Apple's largest supplier reported 24 percent surge in revenues from OLED display, componen...

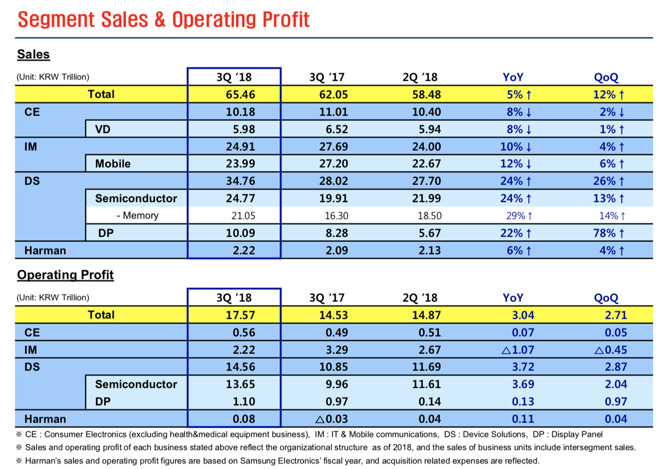

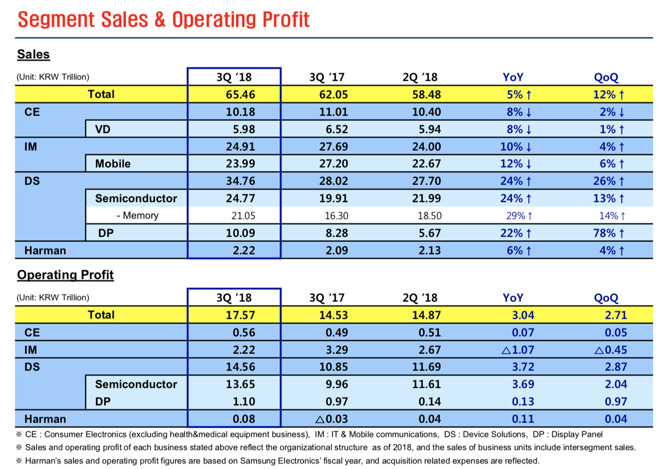

Apple's largest supplier-- and the primary source of the flexible OLED panels used in iPhone X and the new iPhone XS lineup-- reported 24 percent year-over-year growth in its Q3 revenues from its semiconductors, memory, and display panel unit, an increase it attributed to "increasing demand for flexible [OLED] panels." That supplier was Samsung, and the "major customers" it credited clearly included the world's largest seller of high-end OLED phones. Why aren't Samsung's results attributed to being an "iPhone supplier"?

Samsung supplied the high-end, flexible OLED panels used by iPhone X

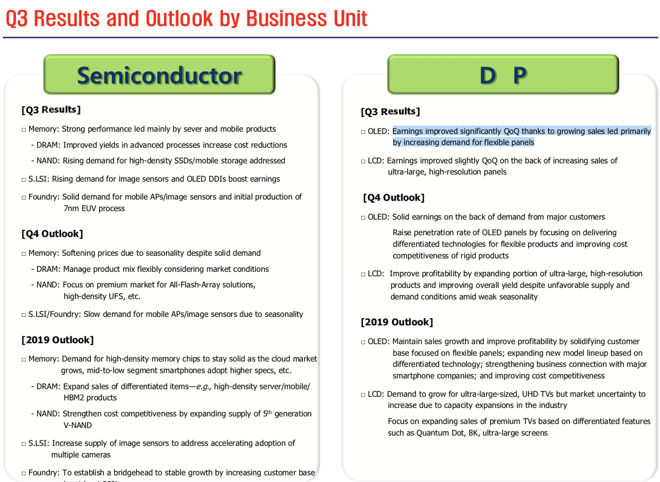

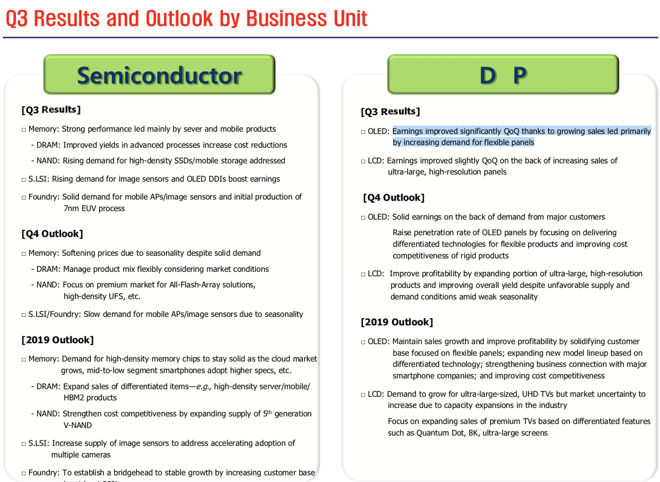

Writing for Bloomberg, Mark Gurman carefully avoided any mention of the fact that Samsung itself had reported that its Display Panel sales were facing intense competition from other suppliers of commodity rigid OLED and conventional LCD screens. Samsung actually stated at the time that "demand for flexible panels remains strong in the high-end segment," a clear reference to Apple, the world's largest supplier of a high-end phone featuring a flexible OLED panel.

Across Q2, Samsung's revenues from its "Device Solutions" unit that builds Semiconductor components and Display Panels were up by 25 percent, while its sales of finished goods were down. Its "Internet and Mobile" group performed the worst, with IM Mobile sales (including Galaxy phones, tablets, and PCs) turning in a 22 percent revenue decline that dragged down the performance of the entire company.

In the most recent Q3, Samsung again turned in solid 24 percent growth in component sales, specifically noting "growing [OLED] sales led primarily by increasing demand for flexible panels," that resulted in "solid earnings on the back of [OLED] demand from major customers."

Suddenly, the OLED supplier's association with iPhones vanished.

Samsung's DS components business is up, while its IM product sales are down

While Samsung's component sales performed well, finished good sales from one of its largest component customers did not. Samsung's own IM Mobile unit turned in another 12 percent decline in YoY sales, and profits from IM Mobile declined by more than 32 percent. That leaves one other "major customer" responsible for selling that many of Samsung's flexible OLEDs -- Apple.

Smartphone estimates for Q3 from Gartner indicate that Samsung's sales fell by 14 percent YoY, by far the worst performance across the top five smartphone makers. It was "the largest year-over-year decline since Gartner began tracking smartphone sales globally."

Apple's iPhone sales remained flat YoY, but its product mix shifted from sales of one OLED phone with the launch of two new iPhone XS flagships. If demand were weak for Apple's new high-end OLED iPhones, surely it would be evident in Samsung's OLED sales-- the most expensive component of the new models-- rather than just a few minor component suppliers who get most of their business elsewhere-- including Samsung's poorly performing IM Mobile group suffering from a chronic, devastating decline in sales that's persisted across 2018.

Samsung cited demand for flexible OLED panels, which are being driven by Apple

The world's other leading phone makers, Huawei, Xiaomi, and Oppo, get most of their display panels from other suppliers, including BOE and LG. Apple is also reportedly sourcing OLED panels from LG as an alternative to Samsung beginning this quarter. Further, sales of iPhone XR, Apple's first Face ID model to not use an OLED panel, began at the very end of October. That means the business holding up Samsung's OLED growth is likely to begin slipping over the next year.

But right now, Samsung's component business is outpacing the growth of the rest of the company while its smartphone-centric IM Mobile group is dragging. The only explanation is that it continues to benefit from a solid customer with strong sales, and Apple is by far the primary driver of the high-end, flexible OLED panels that Samsung credits for its component sales success.

Samsung supplied the high-end, flexible OLED panels used by iPhone X

Supply chain thunder only happens when it's raining

In April, Bloomberg was eager and quick to associate slow Q1 growth in Samsung's OLED unit to an imagined problem of "weak" sales of Apple's iPhone X. That was clearly not true.Writing for Bloomberg, Mark Gurman carefully avoided any mention of the fact that Samsung itself had reported that its Display Panel sales were facing intense competition from other suppliers of commodity rigid OLED and conventional LCD screens. Samsung actually stated at the time that "demand for flexible panels remains strong in the high-end segment," a clear reference to Apple, the world's largest supplier of a high-end phone featuring a flexible OLED panel.

Across Q2, Samsung's revenues from its "Device Solutions" unit that builds Semiconductor components and Display Panels were up by 25 percent, while its sales of finished goods were down. Its "Internet and Mobile" group performed the worst, with IM Mobile sales (including Galaxy phones, tablets, and PCs) turning in a 22 percent revenue decline that dragged down the performance of the entire company.

In the most recent Q3, Samsung again turned in solid 24 percent growth in component sales, specifically noting "growing [OLED] sales led primarily by increasing demand for flexible panels," that resulted in "solid earnings on the back of [OLED] demand from major customers."

Suddenly, the OLED supplier's association with iPhones vanished.

Samsung's DS components business is up, while its IM product sales are down

While Samsung's component sales performed well, finished good sales from one of its largest component customers did not. Samsung's own IM Mobile unit turned in another 12 percent decline in YoY sales, and profits from IM Mobile declined by more than 32 percent. That leaves one other "major customer" responsible for selling that many of Samsung's flexible OLEDs -- Apple.

Smartphone estimates for Q3 from Gartner indicate that Samsung's sales fell by 14 percent YoY, by far the worst performance across the top five smartphone makers. It was "the largest year-over-year decline since Gartner began tracking smartphone sales globally."

Apple's iPhone sales remained flat YoY, but its product mix shifted from sales of one OLED phone with the launch of two new iPhone XS flagships. If demand were weak for Apple's new high-end OLED iPhones, surely it would be evident in Samsung's OLED sales-- the most expensive component of the new models-- rather than just a few minor component suppliers who get most of their business elsewhere-- including Samsung's poorly performing IM Mobile group suffering from a chronic, devastating decline in sales that's persisted across 2018.

Samsung cited demand for flexible OLED panels, which are being driven by Apple

The world's other leading phone makers, Huawei, Xiaomi, and Oppo, get most of their display panels from other suppliers, including BOE and LG. Apple is also reportedly sourcing OLED panels from LG as an alternative to Samsung beginning this quarter. Further, sales of iPhone XR, Apple's first Face ID model to not use an OLED panel, began at the very end of October. That means the business holding up Samsung's OLED growth is likely to begin slipping over the next year.

But right now, Samsung's component business is outpacing the growth of the rest of the company while its smartphone-centric IM Mobile group is dragging. The only explanation is that it continues to benefit from a solid customer with strong sales, and Apple is by far the primary driver of the high-end, flexible OLED panels that Samsung credits for its component sales success.

Comments

It's not news or reality though.

It's not even clear that Apple ever stopped production of iPhone X. It only stopped selling it in the USA, to focus on its new models. In some other countries, it continued to be sold, the same way Apple kept selling the 6 long after ending its sales in USA.

When the same sources claim that Samsung was selling few OLEDs because iPhone X demand was weak come back in 6 months and say Apple had minimum quotas that are keeping Samsung afloat because iPhone demand is weak, that should tip you off that they are lying to promote a perpetual narrative that iPhone sales are weak, which is the opposite of every real point of data we have.

iPhones are selling for $800 next to $200 Androids, and sales figures were slightly up this year in a market where smartphones are shrinking. It's totally asinine to be creating new possible stories to explain how Apple is in a desperately bad position and that nobody wants iPhones.

I was simply pointing out that there is another possible explanation that has already been brought up that would call into question the assertion that Apple must have strong sales for Samsung's revenue to be what it is. Yes, it is speculation, but no more so than this article either.

Is it any less of a conspiracy theory to say "Samsung's sales are strong, therefore Apple's sales must be strong too"? It is still a "maybe this could be happening" guesswork that takes particular facts and uses them to fit a predetermined narrative.

On the other hand, we do know where high end flexible OLED panels come from, and we do know where they are sold in commercially significant quantities. There is no "maybe" conjecture.

We know where face ID cameras come from (Lumentum which counts on apple for 30% of its revenue), that supplier issued a warning.

We know where the audio chips come from (Cirrus which counts on Apple for 80% of its revenues), that supplier issued a warning.

These are not insignificant quantities of components provided to Apple.

Apple could be having poor iPhone sales or it could be having record iPhone sales, and there is verifiable information that can be used to form an opinion either way.

We also know that Apple has complicated supply chain, and there is no was of know if why one supplier business is going up or down since Apple could be normal moving business around and also trying to mitigate supply chain risks which you would have not idea what those could be.

Lastly, last year Apple had 1 product which uses these parts, this year they introduced 5, do you really believe the volume on 5 product is going to so much worse that is falling well below a single product last year to the point that a supplier had to put our a earning warning so bad if they were truly the sole source the face ID silicon. This is where critical thinking and problem solving needs to kick in.

This. Further, I find it ridiculous that Apple (with Tim Cook - master of the supply chain) could ever be so wrong about supply/demand that they would find themselves in a situation where they had a large surplus of any component.

Second, if Apple has a contract to purchase a certain amount of OLED screens, they could still buy them for future phones to fulfill their contract.

Something else that’s very interesting, when Samsung has to cut their future screen sales forecasts due to LG selling OLED to Apple, will the industry claim and doom and gloom on iPhone sales it again…

/s

I could put two and two together and believe that Finisar just drank Lumentum’s milkshake, but no, that can’t be it.

It seems like work to continually not get what DED writes, every. single. column.