sirlance99

About

- Username

- sirlance99

- Joined

- Visits

- 109

- Last Active

- Roles

- member

- Points

- 1,823

- Badges

- 2

- Posts

- 1,304

Reactions

-

Review: Apple Card is more of an experience than a reward generator

I do all that with my current credit cards as well.GeorgeBMac said:Yes, I agree... More than anything it is the experience that separates it from the crowdAnd, for me, that is the almost entirely online / iPhone based nature of the card -- and that comes out clearly when it comes time to pay the bill:They don't mail you a statement and neither do you mail them a check.It all happens on you iPhone:Tap on "total balance" and you see your a list of your statements with an option to generate a PDF in standard statement format.When it comes time to pay, you simply transfer funds from your linked bank account or AppleCash with your iPhone.Or, for myself, since I don't want to link my bank account, I'll transfer money to AppleCash using my bank's debit card and use that to pay the bill.I suspect we will be seeing a lot more of this 100% online & mobile in the future.And, as an aside: I just got an email from Discover encouraging me to use my card via ApplePay wherever I shop.

-

Editorial: Why iPhone drives the future of mobile silicon and Google's Pixel doesn't

That’s just weird to talk about something completely off topic.tmay said:

No, I'm fine with being offtopic:gatorguy said:

Very insightful...tmay said:

How wonderful for Google, that, and tracking...gatorguy said:corrections said:

That's not what Android fan sites and Google's blog were saying. In fact, they parroted off the same ideas you did: that Tensor acceleration gave Google some lead, that Pixel photography was better than an iPhone (that is not true, and continues to be false).gatorguy said:Pixel? PIXEL? Of course it doesn't drive "the future of mobile silicon"

I don't know that you understand what Google's Tensor Processing Units (TPU) are and I think you're using terms you don't know much about but making it sound as tho you do.

Tensor processors aren't made for smartphones.

So yes, Tensor acceleration enabled by Google's own silicon gives them a definite leg up on competitors, and BTW Apple is not one of those competing with them.

TPU's are for servers.

https://cloud.google.com/blog/products/ai-machine-learning/what-makes-tpus-fine-tuned-for-deep-learning

EDIT: Google has moved so far beyond ARM or Intel and yes even Apple...

Not only have they designed and shipped TPU silicon, they also have designed, tested, and refined their own Quantum computing chips and may be the first company on the planet to achieve Quantum Supremacy.

https://interestingengineering.com/googles-quantum-processor-may-achieve-quantum-supremacy-in-months

Apple and Google may compete in some areas but are far apart on other custom silicon the two companies develop. Apple does it primarily for consumer uses, a great source of income obviously, while Google does it for science, industry, and enterprise. Different needs and different reasons for developing their own special silicon.

Amazed you bothered to make an off-topic comment. You're usually better than that. Perhaps try again?

https://freedom-to-tinker.com/2019/08/23/deconstructing-googles-excuses-on-tracking-protection/

-

Apple Card Preview program invitation emails going out now in US

You’re absolutely insane if you think all 200 million are going to or even can apply for this card.larryjw said:I would not be surprised if Apple pushes out invites to the public incrementally. The last I read, Apple has about 200M users in their system, which is about double what each of their competitors have.

MasterCard currently has about 100M. Goldman-Sachs has zero. Imagine opening up Apple Card to all 200M Apple users all at once. Ain't gone to happen I'd suggest.

-

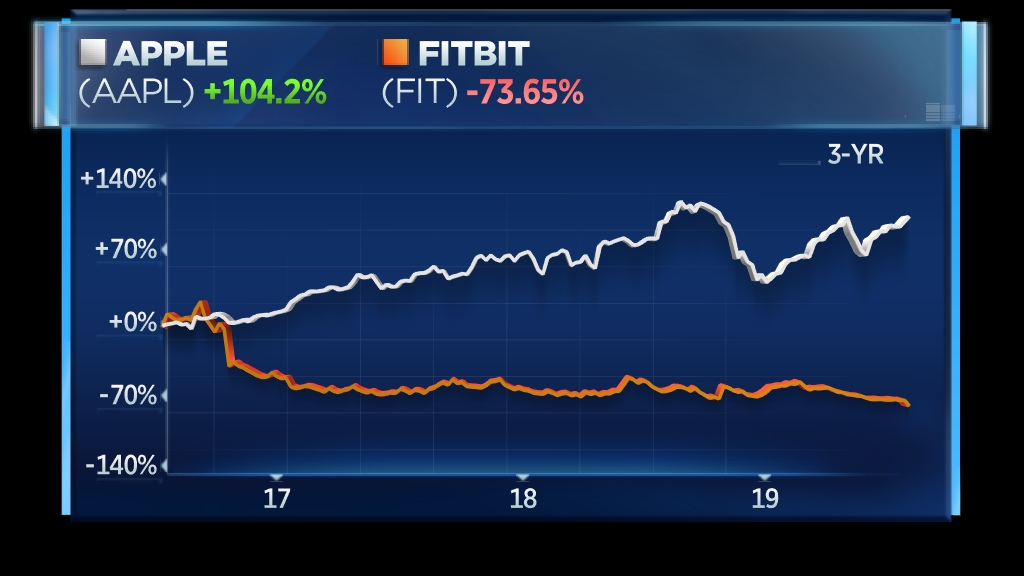

Fitbit's new financial worries are just its latest in a long line

Why does it always have to be checkmate with you. The world would be boring in your vision of only Apple and everything Apple.AppleExposed said:Just read up on this yesterday. While tech sites are busy typing up the next "Apple is doomed" bait they're ignoring a massive turd in the punchbowl.

Apple Watch sales and user base is WAY up. 75% of Q3 Watch buyers are new.

VS.

Fitbit. Reported record losses and their latest attempt to knock off Apple Watch has sold less than expected. Fitbit stock plunged to record lows and a drop of 15% while Apple reported GREAT news.

"In its effort to stay competitive, Fitbit has been slashing prices, which resulted in a shrinking of its gross margin, or the profit left after subtracting costs of goods sold, to 34.5% from 39.8%."

https://www.cnbc.com/2019/07/31/apple-fitbit-results-show-smartwatch-market-becoming-winner-take-all.html

This has caused Fitbit to lose 82% of it's IPO since 2015. Fitbit is now valued under 1B dollars.

Now, I don't give a F about stock prices but what this shows us is that Fitbit, the company that was supposed to be the knockoff Apple Watch for Android is now a slowly dying company. Yet they are still outselling the next closest competitor. This means android Wear (or whatever flavor of the week name they have) is doing a LOT WORSE.

Fitbits strategy going forward is services. The problem here is that they're competing with a company that has been planting their seeds into services for over a decade and are about to storm the industry with more refined, secure, quality services which have been in the works for years.CHECKMATE.

-

Apple services & Apple Card 'too late to the game,' HSBC downgrades stock

Easy, Amazon Store Card, Amazon Chase Card or Discover. 5% back. Since I don’t buy products at the Apple store because I can get them cheaper and get 5% back buying online, I’m saving even more money. So once again, NFC 3% is a non issue. Don’t care at all about getting the cash back immediately as it such a insufficient amount it has no bearing on my finances.Soli said:

Again, which cards offer you better than 3% on Apple products or better than 2% as a minimum for NFC-based purchases?sirlance99 said:

Amazon,Citi, Chase and Discover just to name a few.Soli said:

Which cards do you have that offer you more than 3% back on Apple purchases?sirlance99 said:

I have many card that beat the Apple Card.ashokbharwani said:Did HSBC even bother to study these new services? The apple card is something no other card can even come close to offer. The TV service is also much more comprehensive than other services. If it was too late, I wonder why Samsung, LG and other makers have made Apple TV a native app on their smart TV. Lastly their Apple Music was launched way after Spotify but has already surpassed paid users in USA. I think HSBC should worry more about their own performance which has dwindled along these years rather than making comments on subjects they are not even familiar with or made thorough study.

Which cards do you have that offer you more than 2% bak on Apple Pay-based purchases?

Which cards do you have that offer you your cash back that day instead of waiting for the billing cycle to roll over (and in many cases only give you half your percentage back until you pay off your charges)?

Which cards do you have that offer you better than zero late fees? (How is that even possible other than giving you some cash incentive for paying on time?)

Which cards do you have that offer you better than zero on overage fees? (How is that even possible other than giving you some cash incentive for not going over your balance?)

Which cards do you have that offer you better than a laser etched, titanium card? (How is that even quantifiable?)

What cards do you have incentive the security of Apple Pay over using the physical card counterpart?

What cards do you have that are available via Apple Pay after you've signed up and before you've received your physical card?

Saying the Card doesn't offer anything because it exits within the reality of finance and credit cards is like arguing that Apple's A-series chips are meh because Apple licenses from ARM instead of reinventing the entire microprocessor from the ground up. Being the best and most idealized option doesn't mean that everything has to outlandishly original to be an effective product—nor does it have to be the best option for everyone. You're a frequent travel so you prefer your Delta card for airline miles? That's perfectly fine just as there are legitimate reasons one needs or prefers an Android phone or Windows laptop without having to hate Apple for existing.

Literally almost all my cards since they are all in the wallet app already for use with NFC payments.

Capital One and Navy Federal offers cash back as soon as the purchase posts. But I don’t care about the few cents to a few dollars a day I get anyway as it has no impact on my budget and I turn them all in once a year anyway. Non issue.

Late fees never worry me as I never occur them. Non issue.

Once again, a non issue since I have such high limits overage fees will never happen.

Have a few metal cards. Don’t care about that at all as all that does is try and impress others which I don’t care about. Non issue.

Have almost all my cards res in the Wallet app already for use for NFC payments. Same security. Non issue.

Have many cards that that beat the Apple Card so don’t care about having it the same day. Once again, a non issue.

Don’t hate Apple as all my products are Apple. But I do play the credit card churning game and all of us don’t see that much of a benefit with the Apple Card. I’ll make more money off of other cards.

I’m not seeing a single one. I see one card for the former, the current Apple credit card from Barclays, that offers the same 3%, but you have to wait until you get $25 built up and then they mail you an Apple Store GC which makes it overall worse than their announced card, and many that equal the 2% back as a minimum, but nothing that “does better” for Apple Pay payments.

I also see no other card that is designed to help spur increased awareness and usage of Apple Pay, only basic support for Apple Pay.

Where’s the price protection, where’s the extended warranty, where’s the many other rewards that other cards have that Apple Card does not?

The Apple Card is a middle of the road card. Better then some, worse than others.