iPhone XR launch attracted more Android switchers in the U.S. than the iPhone 8 & iPhone X...

A new report by Consumer Intelligence Research Partners indicates that iPhone XR attracted a significantly larger proportion of Android switchers in the U.S. during its first month compared to last year's launches of iPhone 8 and iPhone X models, bolstering the idea that Apple is successfully expanding its installed base of buyers rather than just selling to iPhone users.

"It appears that iPhone XR did serve to attract current Android users," wrote CIRP Partner and Co-Founder Mike Levin. "Of course, Apple doesn't just state plainly its launch strategy. But, based on the pricing and features, we can infer that Apple positioned the iPhone XR to appeal to potential operating systems switchers from Android."

Pricing has long appeared to be a key issue for Android users. This summer, CIRP reported that Android switchers over the previous launch season were much more likely to buy Apple's cheapest model, the now discontinued iPhone SE, and were the least likely to splurge on the then-new iPhone X.

Chasing low prices has caused a problem of brand churn among Android licenses. A Merrill Lynch Global Research report in October indicated that globally, no Android brands came anywhere close to the loyalty of Apple's iPhone buyers. Buyers of Samsung and Huawei, the largest two Android makers, had only about 54 percent of their customers intending to buy another model, while 70 percent of Apple users intended to replace their iPhone with a new one.

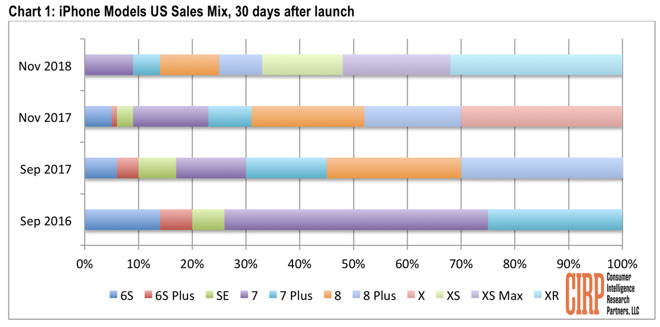

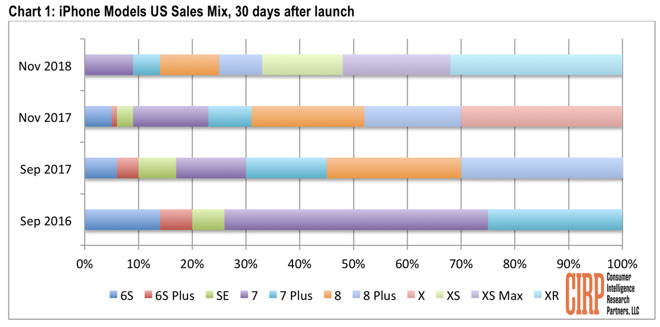

At the 2016 launch, Apple's most popular model by far was iPhone 7, rather than the larger and more expensive iPhone 7 Plus. Last year, iPhone 8 Plus outsold the standard sized iPhone 8, and the discounted iPhone 7 Plus sold better than the standard iPhone 7. And after iPhone X became available, it became Apple's top seller, despite a false media narrative that persistently claimed that "many people" would not buy the advanced new $999 product because it was so expensive.

This year, a series of reports have claimed that Apple's prices are again too high, and, at the same time, that demand for the less expensive iPhone XR is "disappointing," based on lowered expectations at a variety of component suppliers. However, those suppliers not only supply Apple, but also serve its competitors, all of whom are fairing far worse in facing slipping demand and pricing problems.

CIRP specifically noted that demand for iPhone XR is higher now than either iPhone X or iPhone 8 at their launch, refuting the idea that iPhone XR is suffering some sort of demand problem. Further, the second most popular model this year is Apple's most expensive iPhone XS Max, which narrowly outside the standard sized iPhone XS.

This years "trifecta" of advanced Face ID models using the full screen design introduced by iPhone X accorded for more than 65 percent of iPhone sales, a rapid expansion over last year that indicates that buyers have enthusiastically adopted Apple's vision for the future of smartphones, despite the premium price attached to those models and the availability of previous year's iPhone 7 and iPhone 8 models now sold at a significant discount.

This completely upends the media narrative that iPhone buyers are not happy with Apple's higher pricing on advanced models and are really looking to buy a cheaper iPhone-- or that any significant number are really considering buying a much cheaper Android. Instead, it indicates that even Android buyers are willing to pay a premium for an advanced new iPhone once they feel like they can afford it.

A big jump in American Android switchers

CIRP noted that 16 percent of iPhone buyers reported having switched from Android during the first launch month of iPhone XR, a 33 percent increase over the number of Android switchers following the launch of iPhone 8 models a year ago, and a 45 percent increase in Android switchers in the month after the launch of iPhone X."It appears that iPhone XR did serve to attract current Android users," wrote CIRP Partner and Co-Founder Mike Levin. "Of course, Apple doesn't just state plainly its launch strategy. But, based on the pricing and features, we can infer that Apple positioned the iPhone XR to appeal to potential operating systems switchers from Android."

Pricing has long appeared to be a key issue for Android users. This summer, CIRP reported that Android switchers over the previous launch season were much more likely to buy Apple's cheapest model, the now discontinued iPhone SE, and were the least likely to splurge on the then-new iPhone X.

Chasing low prices has caused a problem of brand churn among Android licenses. A Merrill Lynch Global Research report in October indicated that globally, no Android brands came anywhere close to the loyalty of Apple's iPhone buyers. Buyers of Samsung and Huawei, the largest two Android makers, had only about 54 percent of their customers intending to buy another model, while 70 percent of Apple users intended to replace their iPhone with a new one.

iPhone buyers trending toward larger, premium models

The group's data also indicated that over the past three years, Apple has successfully shifted iPhone buyers toward progressively higher-end models, in part due to a growing preference for larger phones.At the 2016 launch, Apple's most popular model by far was iPhone 7, rather than the larger and more expensive iPhone 7 Plus. Last year, iPhone 8 Plus outsold the standard sized iPhone 8, and the discounted iPhone 7 Plus sold better than the standard iPhone 7. And after iPhone X became available, it became Apple's top seller, despite a false media narrative that persistently claimed that "many people" would not buy the advanced new $999 product because it was so expensive.

This year, a series of reports have claimed that Apple's prices are again too high, and, at the same time, that demand for the less expensive iPhone XR is "disappointing," based on lowered expectations at a variety of component suppliers. However, those suppliers not only supply Apple, but also serve its competitors, all of whom are fairing far worse in facing slipping demand and pricing problems.

CIRP specifically noted that demand for iPhone XR is higher now than either iPhone X or iPhone 8 at their launch, refuting the idea that iPhone XR is suffering some sort of demand problem. Further, the second most popular model this year is Apple's most expensive iPhone XS Max, which narrowly outside the standard sized iPhone XS.

This years "trifecta" of advanced Face ID models using the full screen design introduced by iPhone X accorded for more than 65 percent of iPhone sales, a rapid expansion over last year that indicates that buyers have enthusiastically adopted Apple's vision for the future of smartphones, despite the premium price attached to those models and the availability of previous year's iPhone 7 and iPhone 8 models now sold at a significant discount.

This completely upends the media narrative that iPhone buyers are not happy with Apple's higher pricing on advanced models and are really looking to buy a cheaper iPhone-- or that any significant number are really considering buying a much cheaper Android. Instead, it indicates that even Android buyers are willing to pay a premium for an advanced new iPhone once they feel like they can afford it.

Comments

162 buyers seems like a rather low sample in this day and age when they can have access to buyer information from retail stores, get the information from Google or Amazon, etc, and get a sample size 10x as many, plus have a gazillion other questions asked and answered.

A lot of the surveys these days come right on the receipt with the reward of some kind for taking the survey. Best Buy should be able get hundreds to thousands by themselves alone if they sold tens of thousands of iPhones in November

As for the plot design, they’d be fine with shades of gray as long as they labeled segments of the bar individually, but plotting is not the strong suit for industry analysts, let alone engineers who are universally bad at it.

https://mixpanel.com/trends/#report/iphone_Xs

What is missing from the imo dumb headline you posted is that in 2017 the iPhone 8+ was the biggest screen phone which = more sales.

in 2018 the XS Max has the biggest screen pulling sales from the XR.

The only thing stopping 95% of android users is price.

If iPhone XR was $200 bet your ass 50% of buyers would be android switchers.

And then there's those droiderz who won't buy anything unless it's FREE-$50 bucks.

On the other hand, the data in link you posted would likely have a large margin of error, not because of the sample size, but because the sample group is made up of people who use certain apps and users of those apps aren’t necessarily representative of the general population. And also it says it’s based on 1.2 trillion records, which is absurd on its face.

This suggests they won’t.

Plus, while Apple has never broken out iPhone sales by model, Joz already said the iPhone XR was the top-selling phone. Conclusion: everything’s fine, and this will be another record quarter. This negative press is just further (typical) analyst wrongness with bonus anger that Apple isn’t going to give them more data than any other tech company does — like it used to.

Mixpanel is the makeup of the installed base, not of new sales. So it's useful data looking at something entirely different.