Last quarter before Trump tariffs sees Apple beat Wall Street with $95.4 billion earnings

Apple has reported the fiscal results for the second quarter of 2025, with the financials revealing Apple may have benefited a little but perhaps not as much as expected from consumer tariff fears, earning $95.4 billion in the quarter.

Apple CEO Tim Cook [left], CFO Kevan Parekh [right]

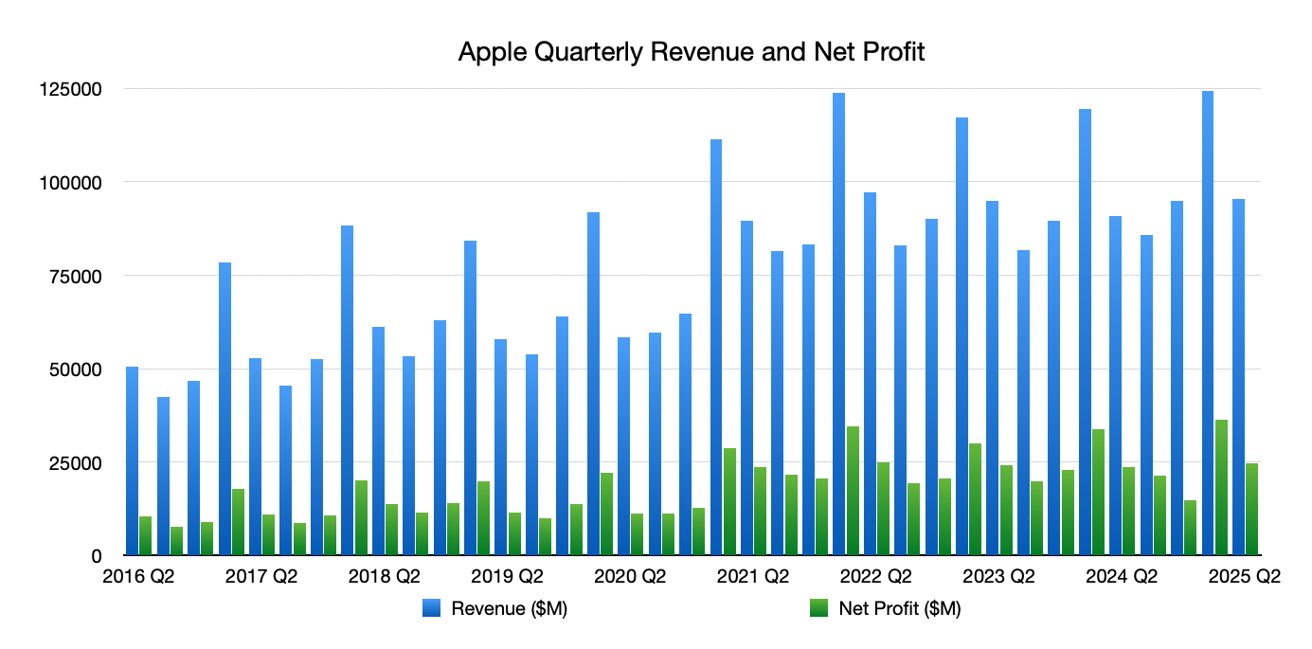

Following the blockbuster Q1 quarter and the benefits of holiday sales to Apple's bottom line, Q2 is usually a fair bit lower in comparison. However, at Apple's scale, the figures are still very important to the company.

In the second quarter, Apple's revenue of $95.4 billion is up 5% year-on-year from the $90.75 billion reported in Q2 2024. This is also above the Wall Street Consensus, which believed Apple would haul in $94.42 billion as an average.

Apple quarterly revenue and net profit, as of Q2 2025.

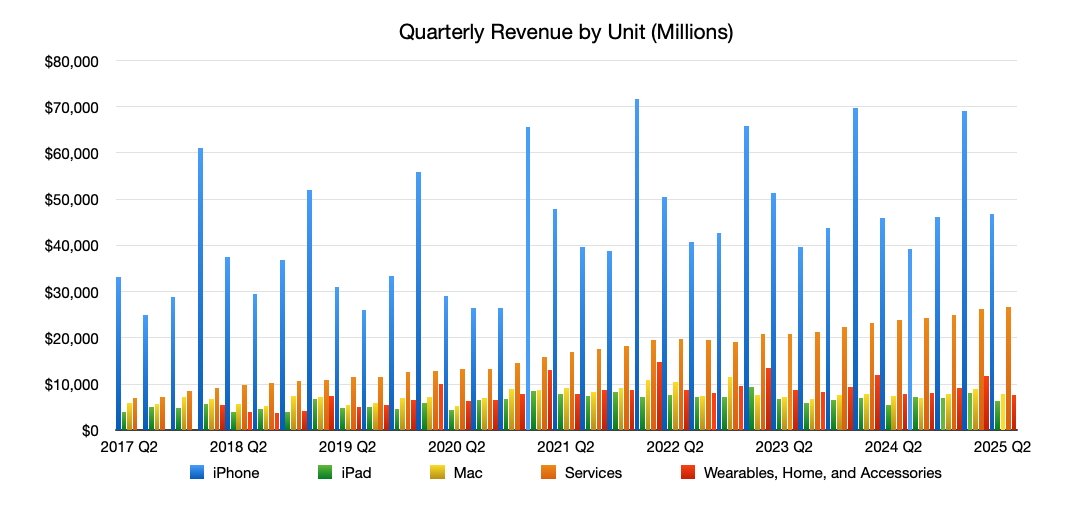

On a per-unit basis, iPhone revenue of $46.84 billion is up from $45.96 billion in the year-ago quarter. Mac revenue was $7.95 billion, up marginally year-on-year from $7.45 billion.

The iPad revenue went from $5.56 billion in Q2 2024 to $6.4 billion this year, with Wearables, Home, and Accessories down to $7.5 billion from $7.9 billion. The ever-dependable Services arm continued its long run of growth, reporting $26.6 billion for Q2 2025 versus $23.9 billion in Q2 2024.

Apple's board of directors declared a cash dividend of $0.26 per share of common stock. The Earnings Per Share is listed at $1.65.

Quarterly revenue by unit, as of Q2 2025.

During the quarter, Apple continued to benefit from post-holiday sales of fall product launches, including the iPhone 16 range.

The quarter also benefited from its own product launches, including the iPhone 16e, the 11th-gen iPad, the M3 editions of iPad Air, the M4 MacBook Air, and the updated Mac Studio. However, since they launched during the quarter, they won't necessarily have as much of an impact on finances versus products that were available through the entire quarter.

The quarterly results arrive to a backdrop of a tariff war, which sees the administration of Donald Trump trying to apply tariffs against all other countries. China has been the target of considerably high tariff hikes, but Apple and others will benefit from a temporary reprieve for its semiconductor-based products.

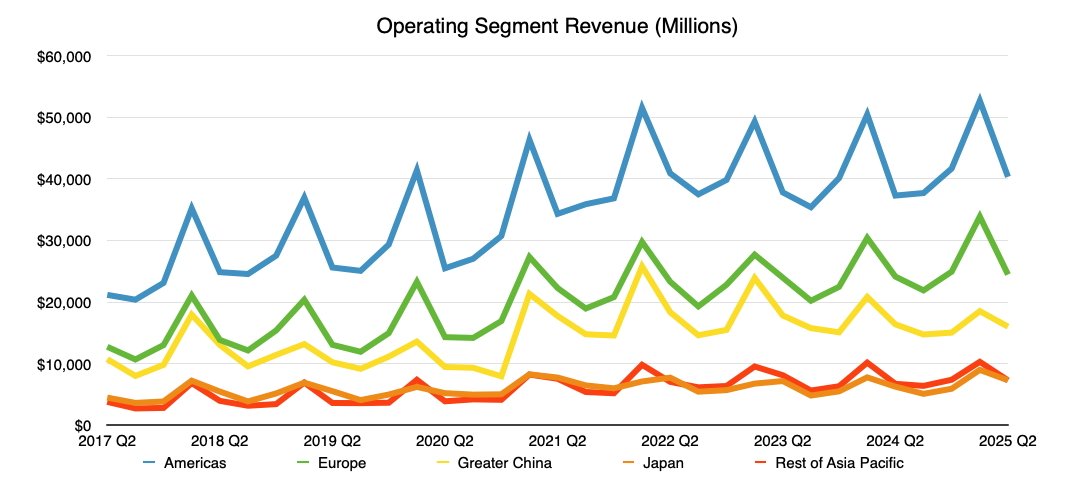

Quarterly revenue by operating segment, as of Q2 2025.

While the tariffs wouldn't have directly impacted Apple's Q2 results because the quarter closed before they were implemented, they will probably make a difference for Q3 2025.

As usual, Apple's share price is taking a hit following the results release. Within 14 minutes of the figures being published, the share price has dipped almost $5 since markets closed in after-market trading.

This is market behavior that is often seen for quarterly results releases, even when they turn out to be record-breaking numbers.

After pointing out the double-digit growth in Services, CEO Tim Cook said the company was proud to announce "we've cut our carbon emissions by 60 percent over the past decade."

CFO Kevan Parekh commented about how EPS growth of 8% and $24 billion in operating cash flow allows Apple to "return $29 billion tos shareholders." He also mentioned high levels of customer loyalty and satisfaction, and a new all-time high for its install base across all product categories and geographic segments.

Read on AppleInsider

Comments

It's pretty clear they just increase the dividend to match inflation, that's it.

Apple thinks that they can invest the money better themselves through acquisitions, stock buybacks or strategic expenditures (like prepaying TSMC *cash* for access to cutting edge nodes and wafers). And you know for 99.9% of retail AAPL shareholders Apple is probably right.

Part of the reason why they sell bonds is because of the tax implications of repatriating cash from overseas operations. They still seem to be waiting for an opportune moment. At this point, they probably think it's still cheaper to use someone else's cash instead of their own.

If you really want to stick your money somewhere else, sell off some of your AAPL and diversify. That's a good idea anyhow. Warren Buffett does it and he doesn't throw temper tantrums about paltry AAPL dividends. And your due diligence should have uncovered that AAPL doesn't pay out handsome dividends before you invested. It takes like 3-4 seconds to figure out Forward Dividend & Yield at Yahoo Finance for any company publicly traded on American stock exchanges.

If you want a stock that pays out big dividends, go invest in a company like AT&T (NYSE:T) which has zero vision and innovates poorly.

Anyhow, feel free to bring up your concerns at next year's annual shareholder meeting.

It would be quite counterproductive for the whims of this administration to prove to be Apple’s undoing. They have to see that not even Foxconn themselves, even given many (unlimited!) incentives, could set up a factory and “bring manufacturing back” to the US quickly.

It’s really nerve wracking as a shareholder watching them have to respond to such challenge coming from inside the house, so to speak. I’m hopeful because Apple has a history of facing existential crises.

Tariff will hurt them, but tariff will hurt everyone.

Update: And I totally guessed that wrong.

The General public at the grassroots level in reality doesn’t own that many shares on Wall Street despite some of the rosy statistics put out by the financial industry mutual funds don’t really count the returns on them while good aren’t even close to owning individual shares. Stock ownership by the public is usually inflated by including ownership in mutual funds, but it is not the same as ownership of individual shares.

Something else I might add owning individual shares, stock splits, and dividends are the three best ways to compound your investment as an individual stock holder, over the years if you look at some of the financial sites and look at some of the forums, many of the so=called management class professional investors? Always argue against stock splits or even paying dividends to individual share owners, which is no surprise to me now after owning shares and participating in some of the forums over the years.

As for payback... do you see AAPL as a bond or a company with the promise of delivering growth through innovation and the ability to deliver? Financial leverage is already much higher than at MSFT. And you want even more?

https://en.wikipedia.org/wiki/Apple_silicon vertical computer company. This is what separates them from Microsoft in which gives them the ability to disrupt, it is also an area where many other tech companies want a free ride on the Apple ecosystem.

As long as Tim is the CEO, there is no vision at Apple.

I can´t see any double-digit growth rates except Services. But their products are not innovative anymore.

Yeah.. Maybe, they design their chips which are innovative, but it does not justify an explosive market growth.

Their revenue is mostly flat. Their EPS is rising only due to buybacks. Their P/E (FWD) is over 30.

Hard to argue that it is a good investment.

Apple stock always tanks by in large when they report their earnings and Apple is always perpetually doomed with many people and many analyst like clockwork, doesn’t matter if they replace Intel with a better CPU/SOC, have ecosystems that everybody wants to squad in, or create a variety of Apple Silicon chips to support their hardware it also doesn’t even matter if they create a new C1 modem soon to be C2 or C3 as time goes on.

In the end, Apple is doomed in comparison to their lagging tech competition, this is despite the fact that most of their competition can’t do OS software, or hardware in combination (in house) nor create whole new ecosystems at any usable level.

Since 2000 Apple has easily been one of them best tech companies to invest in long-term (four stock splits and dividends) they still are mainly because of the fact that they can create something a new ecosystem out of nothing, Microsoft has failed to move beyond Windows (market inertia however is on their side just like Intel) both have been fortunate that Apple up till now hasn’t bothered to create servers with Apple Silicon, nor have they created the behind-the-scenes software for doing so as far as we know.

I think behind the scenes that’s changing not because Apple wants to, but once again changing conditions in the marketplace is forcing them to, most of the new things Apple has created in the last 25 years has been because, in order to survive Apple has had to create something to support their hardware, because no one else would.

One side effect in recent times that keeps coming up for Apple is that once a new product/ecosystem becomes successful, everyone wants to jump in and squat for free, then some governmental entity the EU or the United States Justice Department want to declare you a gatekeeper/monopoly after the fact.

Cook and his team of penny-pinchers made Apple #2 to Microsoft. That is not OK.

Well, I do have a lot of shares. So it bothers me when the most profitable company gives a 0.40 to 0.50% dividend. They could very easily raise that to 1.00% without bothering their buybacks by much. Another thing that bothers me is that the percentage of dividend rise has continually gone down. 4% this year is an insult, really.

i also don’t believe that buybacks should continue. And yes, they should be outlawed again. It was Reagan that began it again, I believe.