Crypto holders left holding the bag as FTX exchange collapses

In what may be a Machiavellian plot after a series of bad business decisions by exchange FTX, cryptocurrency holders are seeing big losses, after an already tough year.

FTX spirals as people pull assets out from the exchange

Confidence in the FTX crypto exchange collapsed as crypto traders pulled their assets out in droves. It left FTX flailing as the value of multiple major coins, including Bitcoin, dropped to their lowest in years.

According to a report from Reuters, a heated rival to FTX, Binance, was set to buy FTX and all its assets to help prevent this liquidation from driving crypto into the ground. However, regulatory threats and the accelerated liquidation of FTX forced Binance to back out at the last minute.

"As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged U.S. agency investigations, we have decided that we will not pursue the potential acquisition of FTX.com," Binance said in a statement on Wednesday.

FTX is now left to fend for itself with the founder, Sam Bankman-Fried, out of options. Individuals who tied up their assets with FTX and the FTT coin -- and the rest of the world's crypto holders -- are suffering major losses after the big players pulled out early.

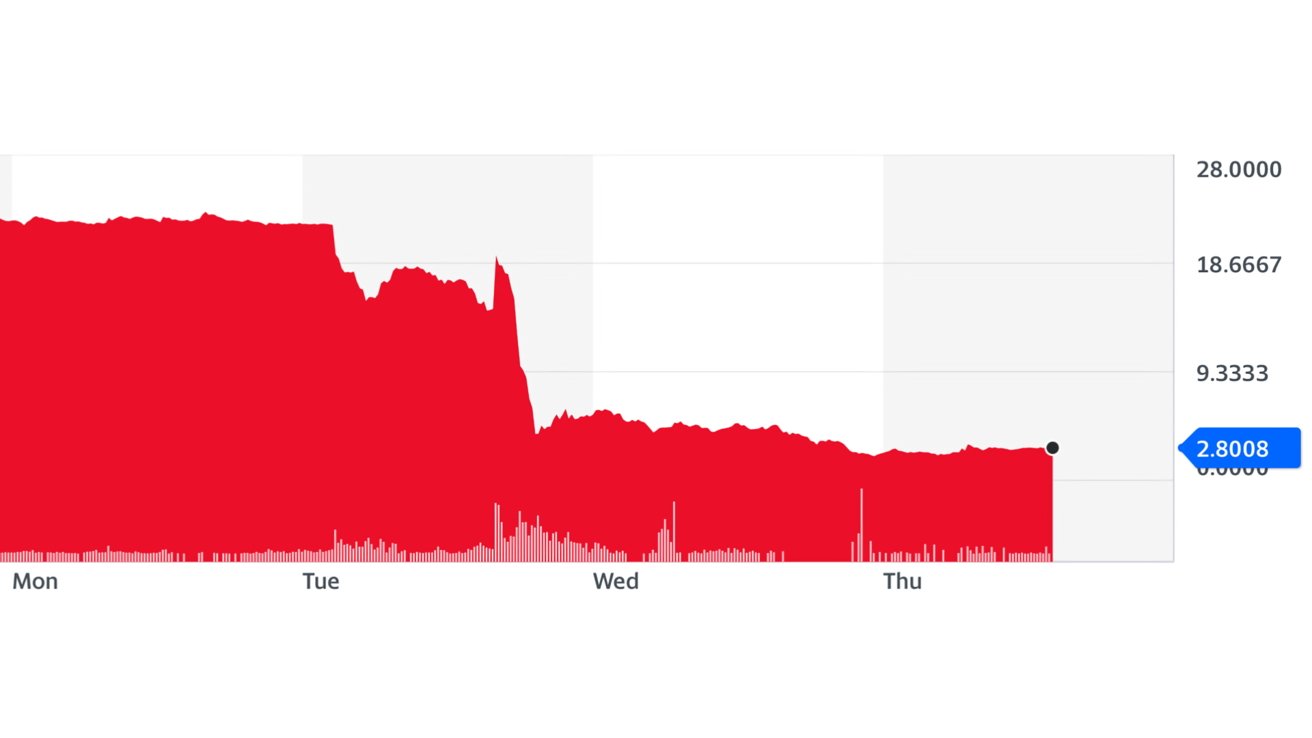

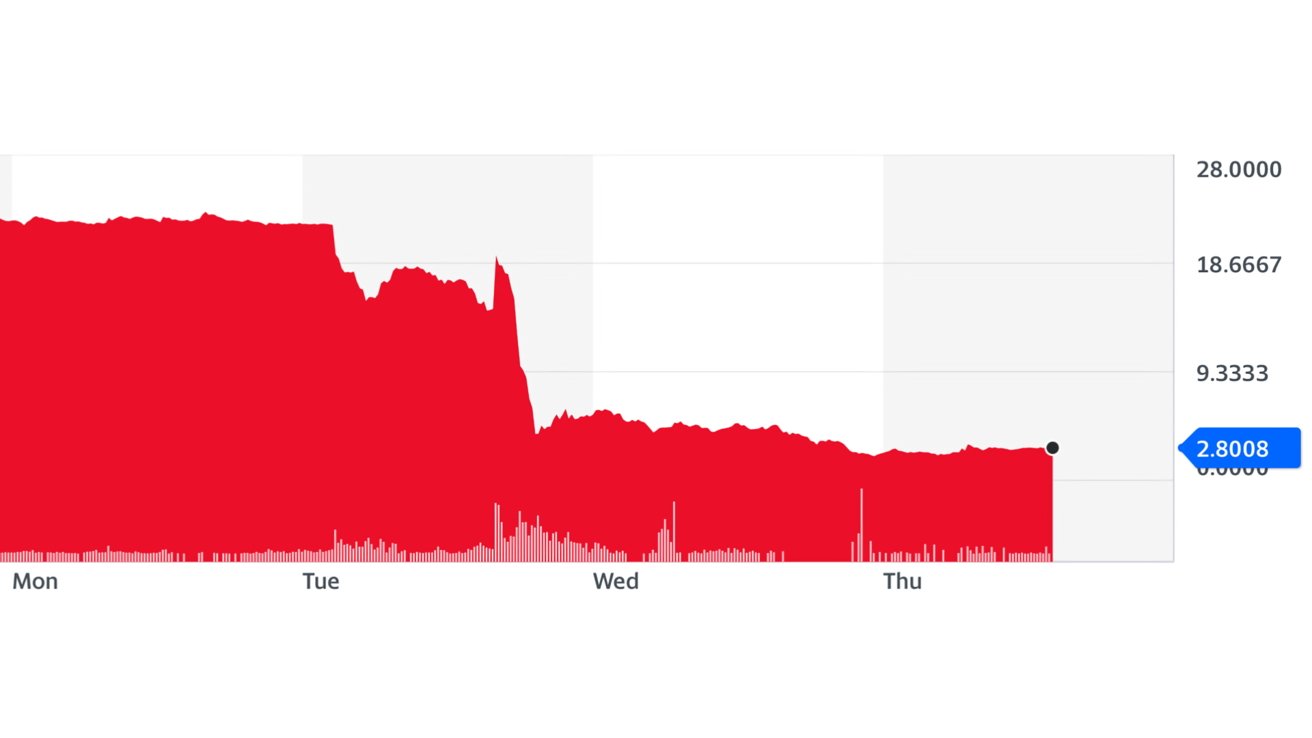

FTT value in USD (Source: Yahoo Finance)

The story behind this collapse is a convoluted one, and can be traced back to a failed crypto lender Voyager Digital. The lender borrowed $500 million from Alameda Research, then filed for bankruptcy.

Alameda Research, Bankman-Fried's trading firm, paid $1.4 billion for Voyager Digital's assets in a September auction. This failed loan and subsequent collapse cost Alameda a lot of money, so much that it was in danger itself.

Worse, Alameda had most of its $15 billion in assets tied up in the FTT coin owned by FTX. Bankman-Fried attempted to prop up Alameda with $4 billion in FTX funds that included customer deposits.

These revelations forced Binance to sell off its $580 million in FTT coin, driving its value down. The subsequent selloff from other FTT owners drove the coin down further, leaving FTX floundering.

FTT lost 80% of its value early in the week, dropping to about $2.80 as of Thursday. Other cryptocurrencies have also dropped in value amid the turmoil, with even Bitcoin suffering a 13% drop Tuesday and then a 15% drop Wednesday.

These drops in value are what led FTX to the threat of a liquidity crunch. It is so bad, Bankman-Fried reached out to his bitter rivals at Binance to ask for a buyout.

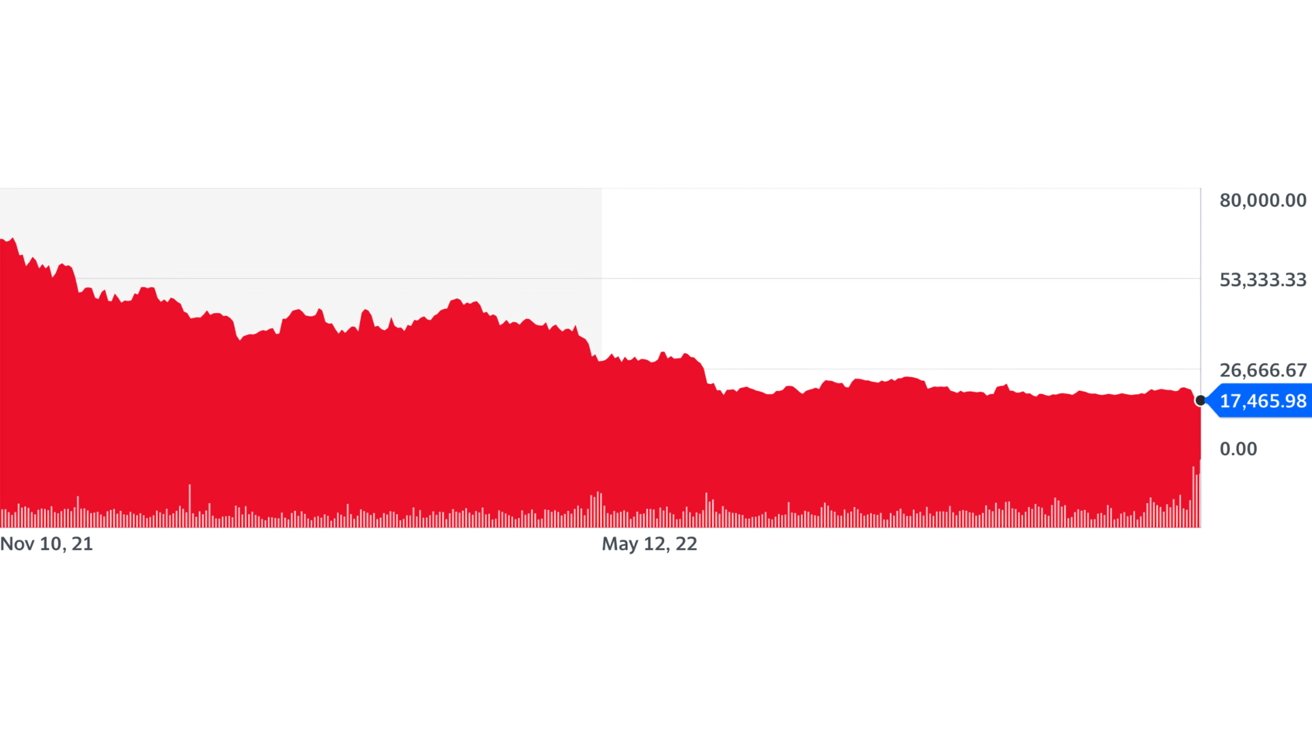

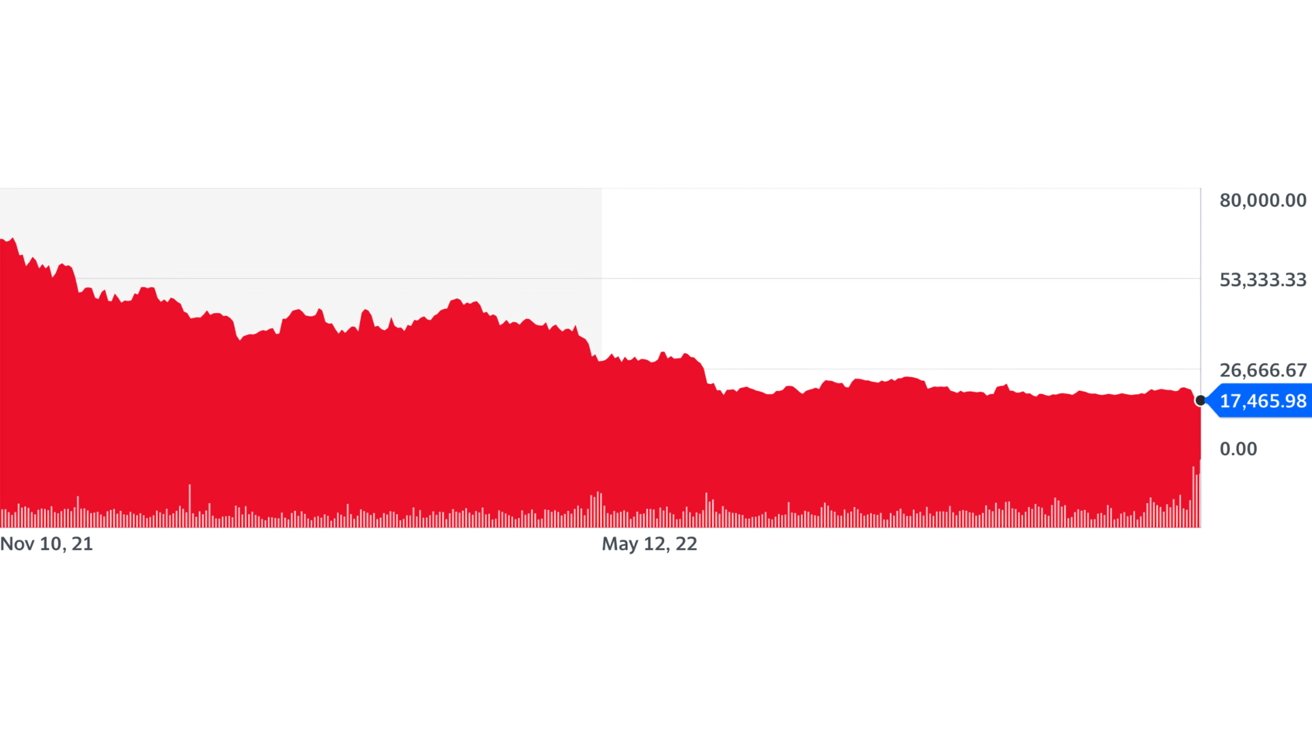

Bitcoin lost over 2/3 of its value in the last year (Source: Yahoo Finance)

As previously stated, the buyout was initially promised then withdrawn. Binance saw too much risk in FTX and faced regulatory action if the acquisition went through.

The cryptocurrency market has shrunk by 2/3 in the past year, and signs show that the shrink isn't slowing. Crypto was booming during the pandemic as uncertainty in fiat currency increased, though that uncertainty is now placed on crypto.

These events have led to panic among cryptocurrency traders. Big investors pulling out hurt smaller players, leading to calls for government regulation or federal bailouts -- both of which are unlikely and fly in the face of the entire concept of cryptocurrency.

Read on AppleInsider

FTX spirals as people pull assets out from the exchange

Confidence in the FTX crypto exchange collapsed as crypto traders pulled their assets out in droves. It left FTX flailing as the value of multiple major coins, including Bitcoin, dropped to their lowest in years.

According to a report from Reuters, a heated rival to FTX, Binance, was set to buy FTX and all its assets to help prevent this liquidation from driving crypto into the ground. However, regulatory threats and the accelerated liquidation of FTX forced Binance to back out at the last minute.

"As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged U.S. agency investigations, we have decided that we will not pursue the potential acquisition of FTX.com," Binance said in a statement on Wednesday.

FTX is now left to fend for itself with the founder, Sam Bankman-Fried, out of options. Individuals who tied up their assets with FTX and the FTT coin -- and the rest of the world's crypto holders -- are suffering major losses after the big players pulled out early.

FTT value in USD (Source: Yahoo Finance)

The story behind this collapse is a convoluted one, and can be traced back to a failed crypto lender Voyager Digital. The lender borrowed $500 million from Alameda Research, then filed for bankruptcy.

Alameda Research, Bankman-Fried's trading firm, paid $1.4 billion for Voyager Digital's assets in a September auction. This failed loan and subsequent collapse cost Alameda a lot of money, so much that it was in danger itself.

Worse, Alameda had most of its $15 billion in assets tied up in the FTT coin owned by FTX. Bankman-Fried attempted to prop up Alameda with $4 billion in FTX funds that included customer deposits.

These revelations forced Binance to sell off its $580 million in FTT coin, driving its value down. The subsequent selloff from other FTT owners drove the coin down further, leaving FTX floundering.

FTT lost 80% of its value early in the week, dropping to about $2.80 as of Thursday. Other cryptocurrencies have also dropped in value amid the turmoil, with even Bitcoin suffering a 13% drop Tuesday and then a 15% drop Wednesday.

These drops in value are what led FTX to the threat of a liquidity crunch. It is so bad, Bankman-Fried reached out to his bitter rivals at Binance to ask for a buyout.

Bitcoin lost over 2/3 of its value in the last year (Source: Yahoo Finance)

As previously stated, the buyout was initially promised then withdrawn. Binance saw too much risk in FTX and faced regulatory action if the acquisition went through.

The cryptocurrency market has shrunk by 2/3 in the past year, and signs show that the shrink isn't slowing. Crypto was booming during the pandemic as uncertainty in fiat currency increased, though that uncertainty is now placed on crypto.

These events have led to panic among cryptocurrency traders. Big investors pulling out hurt smaller players, leading to calls for government regulation or federal bailouts -- both of which are unlikely and fly in the face of the entire concept of cryptocurrency.

Read on AppleInsider

Comments

And it looks like they just ran out of suckers.

Well that strategy didn't work

SBF, as he is nicknamed in the crypto industry, has, through his firm FTX Ventures, embarked on an acquisition spree and bailouts of struggling crypto firms to avoid a collapse of the sector.

https://www.thestreet.com/investing/cryptocurrency/crypto-billionaire-bankman-fried-loses-entire-fortune-in-one-day

Guess what? Nothing has changed in the 21st century. End of story.

Cryptocurrency is not a scheme, not a fad. But often it's run by greedy, get-rich-quick-minded folks that aren't looking at the long-term plan. It's a very volatile type of currency, so as long as you invest with that in mind, it can be very lucrative. In other words, don't put all of your eggs into one basket.

--- but to scam young adults, looking to bond with their era, out of their money is not nice.

We know that cryptocurrencies aren't currencies for a number of reasons. For one, at least in the U.S., buying things with crypto creates potentially taxable events. You aren't really buying things with crypto, you're trading crypto for things. Every time you do that you potentially create a capital gain or a capital loss depending on whether the value of the crypto has gone up or down since you first acquired it. For another, we don't think of swings in the trading value (or supposed buying power) of crypto as inflation or deflation, we think of it as gains or losses. For another, we'd never accept such wild fluctuations in the value of a currency. The primary point of a currency is as a stable and reliably recognizable store of value.

The clearest way that we know crypto isn't currency is that we think of its value almost exclusively in terms of actual currencies, and not just in FX contexts. If you ask what 1 Bitcoin is worth, the answer is most often going to come in terms of dollars (or some other currency). We don't first think of a bitcoin as being worth one Tesla or one bottle of soda or the value of an hour of labor. If you ask what 1 Dollar is worth, the answer isn't likely to come in terms of bitcoin or any other currency unless the context of the question is with regard to the relative values of particular currencies. The value of 1 Dollar is rather vague, it's generally conceived of based on what we could buy with it and/or what it would take to earn it. It's a store of general, not definitively defined (other than by specific contexts), value. Put another way, a currency is the way we measure the value of other things. The value of 1 Dollar is 1 Dollar. The value of 1 Bitcoin is, currently, something like 17,000 Dollars.

That said, the value of crypto assets is derived from the belief (or hope) that at some point in the future they will become actual currencies. And their value is based on other people's beliefs regarding the likelihood that that will happen. How likely is it that a given crypto asset will eventually become an actual currency and, at its current valuation, would it then be under supplied or over supplied? So, if one is interested in investing in crypto, they should be thinking about the possible paths by which given cryptos might become actual currencies. Is there any way they can? Importantly, is there any chance (the major) governments around the world will allow them to become actual currencies rather than just the speculative assets which they currently are allowed to exist as?

If you can see the path whereby they might become actual currencies, then maybe they have some long-term value. If you can't see such a path (or think it sufficiently unlikely), then the only thing left supporting their value is that some others don't yet recognize what you do. To the extent that's the case, investing in crypto is just a dicey game of trying to figure out (or recognize) when you would (or did) transition from being one of the people taking advantage of the suckers to being one of the suckers.

I'm not suggesting that investing in crypto is a bad idea. I am, however, suggesting that if crypto investors aren't thinking about crypto in the way I just described, then they don't understand the fundamentals of the game they're playing and, as a consequence, the likelihood of them winning at that game is reduced.