Trump vs. China: How the tariff war has hit Apple so far

The battle between President Donald Trump and China over import tariffs has impacted Apple, and will hit consumer wallets soon. Here's everything you need to know about it, current through June 4, 2025.

Apple's stock has been hit hard by the Trump tariff battle with China

President Donald Trump's first presidency was known for many things, but one of the biggest events in it was the U.S.-China trade war. The financial event saw the U.S. apply high tariffs against Chinese imports, impacting the cost of produce entering the country.

The incident caused issues for many businesses, but Apple managed to steer clear of the effects. This was chiefly down to the positive relationship CEO Tim Cook had with Donald Trump at the time.

With Trump now in a second term in office, import tariffs have become an issue once again. This time, it's a bigger problem that's affecting markets around the world.

And, it will soon impact consumer prices as exporting countries don't pay tariffs -- importing companies do. Those companies typically pass increased costs for any reason to the consumer, and tariffs certainly count as increased costs.

While it escaped being hit last time, Apple has been caught up by the tariff battle, and not just by hits to its share price. As the tariff battle shifts to beyond tariff hikes, Apple faces even more financial challenges on the horizon.

This is what has happened in the Trump tariff fight so far, as of June 4, 2025.

November 11, 2024: Trump's tariffs could raise prices

Ahead of Trump's second term, the President-Elect was extremely keen to apply tariffs on imports on goods around the world. The goal was part of a continued push to bring manufacturing to the United States, instead of relying on foreign production.

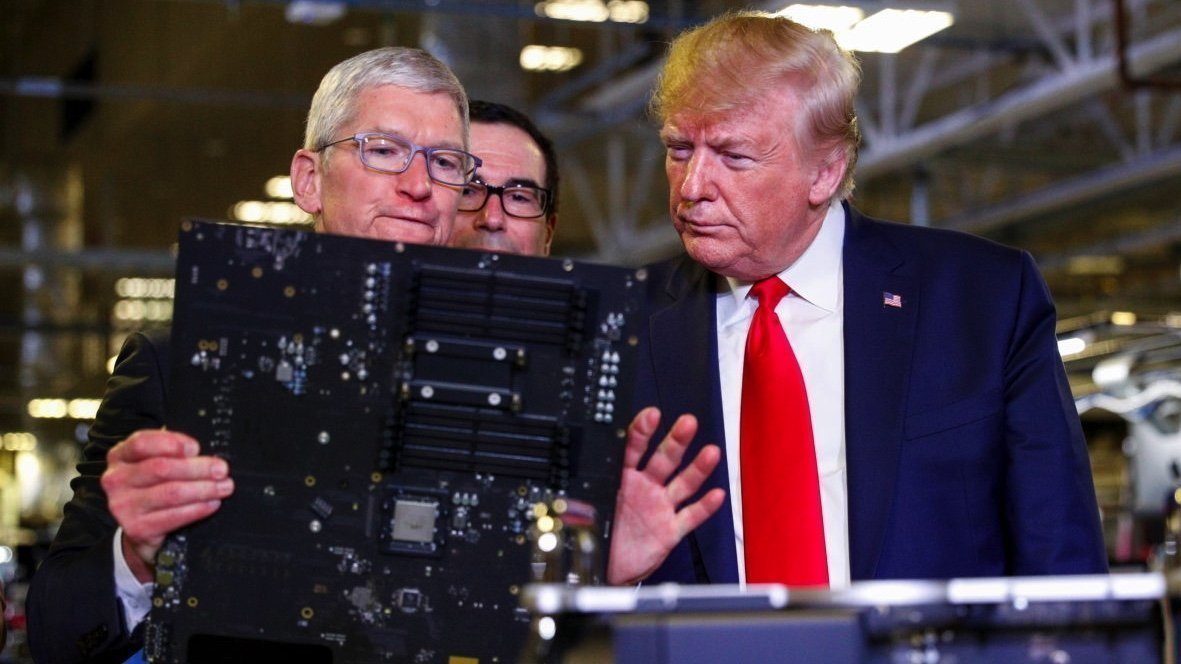

Tim Cook and Donald Trump in a meeting at the White House in 2018

In a 22-page report, the Consumer Technology Association explained how the tariffs could impact the world. While most countries would get 10% or 20% tariff bands, China was expected to get a 60% tariff.

The report warned that there would be "unintended consequences," including a deteriorated reputation for the U.S., a downgraded credit rating, and more trade restrictions.

However, Apple was in a somewhat stronger position than last time, as it had set up some bases of manufacturing outside of China. With supply chain sections in India and other countries, it was thought Apple could produce iPhones destined for the U.S. there and deal with a lower tariff, leaving China-produced iPhones for the rest of the world.

January 27, 2025: Trump's chip tariff threat takes aim at Apple's TSMC partnership

In a speech at an Issues conference at the Trump National Doral Resort in Miami, Florida, Trump talked at length about tariffs. Aside from tariffs on vehicles imported from Mexico, Trump added that there would be others placed on foreign-produced computer chips and semiconductors.

Reiterating a need to return production to the United States, Trump mentioned Taiwan's holding of about 90% of the chip business, in reference to Apple chip partner TSMC.

Believing TSMC already has billions and doesn't need financial incentives like the Chips Act, Trump instead offered that not having to pay tax was incentive enough.

"They will build a factory with their own money," Trump insisted. "They will come in because it's good for them."

February 5, 2025: China threatens App Store probe in trade tensions retaliations

With the prospect of tariffs on the horizon, China was reportedly considering an antitrust investigation into Apple's App Store.

Part of potential retaliatory measures, a report claimed that the App Store's fees and practices could be targeted by the investigation. China's State Administration for Market Regulation would perform the probe into Apple's policies and its 30% commission on purchases, as well as third-party payments and app storefronts.

On May 2024, China had concluded a previous investigation into the App Store, and deemed that Apple did not abuse its market position.

February 20, 2025: Cook meets with Trump at the White House

Apple CEO Tim Cook met with Trump on February 20, in a visit that probably discussed the import tariff situation and U.S. manufacturing.

FOX Business Cameras caught Apple CEO Tim Cook on asking into the White House about 10 minutes ago. #Apple #WhiteHouse pic.twitter.com/CONgQhI3bG

-- Edward Lawrence (@EdwardLawrence)

Spotted on his way into the White House for a little after 10 AM Eastern Time, he left about 45 minutes later. Though details of the meeting were not disclosed at the time, Cook insisted he had a "great meeting" with the President.

February 20, 2025: iPhone prices could rise 10% under Trump tariffs

In a February 20 report, Bank of America analysts estimated that, whatever Apple does to spread manufacturing outside of China, it will face a minimum 10% tariff.

Apple could feasibly absorb the cost in the short term, which would cost Apple a loss of 26 cents in earnings per share. The equivalent of a 3% drop across the 2026 calendar year.

Rising prices by 3% to partially offset costs would mean a 2.4% slide and a per-share earnings drop of 21 cents. If Apple passed the increased cost onto buyers and sales decrease in tandem, BoA forecasted Apple would have to raise prices by 9%.

March 14, 2025: Foxconn chief predicts U.S. manufacturing surge

Commenting on the threat of tariffs, Apple assembly partner Foxconn CEO Young Liu confirmed the subject was an issue for its clients in March. The attitude and approach from the U.S. on tariffs made predictions for the following year harder to make, he added.

Foxconn is an Apple supply chain member, but mostly operates in China. - Image Credit: Foxconn

Liu warned that geopolitics and tariffs will introduce challenges to manufacturers, which could include a drop in demand.

Answering a question from an investment firm, Liu said that multiple clients were working with Foxconn on plans in the U.S. They were, however, just talks, and Apple wasn't directly mentioned either.

April 2, 2025: Liberation Day

Styled by Trump as "Liberation Day," the President laid out tariffs against almost every country. The "reciprocal tariffs" on imports would range from 10% to 49%, with the figure varying by country.

The Administration claimed the figures were determined by cutting the existing tariffs on the U.S. from the countries, and applying them back at half the rate. Instead, the figures were seemingly generated by dividing the trade deficit by imports to determine the "tariffs on America."

That percentage is halved to create the reciprocal tariffs.

-xl-xl.jpg)

Donald Trump started the Tariff War with China.

Not missing a branding opportunity, Trump called the Rose Garden event "Make America Wealthy Again."

For Apple, the big issue is China, which had an import tariff of 34%. With 80% of Apple's production capacity and 90% of iPhones made there, it could hurt Apple heavily.

India had a tariff applied to it of 26%, but Vietnam was hit with a 46% tariff. At least with India's low tariff, it appeared that Apple could import U.S. iPhones from that country to minimize costs.

April 4, 2025: Apple stock bloodbath continues after China applies retaliatory tariffs

Not to leave the U.S. tariff announcement unanswered, China announced its own tariffs on the United States. As the U.S. levied a total of 54% in tariffs on China, including the new 34% reciprocal version, China applied a 34% tariff on U.S. imports into China.

Trump insisted that China "panicked" and that it was the "one thing they cannot afford to do" on Truth Social. While golfing, Trump told reporters that it was like operating on a patient, and that the U.S. is "going to boom."

Meanwhile, the stock market didn't take the announcement in its stride. As of noon on April 4, AAPL was trading at $195.63, down from the high of $225.19 before the announcement.

April 4, 2025: iPhone 17 Pro predicted to cost over $2,000

For consumers, the tariff was believed to hit the iPhone price very hard. Rosenblatt Securities forecasted on April 4 that there would be massive price rises on Apple's products. A 43% iPhone price rise would increase the base model iPhone 16 to over $1,140, while the 1TB iPhone 16 Pro Max would go up to almost $2,300.

Other analysts were a little more level-headed, such as Counterpoint Research's 30% increase forecast, and CFRA Research's 10% figure for the moment but higher levels for the iPhone 17.

Rosenblatt added that the cost will largely come down to where the iPhone is made, due to lower tariffs for India versus China. Ultimately, the tariffs as imposed could've cost Apple up to $40 billion, though according to Morgan Stanley, it would be more in the range of $33 billion.

April 7, 2025: Customers panic-buy iPhones under threat of price rises, while Apple increases its stockpile

The possibility of Apple handing down the cost of high import tariffs to consumers apparently scared some on-the-fence iPhone buyers into pulling the trigger. An April 7 report insisted that U.S. Apple Stores were as busy as they were during holiday seasons.

Higher sales were experienced over the weekend, as consumers expected major price increases. Employees were often asked about increases in iPhone pricing, but they had not been given any corporate guidance on the subject.

To try and counter the tariffs before they're implemented, Apple reportedly spent some days in the last week of March shipping more products to the United States. Over three days, five flights were used to transport Apple products from China and India to the United States.

As for the U.S. warehouses, they apparently had enough stock for several months anyway.

April 7, 2025: Apple stocks plummet under 104% tariff threat

Following China's rebuttal of a 34% tariff on U.S. imports into the country, Donald Trump fought back. After applying an additional 50% on top of the existing 34% reciprocal tariff, he threatened on April 7 to increase the tariff to 104% on Chinese imports.

In effect, this would double the cost of every component or device it imports from China.

AAPL stock changes over the month before the tariff war heated up

By midday, AAPL was down another 5.3% as part of another volatile trading day. By the end of trading, Apple's stock ended at $181.46, down $6.92 from the previous Friday's close.

It was a situation felt elsewhere in the stockmarket too. The S&P 500 briefly entered a bear market status, while U.S. stocks in general dropped about 20%.

April 9, 2025: Apple braces for another share battering as China, EU fight back

After Tuesday's heavy day on the markets and Trump's new tariff, Apple had to deal with further escalations. From China, the 34% tariff on U.S. imports became 50% higher, at 84% on April 9.

It was expected that China's move would inevitably get another response from Trump.

However, the European Union also stepped in with its own retaliatory tariffs. Referring to the U.S. tariffs as "unjustified and damaging," the EU said it will be applying its own from April 15 in a first grouping, with second from May 15.

The level of the EU tariffs were not disclosed at the time. However, the EU signaled positively that it was open to negotiations.

April 9, 2025: Trump hikes tariff to 125%, pauses others for 90 days

In a bit of mixed news, April 9 saw Trump announce that he would be implementing a 90-day pause on new tariffs against most countries the U.S. deals with. During the period, the reciprocal tariff would go down to 10%.

The pause was apparently to give the Trump Administration time to make deals with more than 75 countries claimed to have attempted to negotiate with the U.S. over tariffs.

The big exception is China. Instead, the tariffs against China were jacked up to 125% due to the country's "lack of respect," Trump claimed.

The announcement was a positive thing for Apple, despite the China tariff change. Shortly after, the Dow surged 2,000 points, and Apple's stock bumped up 11.28%.

April 9, 2025: An AAPL recovery of sorts

For April 9, Apple saw its stock go from the previous day's close of $172.87 to around $169 in pre-market trading, then started the day at $172.18.

Amid a longer period where it was battered, AAPL did occasionally recover.

While markets braced for more turmoil, the stock level started to hover around $178 before Trump's 90-day pause announcement. Immediately after, the Nasdaq jumped 7% and the Dow surged 2,000 points again.

Apple closed at $198.85, up 15.3% on the previous day's closing. At the same time, its market capitalization returned to $2.99 trillion, almost to its former $3 trillion level.

April 9, 2025: Trump blinks, suggests Apple could get some relief

After the markets closed on April 9, Trump made a comment that had the potential to fix Apple's situation. Speaking to the press, Trump suggested that some companies may be considered for an exemption from tariffs.

Companies "hit harder" by tariffs would be considered, but the decision would be based on "instinct," Trump added.

April 10: Apple crumbles as White House clarifies 145% tariff rate

It was good while it lasted

Following April 9th's positive end to trading, the markets continued a downward trajectory, with AAPL's price down to $189.06 in early trading, before shooting back up to $194.78 within an hour.

However, by the end of April 10, Apple's shares were down 4.24% from the start of the day at $190.42. Its lowest point was at midday with $183.

Part of the problem was the tariff level against China. While Trump declared a 125% tariff, it turned out to be 145% in total.

Investors were also concerned about the 90-day pause, with fears that Trump's continued attacks on China would potentially slow down economic activity anyway.

April 11, 2025: China strikes back with 125%

On April 11, China continued the tit-for-tat tariffs with the U.S., increasing the tariffs on all U.S. goods by another 41%. This made the total tariff against U.S. goods 125%.

However, China also said it had no interest in raising tariffs again. Instead, if the U.S. continued, the Ministry of Commerce said it would enact its own countermeasures.

China didn't say what these countermeasures would be at the time, but limiting the transportation of goods would be one effective method at its disposal.

China insisted it was open for negotiation, but threats and pressure weren't the right way to deal with the country. Trump, meanwhile, claims he's waiting for a call from Beijing.

April 11, 2025: Apple stock rebounds again

Following the return to a slump on April 10, Apple saw premarket movements going downward to $186.10 on April 11. On opening, it rapidly climbed to $199.54 and ended the session at $198.15.

Elsewhere, the markets saw gains, including the Dow going up 619 points.

White House press secretary Karoline Leavitt said Trump was "optimistic" that the U.S. and China could strike a tariff deal, and that he was "open to a deal with China."

April 11, 2025: Trump gives Apple a giant break with wide-ranging tariff exemptions

In a surprise announcement extremely late on April 11, President Trump issued exemptions on reciprocal tariffs, affecting smartphones, computers, and chips.

Donald Trump with Tim Cook at a Mac Prio factory during his first presidential term

The move effectively spared Apple and other tech companies from potentially billions in import fees. It applies across almost al of Apple's product line, though accessories like leather goods and Apple Watch bands didn't get a reprieve and would face tariffs.

April 13, 2025: iPhone & Mac tariff reprieve only temporary

Clarifications were made on April 13 over Trump's tariff reprieve. The exemptions would only be temporary, as other tariffs are on the way.

Commerce Secretary Howard Lutnick explained that a future "semiconductor tariff" would be applied instead. As for when that would be, Lutnick said "in a month or two."

The aim of the tariff was to try and encourage component makers to set up facilities in the United States. Lutnick insisted that the U.S. shouldn't be reliant on Southeast Asia for its electronics.

The level of the inbound semiconductor tariff was not advised at the time.

April 14, 2025: China escalates US tariff war by halting rare earth mineral exports

China kept its word that its response to the U.S. tariffs would not be more tariffs on its side. Instead, it's going to make it harder to produce hardware.

In an April 14 report, it was confirmed China placed a series of rare earth minerals and magnets on an export control list since April 4. The move requires an application to the Ministry of Commerce for a license to export a list of seven rare earth minerals out of the country.

The minerals and magnets are chiefly used in the production of components in a few industries, including energy, automotive, defense, and tech products.

The problem for manufacturers like Apple is that the opaque process can take a lot of time to complete, with estimates being between six weeks and a few months before a license is granted.

In the meantime, manufacturers in supply chains around the world that rely on those minerals will have to manage with whatever stockpiles they have at the moment.

As China occupies around 90% of the market for the minerals, that leaves only a very small number of other sources for the manufacturing materials, which could lead to intense competition to secure supplies.

April 14, 2025: Trump confirms he reduced tariffs to help Tim Cook

Speaking to reporters while officially meeting with El Salvadoran President Nayib Bukele, President Donald Trump effectively admitted that he changed the tariffs after speaking to Tim Cook.

Telling reporters he was flexible on April 14, Trump likened the China tariff battle to a wall, and that "sometimes you have to go around it, under it, or above it." He then uttered "There'll be maybe things coming up... I speak to Tim Cook."

"I helped Tim Cook recently," Trump said more definitively. "And that whole business. I don't want to hurt anybody."

April 15, 2025: US launches semiconductor probe to explain away tariff exemptions

Following the confirmation that semiconductor tariffs will be on the way and a separate tariff "bucket" than the headline one against China, the White House decided to try and justify the exemptions and inbound tariff changes.

In a document in the Federal Register readable on April 15 ahead of its official April 16 publication, the White House claimed the Secretary of Commerce initiated an investigation under section 232 of the Trade Expansion Act to "determine the effects on national security of imports of semiconductors, semiconductor manufacturing equipment, and their derivative products."

It is unclear why the investigation apparently started on April 1 but was announced on April 15, and not officially enacted until April 16. There's also the oddity of the investigation starting long before the introduction of "reciprocal tariffs" and it only being announced after Apple benefited from the semiconductor exemption.

April 17, 2025: A call from Tim Cook helped convince Trump to introduce tariff exemptions

A report claimed that Tim Cook played a part in the tariff changes becoming a reality. This was during a call to Commerce Secretary Howard Lutnick earlier in April about the potential impact of tariffs on iPhone prices.

There was also a decision by Cook to avoid publicly discussing or criticizing Trump and his policies. This was despite other executives taking to television to denounce the tariffs.

There apparently wasn't a complete agreement on the issue within the White House. Aide Peter Navarro allegedly wanted the tariffs to stay as they were without any electronics carveout.

April 18, 2025: EU puts Apple fine on hold while US trade talks continue

The European Union reportedly postponed fining Apple and Meta over alleged Digital Markets Act violations, specifically so the decision would not affect trade negotiations. The April 18 report said that the European Commission disclosed to at least one of the companies that a fine would've happened on April 15, but the EU postponed them.

This was at a time when EU trade commissioner Maros Sefcovic, and separately Italy's Prime Minister Giorgia Meloni, met with Trump.

April 21, 2025: Trade war escalations between Trump and China to significantly impact Apple

In an April 21 report, China had responded to the most recent Trump tariff rises, by reiterating it will "take reciprocal countermeasures" if any party reaches a deal at the expense of China's interests.

While China seemingly wanted discussions to take place, and that Trump had claimed to be in discussions with the country, none had allegedly taken place at the time.

Analyst Ming-Chi Kuo spelled out the severe risks to Apple, including how countries could impose their own tariffs on components sent to them from China. However, if only the U.S. imposes high tariffs, the risks to Apple "are manageable."

April 23, 2025: Senator Warren asks if Apple CEO Tim Cook's Trump playbook is blatant corruption

Cook's relationship and discussion with Trump staff over the tariffs caught the attention of Senator Warren on April 23, who asked whether lines were crossed at all.

Warren listed Cook's dealings with Trump in a letter, and suggested they created "the appearance of impropriety." She asked for Cook to respond with information about "your attempts to influence Trump Administration officials."

The letter on its own did nothing except bring light to the actions of big tech to win favor with the Trump administration. It also didn't require Apple or Cook respond to the senator about it either.

April 23, 2025: Apple EU anti-competition fine is a relatively modest $570 million to avoid Trump retaliation

While the European Union finally fined Apple for what it claims is non-compliance with its Digital Markets Act on April 23, the sum involved was kept low to avoid increasing EU/US trade tensions.

Apple's fine of $570 million was much higher than Meta's $227 million fine. The EU claimed APple had failed to comply with an obligation to allow developers in the App Store to freely inform customers of alternative offers.

Apple said it would appeal, and also accused the EU of discriminating against it, and of requiring it to give its technology to rivals for free.

April 24, 2025: Uncertainty returns for Apple as Trump tariff pause halved for countries not making a deal

On April 24, President Trump said the 90-day pause would end sooner for select entities, specifically any countries and companies not actively trying to reach a deal, or those unable to accept offered terms of a deal, would get tariffs set for them.

This became an issue for Apple, once again, because while it had exemptions against tariffs on China imports to the U.S., it has production in other countries. Those non-China manufacturing efforts had a greater risk of being stung by the changes.

April 24, 2025: Apple's India supply chain expansion held back by Chinese tensions

Apple's attempts to shift its manufacturing into other bases has been problematic at times, thanks to tensions between China and India. As well as China's intention to hold on to Apple's supply chain as much as possible.

In a report outlining the difficulties Apple has faced published on April 24, this included the Indian government blocking Chinese suppliers from investing in India. Issues with employment law in India also meant Apple's supply chain partners couldn't use teams of employees in the same way.

On the China side, the unwillingness to comply with shifting manufacturing changes included making it hard for suppliers to secure work visas for employees, as well as preventing machinery from entering India from China. Authorities in China have also spoken to Apple's supply chain partners, to try and encourage them from shifting lines and risking damage to local employment prospects.

April 28, 2025: Apple revenue could actually benefit from China tariff war

In pre-Q2 results notes, analysts all offered a similar view when it came to shipments. Investor notes included forecasts that demand for Apple products would be higher than expected.

A so-called "pull-forward" of demand refers to consumers buying products earlier than originally intended, to avoid the prospect of higher tariff-driven prices. This wasn't just with consumers, as retailers apparently did the same thing.

April 29, 2025: Apple supplier Pegatron says tariffs will mean third world-style shortages for US

The chairman of Pegatron, T.H. Tung, warned that the tariffs could cause big problems in the United States. Reports on April 29, 2025 had the chairman declaring doom and gloom.

"Within two months, shelves in the United States... might resemble those in third-world countries, where people visit department stores and markets only to find empty shelves, all because everyone is waiting and seeing," Tung said.

Pegatron wouldn't increase prices itself, as "Just because Trump raises tariffs doesn't mean the rest of the world will do the same," continued Tung. "We won't immediately adjust our long-term plans just because of two or three months of tariff changes."

"Manufacturing bases require long-term planning," he continued. "Taiwanese contract manufacturers are sticking to their overseas plans."

April 29, 2025: Apple denies it had plans to be clear about consumer tariff costs

On April 29, the White House responded to claims Amazon would display the specific impact of tariffs on everything it sold. The proposal was declared a "hostile and political act by Amazon," according to White House press secretary Karoline Leavitt.

However, Amazon hadn't proposed that at all.

"The team that runs our ultra low cost Amazon Haul store has considered the idea of listing import charges on certain products," an Amazon spokesperson told AppleInsider. "Teams discuss ideas all the time. This was never a consideration for the main Amazon site and nothing has been implemented on any Amazon properties."

April 29, 2025: Arms race: Apple's waiting for robotics for US iPhone assembly, says Commerce Secretary

In an interview, U.S. Commerce Secretary Howard Lutnick was insistent that Apple still wanted to produce iPhones in the United States. All Tim Cook was waiting for was robotic arms.

"Do it at a scale and a precision that I can bring it here, and the day I see that available, it's coming here," Cook reportedly told Lutnick.

April 30, 2025: Two new iPhone factories years in the making open in India

India assembly partner Tata and Foxconn expanded their presence in the country's iPhone manufacturing landscape, by opening two new factories.

The Tata factory was reportedly operational and producing older iPhone models. Foxconn's $2.6B plant was, at the time of reporting, still being set up but was close to open.

May 1, 2025: iPhone panic buying ahead of Trump's tariff implementation was light

Apparently analysts can be wrong, as the AAPL Q2 2025 results seemingly revealed.

In the call with analysts after the results were revealed, Tim Cook commented on whether there was panic-buying from consumers. "We don't believe that there was a significant pull forward due to tariffs into the March quarter," he said. "There's no obvious evidence of it."

Cook did add that there was limited impact from tariffs to to Apple optimizing its supply chain and inventory. But it could not precisely estimate the impact of tariffs for the Q3 figures.

Cook did note that "most of our tariff exposure relates to the ... 20% [rate], which applies to imports to the US for products that have China as their country of origin." He added that the additional China tariffs affected "some of our US AppleCare and accessories businesses and brings the total rate in China for these products to at least 145%."

"However, for some color, assuming the current global tariff rates, policies, and applications do not change for the balance of the quarter and no new tariffs are added," he continued. "We estimate the impact to add $900 million to our costs."

May 1, 2025: Everything but iPhone will ship from Vietnam and India in Q3

According to Apple CEO Tim Cook, in response to an analyst question on the Q2 earnings call, devices delivered to the United States will originate primarily from Vietnam except for iPhones. Half of iPhone shipments will come from India, while the other half will continue to come from China.

As for the rest of the globe, China will be providing inventory. This helps ensure the supply chain keeps moving while minimizing the impact of tariffs in the United States.

May 5, 2025: Apple admits the Q2 surge in imports won't be enough to stop price hikes

While Apple may have mitigated against the tariffs before their full extent was announced, SEC filings uncovered on May 5, 2025 say it was a short-term tactic, and price hikes may be inevitable.

According to a note to investors seen by AppleInsider, Morgan Stanley has calculated from Apple's latest 10-Q filing that Apple's costs were at a three-year March quarter high. The company bases this on Apple's reported balance sheet inventory, and vendor non-trade receivables -- in this case effectively pre-payments to suppliers for goods they are storing before sending to Apple.

Morgan Stanley says the figures imply that Apple had almost $70 billion worth of inventory and components on its books at the end of the quarter. Separately, estimated inventory at both Apple and its contract manufacturers was up 17% year over year.

Morgan Stanley also notes that for the first time ever, Apple's filings include reference to the potential need for it to increase prices.

May 9, 2025: Apple said to use Brazil for lower-tariff iPhones, despite denials

Media in Sao Paolo claimed that Foxconn was expanding in Brazil, despite Apple saying it wasn't increasing production, and wasn't trying to beat US tariffs.

A publication made the claim in April, which Apple responded to by insisting that Brazil iPhone production was for local sales only. In May, the publication effectively repeated the original story.

The point of the Brazil expansion, it claimed, was to export iPhones to the U.S., due to Brazil having a lower reciprocal tariff than China.

May 12, 2025: US and China temporarily lower tariffs to start trade negotiations

The White House and China issued a joint statement, announcing a 90-day reduction in tariffs in a cool-down period to kick off negotiations for a new trade deal.

This involved the start of a 90-day pause in their tariffs. The pause did not entirely remove the recent tariffs, and it did not affect those tariffs introduced by Trump during his first administration, including a 20% one on smartphones.

Instead, the US wpi;d reduce its 145% tariff on most Chinese imports to 30%, starting on May 14, 2025. The 125% Chinese tariffs on US goods would be dropped to 10%, presumed to be at the same time.

May 12, 2025: Apple may raise iPhone 17 prices but not blame tariffs

According to the Wall Street Journal, Apple had been working to get its suppliers to reduce costs. But it had reached the limit of that approach, and now considers raising iPhone prices to be the least worst option to counter tariffs.

Citing two unspecified sources said to be familiar with the supply chain, the publication reported that Apple is wary of blaming tariffs for any price rise. That's because there was a claim in April that Amazon would display the additional costs caused by tariffs.

Consequently, Apple was aware that any acknowledgement of the truth that it is tariffs that are pushing up costs for it and consumers, could endanger its ongoing dealings with Trump.

May 12, 2025: President Trump talked to Apple CEO Tim Cook after China tariff reduction

According to a report on May 12, President Trump said he spoke with Apple CEO Tim Cook on the phone after announcing the changes to the tariffs in China. He didn't share details of the conversation, only that Cook would "even up his numbers."

There's no real way to interpret what that phrase might actually mean. This could mean anything from Apple not losing $900 million in the June quarter, to Apple recouping its $500 billion investment into the U.S.

May 15, 2025: Trump has a problem with Tim Cook, because Foxconn is building factories in India

"I had a little problem with Tim Cook yesterday," Trump said to press on May 15. "I said to him, 'my friend, I treated you very good. You're coming here with $500 billion, but now I hear you're building all over India.' I don't want you building in India."

"I said to Tim, I said, 'Tim look, we treated you really good, we put up with all the plants that you build in China for years, now you got build us," he continued. "We're not interested in you building in India, India can take care of themselves... we want you to build here'."

Trump then told press that Apple would be "upping" its manufacturing in the US, although as ever he gave no details. These latest comments follow a similarly unspecific claim on May 12 where Trump said Tim Cook will "even up his numbers."

May 23, 2025: Trump demands 25% tariff on any iPhone not made in the US

President Trump continued to emphasize that Apple must make the iPhone in the United States, or a steep import tariff will continue to be applied to the company.

In a post to Truth Social, Trump said he expected iPhones to be built in the U.S. If not, he expected a tariff "of at least 25% must be paid by Apple."

In later clarifying statements, Trump insisted that other smartphone producers would also be affected, and any other manufacturer who relies on imports to the U.S.

"When they build their plant here, there's no tariff," said the President. "So, they're going to be building plants there, but I had an understanding with Tim [Cook] that he wouldn't be doing this."

"He said he's going to go to India to build plants." Trump commented that it was "okay to go to India, but you're not going to sell into here without tariffs."

May 23, 2025: It's still cheaper to import iPhones with 25% tariffs, than assemble in the US

Analyst Ming-Chi Kuo said after Trump's announcement that his new 25% tariff on Apple shouldn't make the company move manufacturing to the US, because it's still far cheaper to import.

Kuo didn't go further than the immediate bottom line cost, but chiefly because that issue alone is compelling enough. The cost of U.S. production was speculated to be hundreds of billions of dollars, aside from the initial two TSMC processor factories in Arizona already costing $40 billion.

May 24, 2025: California Attorney General threatens lawsuit over potential 25% iPhone tariff

One day later, the inevitable reaction occurred. California's Attorney General Rob Bonta said he would consider taking the Trump administration to court over the iPhone-targeted announcements.

"The statement about Apple is something that is obviously disappointing," Bonta said in a statement. "It's almost like [Trump] wakes up in the morning and he says, Hey, I think Apple should build more Apple phones, and so maybe I'll tell their CEO that he should do that.' And then maybe tomorrow, he wakes up and he says, Hey, I was just kidding.'"

"We're proud of California companies, and we want to make sure that their rights are not violated, especially by the president of the United States," said Bonta, "which is not something that you would normally have to protect against."

Bonta said his office would be examining the actual tariff policies for evidence of it targeting California companies like Apple before making any decision about possible lawsuits.

May 26, 2025: Trump may have added 25% iPhone tariff specifically to punish Tim Cook

The reasoning for the tariff could have been because Trump was singling out Apple. From May 13 to May 16, Trump was visiting the Middle East and bringing with him representatives of many US companies, but Apple was not in attendance.

Two unnamed sources said that Tim Cook declined Trump's invitation to join the trip, and this is said to have irritated the president. What is certain is that Trump repeatedly referred to Cook's absence during the trip

"I mean, Tim Cook isn't here, but you are," Trump commented to Nvidia CEO Jensen Huang.

It was during the trip when he was in Qatar, that Trump said he "had a little problem with Tim Cook." Then it was following the trip that Trump announced the 25% tariff on iPhones, saying it was because Apple wasn't making the devices in the US.

May 27, 2025: iPhone buyers worldwide may see higher prices because of Trump's tariffs

The 25% tariff is going ahead well in advance of the iPhone 17 launch, and Morgan Stanley concludes that it's in Apple's best interests to pay the tariff instead of moving manufacturing to the US.

The note to investors seen by AppleInsider suggests that there could be a level of tariffs where Apple is forced to reshore to the U.S., which could be around 145%.

At the same time, there is a worry that the current rate could increase iPhone prices by 4% to 6% globally, to offset the U.S. import fee. Raised profit abroad would balance the lower profit in the United States.

May 27, 2025: India leads iPhone exports to the U.S. as trade war reshapes supply chains

Apple hit a major supply chain milestone in April 2025. For the second consecutive month, more iPhones bound for the U.S. were shipped from India than from China. According to data from Canalys, shipments from India surged 76% year over year to an estimated three million units.

Shipments from China, by contrast, fell 76% to about 900,000. While the export milestone is a clear shift in Apple's manufacturing strategy, it comes outside the peak season for Pro iPhone models.

May 28, 2025: White House says Trump doesn't want to harm Apple and iPhone prices won't rise

On May 28, an interview with Trump advisor Kevin Hassett played down the "tiny little tariff" and insisted that consumers won't pay more for iPhones. The confusing interview had Haslslett claim that CEOs came to him to complain, but also that they didn't want their bonds downgraded.

"So the point is that everybody is trying to make it seem like it's a catastrophe if there's a tiny little tariff on them right now," he continued, "to try to negotiate down the tariffs."

May 29, 2025: Trump 'Liberation Day' tariffs blocked by U.S. trade court

The so-called reciprocal tariffs imposed on "Liberation Day" and the trafficking-related tariffs were all ruled an illegal overreach by the President and had been blocked by a U.S. trade court.

The U.S. trade court ruled that President Trump overstepped his authority. While it didn't pass judgment on whether the tariffs would work as intended, the court did say they are not allowed according to federal law.

The ruling provided a permanent injunction against enforcing the tariffs. The Trump administration filed an appeal.

May 30, 2025: Trump tariffs return until June 9 after appeals court stays injunction

Well, that was short-lived. After being ruled illegal, the administration was granted a temporary stay until arguments were filed.

An appeals court stayed the permanent injunction until June 9. That's the deadline for both parties to file arguments about the case, and the courts will then decide if a longer stay is in order during the appeal.

June 4, 2025: Trump trade war delays Apple Intelligence's debut in China

Apple's eventual rollout of Apple Intelligence in China hit delays, thanks to regulatory issues raised in response to President Trump's tariffs.

According to a report on June 4, applications from Apple and Alibaba to release the AI features did not gain the approval of the Cyberspace Administration of China. The regulatory rubber stamp is required in China by law, which prevents Apple from adding them to iOS.

Two sources of the report saidthat the blockage was due to the increasing tensions between China and the United States. By this, the main reason was seemingly the trade war and tariff activity instigated by the current administration of President Donald Trump.

While the regulator won't publicly confirm it's a move against the tariffs, it's an action that fits into the ongoing actions of China in response to the international political activity.

Read on AppleInsider

Comments

After all, it is tragic that this guy is doing his best to destroy one of the best company in the world, and it is a disaster that he even dosn't get it of what he is doing.

Trump will get his wish to go down in history. One of the most impactful humans ever.

It was a rhetorical question, because randominternetperson's post did left some room for doubt ;-)

I was just looking for conformation of what I thought.

Even if you agree with the end goals, the communications and execution of this tariff effort has been a complete sh*tshow. The Admin better start signing great trade deals fast (eg. IndIa, Taiwan, Japan, etc...) to re-gain momentum or this is going to a disaster.

And, Tim Cook bears major responsibility for backing Apple into a Chinese corner. Why has he not at least tried to bring more manufacturing to the US? Either final assembly using state of the art automation, or pushing harder for parts vendors to do more manufacturing here? The writing has been on the wall for 10+ years . Your sitting on $150 billion in cash for fuckin* sake

As for Tim's direction of Apple... none of this is happening in isolation. For efficiency of manufacture, you want all the components to be manufactured within a reasonable geographic distance of your assembly point (otherwise you're holding excess inventory to reduce the risks and costs of shipment) - this means that any labour cost differential is magnified across all of the components and subcomponents that go into the final product. Even if wages in the US were "only" double those in China, that's a big impact: market forces are such that actively seeking to pay more than double the cost for the same product will see any management team suffer dire consequences. That's why the manufacturing moved overseas in the first place; the cost savings were significant and management teams and investors got rewarded for cost reduction.

There are also arguments made about workforce availability, housing, transport and the sheer volume and variety of components. Apple is not the sole customer for most of the component manufacturers, and while it is an important enough customer to demand great pricing I doubt it has enough sway to demand the location of manufacture (unless it pays substantially more, which as stated above is a self-damaging move).

The way I see it, either the US workforce needs to accept a massive reduction in compensation, the US companies need to accept a massive increase in costs, or the manufacturing jobs remain where they are. Any change to the status quo will need to happen over a long-term timeframe so that the current shortcomings in US capabilities can be addressed.

But credit where credit is due

At least he's holding it right.