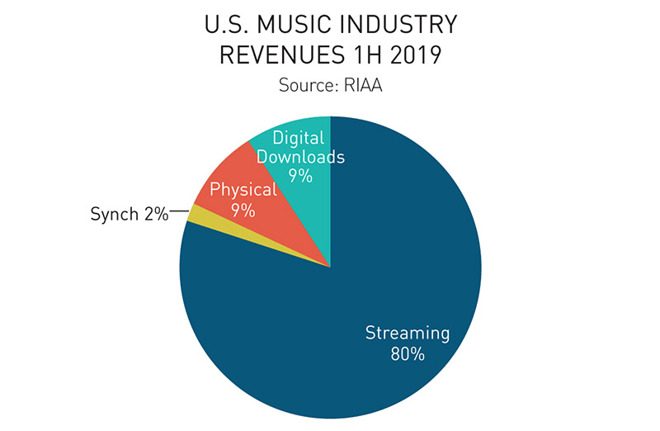

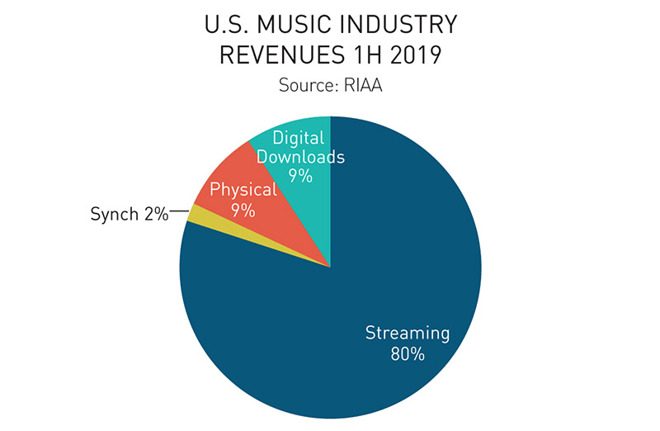

Apple Music, other streaming services account for 80% of music industry revenue

Streaming services like Apple Music and Spotify continued to be the engine driving America's music business, with the category accounting for some 80% of all industry revenue for the first half of 2019.

According to a fresh report from the Recording Industry Association of America (PDF link), revenue from streaming services hit $4.3 billion in the half, up 26% from the same time last year. The segment incorporates revenue from subscription products like Apple Music, digital and customized radio services like Pandora and SiriusXM, and ad-supported on-demand services like YouTube.

Subscription services were once again the biggest driver of income at a collective $3.3 billion, up 31% year-over-year. Also included in the paid streaming category are contributions from "Limited Tier" products such as Amazon Prime and Pandora Plus, which brought in $482 million.

The growth is thanks to a massive influx of new users -- an average of 1 million per month over the past year -- that saw paid subscriptions hit 61.1 million users, up 30% from 2018.

Altogether, income from subscription services accounted for 62% of overall industry revenues and 77% of U.S. streaming music revenues, the report said.

Streaming services helped push retail revenues to $5.4 billion, up 18% from $4.6 billion in 2018.

The RIAA notes gains in streaming revenue were partially offset by declines in digital sales. In the first half of 2019, download revenues drooped to $462 million split between individual track and album purchases. That compares to $561 million in revenue in 2018 and $765 million in 2017.

Apple's streaming solution continues to gain traction worldwide, seemingly at pace with market leader Spotify. In June, Apple SVP of Internet Software and Services Eddy Cue said Apple Music hit the 60 million subscriber mark, an achievement for a product that launched in 2015.

Spotify remains the clear dominant streaming presence, however, and in July recorded 108 million paid subscribers, up 30% year-over-year. The platform boasts a massive 232 million listeners across its paid and free-to-listen tiers.

According to a fresh report from the Recording Industry Association of America (PDF link), revenue from streaming services hit $4.3 billion in the half, up 26% from the same time last year. The segment incorporates revenue from subscription products like Apple Music, digital and customized radio services like Pandora and SiriusXM, and ad-supported on-demand services like YouTube.

Subscription services were once again the biggest driver of income at a collective $3.3 billion, up 31% year-over-year. Also included in the paid streaming category are contributions from "Limited Tier" products such as Amazon Prime and Pandora Plus, which brought in $482 million.

The growth is thanks to a massive influx of new users -- an average of 1 million per month over the past year -- that saw paid subscriptions hit 61.1 million users, up 30% from 2018.

Altogether, income from subscription services accounted for 62% of overall industry revenues and 77% of U.S. streaming music revenues, the report said.

Streaming services helped push retail revenues to $5.4 billion, up 18% from $4.6 billion in 2018.

The RIAA notes gains in streaming revenue were partially offset by declines in digital sales. In the first half of 2019, download revenues drooped to $462 million split between individual track and album purchases. That compares to $561 million in revenue in 2018 and $765 million in 2017.

Apple's streaming solution continues to gain traction worldwide, seemingly at pace with market leader Spotify. In June, Apple SVP of Internet Software and Services Eddy Cue said Apple Music hit the 60 million subscriber mark, an achievement for a product that launched in 2015.

Spotify remains the clear dominant streaming presence, however, and in July recorded 108 million paid subscribers, up 30% year-over-year. The platform boasts a massive 232 million listeners across its paid and free-to-listen tiers.

Comments

“The music business is a cruel and shallow money trench, a long plastic hallway where thieves and pimps run free, and good men die like dogs. There's also a negative side.”

― Hunter S. Thompson

The big music labels used to both sponsor and act as gate keepers for music and musicians. It was an ugly business but we got beautiful, music filled songs that often took months and years to perfect and produce.

Now we get single, lonely voices in monotone "singing" along to electronic thump-thumps. It's cheap. And we get what we pay for.

What the heck is “Synch 2%” on that chart?

http://www.riaa.com/wp-content/uploads/2019/09/Mid-Year-2019-RIAA-Music-Revenues-Report.pdf

Over the air radio is governed by a different revenue structure.

https://www.bmi.com/creators/royalty/us_radio_royalties

FunFact: According to the most recent info I can find (early 2018) only 17% of streaming revenues are actually paid out to the artist performing them.

Why would you presume that people don't or can't listen to albums on streaming services? Just taking a quick look at screenshots of Apple Music (and presumably Spotify) shows that you can certainly do exactly this.

The last time (probably last year) AI wrote an article on this topic, ISTR that they explained it. "Synch" refers to income from licensing out the music to other media, from ads to movies, video games, i.e. anything other than the original recording in its various formats.

Record labels have mostly been in the business of churning out money making pop for most of recorded music’s history.

The biggest difference now is that online services allow independent creators to distribute their music without having to foot the bill to make boxes of physical media that only gets sold or even seen in their hometown.

For the listener, all you have to do is look for it and you can find it. If you can’t find your way past current pop and your generation’s oldies, it’s not the industry’s fault. You’re just not looking for it.

Next up is movies, streaming is already biting into physical sales. Studios are trying to respond by upping the quality (requirements) but we’re getting to the point our eyes can’t tell the difference.

I’m just waiting for VR glasses to kill off the TV experience. Theatre's will do fine though... it’s a social experience.