maestro64

About

- Username

- maestro64

- Joined

- Visits

- 158

- Last Active

- Roles

- member

- Points

- 4,923

- Badges

- 2

- Posts

- 5,043

Reactions

-

Citigroup bailed on Apple Card because of worries about profits

I will tell you again, like the last time you brought this up, you only pay interest if you are buying things you can not afford. If you use a CC to delay payment by 30 days and use someone else money for 30 days and pay it off then you do not pay interest. This is not a hard concept to understand.rob53 said:"Sen. Bernie Sanders and Rep. Alexandria Ocasio-Cortez announced new legislation Thursday to cap credit card interest rates at 15%, a move that they said will help protect consumers from the "greed" of the credit card and banking industries."

USA Today, May 9, 2019

Before people start screaming about this being political, just think about what AI is saying in this article about Citigroup. Credit Card companies are today's LEGAL loansharks and very few people in our government are doing anything to stop it.

"Goldman Sachs seeks to disrupt consumer finance by putting the customer first," claimed a Goldman Sachs spokesman. "We are excited for customers to use Apple Card, which is designed to help people take control of their financial lives."

At least there is one company trying to buck the trend. I'm sure Goldman Sachs and Apple are still making some money on this deal but like medical insurance companies, there's no reason why credit cad companies should be making a vulgar amount of money doing practically nothing.

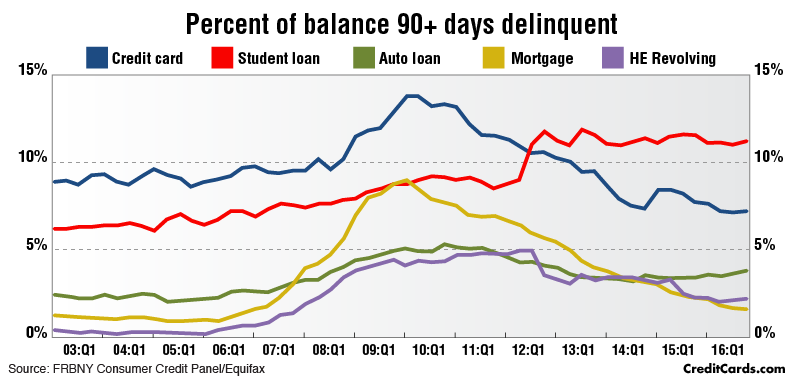

The reason CC interest rates are high due is to the fact it is unsecure loan of money that any one can walk away from and people do every day. If you are willing to pay high interest rate on a card to helping those who choose to walk way from their debts.

Stop expecting the government to fix your problem, learn how to manage money.

This is why interest rates are high

-

Citigroup bailed on Apple Card because of worries about profits

I am no Goldman Sachs fan by any measure, but I am far less a fan of Citibank. This company looks for any way to extract interest out of you. This is old, but relevant.

Back in the day before you could make electronic payments, we use to have Citibank for our American Airline CC. My wife used it all the time for work travel so we always paid it off. All of a sudden we started get hit with interest even though we paid in full. Call them up ask why, they said the payment was late, like by a day and some times longer depending which day in the week the due date fell. Even though we always paid the bill ~3 days before it was due, i.e. dropped it in the mail at the post office, just like all our other CC and bills. For some reason Citibank was the only one arriving late.

What I eventually figure out, Citibank did not consider it paid until they deposited your check, so if the due date was Saturday and they did not deposit it Friday when the payment arrived and deposited it Monday you got nails for 2 days of interest, plus of the entire next billing cycle you were charge interest for the average daily balance. So we backup the payment day to 5 days or made sure if would arrive 2 days prior to a weekend due date. But the problem persisted, I complained to them and informed them US law considers a bill paid based on the post mark on the envelop not when it arrives at their processing facility (since US mail at the time could be delayed for lots of reason consumers were not to be penalize for late payment if it was post marked prior to the payment due date). When I ask them to what the post mark was on the envelop they claim they did not have it as far as they were concern it was late. At this point I dumped them as CC company and never looked back.

I had second run in with them which I had not choice in. I had Employee Stock Purchase Plan with a company I worked at and Smith Barney was the holding company for the stock and Citibank bought them a few years into the plan. Once Citibank took over, it took forever to get my money when I sold stock. Smith Barney use to allow electronic deposit of funds at no cost, when Citibank took over, they would charge you $50 to do deposit wire transfer. When you are only making sometimes a few hundred on a ESPP transaction it was not worth giving Citibank $50, so they would mail you a check. Those check would take 2 to 3 weeks to get, even though it only takes 3 days to clear the stock transaction. I caught them sitting on the check, they used a stamping machine and it dates the envelop when they put on the stamp. Many times the envelops were stamped 3 to 4 days after the sale as you would expect, but the check would not arrive for a week or two later. When called on this they blamed the post office.

Citibank most likely passed on the deal because Apple would have held them to a higher standard, and Apple would encourage people to pay off the card.

-

Honey I Shrunk the Chips: How die shrinks help make processors more powerful

Part of the reason Apple is able to keep jumping to the next process technology is due to the fact they do not have to worry about hardware backward compatibility and they have complete end to end control over the entire design. When you shrink the process technology on a specific chip design, sometimes there are unforeseen side effects on how the chip runs. If you have to make sure the current chip works the same way as the previous chip (like Intel Processors, and Memory Chips) it can make it very difficult to process jump. Intel can not all of a sudden jump process technologies and tell everyone the processor now behaves differently and Computer companies have to redesign the boards and Microsoft has to change how Windows works.

This is why with every generation of the Apple A processors there is new hardware around it and new software. Apple only has to worry about Apple. Other companies do not have this luxury so they have to make sure when they make a process change the new chip works like the old one, or they have to modify the chip to work the same way in the new process technology as it did on the previous technology and this is not trivial.

-

Editorial: Latest IDC estimate of Q1 2019 iPhone sales 'highly inaccurate' to the point of...

In a previous job, I had access to both Gartner and IDC paid data as well as quarterly conference calls with their head analysis for the report, and it not very different than what they show publicly.

They may be trying to influence the markets, but I found they show us obviously bad data, and try to get us to comment on it and tell them or share with them our actually numbers and costs. The conversation were always one way them telling us what they though we never gave them our own data.

The reports I was looking at was based on actual data the supplier published and they number were usually off and they had all kinds of excuses. Like my supplier came in told me their company sold x units last quarter and analysis would say y units, and I ask why the difference and the usually best answer was the analysis never count channel inventory and WIP, like they know what are those numbers, only units which made it to the end consumer. The numbers got a lot murkier when you try to break it down by business segments and your competitors

-

Apple earns $58B in revenue as services hit all-time high of $11.5B

I think what we are begin to see, consumers are spending more on intangible items like services verse items which you can put your hands on and keep and enjoy over time. I see people going out to dinner more, so many place I go are packed and there is a wait and it is more than the trendy places. All the hardware today is good enough, same with cars, other than styling on car there is no must have feature unless you want electric, beyond that cars have topped out on the power curve, there is no must have feature which was not there 3 yrs ago and cars are lasting longer. My daily driver is 12 yrs old 166K miles and it like new runs well and have no issue with it why replace it.melgross said:Not bad, considering. Phone sales and computer sales drops are following the industries drops. A nice part is iPad sales rising from $4 billion a year ago to $4.9 billion. I’m curious to know how tablet sales did overall, that’s been declining for everyone, except for under $100 models from china with unknown branding.

It all about making people feel good and services is where it is at.