DanielEran

About

- Username

- DanielEran

- Joined

- Visits

- 43

- Last Active

- Roles

- editor

- Points

- 2,529

- Badges

- 3

- Posts

- 290

Reactions

-

Apple bought back a record $23.5B of AAPL shares in Q1 as Wall Street peddled "full panic ...

GeorgeBMac said:

Apple borrowed Bonds against the value of itself, effectively its cash overseas. So it paid extremely low interest for flexibility to avoid paying very high tax penalties. It can now hold that debt and spend its cash pile, and pay off its debt from earnings (or cash, but it can probably invest its cash with a far better return!)In the years following the Great Recession Apple and many other companies were borrowing money (at super cheap rates) in order to funnel it out to shareholders as stock buybacks and dividends --which is obviously not a sustainable business model. But it kept the stock market in a 10 year bull market -- the largest period of sustained growth in its history (Well, actually, the 2nd longest).But, now that the Fed is raising rates, that mechanism is no longer viable. So, rather than letting the stock market crash to its fundamental value, they thought up a new ponzi scheme: The federal government borrows the money, funnels the proceeds to corporations and the corporations funnel it out to their stock holders via share buybacks and dividends. Essentially, the U.S. government borrows the money from China and gives it to stock holders...Like all scams, it's a brilliant scheme that works really, really well. Until it doesn't.

Rates are rising, but Apple no longer needs to issue debt.

How do you think the fed govt "funneling money to corporations"? Apple is distributing its earnings to shareholders. Apple also holds billions in US Govt securities.

-

Why was iPhone X so successful at $999 despite a mountain of false reporting?

k2kw said:I admit it DED was right-on that Gurman was wrong (although I still would like to see his projection of revenue and sales counts ).

Only disappointing thing seems to be HomePod. I thought it would add $2 billion in the quarter. Seems more like one billion.

Adding 3% count per the quarter was impressive. Was this due to geography namely China or Android switchers? at high end or low end?

You expected HomePod to launch as a quarterly business larger than Microsoft Surface and Google Pixel put together, despite the fact that it was only available for sale in English within the United States, Australia and the United Kingdom. OK.

-

Apple grew 44% in India, generating half the revenues but 10x the profits of Xiaomi, Vivo,...

The billions Google pays Apple are income Apple reports.tzeshan said:Maybe Xiaomi and every other Android smartphone makers have a contract with Google like Apple does that Google will pay the smartphone makers a certain percentage for ads on the phone? Maybe this is the conspiracy designed by Google to entice the companies making Android phones even without profit? Because this revenue will continue for many years as long as the phone is being used.

Xiaomi looks significant in China, where it has 5th place market share. But it has no major business elsewhere. Its big play in India is earning low millions. If you think Google is paying Xiaomi anything to direct it customer search queries in a country that Google isn't even available in, you might need to rethink your logic.

saltyzip said:

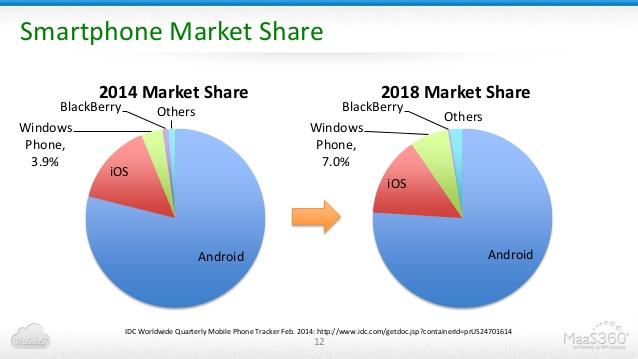

The graphic you posted is an IDC fantasy from 2014 of Windows Phone being relevant in 4 years, not real data.

Depends how you define winning, market share with good profits vs being greedy and having exorbitant profit's. Which one is most sustainable long term, that's the challenge. Having a much much larger market, android is the winner surely long term, there is only so much a phone can do for the average Joe.nunzy said:All that Apple cares about is total profits. Anything else is just the means to that end.

And Apple is winning!

There is nothing other than iMessage that warrants a user switching from android to apple, it used to be camera, but android phones like the pixel have surpassed the iPhone. This is why apple services are trying to make unique content to entice people over to the platform, as their hardware advantage has gone. Not sure how successful that approach will be, not very would be my guestimate.

-

Apple grew 44% in India, generating half the revenues but 10x the profits of Xiaomi, Vivo,...

Yes certianly Xiaomi can make money but is choosing not to because of a genius design.avon b7 said:

"Xiaomi has previously indicated that it planned to make virtually no money in phone sales and eventually make money from services targeted at its installed base, but Android buyers have little keeping them attached to any specific vendor, and Xiaomi has yet to produce any impressive results from its services offerings."

Yes, Xiaomi has stated exactly that. In fact it has publicly stated that it plans to put an indefinite 5% cap on net profits (I'm not sure if that is limited to hardware or its entire business model).

Clearly, even if it could make more, it wouldn't - but by design.

In the last quarter, "Apple posted $8.5 billion in revenue in its services category, up 13 percent year over year. At present, services revenue has grown to about $30 per active device." So you think Xiaomi is choosing not to make money on principle, while Apple is yet to make any progress in Services, when it's generating $8.5B per quarter. That's insane.Saying that Apple makes 10x the profits of Xiaomi therefore becomes a very stale comparison.

They have yet to make any inroads into services because they are just getting started in earnest, so yes, eventually they hope it will be a revenue driver for the future.

Did you notice how Xiaomi "created a base" in China making no money, then fell into fifth place while its customers moved to the next cheap Android maker? When is it "yet" to start monetizing its fleeing "base"?Although the quote actually gives that information, it is flooded in a sea of Apple positives and spin. And while that strategy may or may not work, Apple is apparently seeing unit sales fall in India while Xiaomi unit sales have surged. If they are to see their plan succeed, at least the base is being created.

"ASP (Average selling price) of the smartphone has increased from $131 in Q1 2016 to $155 in Q1 2017. And almost 67% of smartphones, sold in India by Chinese vendors, are now available in the price range of $100-$200." China's move into India largely replaced sales from domestic Indian phone producers.One of the source pieces speaks of the Indian market being polarised by Chinese manufacturers while this piece takes less than one paragraph to plunk this on the table:

"a series of Chinese makers working to flood the emerging nation with cheap smartphones."

However, the same source article tells us:

"In the just concluded Jan-March quarter, Apple lost its leadership status in the Rs 30,000-plus segment to Samsung that captured half of the total market with its new launches, as per Counterpoint. One-Plus was in the second place with one-fourth share of the premium market, the researcher said"

So maybe they are flooding the Indian market with cheap but also 'premium' phones? 'Rs 30,000-plus' is about 400€ as a starting price, so not cheap at all.

Meanwhile, Apple's sales have grown by 44% and are fueling Apple's expansion there with real profits. The fact that a minority of Android makers are pushing into the low end of the $400+ market and not making any money at it isn't a serious threat to Apple growing and profiting from the high end of the $400+ segment.

-

Editorial: Will Apple's 1990's "Golden Age" collapse repeat itself?

This is false. The profit margin for iPhone X is actually much lower than historical profits because it is so expensive to develope and build. The cost number you cite is total BS.tzeshan said:The biggest blunder Cook made regarding iPhone X is the price. He cannot see that iPhone is beleaguered. The estimated cost of iPhone X parts is $370. He is so obsessed with profit margin that iPhone X price is set to $999. Even at $799, the profit margin is 46%. Apple is giving many buyers an impression of greedy. If you want to sell a product to mass of people, the first thing you should not do is greedy.

Unless Apple has a breakthrough mass product, its future is really not very bright. Cook has wasted the goodwill Jobs created for Apple.

Apple today is far larger and more successful than when Jobs was alive. Part of that success is directly following Jobs vision. Part comes from trying new things that Jobs would have opposed.

But to suggest that the most successful company in the world is in dire trouble because it hasn’t reinvented the PC over and over again (and has “only” created and launched personal mobility in Apple Watch, AirPods) is really myopic and ignorant.