radarthekat

About

- Username

- radarthekat

- Joined

- Visits

- 342

- Last Active

- Roles

- moderator

- Points

- 8,966

- Badges

- 3

- Posts

- 3,944

Reactions

-

Apple posts record $89.6B in Q2 revenue on back of across-the-board growth

The negativity and doomsaying chatter surrounding Apple seems to have lessened in the past couple of years versus the old days of ‘Tim cook needs to go, Apple is doomed’ retorhic. Maybe enough of the world has switched to Apple products and services such that the naysayers have been quieted. Or maybe they’ll come roaring back.melgross said:Being realistic, Apple could reach $340 billion this year if the next two quarters hit $70 billion each.

but with all the euphoria around, I’d like to remind people about what happened in 2016, 2017 and 2018. 2016 also had a major factor for about a 50% sales increase in iPhones because of the new large sizes. I tried to tell people that sales could be lower next year, and possibly even for the year after that. The reason was that people bought the big phones in 2016 who would otherwise have bought a phone the year after, and even some, the year after. Then, those people wouldn’t buy a phone in those years. That turned out to be true before sales began to rise again, despite pundits stating that Apple had seen “peak” iPhone.

this year, we have the pandemic. Many companies are seeing large sales lifts if their products fall into the area where people who are staying home would want and need. Computing and telecommunications were two of those areas. Food delivery services were another. Apple’s sales rise of 54% is stupendous, but I believe that some of that would have been next year, and some from the year after that, just as in 2016. So don’t be surprised if the might be a sales fall next year if the pandemic is mostly gone, and people are getting back to normal. Then, as a result, don’t be surprised if those wonderful pundits start talking about “peak” Apple, with a drop in share price.But, in general, the spike in sales will be good for Apple, even if some analysts will see the subsequent drop as a sign of peak all-things-Apple. And the reason it’s a positive is that it gets the clock at least started ticking on that huge number of products recently purchased, toward eventually themselves being replaced in years ahead, it puts a lot of cash into Apple’s hands to fund all their initiatives and it simultaneously deprives Apple’s competition of a lot of customers who are being brought into the sticky Apple ecosystem.On top of all the above, this spike consumed yet another year of waiting on the next really big thing out of Apple, which may be their initiative in the transportation sector or may be in the medical/health maintenance sector. Either way, it makes the waiting easier.

-

Apple roped into Juniper Networks patent lawsuit

This is called indirect infringement, when you incorporate into your product or service a product from another company that itself directly infringes a patent. Typically large companies would have indemnification clauses in purchase contracts to cover this situation. Juniper would, under such a clause, if exists, be required to defend Apple against any actions taken against Apple and to reimburse costs incurred and penalties levied.The whole ballgame changes, of course, if the entity charged with indirect infringement knew they were infringing.

-

Apple reveals further details about AirTag's anti-stalking feature

There’s a use case within that three day stalking window that, while unethical, is certainly feasible. Your partner, I’ll use girlfriend as that’s my situation... your girlfriend goes out occasionally for a girls’ night out and returns home well past midnight. You become suspicious so tag her handbag or even car before she goes out. Then, a few times during the evening you search for that air tag. She’s not going to get alerted, but you’ll know if she’s no longer at the restaurant or club she claims the girls frequent. You’ll potentially even know the hotel or residential address where she went, assuming she’s cheating. And she’ll be back within 24 hours, or less if she’s trying to cover her tracks; she’s not likely to not come home for three days.

-

Apple sues former employee for allegedly leaking to media

The company is Arris Composites. What they do might just be revolutionary and incorporated heavily into the design of an Apple car.Tesla is creating mega castings using a proprietary aluminum alloy they designed to be able to be rapidly injected and cooled without forming stresses. This is what allows Tesla to create the entire rear end of the Model Y frame as a single piece, replacing 70 pieces that represent the Model 3 rear frame assembly. This not only reduces 69 components that have to be designed, sourced and assembled, but it creates a rear frame assembly that is ultra precise, meaning the addition of body panels is that much more precise, resulting in a higher quality vehicle that’s cheaper to manufacture in less manufacturing space with fewer robots and employees. A win all around.Arris has developed a process that combines the efficiency and precision of injection molding with the materials and structure of carbon fiber.Here’s an article about that...

https://www.designnews.com/materials/arris-composites-combines-speed-injection-molding-strength-carbon-fiber

The result is a part that could be structurally equivalent to Tesla’s Model Y single piece cast rear frame section, but with even lower weight and potentially higher strength, than Tesla’s aluminum alloy. Certainly lower weight. I can imagine Apple is looking at everything Tesla has been doing and thinking, can we do even better?Here’s the Yahoo Finance private company detail page on Arris Composites, showing Simon Lancaster in his role there...

https://finance.yahoo.com/company/arris-composites?h=eyJlIjoiYXJyaXMtY29tcG9zaXRlcyIsIm4iOiJBcnJpcyJ9&.tsrc=fin-srchMy guess is this lawsuit will be settled with some accommodation to Apple that doesn’t end Lancaster’s career. The two companies will continue to work together and all will be put behind them.But doesn’t this make you a bit more anxious for an eventual Apple vehicle reveal?

-

Apple's $111.4B Q1 shatters quarterly record with massive growth across all categories

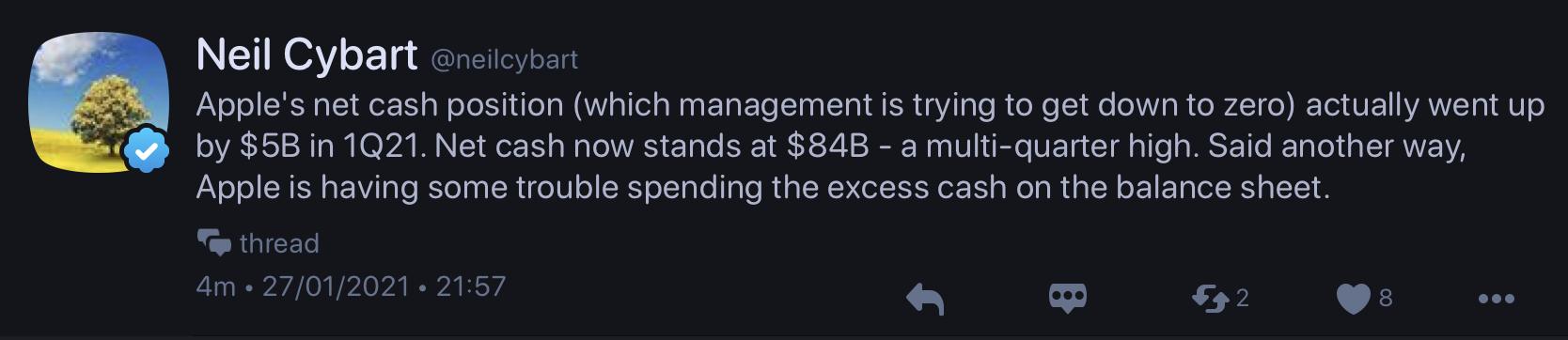

cg27 said:

Why not keep as much net cash as possible? Keep the powder dry for acquisitions, rainy days, dividend increases, or whatever. Getting net cash to zero sounds dangerous should the economy really go south. Maybe they’re just saying they’d like to get to zero but know that will never happen, because they won’t let it.Rayz2016 said:Nice problem to have …

By removing unproductive cash from the balance sheet and using it to reduce the share count, a business increases the percentage of each dollar invested representing the operating business. And at the same time increases the ownership percentage represented by each remaining outstanding share. As a potential investor you want your invested dollars [capital] to purchase an operating business that produces outsized returns, not static and unproductive cash.

There was a time a few years ago, back when Icahn was carping, that each dollar invested in Apple shares represented only 75 cents invested in the operating business and 25 cents invested to buy a bit of Apple’s cash hoard. Most casual investors don’t think about that. But what if you said to your broker, “please invest $100,000 from my account in this company I feel is a good business” and your broker replied, “sure, but I’m going to invest only $75,000 in the company’s shares and let the other $25,000 sit and do nothing for you.” You’d question his action, and yet that’s exactly the decision that all of us investors faced, and made, when we bought Apple shares back in those days. Get unproductive cash off the balance sheet, and put it to good use.