Goldman Sachs & Apple credit card with added iPhone features about to enter testing

Apple and Goldman Sachs are continuing to work on a project that could result in a jointly-produced credit card, one that offers extra functions in the Wallet app that may help users manage their spending and their accounts more effectively, without requiring a separate card-specific app.

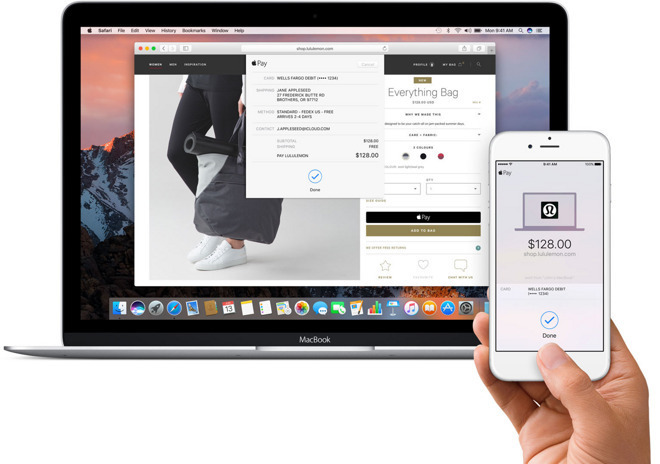

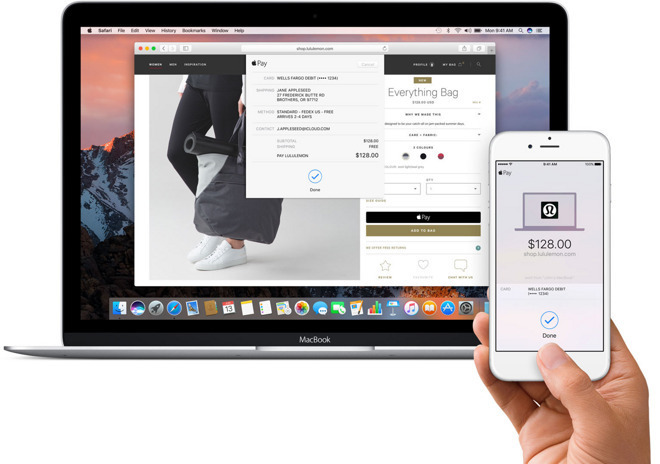

Apple Pay works on both Mac and iPhone

In 2018, Apple was said to be in discussions with Goldman Sachs for a possible Apple Pay-branded credit card, with a view to launch sometime in 2019. A new report suggests the collaboration is close to launch, with testing of a card by employees set to start in the coming weeks.

The Wall Street Journal reports the card will offer users with extra functionality via Apple's Wallet app, which will display spending goals, rewards, and to help manage their balances, according to sources with knowledge of the project. The Wallet features are thought to help users pay down any credit card debt before it becomes an issue, along with the possibility of using notifications if spending veers away from normal patterns.

There is also the suggestion that the "Rings" concept used for fitness on the Apple Watch could be borrowed for the project, though it is unclear what metrics would be monitored in this fashion.

Using Mastercard's payment network, the second-largest behind Visa, the card will earn its users cashback of around 2 percent on most purchases, with potentially higher percentages when used for Apple goods and services.

The card would be Goldman Sachs' first, and is reportedly costing a hefty amount to organize. The card project is said to have a budget of $200 million, with the bank adding customer support call centers and improving its internal infrastructure to handle increased numbers of payments.

Apple Pay is already a revenue generator for Apple, with the company taking fees from transactions performed through the mobile payment platform. It is suggested by the report sources that Apple would get a larger slice of the transaction fees from its own card, boosting its Services revenues further.

It is also possible that the card and its connection to Apple could help boost the use of Apple Pay, both by users and by merchants. It was recently estimated only 24 percent of US-based iPhone users have tried out Apple Pay, with the number increasing to 47 percent for international users.

Apple Pay works on both Mac and iPhone

In 2018, Apple was said to be in discussions with Goldman Sachs for a possible Apple Pay-branded credit card, with a view to launch sometime in 2019. A new report suggests the collaboration is close to launch, with testing of a card by employees set to start in the coming weeks.

The Wall Street Journal reports the card will offer users with extra functionality via Apple's Wallet app, which will display spending goals, rewards, and to help manage their balances, according to sources with knowledge of the project. The Wallet features are thought to help users pay down any credit card debt before it becomes an issue, along with the possibility of using notifications if spending veers away from normal patterns.

There is also the suggestion that the "Rings" concept used for fitness on the Apple Watch could be borrowed for the project, though it is unclear what metrics would be monitored in this fashion.

Using Mastercard's payment network, the second-largest behind Visa, the card will earn its users cashback of around 2 percent on most purchases, with potentially higher percentages when used for Apple goods and services.

The card would be Goldman Sachs' first, and is reportedly costing a hefty amount to organize. The card project is said to have a budget of $200 million, with the bank adding customer support call centers and improving its internal infrastructure to handle increased numbers of payments.

Apple Pay is already a revenue generator for Apple, with the company taking fees from transactions performed through the mobile payment platform. It is suggested by the report sources that Apple would get a larger slice of the transaction fees from its own card, boosting its Services revenues further.

It is also possible that the card and its connection to Apple could help boost the use of Apple Pay, both by users and by merchants. It was recently estimated only 24 percent of US-based iPhone users have tried out Apple Pay, with the number increasing to 47 percent for international users.

Comments

https://www.nytimes.com/2009/12/24/business/24trading.html

"But Goldman and other firms eventually used the C.D.O.’s to place unusually large negative bets that were not mainly for hedging purposes, and investors and industry experts say that put the firms at odds with their own clients’ interests."

Would you ever trust one red cent to anyone connected to Goldman?

The word "social" and the words "socialist" or "socialized" are not interchangeable. Regardless of what you find when you look up the word "socialized," in practice it means to be controlled by brute force, to have no consideration for anyone, and to make sure you have something whether or not others have anything under the guise of ensuring that everyone is sharing misery equally. You can dream about Scandinavian socialism all you like but it ends up like Venezuela. You have to be naive to think that socialism isn't driven by greed and envy.

Nobody's in this -- not even Apple -- for charity.

Lots of financial firms got bailed out during the financial crisis (as did manufacturing firms like GM), but what bailout did Goldman Sachs receive?

No one's holding a gun to anyone's saying they should get this. There are plenty of other cards. As far as I am concerned, these are two top-notch firms in their respective businesses, and I'd be among those first in line to get this card.

I have a feeling I am not the only one.

Find some other place to shill for the slime.