Apple Card falls to third in customer satisfaction rankings, after holding top spot for fo...

The Apple Card isn't the customer service standout it once was, with new data showing satisfaction slipping as consumers chase richer perks elsewhere.

Apple Card

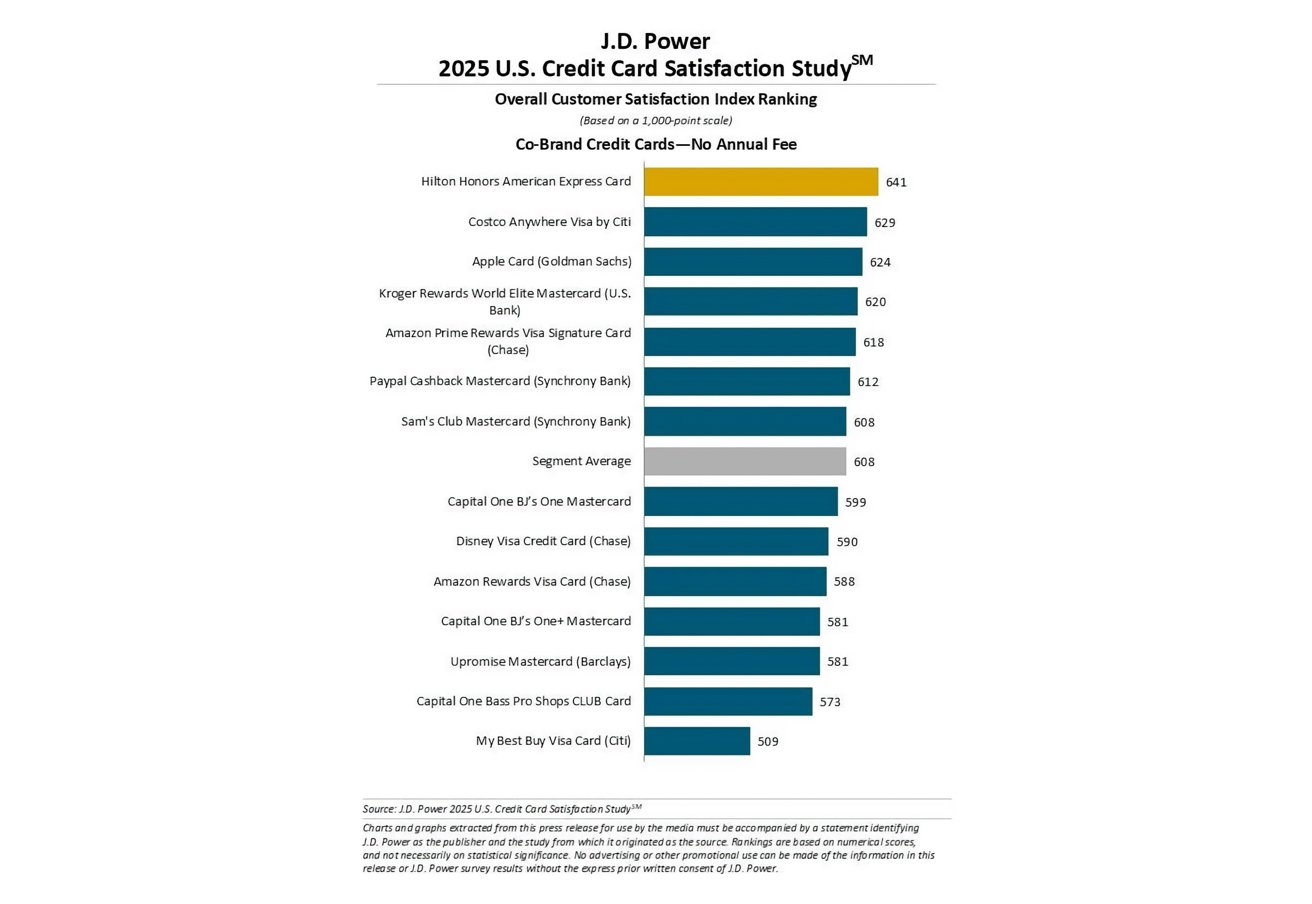

The 2025 study gave Apple Card a satisfaction score of 624 out of 1,000. This was down from 654 in 2024.

The drop pushed it behind Hilton Honors American Express, which scored 641. It also fell behind Costco Anywhere Visa by Citi, which scored 629 in the best co-branded credit cards category.

Apple Card, issued by Goldman Sachs, had topped the J.D. Power credit card rankings for this segment every year since 2020.

J.D. Power's research evaluates seven factors like account management, customer service, rewards earning and redemption, and terms. The decline suggests Apple Card lost ground in some categories, though the study doesn't specify which ones.

Changing market dynamics

Hilton Honors AmEx and Costco Anywhere Visa are linked to loyalty programs offering travel perks and store benefits to high spenders. The trend shows more consumers are willing to pay fees or change spending habits for better rewards.

Searches like "Apple Card vs Hilton Honors AmEx" or "Apple Card vs Costco Anywhere Visa" are now more competitive for potential cardholders comparing benefits.

Apple Card is known for its no-fee structure and simplicity, making it a top no-annual-fee credit card in 2025. However, that isn't good enough in a rewards-focused market.

A J.D. Power report highlights a growing divide between financially healthy customers and those under strain. Cardholders without revolving debt reported higher satisfaction, especially with annual-fee rewards cards.

Apple Card is known for its no-fee structure and simplicity. Image credit: J.D Power

Financially challenged customers, who make up over half of U.S. cardholders, rated lower on credit limits, account management, and balance transfers.

Speculation on Apple Card's next chapter

Apple Card lost its top spot as Goldman Sachs reportedly considered exiting the partnership. Although J.D. Power's survey doesn't link issuer stability to satisfaction, uncertainty about the card's future could affect customer perceptions.

With Goldman Sachs eyeing an early exit, Apple may hand the reins of Apple Card to JPMorgan Chase. Reports suggest the bank is Apple's preferred suitor and that negotiations have intensified in 2025, though talks are not final.

JPMorgan could modernize the card with its infrastructure and scale without disrupting features like the "payment wheel" and Wallet integration. If the bank takes over, Apple Card might gain new perks or extended availability, potentially expanding internationally through Chase's retail presence.

However, transition risks remain, especially concerning user trust if billing tools or savings features change under a new issuer.

Apple must decide whether to maintain its simplicity focus or add features that match the high-value rewards of its competitors. Better redemption options, account tools, or travel perks could help Apple Card regain its top position in future J.D. Power rankings.

Read on AppleInsider

Comments

Apple Card is still tops with me.

home policy out there with folks that speak English. Have had the Platinum card for more years than I can remember at age 80.

Apple Card has lost its glow as the interest rates have declined to average or lower than average. It is still very convenient and works off my Apple Watch if I accidentally leave my iPhone elsewhere than on my person. That has been a face saver more than once. But other cards also work with the Apple Pay system to complete the sale like our CostCo Citi card.

Apple's albatross is the large number of sub-prime users that turned into "no Pay" folks. Goldman Sachs probably did not screen applications carefully enough to weed out those folks before giving them a line of credit. I would think the next bank does not want the bad accounts, only those that pay on time or early.

With uncertainty in the economy caused by all the politicians from top to bottom, we pay the account balance multiple times per month to keep the balance low in case the fan blades turn brown.