Wall Street reacts to Apple's strong Services and Wearables growth [u]

Analysts have passed comment on Apple's record fourth quarter results for the fiscal year 2019, with investor expectations and analyst estimates being beaten in a variety of ways, though the lower iPhone revenue is suggested to be an indicator of challenging December quarter results.

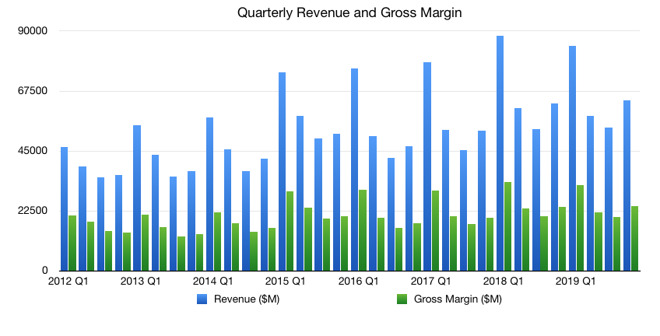

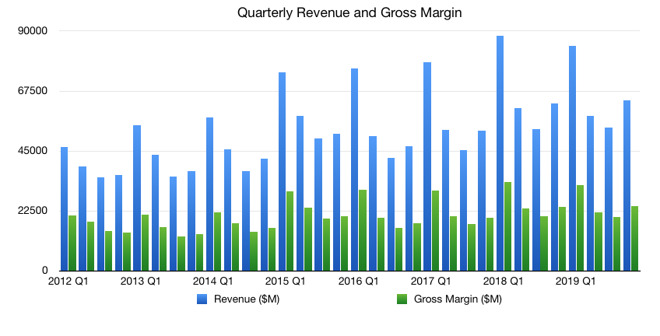

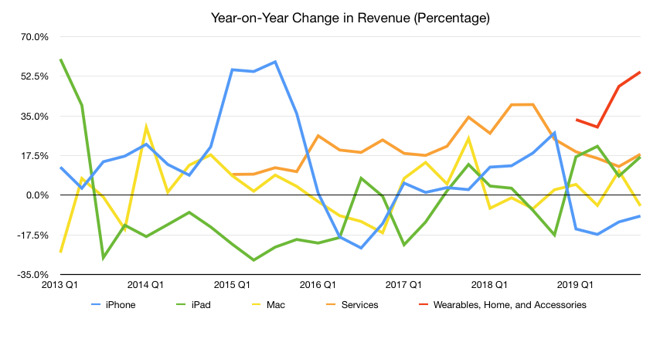

For the fourth quarter, Apple earned $64 billion in revenue, earning a profit of $13.69 billion during the period. With iPhone revenue down 9% year-on-year at $33.36 billion, the shortfall from the key product's revenue was mitigated by sales from a number of other areas growing year-on-year.

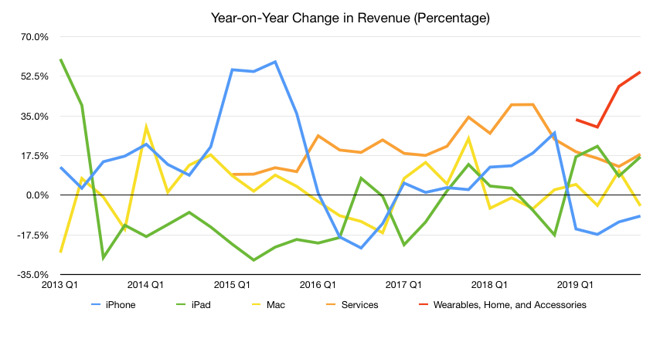

Services saw its growth continue in a predictable fashion at 18% to 12.52 billion, with iPad also up from $4.1 billion last year to $4.66 billion, and wearables rising a meteoric 54% from last year at $6.52 billion for the quarter. Mac revenue fell slightly from $7.4 billion to $6.99 billion.

Prior to market opening on October 31, Apple stock pricing is at $247.30, an over $4 per share gain since the earnings report was issued.

The better-than-expected results prompted a raise in Cowen's 2020 iPhone units forecasts, and a raising of its price target from $250 to $290.

Services' growth is "robust" as a number of sub-segments like the App Store, AppleCare, Apple Music, and iCloud "reach new all-time highs." The Services growth is "a testament to Apple's ability to navigate the difficult macro head winds with its pricing strategy."

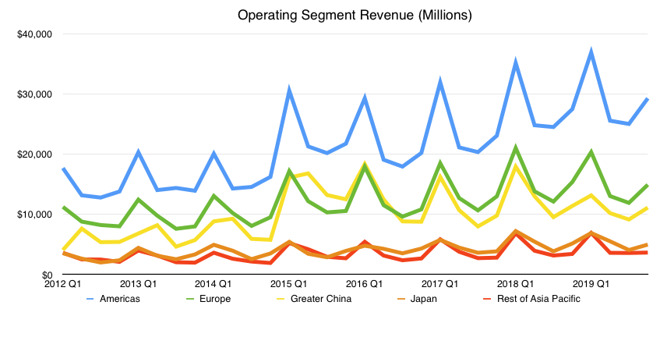

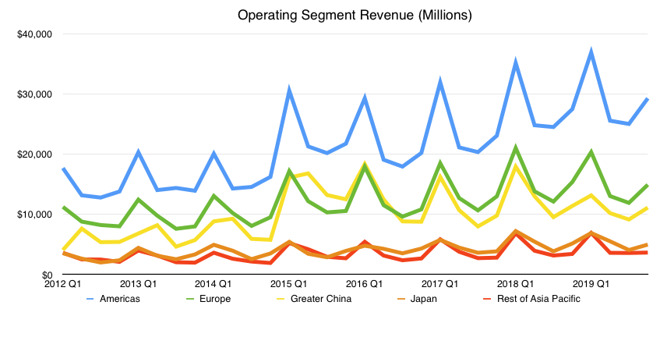

Chinese revenues are also thought to have recovered despite dipping 1% year-on-year, as last year it was seeing 20% shrinkage, with iPhone pricing, wearables growth, and "key game approvals" assisting Services growth in the region.

Despite seeing a resuscitation of revenue for Greater China, Rosenblatt believes "Apple still has yet to face its biggest challenge in China, which is the upcoming launch of 5G service in November as well as the coverage for 5G service expanding to 100 cities by the middle of 2020." The firm expects Apple's market share in the region to decline with the growth of 5G in the country.

Globally, the initial 5G cycle will provide two challenges to Apple, in the form of mmWave systems "overheating" and the higher costs and resulting retail pricing. "We believe it may not make sense for Apple to launch a low-end 5G version for the iPhone 12 (the next upgrade from the iPhone 11) due to our estimate that retail prices may start ~$900. We think it makes more sense for Apple to launch both a 4G and 5G model for the iPhone 12 Pro, while just a 5G model for the iPhone 12 Pro Max."

It is expected the 5G model of the "iPhone 12 Pro" will be roughly $300 more than the 4G-equipped version. The price rise may be too high, with Apple tipped to ship a total of 20 to 30 million 5G iPhones in the 2020 calendar year.

The December quarter guidance of $87.5 billion "suggests slight iPhone revenue growth," which Rosenblatt models at around $52.5 billion in the quarter, slightly up from $52 billion last year. "With the earlier launch of new iPhone models and the upcoming production of the iPhone SE2, we do not think slight y/y growth from iPhone revenues will bring much excitement."

Rosenblatt rates Apple as "Sell" with a price target of $150. Zhang's predictions for Apple stock pricing has trailed reality for about four years.

The improvements resulted in J.P. Morgan raising their revenue and margin forecasts, and its price target from $275 to $280.

"Investors might be wary of sales momentum carrying into December quarter," the firm reasons, but "discussions with the company indicate greater confidence in the revenue forecast." Additionally, the higher portion of Services revenue that consist of subscriptions "drives higher visibility into the guide."

Both better iPhone pricing and Services momentum have "long-term implications" for the company, with the latter's likely "higher monetization of the installed base" a good sign for the future. Apple "remains on track for paid subscriptions to exceed 500 mn in 2020," J.P. Morgan insists.

Services growth acceleration "should continue" with more driving by AppleCare and the App Store alongside new services like Apple TV+ and "to a lesser extent" Apple Arcade and Apple Card. Gross margins for Services going forward are tipped to contract "due in part to the inclusion of Apple TV+," though the sequential growth in high-margin services like the App Store and iCloud could "act as a more meaningful offset" than Morgan Stanley currently models.

On the subject of wearables, Morgan Stanley claims "We believe Apple Watch and AirPods penetration among the iPhone installed base remains far below mature levels, and considering 3 of every 4 Apple Watch customers are new to the device, expect a long growth runway going forward."

Morgan Stanley has set a new price target of $296, with AAPL remaining the firm's "top pick for 2020."

For the fourth quarter, Apple earned $64 billion in revenue, earning a profit of $13.69 billion during the period. With iPhone revenue down 9% year-on-year at $33.36 billion, the shortfall from the key product's revenue was mitigated by sales from a number of other areas growing year-on-year.

Services saw its growth continue in a predictable fashion at 18% to 12.52 billion, with iPad also up from $4.1 billion last year to $4.66 billion, and wearables rising a meteoric 54% from last year at $6.52 billion for the quarter. Mac revenue fell slightly from $7.4 billion to $6.99 billion.

Prior to market opening on October 31, Apple stock pricing is at $247.30, an over $4 per share gain since the earnings report was issued.

Cowen and Company

Reiterating its "Outperform" rating on the stock the iPhone business is performing "better than market expectations in the near term." The iPhone 11 product family "is being received well by consumers and this could drive a re-rating in shares," the firm suggests, "especially as a potential low-cost SE2 in C1H20 and a 5G iPhone by C4Q20 could be additional catalysts in the coming year."The better-than-expected results prompted a raise in Cowen's 2020 iPhone units forecasts, and a raising of its price target from $250 to $290.

Services' growth is "robust" as a number of sub-segments like the App Store, AppleCare, Apple Music, and iCloud "reach new all-time highs." The Services growth is "a testament to Apple's ability to navigate the difficult macro head winds with its pricing strategy."

Chinese revenues are also thought to have recovered despite dipping 1% year-on-year, as last year it was seeing 20% shrinkage, with iPhone pricing, wearables growth, and "key game approvals" assisting Services growth in the region.

Rosenblatt Securities

The 1.58% year-on-year revenue increase is "mainly driven by the wearable segment" and primarily from AirPods, Rosenblatt claims, though this is of limited use to the company as it "does not bring much upside to iOS services" at all. "We believe the lack of upside to services from wearables is why the Street gives low multiples to wearable companies."Despite seeing a resuscitation of revenue for Greater China, Rosenblatt believes "Apple still has yet to face its biggest challenge in China, which is the upcoming launch of 5G service in November as well as the coverage for 5G service expanding to 100 cities by the middle of 2020." The firm expects Apple's market share in the region to decline with the growth of 5G in the country.

Globally, the initial 5G cycle will provide two challenges to Apple, in the form of mmWave systems "overheating" and the higher costs and resulting retail pricing. "We believe it may not make sense for Apple to launch a low-end 5G version for the iPhone 12 (the next upgrade from the iPhone 11) due to our estimate that retail prices may start ~$900. We think it makes more sense for Apple to launch both a 4G and 5G model for the iPhone 12 Pro, while just a 5G model for the iPhone 12 Pro Max."

It is expected the 5G model of the "iPhone 12 Pro" will be roughly $300 more than the 4G-equipped version. The price rise may be too high, with Apple tipped to ship a total of 20 to 30 million 5G iPhones in the 2020 calendar year.

The December quarter guidance of $87.5 billion "suggests slight iPhone revenue growth," which Rosenblatt models at around $52.5 billion in the quarter, slightly up from $52 billion last year. "With the earlier launch of new iPhone models and the upcoming production of the iPhone SE2, we do not think slight y/y growth from iPhone revenues will bring much excitement."

Rosenblatt rates Apple as "Sell" with a price target of $150. Zhang's predictions for Apple stock pricing has trailed reality for about four years.

J.P. Morgan

Apple "managed to clear even the high hurdle of investor expectations," J.P. Morgan's investor note starts, with the higher revenue demonstrating Apple is able to "comfortably offset margin dilution from sales of a higher mix of lower-end iPhones." The leverage impact will "drive higher investor confidence in gross margin expansion medium-term," due to overall revenue growth and a potential return to growth for iPhone revenue.The improvements resulted in J.P. Morgan raising their revenue and margin forecasts, and its price target from $275 to $280.

"Investors might be wary of sales momentum carrying into December quarter," the firm reasons, but "discussions with the company indicate greater confidence in the revenue forecast." Additionally, the higher portion of Services revenue that consist of subscriptions "drives higher visibility into the guide."

Both better iPhone pricing and Services momentum have "long-term implications" for the company, with the latter's likely "higher monetization of the installed base" a good sign for the future. Apple "remains on track for paid subscriptions to exceed 500 mn in 2020," J.P. Morgan insists.

Morgan Stanley

Calling the quarter "Clean Across the Board, Morgan Stanley notes the iPhone 11 cycle is "strong out of the gate" with iPhone replacement rates nearing a ceiling and "setting up for improving and more stable growth in the medium-term." Battery and camera innovation, more affordable pricing, and trade-in and financing offers are "proving catalysts for stronger upgrade rates," allowing iPhone to beat the firm's forecast.Services growth acceleration "should continue" with more driving by AppleCare and the App Store alongside new services like Apple TV+ and "to a lesser extent" Apple Arcade and Apple Card. Gross margins for Services going forward are tipped to contract "due in part to the inclusion of Apple TV+," though the sequential growth in high-margin services like the App Store and iCloud could "act as a more meaningful offset" than Morgan Stanley currently models.

On the subject of wearables, Morgan Stanley claims "We believe Apple Watch and AirPods penetration among the iPhone installed base remains far below mature levels, and considering 3 of every 4 Apple Watch customers are new to the device, expect a long growth runway going forward."

Morgan Stanley has set a new price target of $296, with AAPL remaining the firm's "top pick for 2020."

Comments

Amazing. No one in the world ever has to watch a single episode, and it will be reported as one of the most successful services of all time. Amazing what sleazy accounting can accomplish!

In the short term, though, the stock seems a bit pricey. Since 2007, I've had the impression that when the P/E goes above 17, AAPL is likely due for a correction. Currently, the P/E is almost 21.

On the other hand... one reason Wall Street might have been skeptical about AAPL in the past was a concern that they were too dependent on one product. Perhaps if Apple can show revenue+profit growth across multiple products, Wall Street might tolerate a higher P/E.

Still, I suspect that between now and the middle of next year AAPL will experience a noticeable downturn. I'm just not sure when.

Why? Apparently existing 5G phones require two modems - one for 4G and the other for 5G but that’s set to change next year.

That's not to say that I personally think those companies are a good buy -- I don't. I'd rather own Apple, and despite selling quite a few shares, I do still own quite a few shares. But I think I understand why Wall Street looks at things the way they do.

So how dumb is it now, knowing that this is directly from Apple?