Apple Savings is expected to finally launch on April 17

The code for Apple's high-yield Savings account is live on the server's backend, and new examination of the code suggests that the launch will happen in the next few days.

Apple Savings may launch soon

Earlier on Thursday, Twitter user @aaronp613 discovered that the Apple Savings account backend is now active. It suggests Apple is finalizing the necessary steps to make the service available.

Aaron reexamined the code in a separate tweet and found a possible launch date for Monday, April 17. The code also suggests the Savings account will require iOS 16.3 or later to use the feature.

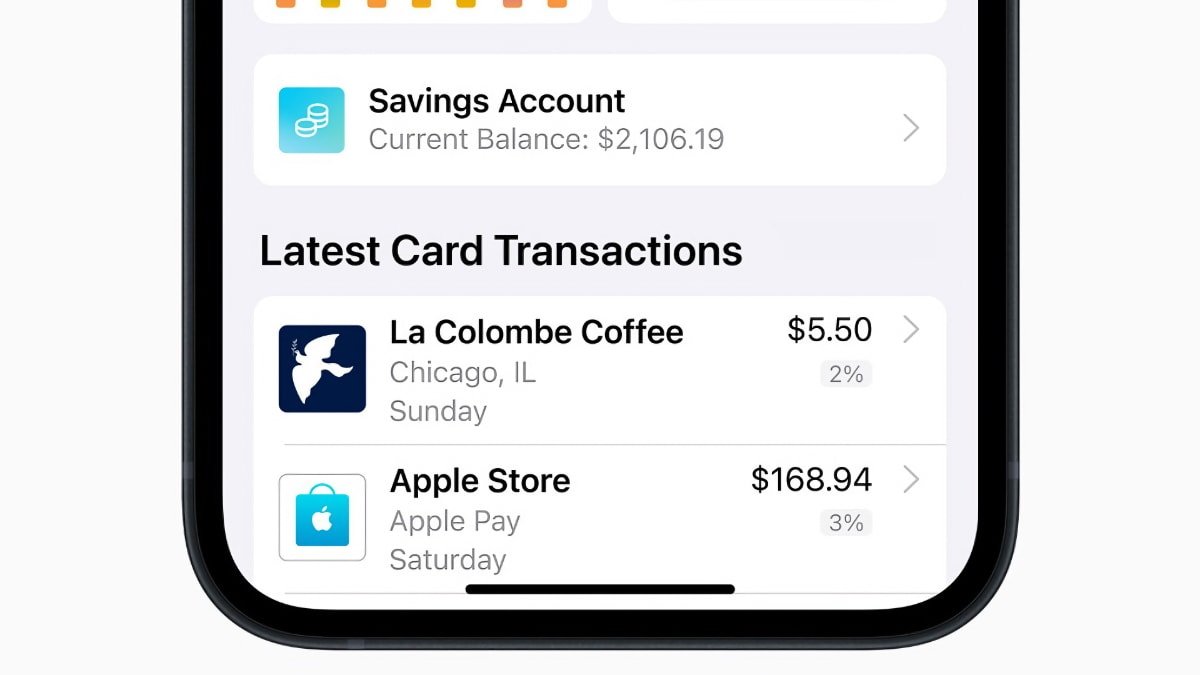

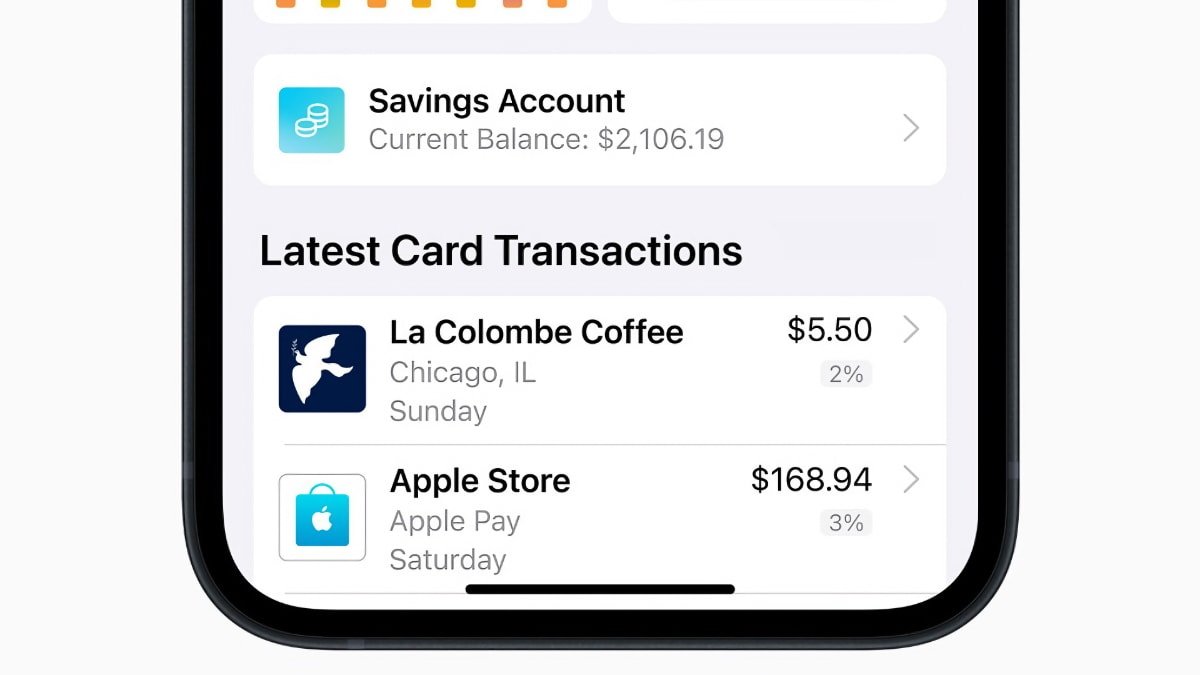

Customers can transfer their Daily Cash rewards from their Apple Card to their high-yield account in Apple Wallet when available. Goldman Sachs will provide the Savings account, just like the Apple Card.

In October, Apple revealed the savings account and promised it would be accessible soon. The function was mentioned in the release candidate notes for iOS 16.1, but it was not included in the final release.

Read on AppleInsider

Apple Savings may launch soon

Earlier on Thursday, Twitter user @aaronp613 discovered that the Apple Savings account backend is now active. It suggests Apple is finalizing the necessary steps to make the service available.

Aaron reexamined the code in a separate tweet and found a possible launch date for Monday, April 17. The code also suggests the Savings account will require iOS 16.3 or later to use the feature.

After re-examining the backend code, it seems like Apple Card Savings Accounts may go live on April 17

Additionally, it seems like the customized Chinese Apple Pay transit cards may go live on April 18 https://t.co/ljJxjqaIFy-- Aaron (@aaronp613)

Customers can transfer their Daily Cash rewards from their Apple Card to their high-yield account in Apple Wallet when available. Goldman Sachs will provide the Savings account, just like the Apple Card.

In October, Apple revealed the savings account and promised it would be accessible soon. The function was mentioned in the release candidate notes for iOS 16.1, but it was not included in the final release.

Read on AppleInsider

Comments

The problem is the bank conglomerates. They hate giving up a (tiny) portion of THEIR fee to give to Apple, and Apple isn’t budging on not charging the consumer for this.

Australia tried this and failed, and now Apple Card is huge there, as it is in the US. So if you’re in a country where you don’t have access to the Apple Card, now you know why.

I think you're confusing Apple Card and Apple Pay. Apple Pay is already available in the UK, Canada and EU.

I'm not sure I have any stocks with a yield lower than some high-yield savings accounts (HYSA), but I wouldn't sell it anyway as I'd be taxed on the gains from that sale. Any extra funds, including the gains from dividends can now go into a HYSA.

What HYSA are you seeing with MS? All I see is their crappy one

https://www.morganstanley.com/wealth-general/savingsratemonitor

It looks like you have to go with a CD to get higher than 4% from MS.

https://www.morganstanley.com/what-we-do/wealth-management/cd-savings

If you think it may not be possible then how would you get cash into your GS Apple Savings account?

My reading of that is that you can transfer directly in or out of a linked account and do not need to go through Apple Cash.

You can read the press release here.