Apple buys startup that turns smartphones into mobile payments terminals

Apple recently purchased Mobeewave, a payments technology startup that developed a method by which smartphones like iPhone can be used as mobile payments terminals.

Citing sources familiar with the matter, Bloomberg reports Apple paid approximately $100 million for Montreal-based Mobeewave and its "dozens" of employees. The team has been retained and continues to work out of its headquarters.

Apple confirmed the purchase with a boilerplate statement, saying, "Apple buys smaller technology companies from time to time and we generally do not discuss our purpose or plans."

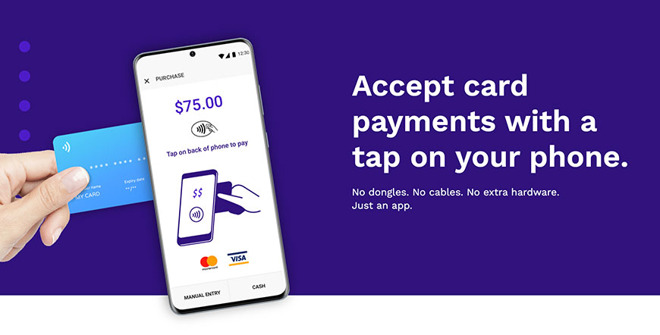

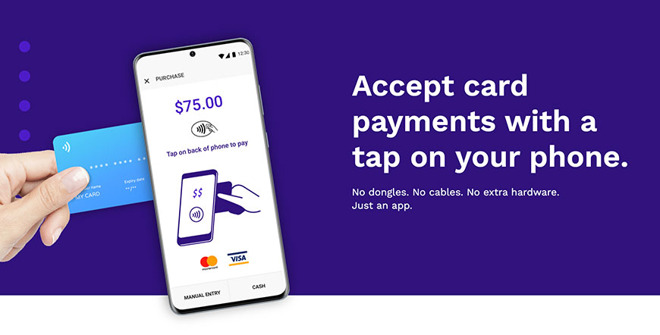

Mobeewave's technology employs NFC communications to enable users to conduct payments by tapping a compatible credit card on a smartphone. Consumers can also trigger transactions by bringing two smartphones within close proximity of each other, the report said.

Details of the payments tech were left unreported, but Mobeewave's solution appears to focus on the secure transfer of credentials over existing hardware protocols. A number of point of sale terminals support tap-to-pay credit card transactions, though the tech has yet to make the leap to iPhone. Apple first integrated NFC capabilities into its flagship smartphone with iPhone 6 and 6s in 2014.

If adopted, the payments tech would allow Apple to compete with the likes of Square. Unlike existing solutions that require extra hardware like first-party dongles or NFC reader attachments, however, Mobeewave's integrated system is much more appealing and could be a game changer for small businesses.

Citing sources familiar with the matter, Bloomberg reports Apple paid approximately $100 million for Montreal-based Mobeewave and its "dozens" of employees. The team has been retained and continues to work out of its headquarters.

Apple confirmed the purchase with a boilerplate statement, saying, "Apple buys smaller technology companies from time to time and we generally do not discuss our purpose or plans."

Mobeewave's technology employs NFC communications to enable users to conduct payments by tapping a compatible credit card on a smartphone. Consumers can also trigger transactions by bringing two smartphones within close proximity of each other, the report said.

Details of the payments tech were left unreported, but Mobeewave's solution appears to focus on the secure transfer of credentials over existing hardware protocols. A number of point of sale terminals support tap-to-pay credit card transactions, though the tech has yet to make the leap to iPhone. Apple first integrated NFC capabilities into its flagship smartphone with iPhone 6 and 6s in 2014.

If adopted, the payments tech would allow Apple to compete with the likes of Square. Unlike existing solutions that require extra hardware like first-party dongles or NFC reader attachments, however, Mobeewave's integrated system is much more appealing and could be a game changer for small businesses.

Comments

Small businesses choose to use iPads(with 3rd party software) but they aren't supported natively. Imagine if they were?

Forgot to add. Apple has also shi**ed on companies who used to use iPod touches to take people's orders. Hopefully Apple supports them again but unfortunately there has been nothing as cheap or small as the iPod since.

Intriguing.

My first guess is that Apple will only use the system for the retail stores, which rely on a clunky iPhone terminal add-on to process credit cards (do Apple store even take cash? Not that it matters; after this year, no one will).

I think they will also add a framework so that services like Square can process payments on-device, without the need for extra hardware.

But I'll tell you where this will really make a huge difference: craft fairs, outdoor gigs … We went for a walk around the grounds of stately home the other day (no one is allowed inside at the moment). Now that it's card payments only, all the ice cream vendors have terminals to take the money. So from the gift shop (closed) you can see all these vendors running about waving payment terminals in the air, trying to get a connection. Turned out that the best place to get a signal was by the entrance to the ladies toilets … that was a very weird queue: women looking suspiciously at men, and men shouting: "I'm just buying ice cream!"

Anyway, yes, processing payments on device, without needing to connect to a network would be a game changer for outdoor venues.

So, I see this as a boon to small, owner operated businesses and to things like vendors at farmers markets, etc....|

I have never once had to do that. And, I use ApplePay on my watch almost always -- even at gasoline pumps.

My in-laws have a landscaping business. If this ‘hold the credit card up to the phone’ thing comes to fruition that may finally get them to stop mailing out invoices and waiting for checks to be mailed back.

Yeh, true... I occasionally get that crap too. But that's from the merchant, not the bank. The, "Credit or Debit" thing always bugs me: why would anybody with a credit card choose "debit"? What a silly question!

The Bay Area transit system is certainly not unique in their backwardness. At least not in the U.S.

The US is laughably behind Europe and even further behind modern parts of Asia like Singapore, Hong Kong, and major Chinese cities when it comes to certain types of modern infrastructure. Capabilities like this payment system have not only been pervasive for at least 10-15 years outside of the US in restaurants and stores, but are widely used in public transportation, parking garages, toll booth free toll roads, etc. The good news is by the time the technology reaches the US it’s already been well tested and had most of the kinks worked out over a 10 year beta test period.

The other thing that I’ve seen is how reasonable the fees are for using electronic payment systems outside the US. I had to use an ATM card at a hotel in China once and was somewhat fearful of getting slammed with a big fee, like you see when you use a bank ATM not affiliated with your bank in the US. The fee for pulling $300 USD equivalent in Chinese currency was a whopping 80 cents. Go figure.

One would think. But, transit systems people seem to live in their own little universe.

available in the USA only. Sighs.