What matters most for AAPL shares next week

Apple's latest installment of quarterly earnings is on January 30 after market close, and there are five key points that Apple needs to make to satisfy investors.

Apple CEO Tim Cook

Morgan Stanley has proven to be one of the more accurate and reasonable firms that cover Apple. In a new note released on Friday by the firm, analyst Erik Woodring notes that the earnings setup feels very similar to a year ago. Like a year ago, he is expecting a street beat, but a lower than expected second quarter revenue predictions.

Specifically, the firm remains bullish on its overweight rating and maintained $273 price target. Woodring expects revenue of $124.0 billion, and $2.31 earnings per share. This all implies a 3.7% revenue growth -- which is roughly in line with what Wall Street expects as a whole.

The note does cite some uncertainty about short-term iPhone sales. It points to the iPhone SE 4 launch in March, iOS 18.4 in April, and an uncertain timing for a partnership for AI in China as catalysts for the next quarter.

In the note, though, Woodring details what he wants to see, and what should matter the most to investors on Thursday, January 30 in the longer-term.

Apple Intelligence impacts on iPhone demand

The rollout of Apple Intelligence has been contentious. Apple heavily promoted the feature in the September debut of the iPhone 16 lineup, and is still trickling out features -- and will be for some time to come.

So, the question of how much Apple Intelligence influences iPhone sales is an open one, with an enormous number of variables. Apple will likely make some kind of commentary about Apple Intelligence, but will shy away from specifics on demand impact, like it always does.

Apple will probably not update the schedule for wider global distribution of Apple Intelligence, particularly in China. However, we're certain that analysts will try to get details on this in the post-earnings question and answer session.

It's not clear where Apple stands on signing a deal with Chinese providers for Apple Intelligence, though. The earnings report is likely not going to be the venue where Apple announces that rollout, or the local companies it is required to partner with in China, as that would merit a spotlight all its own not hidden under financial results.

China iPhone demand

Apple has been clear for over a decade about the importance of China not just as a manufacturing partner, but also as a market for iPhones. Apple's fortunes in the country have waxed and waned, depending on a number of factors, not the least of which are geopolitical issues and Chinese consumer sentiment about US companies.

And, Apple is generally clear about how it's doing in the region. For instance, in the conclusion to Apple's 2024 fiscal year, Apple said that reports of poor demand in China were overblown, with the company seeing great successes in the region prior to the iPhone 16 launch.

Quarterly revenue from Greater China

Apple will certainly comment on demand in China, if not in the leading remarks, then certainly in the question and answer session. There have been recent tales of doom and gloom for Apple demand in the country, that historically don't seem to be based on much more than rumor.

Apple hasn't been shy on offering discounts in China for holidays and special occasions to drive demand. The Chinese New Year is the day before the earnings call on January 29 with celebrations extending to February 4 -- and sometimes longer.

Services cost and Apple's desire to raise prices

Apple's services revenues are a bulwark against the fluctuations in hardware sales as the year progresses.

Woodring notes that Netflix has just increased its rates, in what appears to be an annual tradition for them. Apple has generally not followed the same annual increase path, with its services only seeing smaller increases over the last few years.

A price hike in Apple Services would lead to increased revenue, which Woodring is hoping to see.

As part of Morgan Stanley's estimates for services earnings, Woodring is also hoping for some clarity on Apple's installed user base. Apple hasn't reported this figure with any granularity for years, so it's not precisely clear what Woodring is looking for.

The predictions made on Thursday assume an active product user base of 2.3 billion devices, implying that the iPhone replacement cycle is at about 4.6 years.

If this is correct, there is a "a record base of eligible iPhone upgraders (we estimate 700M+) that serve as a critical cohort for driving iPhone upgrades in FY26," according to Woodring.

And with that upgrade base, would come increased services revenue, cost hikes or no.

Capital expenditure spending intentions

Apple isn't always transparent how they allocate capital expenditure. Apple does have several giant initiatives on the fire, including a campus in Cary, North Carolina; and continued expansion in Austin, Texas.

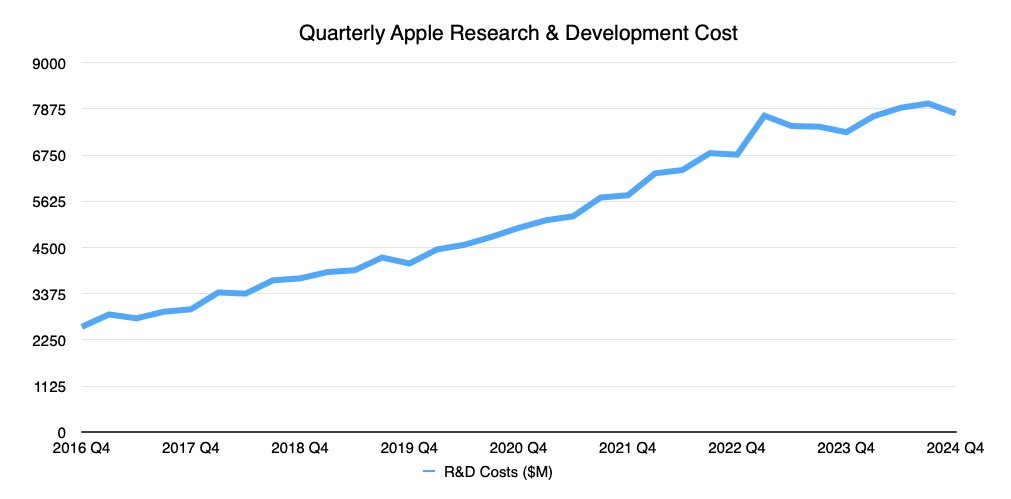

Of note, Apple's research and development measured over a decade shows a fairly linear increase, with some hiccups here or there. Minus an outlier in the beginning of 2023, there are few spikes to indicate that a major new project is underway.

Apple's research and development budget since 2016 through September 2024

Apple will likely not disclose any new initiatives for capex during the call. It almost never does.

Kevan Parekh's debut in the earnings presentation

Also, the January 30 earnings call marks Kevan Parekh's first public earnings call. Apple wouldn't have selected him if he was going to be radically different than Luca Maestri, so large changes in presentation aren't expected.

However, how details are covered may vary. Focuses will likely be different, and how he responds to analysts' questions will be interesting to witness.

Read on AppleInsider

Comments

You have to go ALL the way back to 1994's short lived eWorld for an example.

Even Apple Maps business reviews are outsourced to Yelp.

Social media companies have armies of people making sure you don't see cats in blenders and human decap tiations and even worse

Its not in Apple's DNA

Short term holders of AAPL are buying or selling on rumors and gossip in the runup to 1/30. If you are looking for a quick hit, hold tight I guess. If your timeframe is anything longer, pay more attention to the period from about a week after earnings to 9 wks post-earnings, it’s more reflective of market sentiment.