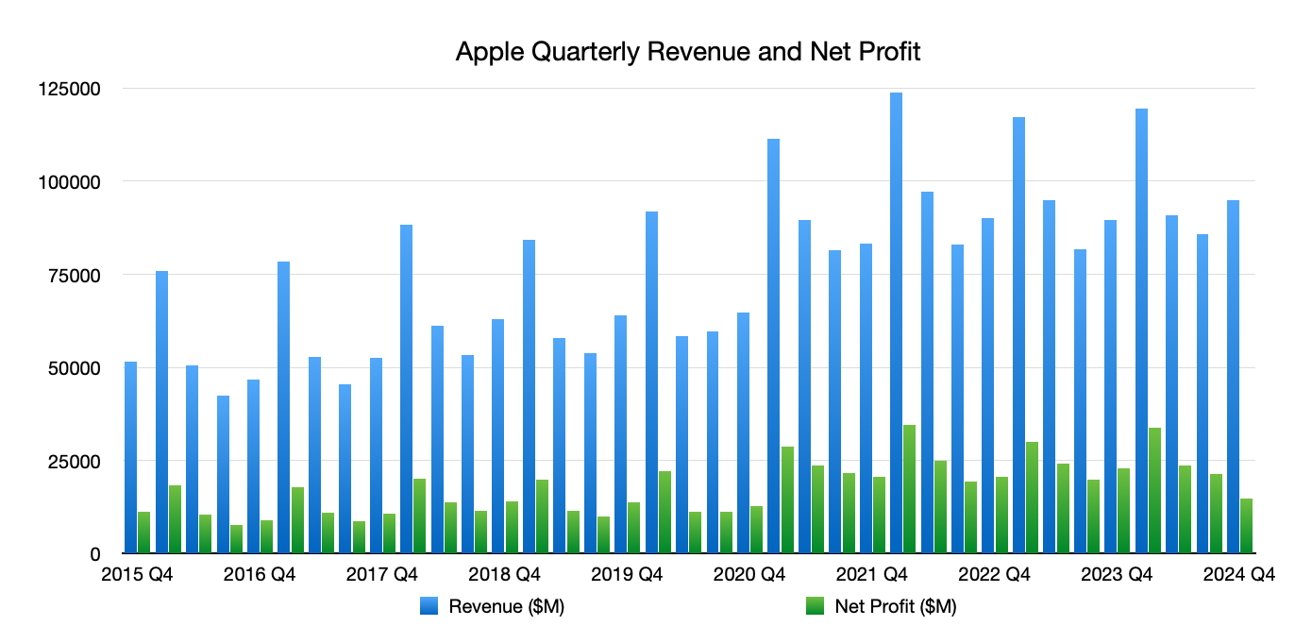

In the fourth quarter, Apple achieved $94.93 billion in revenue, up from the $89.5 billion it reported in Q4 2023. The earnings per share was also declared at $1.64.

The Wall Street consensus was for $94.4 billion in revenue and $1.55 for the earnings per share.

Apple Q4 2024 revenue and net profit

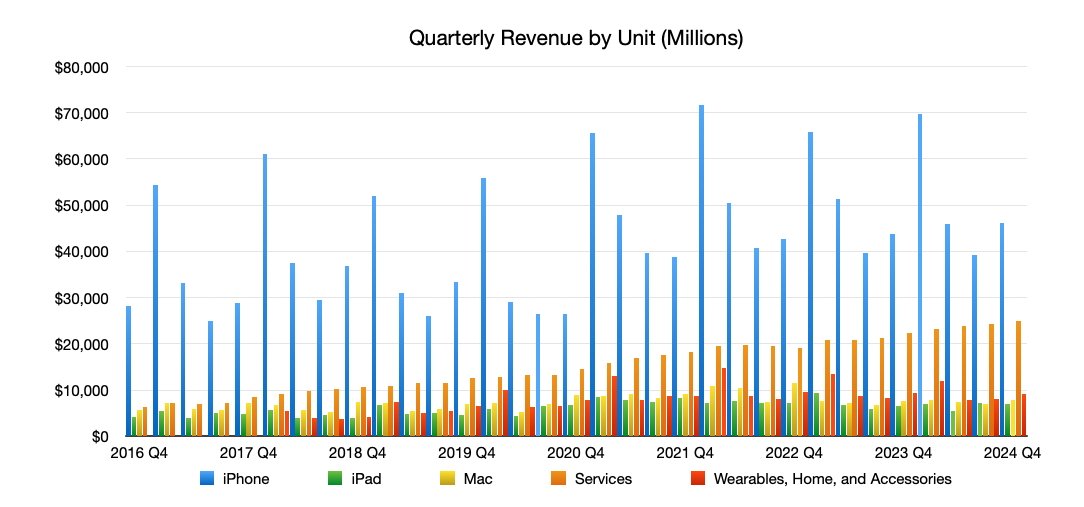

Revenue from iPhone was $46.22 billion, up 5.5% from $43.8 billion in the same quarter last year. Sales from iPad was $6.95 billion, an increase of 7.9% from $6.43 billion in the year-ago quarter, while Mac revenue rose from $7.6 billion one year ago to $7.74 billion this year, up 1.7%.

Services, a continually reliable source of growth for the company, continued its upward march from $22.3 billion in Q4 2023 to $24.7 billion this quarter, up 11.9%. Wearables, Home, and Accessories hit $9.04 billion, the only blemish in the figures, as it's down from $9.32 billion, a 3% decrease.

The product launches in the quarter include the iPhone 16 range, AirPods Max with USB-C, the Apple Watch Series 10, and a new black colorway for the Apple Watch Ultra 2. However, their launches will benefit Apple more in Q1 2025 since they launched late in Q4.

Apple 2024 Q4 product category revenue

Third-quarter launches will make more of an impact on Apple's financials, due to there being an entire quarter of sales for them. That list includes the iPad Pro on M4, the iPad Air with M2, and the Apple Pencil Pro.

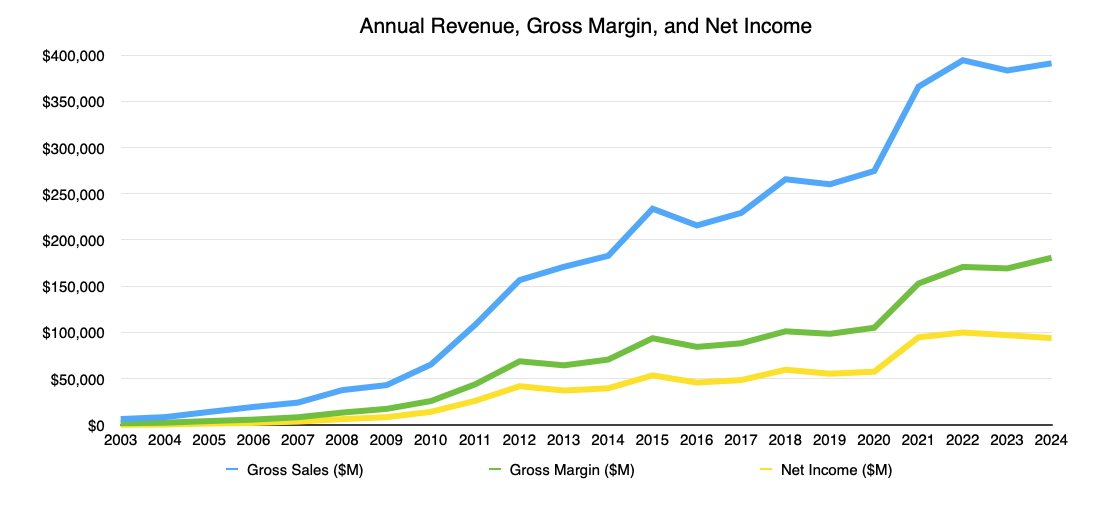

For Apple's full-year results for 2024, gross sales reached $391 billion, up from 2023's $383.3 billion. The gross margin hit $180.7 billion, up from 2023's level.

Apple annual revenue, gross margin, and net income

The results, and the following call with analysts, will be CFO Luca Maestri's last alongside CEO Tim Cook. Maestri is stepping down from his role in January, with VP of Financial Planning and Analysis Kevan Parekh taking over.

"Today Apple is reporting a new September quarter revenue record of $94.9 billion, up 6 percent from a year ago," said Cook.

"Our record business performance during the September quarter drove nearly $27 billion in operating cash flow, allowing us to return over $29 billion to our shareholders," said Maestri.

The outgoing CFO continued "We are very pleased that our active installed base of devices reached a new all-time high across all products and all geographic segments, thanks to our high levels of customer satisfaction and loyalty."

Read on AppleInsider

Comments

meanwhile, the stick went down $4.19during the day and is about $4.50 down after hours. I know the market is down today (Microsoft was down over $26, for example), but still

No one analyst is always right all the time so it's best to take the middle chunk. It's okay to lean one direction or another if you see a particularly reliable analyst on one side of the fence.

For a while, amateur analysts (bloggers) were beating the pros on a regular basis.

Many analysts are rated by Starmine which tracks their accuracy over time. Any longtime follower of Apple's business will remember some horrifically inaccurate analysts that many Apple media sites LOVED to quote (*cough* Munster *cough*). Some were so consistently wrong that it was easier to best on the opposite of their take. Some were longtime bears who always came up short (Katy Huberty at Morgan Stanley was like this for years before she finally came around and saw the light).

Since the start of the pandemic Apple stopped providing their own guidance so it has forced analysts to actually use their brains instead of just picking up the Magic 8-Ball.

The era of Apple routinely smashing expectations is over. Apple is more of a value stock rather than a growth stock here in 2024. It's not 2009 anymore.

As I've said for a very long time, AppleInsider (and other tech media sites) really need to track the accuracy of the analysts they quote. Market researchers like CIPR are mostly pulling their numbers out of a body orifice (I'll give you three guesses but you'll only need one).

And once again, CIRP, Kuo and all the rest of the Apple naysayers who claim to have secret, proprietary knowledge about Apple sales GOT. IT. WRONG. Quelle surprise with these clueless clowns, so frequently headlined by AppleInsider. Turns out that looking at delivery wait times on Apple's website to predict how actual sales are doing is as stupid and unreliable as it sounds.

Plus consider this: early iPhone 16 sales outpaced those of the 15 last year, and the 16 didn't even ship with its marquee feature, Apple Intelligence. Analysts who actually know what they're talking about foresee unprecedented sustained strength in iPhone 16 sales as more AI features continue to roll out, creating another wave of buzz every time they drop. But yeah, Apple is doomed.

https://www.ped30.com/

Re: the Mini / Studio, I agree. I am going to be grudgingly accepting that there will be no replacement for the 5K. I've picked up a couple of 4K screens already and will be getting a head for them once I see what the new Studio looks like. An entry M2 Studio easily passed a fully stuffed M2 Mini. I'm very curious to see how the M4 Studio will stack up.

It's important to understand that >85% of Mac unit sales are notebook models. This has been the case for 15+ years. For the desktop systems, the iMac and Mac mini have more unit sales than the Mac Pro and relatively new Mac Studio.

Mac sales are 8% of Apple's total revenue. iPhones are about 48%. Even if Mac Studio sales jumped (hard to see that happen with its price tag) it's not going to move the needle that much.

For sure Apple enthusiasts can rave about anything but their numbers simply aren't big enough to make a significant impact.

A bigger influencer on Mac sales will be the M4 MacBook Air. Top selling model amongst Apple notebooks. This is a very price sensitive category. A $100 price difference for a MacBook Air is much bigger deal that it would be for a Mac Studio.

Whoa, how low was Wall Street’s expectation?! On a different note, I would have expected a billion-fold more from Apple, even if their sales sucked!

AAPL went up significantly with the AI announcement. No real revenue associated with it except for the vague projections of enhanced future iPhone sales.

Now AAPL is going down because projections for China are low.

10K invested in early 2000s is now over 1.5M. If I listened to the analysts I would have never got that.

You're correct in stating that great new Macs, no matter how awesome, will not significantly move the needle on gross Apple revenue. Apple is a very different company now, one in which its Services division is the second biggest revenue and profit generator, eclipsing the Mac and IPad businesses combined. But a focus how much new models in a given product line move the needle on gross revenue misses the forest for the trees. By continuing to renew and strengthen all of its major product lines, Apple also renews and strengthens it's most compelling product of all, the one it doesn't actually sell: the Apple ecosystem. Compelling new models of existing products are key to keeping buyers loyal to that ecosystem, as well as attracting new customers to the Apple fold. (And the incredible price/performance ratio of the new M4 Mini will make it excellent new customer bait.) And the release of exciting new products like this summer's iPad Pro M4 and the new Mac Mini keeps a buzz of excitement around Apple, itself.

as an aside, it’s comforting to see American companies being forced to fund the snouters in Brussels.

all true, however don’t forget the Mac division part of Apple is still larger than many, many large corporations about the world. it pretty well owns the high end of the consumer PC market.

It can be that they are talking their own book... i.e. they talk down stocks when they have large clients that want to accumulate a position and buy into weak demand or increasing sales. They talk up a stock when they have large clients that want to offload a large position without moving the market down and thus increase the buy-side demand to sell into stronger prices.

No analyst in my mind would publicly talk up a stock without having all their key stakeholders first move on the signals and insight they have produced before the wider market benefits. Naturally all equities analysts will have the same interest or indeed may want to poison the well for the competition by dropping signals early.

Or maybe I am jaded

Overall it was a healthy development for the Apple business. Services keeps on its stable growth and the very positive outcome from my side was the bump in iPhone sales. Clearly the Apple intelligence hype is triggering upgrades and hopefully this will be a strong trend in the next couple of generations of devices.

I think a potentially key missing step in Apple's AI strategy is developer friendly ways for all the GenAI startups to somehow securely tap into the growing on-device capability of Apple Silicon as a way to offset their capital burn on tokens consumption on the server side. Video AI is a clear hit among enthusiasts and likely burns tremendous amounts of tokens and capital for the startups. Apple's hybrid approach for their own models, which effectively pushes much of the Capex of compute to the customer device purchase, may paint a path for others to follow, should Apple release SDK guardrails to do so.

Apple has figured out a way to scale services revenue and investing in Apple Intelligence while keeping costs largely flat, unless they book Apple Intelligence build out in R&D which has been growing year on year.

As a shareholder I am happy with the outcomes. As a customer I am eagerly awaiting next gen AirPod Max, HomePods, and broader home automation.