Apple admits the Q2 surge in imports won't be enough to stop price hikes

Apple may have been able to mitigate against Trump's tariffs before their full extent was announced, but the company's latest SEC filing reveals that this was only a short-term tactic, and price hikes may be inevitable.

Apple CEO Tim Cook

Apple has projected that it will take a $900 million hit over tariffs in the June 2025 quarter, following Trump's "reciprocal" tariffs. But part of preventing that loss being still higher, involved ramping up manufacturing and importing, including airlifting plane loads of iPhones.

According to a note to investors seen by AppleInsider, Morgan Stanley has calculated from Apple's latest 10-Q filing that Apple's costs were at a three-year March quarter high. The company bases this on Apple's reported balance sheet inventory, and vendor non-trade receivables -- in this case effectively pre-payments to suppliers for goods they are storing before sending to Apple.

Morgan Stanley says the figures imply that Apple had almost $70 billion worth of inventory and components on its books at the end of the quarter. Separately, estimated inventory at both Apple and its contract manufacturers was up 17% year over year.

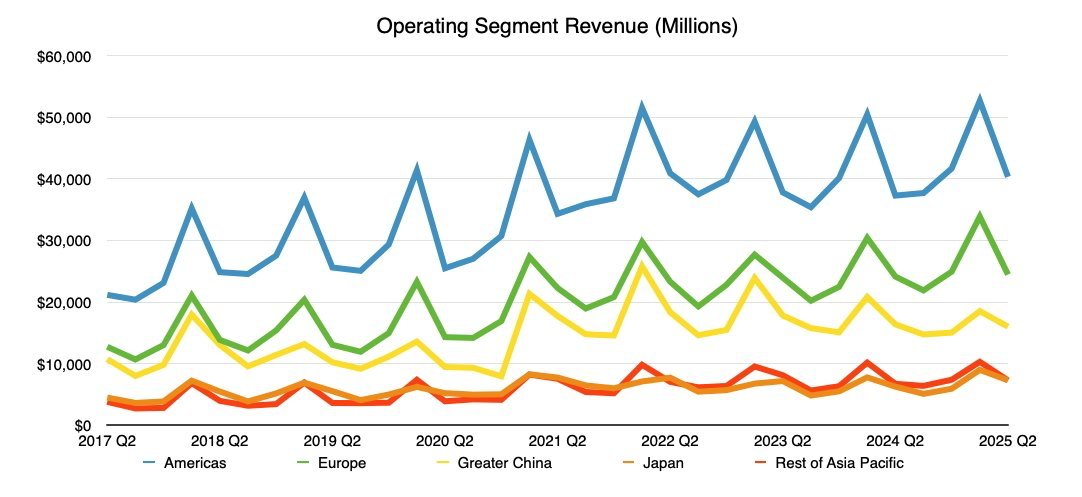

Quarterly revenue by operating segment, as of Q2 2025.

Increasing manufacturing like this, which Tim Cook described as a "build ahead" policy, was solely able to help the March quarter results. Consequently, Morgan Stanley notes that for the first time ever, Apple's filings include reference to the potential need for it to increase prices.

Apple's filing follows the standard form for the company, but now adds that tariffs "can require the Company to take various actions, including... increasing the prices of its products and services."

Apple fared better than predicted

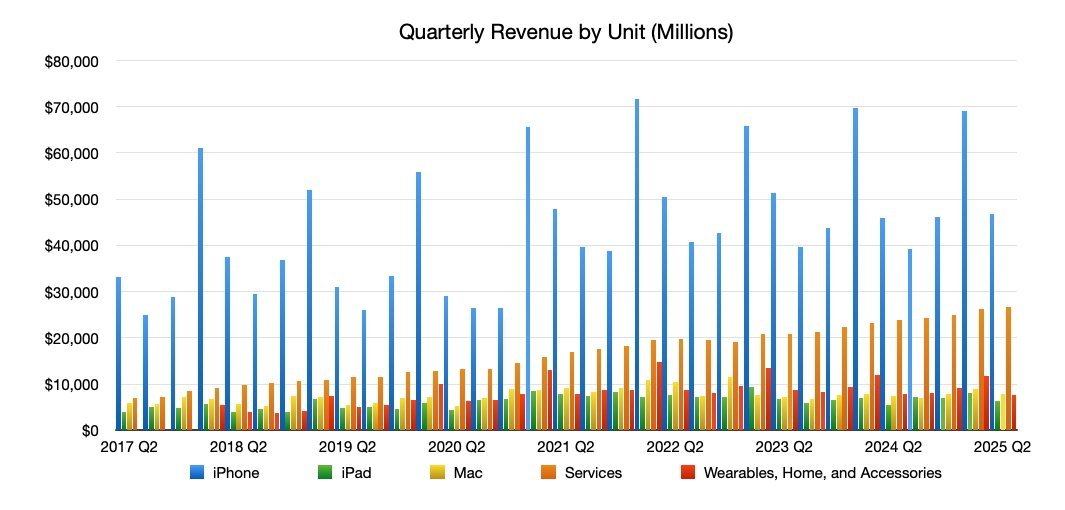

Apple reported that its Services division continued to grow in Q1, going from $23.9 billion in 2024 to $26.6 billion in the same quarter of 2025. Morgan Stanley says that increase was driven specifically by Apple's advertising, App Store, and iCloud, which it says accounted for 71% of the earnings.

Apple's earnings from Services rose in the March quarter 2025

The investment firm expects that growth to continue, but does note that it is studying US App Store performance in particular. It is doing that to estimate the impact of the recent ruling forcing Apple to change its App Store practices.

Even before the tariff announcements, Apple was continuing to see declining iPhone sales in China. However, Morgan Stanley notes that despite demand failing to improve, Apple's financial filing shows that revenues were better than feared.

Specifically, Apple's operating margin -- how much of each dollar earned is profit -- was at 41.4% in China during the March quarter. At the same time, Apple's margins across the Americas and EMEA (Europe, Middle East, and Africa) were at a 10-year high.

What can happen next

Morgan Stanley recently raised its Apple price target to $235. It bases this on an expectation that Apple will continue to mitigate the impact of tariffs, and that there may be pent-up demand for iPhone upgrades in 2027.

However, should iPhone 17 sales disappoint because of tariff-driven price increases, Morgan Stanley proposes that its target price would lower to $153. That would also depend on revenues only slightly growing, while Apple's margins contract.

On the other hand, should Apple Intelligence drive an accelerated iPhone replacement cycle, Morgan Stanley's bull case figure is $284. That's even higher than the $275 target the investment firm set in January 2025, before the tariffs were announced.

It's not yet known how effective any tariff mitigation may be after the June quarter. However, Apple is now reported to be planning to split its iPhone launches into two from 2026, which should lead to manufacturing costs being evened out across the year.

Read on AppleInsider

Comments

And the factories will be automated so very few skilled jobs needed…

Humans are still needed, just look at the photos and videos from Foxconn. They still need human eyes and hands to verify circuits, components and the assembly of the devices. You cannot yet replicate a humans ability to help with the manufacturing process and still keep the cost of the iPhone manageable. If you want to pay $5K for an iPhone, sure Apple can automate the process, but who the hell would pay for it? Customers are already balking at $1K iPhones now! It’s been almost 20 years since the first iPhone came out and still there isn’t an automated factory that can make them. Stop watching the Jetsons, it was a cartoon.