SEC presses charges against GT Advanced & CEO for fraud in iPhone sapphire supply

The U.S. Securities and Exchange Commission on Friday charged GT Advanced Technologies and former CEO Thomas Gutierrez with fraud, accusing them of deceiving investors about its ability to supply sapphire for iPhones.

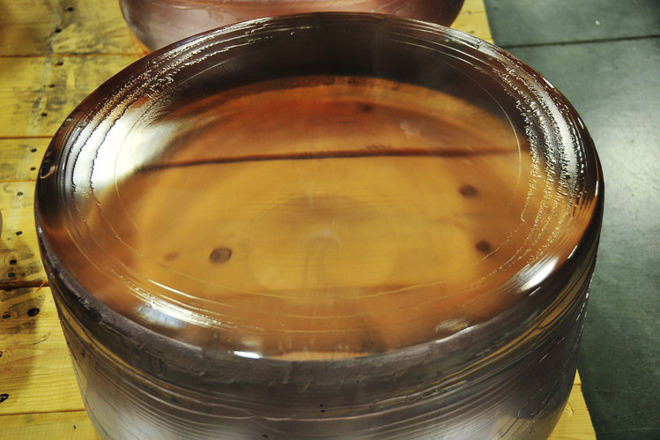

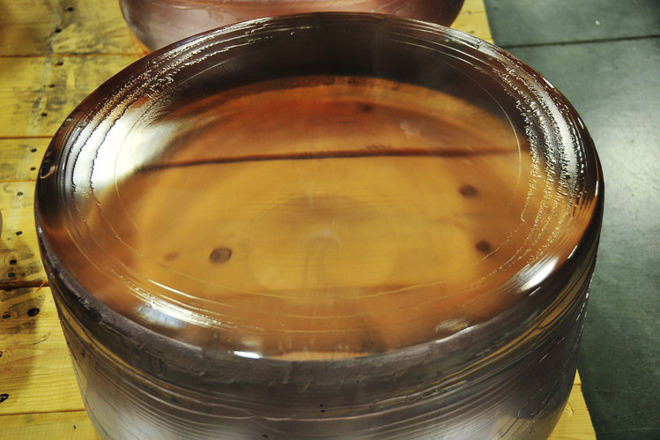

Sapphire en masse.

GT also misclassified over $300 million in debt to Apple, accumulated from its inability to meet multiple milestones, the SEC said. Without acknowledging or denying wrongdoing, both GT and Gutierrez have already consented to the SEC's findings, mostly avoiding punishment beyond a cease-and-desist order. Gutierrez will have to pay over $140,000 in fines.

"GT and its CEO painted a rosy picture of the company's performance and ability to obtain funding that was paramount to GT's survival while they were aware of information that would have catastrophic consequences for the company," wrote Anita Bandy, an associate director for SEC enforcement.

In fall 2013, Apple consented to advancing $578 million for GT, delivered in four installments. By April 2014 however GT was still unable to meet Apple's performance standards, leading to it withholding $139 million, with the option of speeding up repayment of the $306 million already delivered.

GT then accused Apple of breaching part of its agreement in order to be set free from milestone obligations and avoid recognizing debt as current, the SEC claimed. In a subsequent earnings call, Gutierrez nevertheless said that GT was expecting to meet its deadlines and receive its fourth Apple installment by October 2014. The CEO also made exaggerated sales projections, yet within just two months, GT made a surprise filing for bankruptcy. It reached a settlement for $439 million in debt with Apple by November 2015.

GT has since left bankruptcy, but is no longer on the stock market. A joint factory in Mesa, Ariz. has since been repurposed into an Apple data center.

Sapphire en masse.

GT also misclassified over $300 million in debt to Apple, accumulated from its inability to meet multiple milestones, the SEC said. Without acknowledging or denying wrongdoing, both GT and Gutierrez have already consented to the SEC's findings, mostly avoiding punishment beyond a cease-and-desist order. Gutierrez will have to pay over $140,000 in fines.

"GT and its CEO painted a rosy picture of the company's performance and ability to obtain funding that was paramount to GT's survival while they were aware of information that would have catastrophic consequences for the company," wrote Anita Bandy, an associate director for SEC enforcement.

In fall 2013, Apple consented to advancing $578 million for GT, delivered in four installments. By April 2014 however GT was still unable to meet Apple's performance standards, leading to it withholding $139 million, with the option of speeding up repayment of the $306 million already delivered.

GT then accused Apple of breaching part of its agreement in order to be set free from milestone obligations and avoid recognizing debt as current, the SEC claimed. In a subsequent earnings call, Gutierrez nevertheless said that GT was expecting to meet its deadlines and receive its fourth Apple installment by October 2014. The CEO also made exaggerated sales projections, yet within just two months, GT made a surprise filing for bankruptcy. It reached a settlement for $439 million in debt with Apple by November 2015.

GT has since left bankruptcy, but is no longer on the stock market. A joint factory in Mesa, Ariz. has since been repurposed into an Apple data center.

Comments

White collar crime — and the lack of meaningful punishments for it — is a serious problem in the US and needs to be addressed much, much more harshly by the various agencies. There needs to be strong punishment as a deterrent to fraudulent/criminal behaviour among the rich, not just the not-rich.

They didn’t recoup the cost of finishing the abandoned solar plant. They ended up spending a lot of money getting that plant to use green energy.

They also were made to blame for all of the employees who lost their job when the truth came out. Most of them were offered jobs when Apple agreed to take the plant and convert it to a data center among other things.

Sure they got tax breaks, most companies who build something like this get one, but nothing like Foxconn’s deal in Wisconsin.

2014: RadarTheKat

INVESTING VERSUS SPECULATION

or What I learned from Warren Buffett and 25 years in the market. But mostly from Warren Buffett.

The first level of wisdom a prospective investor hears and integrates is the old saw about diversification. And that's about as far as it goes for many. The problem with diversification is that, even if you are diversified, you'll still likely have in your portfolio several holdings that don't fit the definition of a good investment.

Those who go a bit farther in their studies begin to have a more nuanced comprehension and come to realize that not all businesses and opportunities represent investments. So what do these other businesses and opportunities represent if not investments? The answer is that anything that isn't an investment is speculation. To be successful with individual stocks/businesses, you should carry in your mind a definition of these two concepts. Here are my working definitions of the two terms:

"An investment is a commitment to holding a security as long as the underlying fundamentals and business prospects remain intact."

Take Apple, for example. Apple shares are an investment as long as Apple continues to perform as well as it is currently performing. As long as it continues to generate the revenues and earnings it is currently generating. Even if neither rise.

"Speculation is a bet on some future outcome, either positive or negative, that would materially change the fortunes of a business."

Note that the main difference here is that an investment relies upon the continuation of the status quo while speculation is a bet against the status quo.

GT Advanced Technologies (GTAT), a maker of solar manufacturing equipment, is an example of a speculative bet, and one that went terribly wrong for those who made that bet. In 2012 and 2013, GTAT saw its solar business collapse under the weight of competition from Chinese manufacturers. Late in 2013, GTAT partnered with Apple to manufacture sapphire display glass, presumably for use on the iPhone 6. GTAT needed that partnership to go well; it represented GTAT’s lifeline to a corporate reboot, a chance to reinvent itself in a new line of business in which it had little experience. That reinvention, if successful, would materially enhance the value of the company. If a failure, it would mark the collapse of GTAT as a viable business. GTAT did fail, and filed for bankruptcy protection. In the process, the share price went from a high of about $20 to about 40 cents. Many of those holding the shares indignantly complained in online forums that their investment was wiped out by unscrupulous actions of GTAT's CEO and management team. They weren’t wrong about the actions of GTAT’s management, but they were wrong in characterizing their GTAT holdings as an investment. These people were speculating and paid a high price.

2019: SEC's Anita Bandy

"GT and its CEO painted a rosy picture of the company's performance and ability to obtain funding that was paramount to GT's survival while they were aware of information that would have catastrophic consequences for the company," wrote Anita Bandy, an associate director for SEC enforcement.

Sapphire glass screens were just the first big step to using new, innovative materials. But because the deal went bad, out the window went the using all that intellectual property that Apple gobbled up. Remember all those little companies; like consistently 10-15 each quarter that Apple would buy out? Remember Apple working alongside companies like Liquidmetal and Glassimetal? Those days are long over. It's a shame, maybe another firm could have successfully made the boules of sapphire?

So today Tim and Jony are very conservative and adverse to taking risks or experimenting with new technology. Thusly, we have iPhones that are still made of Gorilla glass and aluminum and look and preform pretty much as the the last model you just traded in. You visually can't tell the difference between an iMac made in 2010 or one made in 2020. A Magic Mouse is preforming the same magic as 2009. Etc. etc. etc.

I remember the conference call after the GT debacle and Apple lost that $200 and what ever million; Apple reported making so much God damn money that quarter, the GT $200 million loss---wasn't even mentioned. Not one analyst brought it up. CFO Peter Oppenheimer certainly didn't say a word, he didn't need to.

Btw, what do you call Apple making niche new products in gold and stainless steel and ceramic, if not experimenting with new materials design? From the outside we don’t know what the lessons of that experimentation were, but I love my stainless steel phone which now matches my Watch.

Apple still buys smaller companies from time to time, and generally does not comment on it. Same as it ever was...