Your next iPhone might cost more but Apple may bet you won't notice much

With a 104% tariff now in effect on Chinese-made iPhone models, Apple is bracing for higher costs -- but instead of raising prices outright, it may make changes it hopes you may not see.

iPhone 16 lineup

The tariff, enacted on Wednesday, combines a 20 percent baseline import duty, a newly added 34 percent tariff, and a punitive 50 percent hike in response to China's own retaliatory measures.

With the vast majority of iPhones still assembled in China, Apple now faces a dramatic increase in import costs that will either need to be absorbed or passed along to consumers.

In the short term, Apple has airlifted stockpiles of iPhone and Mac products into the U.S. ahead of the deadline to soften the initial impact. But with the new tariff now in effect, the company will need a longer-term strategy -- and it may already be signaling how it plans to adapt.

Half of buyers already pay more than the base price

New data from Consumer Intelligence Research Partners (CIRP) shows that about 50 percent of iPhone buyers upgrade from the base storage tier, often paying $100 to $500 more than the sticker price. That consistent pattern gives Apple a pricing cushion.

For example, the iPhone 15 Pro Max starts at $1,199 with 256GB of storage. The 1TB model tops out at $1,599. That strategy allows Apple to make quiet adjustments while still technically offering the same entry price.

Half of buyers already pay more than the base price. Image credit: CIRP

With tariff costs now baked in, similar changes may become more common.

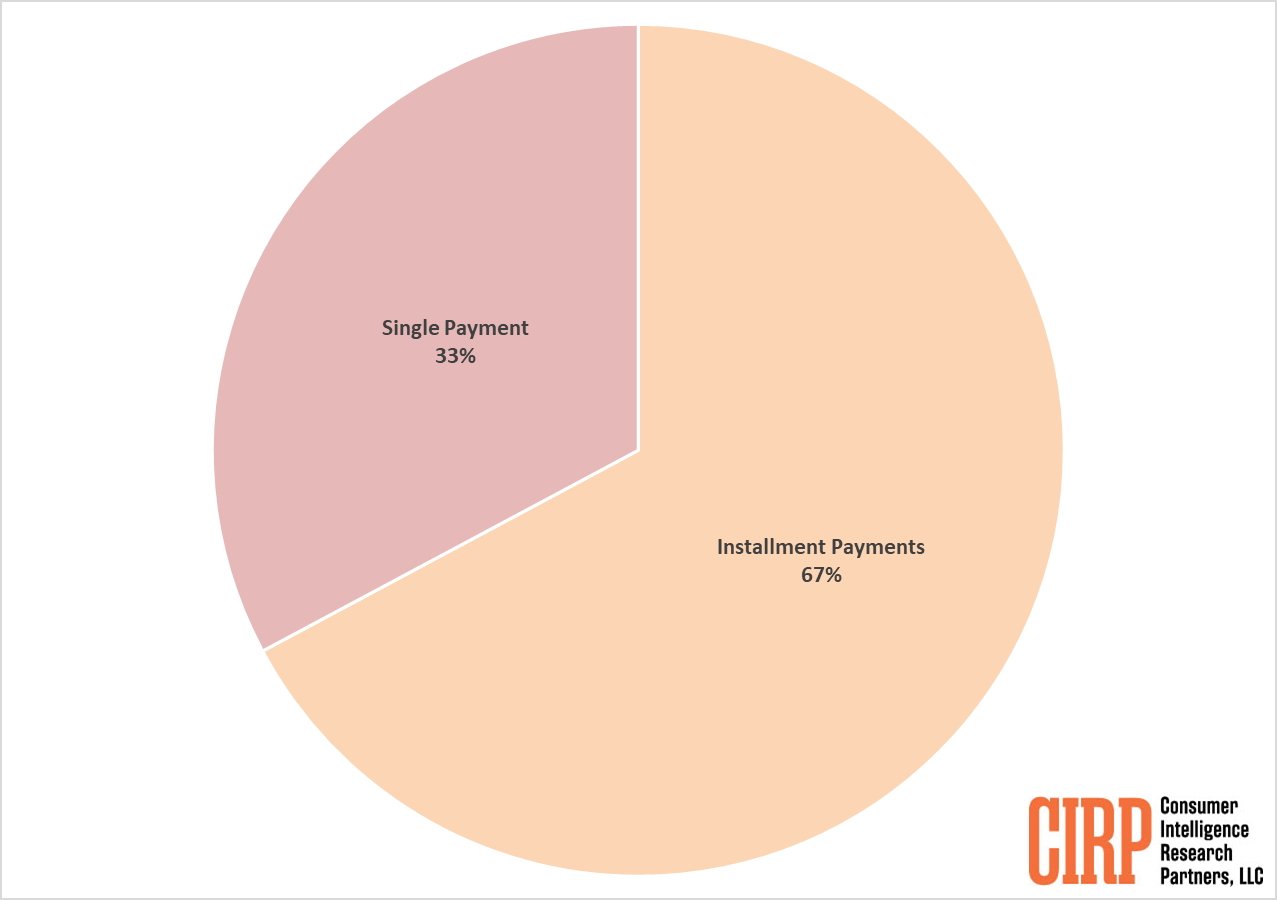

Installments help absorb sticker shock

Two-thirds of iPhone buyers in 2024 financed their phone using interest-free monthly installments, according to CIRP. Options like Apple Card Monthly Installments, carrier payment plans, and in-store financing are widely used.

A $200 price increase translates to roughly $5 to $8 more per month on a 24-month plan. That structure makes it easier for Apple to raise prices without deterring the majority of customers, most of whom focus on monthly payments rather than total cost.

Unlike the tariff threats of 2018 and 2019, which were delayed or avoided, this round is real. The 104 percent tariff applies broadly to Chinese imports and has gone into immediate effect. Apple, which still produces the vast majority of its iPhones in China, is now fully exposed.

To get ahead of the change, the company chartered cargo flights to rush inventory into the U.S. But that buffer won't last long. Apple now faces a hard choice -- raise prices, cut margins, or accelerate its manufacturing shift out of China.

Apple's likely play is subtle price changes

Apple has never liked abrupt pricing shifts. It will likely raise storage tiers in base models, bundle in more services, or quietly adjust trade-in values to preserve the perceived value of an iPhone.

This pricing sleight of hand isn't new. It's already built into the current lineup by offering 256GB as the Pro Max baseline, Apple effectively raised the model's cost while sidestepping a dramatic headline price hike.

Expect more of that strategy going forward.

Even if Apple successfully smooths the pricing transition, higher costs could still ripple through consumer behavior. CIRP data shows the average iPhone upgrade cycle is now close to three years, and it's growing.

Upgrade deferrals pose a longer-term threat. Image credit: CIRP

Modern iPhones are more durable and deliver smaller year-over-year improvements. If retail prices climb, more users may simply wait longer to upgrade. The slow erosion of the upgrade cycle poses a bigger threat than any single round of tariffs.

What buyers should do now

With the tariff in effect, prices could start climbing as early as the next iPhone cycle in September. But changes may be gradual, tucked inside storage bumps or spread out through monthly payments.

Buyers planning to upgrade soon may benefit from acting before any retail adjustments take hold. Those willing to wait until the iPhone 17 should keep an eye on how Apple adjusts its product tiers and trade-in offers in the coming months.

The 104 percent tariff on Chinese-made goods is now a reality, and Apple sits squarely in its crosshairs. While the company has tools to navigate the new landscape -- storage tweaks, installment plans, trade-in incentives -- its pricing strategy will likely be tested in ways it hasn't been before.

Read on AppleInsider

Comments

Donald thinks he's playing 3D checkers. But what happens when someone else decides to simply knock over the entire board?

China could well view these attacks on its economy as attacks on China itself.

So with the US economy is disarray and with the US having alienated most of its trading partners and military allies, China could decide that it's time and past time to move forward and "annex" Taiwan. Adding that islands economic power to its own.

In fact, it may well feel it's been granted the right to do so, especially given Russia's move to annex Ukraine and the number of times Trump has indicated that the US should annex Canada, Greenland, and Panama.

What's sauce for the goose...