Trump's chip tariff threat takes aim at Apple's TSMC partnership

The Trump tariffs could financially hit Apple's chip production partnership with TSMC, after the President insisted the import taxes will be applied to semiconductors and other specific industries in the near future.

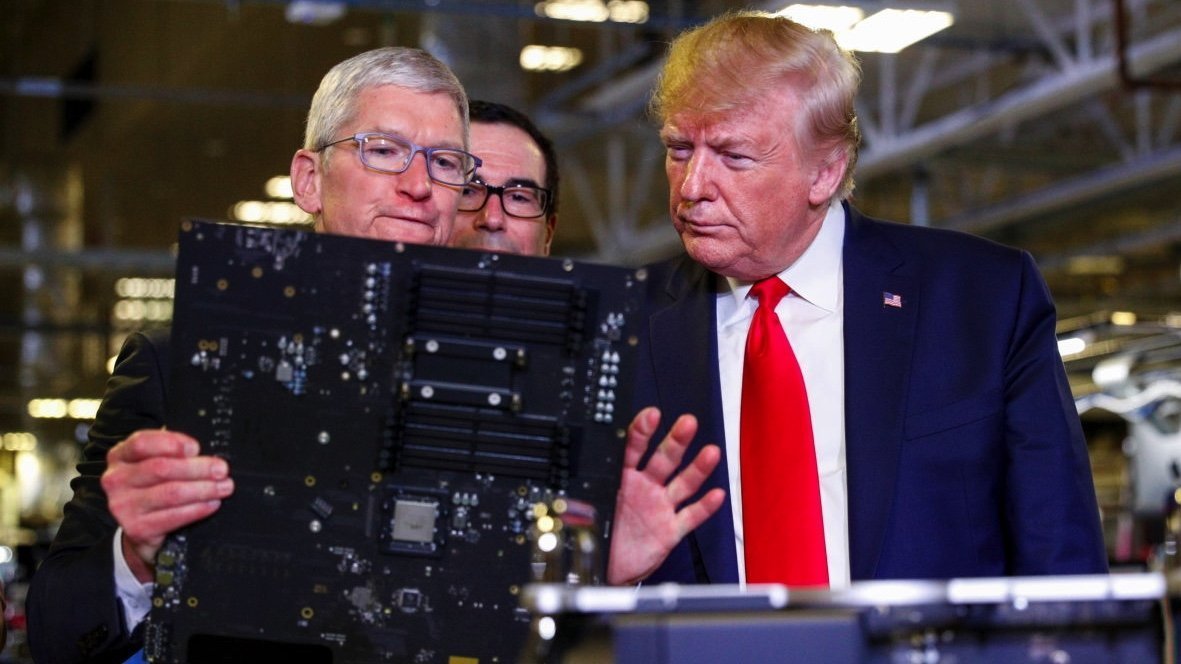

Apple CEO Tim Cook [left] with Donald Trump [right] at a Mac Pro factory

During his re-election campaign, President Donald Trump pushed an agenda to bring more manufacturing to the United States via tariffs. While Apple has so far escaped the prospect of dealing with the tariffs directly, that may not last for long.

In a Monday speech at an Issues Conference at the Trump National Doral Resort in Miami, Florida, Trump discussed a range of topics, but spoke at length about tariffs.

After mentioning applying tariffs on vehicles imported from Mexico, Trump mentioned the placement of "tariffs on foreign production of computer chips, semiconductors," and pharmaceuticals. This is all in a bid to "return production of these goods to the United States," the C-Span video of the speech reveals.

"They left us and went to Taiwan, which is about 90% of the chip business," Trump insisted. "And we want them to come back." This refers to TSMC, the Taiwanese chip giant that Apple relies on for its chip production.

However, Trump wants to accomplish this using tariffs rather than incentives.

"We don't want to give them billions of dollars like this ridiculous program Biden has," Trump says, referring to the billions paid out from the Chips Act. This includes $6.6 billion awarded by the U.S. Commerce Department to TSMC in April to build another chip production facility in Arizona.

"They already have billions. They have nothing but money,. They needed an incentive and it will be they will not want to pay a tax," insisted Trump. "They will build a factory with their own money. They will come in because it's good for them."

Trump didn't offer any indication of how much the tariffs could be on chip imports.

An October report from the Consumer Technology Association proposed there could be three bands of tariffs, with 10% and 20% blanket tariffs expected along with a 60% tariff against China. The cost to consumers could involve price rises of 10.9% for accessories, 46% for notebooks and tablets, and 26% for smartphones, the report offered.

An Apple financial issue

Trump's commentary doesn't reference Apple directly, but the tariffs can have a considerable effect on its finances.

During the first term, CEO Tim Cook went to great lengths to work with Trump, which helped the company avoid the effects of tariffs against Chinese imports. Since Trump's re-election, Cook has already been working to charm the U.S. chief for similar aims.

This has included conversations with Trump before he stepped into office. These talks have evidently been to aid Apple in the future, as Trump boasted about the conversation in a victory rally.

"I spoke with Tim Cook of Apple," said Trump. "He said they're going to make a massive investment in the United States because of our big election win."

Cook's charm offensive may have helped sway Trump at the early stages, with no sign of China-specific tariffs being implemented in the early days of the term just yet. Tariffs are still expected to arrive at some point, with the later the better for Apple.

Apple has also worked to mitigate some of the effects of tariffs from the last time, with an expansion in production in other areas, such as India. At a minimum, if blanket tariffs are applied by the U.S., it will be less expensive for products imported from India than the high rate for China.

When it comes to U.S. production, Apple has already made some early moves to support that, especially when it comes to chips. TSMC's Arizona facilities, the Chips Act recipients Trump complained about, are already producing Apple's chip designs on U.S. soil.

Read on AppleInsider

Comments

https://theweek.com/articles/460179/charts-how-rich-won-great-recession

In this instance the "They" are the people with Capital (big money) that invested for decades overseas rather than investing in their own country.

Yet Trump didn't have any issues with doling out billions of dollars to save US agriculture when his trade war with China backfired.

His old plan had holes the size of combine harvesters blown into it.

His new plan will have holes the size of EUV lithography machines blown into it.

They (TSMC) do not pay the tax. The American company that imports the product pays the tax, and and they usually pass that increase on to the consumer, resulting in higher prices.

TSMC makes the same amount of money per chip no matter what.

Trump is an idiot.

But it's Biden's policy that resulted in a the TSMC fab in AZ and it's that fab that will enable Apple to get around this tariff.

Earlier this year Taiwan changed the policy that TSMC can only fab on the latest node in Taiwan. This means that TSMC can bring the latest node to AZ much faster than before.

So all Apple has to do is move a lot of inventory into the US before the tariff and pay TSMC to expedite the rollout of N3P in AZ.

It won't. It never has. Trump has no idea how anything works. He has no idea what supply chains are or what chip fabs are or the equipment needed to operate them. He thinks of all of them as real estate and buildings because that's all he has any experience with. He's a pompous, incurious moron.

No matter how you look at this issue from an economic perspective any major changes are going to fall on US consumers. You could look at how semiconductor designers and products manufactured using the offshore-fabricated designs, like Intel, Apple, etc., benefited their bottom line both in unit/component costs and saved them the massive cost of building fabs. If component and product makers were the beneficiaries of creating the globalization entanglement shouldn't they be the ones who pay the cost of untangling it?

Maybe not so fast. Who else benefitted? We did. As consumers we were able to purchase products and access outsourced services for much lower prices than we could ever have imagined. Look at the price of a 1980 TV with its pathetic resolution and massive weight compared to what you can purchase today for much less than the 1980 price. You can buy a 55" Class 4K TV at Walmart today for as low as $228.00 USD. If consumers were the beneficiaries of creating the globalization entanglement shouldn't we be the ones who pay the cost of untangling it?

Nobody is going to get off the hook without paying a price. The theory goes that if manufacturers pay more for imported components they will simply pass it off to consumers. If they do it 1-for-1 that would disproportionately penalize consumers. At the very least manufacturers should bear a proportionate share of the tariffs without being allowed to pass it all on to consumers. Of course this also a gut punch to investors who have been essentially double dipping on the benefits of outsourcing with lower costs and higher profits. Suddenly the whole calculus for "Who Pays?" creates its own entanglement.

The one thing that is highly subjective is whether the foreign manufactures and service providers bear any responsibility. While they can be accused of baiting US firms with predatory enticements, they are in my opinion largely blameless. They have a workforce and an economy that allows managers and workers at all levels to substantially enhance their quality of life at levels of compensation that US managers and workers would find unsatisfactory due to cost of living and cost of doing business differences. You cannot blame people for wanting a better life on either side. This cost of doing business differential coupled with the minuscule per-unit costs associated with containerized shipping has a huge pull on US companies trying to maximize profits and increase shareholder value.

Blaming foreign countries we trade with for doing exactly what we asked them to do for our benefit is ridiculous and massively disingenuous.

That's the economic Gordian knot side of the situation we are in today. But there is one broad sword that can cut through the knot, and that is national security. This is the ultimate trump card that is being played by the current administration, not only on trading but on immigration and regulations and safeguards that have been put in place to avoid other dangers to the economy, society, the environment, and global relations. If it took us 50 years to get where we are it's going to take a couple of decades to untangle - that is, unless the broad sword is used to cut through the knot, which would result in everyone concerned needing at least a century to recover from.

The average minimum wage in America is $7.50. Now with all these deportations happening, what American is willing to work at a factory, for 8-12 hours a day, making minimum wage to manufacture iPhones?

https://www.digitimes.com/news/a20240910VL210/2024-development-semicon-taiwan-2024-semiconductors-taiwan-texas.html

Nieh highlighted Texas' competitive advantages, particularly its business-friendly tax system. "Texas doesn't have a state-level corporate income tax or personal income tax. We also waive sales and use taxes for manufacturing equipment and energy used for manufacturing. Additionally, there are property tax exemptions and R&D tax incentives that make Texas attractive to high-tech industries," he explained.

Texas uses their tax structure to attract business. That's typically the primary method used by states...offer tax breaks.