Newly-appointed Apple CFO denies 75% App Store profit claim in UK trial

Apple's Chief Financial Officer, Kevan Parekh, has testified at a UK trial, disputing claims by the prosecution that the company has a 75 percent profit margin on its App Store for iPhone and iPad.

Apple CFO Kevan Parekh. Image credit: Apple

The seven-week trial happening in London is likely to the be the first case in a series of attacks on various Big Tech companies and their various paid services or app stores. The case is being heard by the UK's Competition Appeal Tribunal.

Antitrust and consumer advocates in the case say that because the iPhone and iPad app stores are the only authorized outlets for obtaining apps and services on those platforms, they constitute a monopoly. The lawsuit, filed on behalf of 20 million UK Apple users, says that this monopoly allows Apple to charge a standard 30 percent commission, leading to inflated costs for consumers.

Apple has rebutted the charges, noting that 84 percent of the apps in the App Store are free, and thus developers pay Apple nothing in commission. Those apps generally sustain their costs by running ads within the application.

Apple's cut of App Store sales

Paid apps and in-app purchases are subject to the 30 percent fee, but recurring subscription apps pay only a 15 percent commission after the first year. Apple changed this rule slightly in late 2020, giving developers with less than $1 million in annual revenue a cap of 15 percent commission.

The company has further pointed out in its filing that it considers the fees fair, noting that other app stores have similar commission rates. It notes that the commissions cover the cost of the store and services provided to developers -- such as security, promotion, and the development of digital tools for access.

Barrister Michael Armitage, representing the claimants, pointed to evidence cited in a separate but similar case by the Department of Justice in the US as the basis for the 75 percent profitability claim. He also engaged an expert accountant on behalf of the UK lawsuit, who came up with a similar figure, according to the Financial Times.

In his testimony on January 16, Parekh attacked the prosecution's claim of such a high profit margin, saying both that the 75 percent claim "wasn't accurate," and also suggested that separating out App Store profits from Apple's integrated services was all but impossible.

"I think it's possible to do a directional estimate" of the App Store's profitability, he said. Parekh testified that there were too many "indirect costs" that the company could not allocate to "specific products or services."

In response to the barrister's skepticism, Parekh said that "any attempt to allocate these types of costs would involve imprecise and subjective judgments." The prosecution pointed out that Apple was claiming that figuring out the profit margin of the App Store by itself was essentially impossible.

The case against Apple's App Store fees

The case in the UK is being led by digital economy specialist and lecturer at King's College Dr. Rachael Kent. The class of claiments are seeking 1.5 billion pounds (around US $1.82 billion) in damages on behalf of App Store customers.

Kent said in a statement that Apple has "no right" to charge such a significant commission fee -- "particularly when Apple itself is blocking our access to platforms and developers that are able to offer us much better deals."

It's not clear why Kent believes that Apple has no right to charge what it wants. It very clearly does -- until the laws about platform accessibility get changed.

"Apple achieves this by slapping unjustified charges on its users," she said in her filing, pointing out that global App Store revenues topped $15 billion in 2021. "It would not be able to impose these exorbitant charges if competitor platforms and payment systems were allowed to compete on its devices," the brief noted.

Apple's lawyers have countered that the App Store's integration into iOS enhances user privacy, security, and the value of a seamless experience, and disputed the prosecutions estimate as flawed.

Will consumers use alternative app stores?

By contrast, the European Union handled this matter differently, by passing legislation that mandates that Apple allow alternative app stores -- although thus far, the results are decidedly mixed. Under the EU's Digital Markets Act, Apple is allowed to create rules and guidelines for alternative app stores.

Apple, in a statement, said that its approach to the DMA is guided by two fundamental goals: "Complying with the law, and reducing the inevitable, increased risks the DMA creates for our EU users."

According to Apple's statement, "that meant creating safeguards to protect EU users to the greatest extent possible and to respond to new threats, including new vectors for malware and viruses, opportunities for scams and fraud, and challenges to ensuring apps are functional on Apple's platforms." The company added that despite this effort, "these protections don't eliminate new threats the DMA creates."

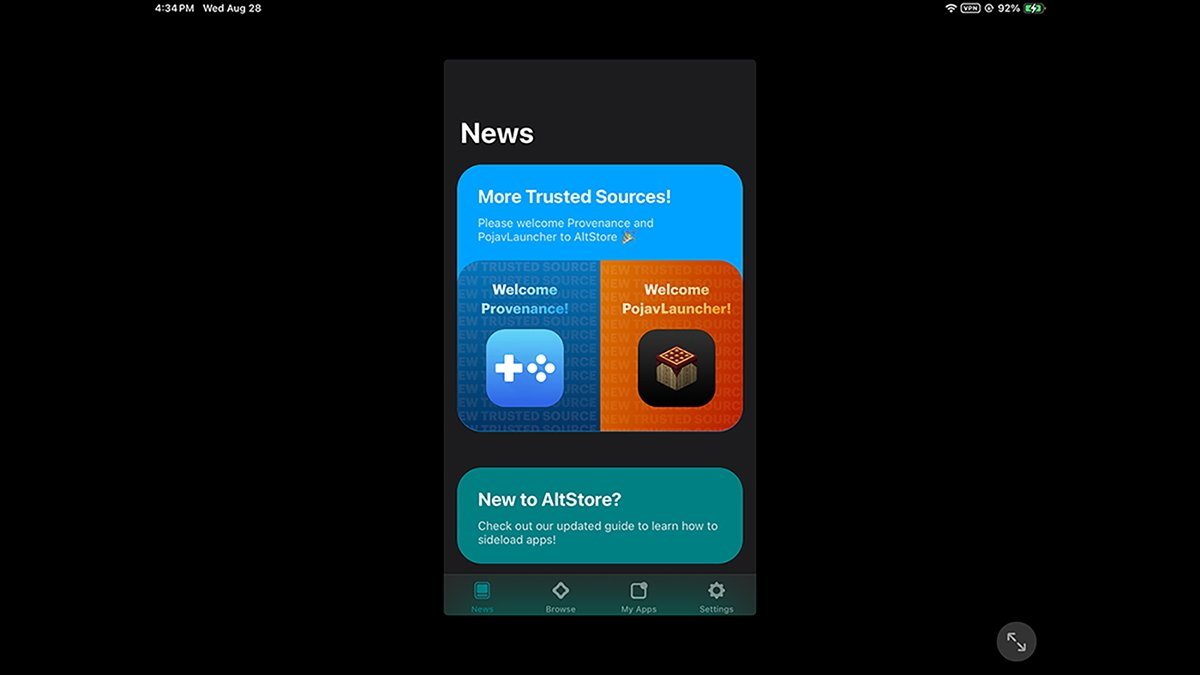

Despite these restrictions, at least four alternative app stores are operating in the EU. The best-known examples are Riley Testut's AltStore, and the Epic Games Store.

Apple is still able to review any apps offered on these alternative stores to make sure they comply with Apple's safety and security rules, a process it calls "notarization." And, there are still fees.

The Altstore running on iPadOS in the EU.

The alternative stores must also pay Apple a Core Technology Fee of about half a Euro (around 51 cents US) after the first million installs of a paid app, and for every new download of a paid app after the first million.

Other alternative app stores include the games-focused Aptoide, productivity-focused Setapp Mobile, and Buildstore. The latter two use a monthly subscription model to access their curated collections of apps.

In general, apps that are completely free are not subject to any fees or restrictions, or as in the case of Setapp Mobile, the apps are included as part of the monthly subscription. It is thus far unclear how successful these two EU alternative stores have been, as they are not required to report sales figures or profits outside of the EU.

The UK trial is expected to last for approximately seven weeks. Similar cases against Alphabet, Meta, and Microsoft are expected in the US and UK later in 2025.

Read on AppleInsider

Comments

I mean my maths is pretty woeful but not that woeful.

The barrister was right to be skeptical. If Apple cannot find the numbers, it will be by design. It doesn't want to provide the numbers.

The solution is to make the App Store stand on its own two feet without strings from the mothership all over the place and actually make that division accountable for the services it provides.

There is inevitably going to be some crossover with other concepts (and again by design!) but at least a pretty decent figure could be provided.

Therefore they are so linked and intertwinned that they are essentially a single product.

The app store is not a separate entity, if Apple turned off the app store can you imagine the outcry about them rendering peoples smartphones useless. Hence I believe it is impossible to determine the profitability of the app store itself.

I have also worked in many places where profitability is way in excess of 75%, making a profit is not a crime, especially on things that are not essential like mobile phone software. I know someone who worked in an opticians and their profit on glasses frames was over 1000%, some frames were bought for $7 and sold for well over $100. I would say that is more of an essential item to many people than apps.

Maybe Apple could adopt a different commission for different types of apps, e.g. entertainment apps (music, games etc) at a higher rate than apps in the health category?

Often, a company being accused of "unfair" or "excessive" margins are ripe for a competition to come in an offer something more attractive. As the App Store is a feature of the iPhone (it has no function or purpose without the iOS hardware to use it). this would take the form of a new phone platform. So far, no on is offering an option, and Apple is doing nothing to prevent a company from entering the market. If they were, that would be a chargeable offense.

So Microsoft couldn't do it, Blackberry failed (that's the big story, given how popular they were and how they failed to leverage their dominance). Nokia, Sony, and others just decided it was too hard to do the whole thing and became part of the Android ecosystem to join Google as Apple's main competitor. So Apple's success is because they make fantastic products and an ecosystem that people feel are worth it.

It's amazing how all these investigations by governments are absent any huge public outcry that something is "wrong" that needs intervention. These are just government sponsored cash grabs, institutional theft from those who know little and do little.

I'm fairly certain margins will fluctuate for products and services all the time, and will be impacted by plans for future investments. Do governments need to know and understand longer-term strategic planning and investment? Fluctuations of infrastructure acquisitions and maintenance? Pricing could also hedge against down economies to maintain stability. There are so many "reasons" none of which are the business - literally or figuratively - justifying scavenging expeditions. Governments get their money on overall financial success from tax revenues. They are not complaining about that, expect they want MORE.

Stop spending so much.

It's like asking a hospital how profitable room 1104 is. A figure could probably be produced, but it would paint an inaccurate picture.

Didn't work with AT&T or Standard Oil or keep competition in browsers (until Microsoft got stopped by regulation) or stop <any financial crisis>. The market is not perfect. We can't doing old mistakes on repeat. Or well... U.S. decided to. Most of the world is moving on. This includes UK. Nations are indeed not alike. Some prefer to learn and adapt.

Apple also has built out and manages these massive data centers around the world to run the store, keeps it maintained and supported 24/7/365. That's not free for Apple and just because they make billions doesn't mean anyone should just blow it off like it nothing.

If there are any kind of processing fees, someone correct me if I'm wrong but I don't think the developer pays any of those.

Bottomline is it's not free for Apple to run the store, keep iOS up to date and create new technologies and features and give developers the tools to build apps based off those new technologies and features so they can make money too. Just because Apple rakes in billions of dollars doesn't mean they need to continue giving more and more and more away for free, or massive discounting on things.

B. The idea that alternate app stores would provide significant savings for mobile app users HAS NO BASIS IN REALITY.

C. Gaming apps generate the most revenue on mobile by a wide margin. Gaming apps are entertainment and NOT A NECESSITY FOR MOBILE USERS.

Example, let's say you have me sell a book on your behalf and you agree that I get token 30% of the sale for my efforts. I post ads to sell the book, pay for packing up and shipping and all that kind of stuff. The book sells for 10 dollars. You get seven and I get three. My revenue is three dollars not ten. If my costs for the ad, packaging and shipping is 75 cents then my profit margin is 75% on my revenue. My revenue being the 30% commission.

The fact that Apple is doing exactly what Microsoft is doing with their app store on their Xbox and what Sony is doing on their PlayStation and Nintendo is doing on their Switch and Google is doing in their Google Play Store with the UK government so far doing NOTHING to regulate them, means that what Apple is doing is not illegal under current legislation.