Another blockbuster quarter earnings report ahead for Apple, analyst claims

Katy Huberty from Morgan Stanley has raised her iPhone sales and revenue forecast for the current quarter, while also predicting strong services growth for the foreseeable future -- and has dramatically increased AAPL's price target as a result.

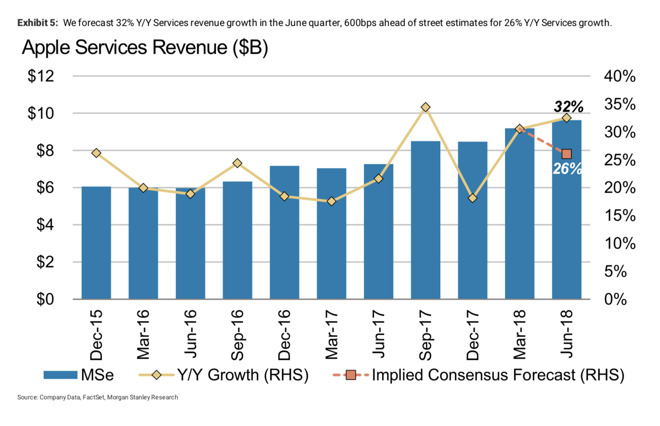

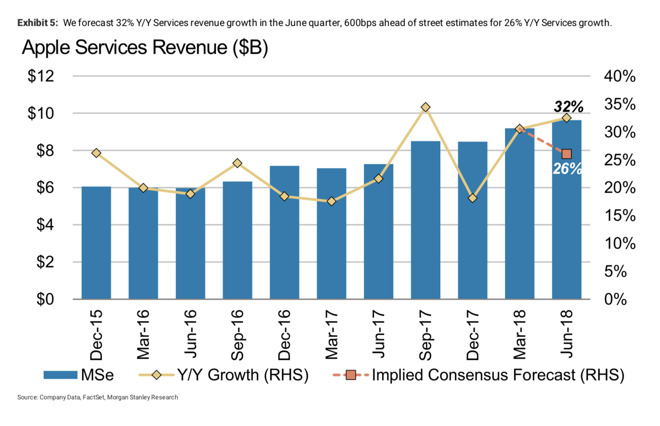

In a new analyst note this week that was obtained by AppleInsider, Katy Huberty of Morgan Stanley estimates that Apple will announce 39.8 million iPhone units sold in its third quarter, with its services sector growing by 32 percent.

"We expect Apple to report an in-line June quarter and provide a slightly weaker than consensus September quarter outlook due to a possible October launch of the 6.1-inch LCD iPhone," Huberty wrote in the note.

Even if the LCD model is delayed, Huberty is still expecting 90 million iPhones to be produced in the second half of calendar year 2018 for the launch of the device.

"iPhone results matter less late in a cycle and consensus expects flattish iPhone growth going forward as the market matures," wrote Huberty. "We expect investors to focus increasingly on Services results as a sign of whether Apple's installed base monetization efforts can drive overall company growth despite declining device revenue."

Because of the confluence of factors in Apple's favor, Morgan Stanley has increased its price target for Apple stock to $232, from the company's previous guidance of $214 per share. Huberty notes that fallout from a trade war, or a longer push-out of the low-end October iPhone may impact Apple's quarterly guidance, and possibly the stock price target as well.

Prior to the Apple's last earnings release, Huberty and Morgan Stanley predicted the quarter accurately, but declared that June quarter estimates would need to be revised lower. The note, and the dozens that followed it, caused Apple's stock to drop for a time in late April.

Apple's Q2 performance beat estimates for the company's best spring quarter ever, and Huberty admitted in May that Morgan Stanley had gotten it wrong.

The current note argues that Apple, due to its large platform and user base, "is well positioned to capture more of its users' time in areas such as augmented reality, health, autos and home," and that services are becoming an ever-more-important part of the company's identity.

Apple will announce its third fiscal quarter of 2018 earnings after the closing bell on July 31.

In a new analyst note this week that was obtained by AppleInsider, Katy Huberty of Morgan Stanley estimates that Apple will announce 39.8 million iPhone units sold in its third quarter, with its services sector growing by 32 percent.

"We expect Apple to report an in-line June quarter and provide a slightly weaker than consensus September quarter outlook due to a possible October launch of the 6.1-inch LCD iPhone," Huberty wrote in the note.

Even if the LCD model is delayed, Huberty is still expecting 90 million iPhones to be produced in the second half of calendar year 2018 for the launch of the device.

"iPhone results matter less late in a cycle and consensus expects flattish iPhone growth going forward as the market matures," wrote Huberty. "We expect investors to focus increasingly on Services results as a sign of whether Apple's installed base monetization efforts can drive overall company growth despite declining device revenue."

Because of the confluence of factors in Apple's favor, Morgan Stanley has increased its price target for Apple stock to $232, from the company's previous guidance of $214 per share. Huberty notes that fallout from a trade war, or a longer push-out of the low-end October iPhone may impact Apple's quarterly guidance, and possibly the stock price target as well.

Prior to the Apple's last earnings release, Huberty and Morgan Stanley predicted the quarter accurately, but declared that June quarter estimates would need to be revised lower. The note, and the dozens that followed it, caused Apple's stock to drop for a time in late April.

Apple's Q2 performance beat estimates for the company's best spring quarter ever, and Huberty admitted in May that Morgan Stanley had gotten it wrong.

The current note argues that Apple, due to its large platform and user base, "is well positioned to capture more of its users' time in areas such as augmented reality, health, autos and home," and that services are becoming an ever-more-important part of the company's identity.

Apple will announce its third fiscal quarter of 2018 earnings after the closing bell on July 31.

Comments

"... despite declining device revenue ..."

They might sound smarter by stating "slower increases in device revenue;" device revenue is not declining that I'm aware.

If the numbers look good we will probable see Apple over $200 shortly.

I'm really looking forward to Apple coming out with a bundled streaming video and music service. That could really put a charge into Apple's revenue. Apple is certainly doing well, but it never seems to perform like the FANG stocks do. Heck, even Microsoft is now considered a rival to Apple to reach $1T market cap. Next, it will be Facebook being considered Apple's financial equal.

IIRC, she was also the one who admitted her prediction about the iPhone X sales was wrong in the first quarter.

$6-8bn revenue opportunity, ex dedicated AR devices

Augmented reality (AR) adoption is set to grow materially with the newly introduced ARKit 2. In our opinion, revenue contribution can be significant even without Apple introducing any dedicated AR hardware. Specifically, we estimate that AR can add $1bn revenue by end of F20 from App Store downloads alone. Moreover, increased use of AR Apps will help drive higher sales of iPhones, especially post rear 3D sensing inclusion in 2019. We raise our iPhone estimates for F19/F20 by 2mn/8mn units as AR drives incremental iPhone sales (Figure 1). In addition, if Apple were to introduce AR specific eyewear (not currently factored into our model) we conservatively size the cumulative revenue upside from such device sales at ~$11bn by F20. We think AR apps will command a price premium. We believe the inclusion of AR features will be appealing to consumers (for use in applications like Maps that can have an additional virtual overlay) as well as to Enterprises where employees can be trained and instructions can be conveyed in real-time. We reiterate our Buy on strong capital returns, continued strong growth in Services revenues and AR providing yet another competitive advantage.

iOS installed base attractive for AR developers

With over 1bn devices that are AR ready, the iOS installed base is extremely attractive for AR developers. We distinguish between smartphone enabled AR and head-mounted displays (HMD). By combining 3D sensing hardware with software enhanced for AR using the recently announced AR Software Developer Kit 2, Apple stands to gain a competitive edge in smartphone enabled AR. In the HMD market, the early failure of Google Glass to garner sufficient customer interest is likely to instil caution in new players. While patent publications lead us to believe “iHMD” is in development, the clear push with ARKit 2 suggests near term focus remains on smartphone enabled apps.

Value across industries; Raising estimates, PO to $230

Retailers like Lowes and Home Depot are using AR to help customers visualize how countertops, paint, flooring and blinds look in their homes before buying. AR can be used to market hotels and travel experiences. Our F18E rev/EPS move to $263.7bn/$11.59, respectively. Our PO moves to $230 (from $225) on 16x C19E EPS of 13.98.

The race to a trillion market cap is something of a fool's game, kinda hope Apple doesn't "win" at risk of negativity publicity. FB has a much higher profit margin than Apple, due to model of user-generated content across platforms. But yeah, agree more services and e-commerce for Apple would be great.