Ex-Apple executives take aim at datacenter processor market

A trio of former Apple executives who worked on the iPhone maker's mobile chips have launched their own startup to design processors destined for use in data centers, with the company Nuvia recently raising $53 million in funding.

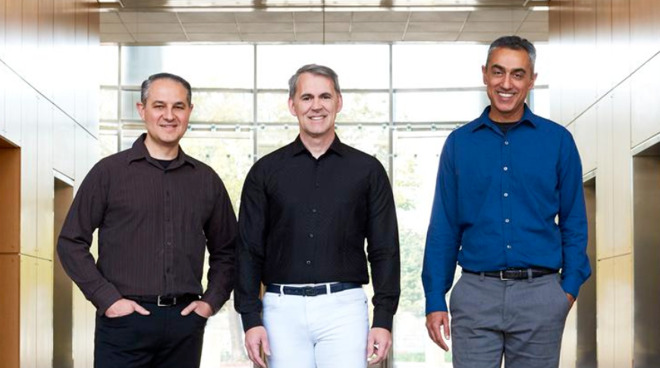

From left to right: John Bruno, Gerard Williams III, and Manu Gulati

The three founders of Nuvia are Gerard Williams III, Manu Gulati, and John Bruno, who all worked for Apple for multiple years. Williams left Apple earlier this year after spending nine years at the company, leaving his position as senior director of platform architecture, and having helped architect Apple's CPU and Systems-on-Chip development for Apple's self-designed A-series processors.

According to Williams' LinkedIn, he was the "Chief Architect for all Apple CPU and SOC development," including leading work on the Cyclone, Typhoon, Twister, Hurricane, Monsoon, and Vortex architectures.

Gulati worked on mobile SoC development for eight years at Apple, before being hired away by Google in 2017. Bruno worked on Apple's platform architecture group for five years after spending time at AMD, before making a similar exit to Google.

Reuters reports the trio are using their backgrounds in mobile chip development and the creation of power-efficient but powerful processors for the iPhone and other Apple products in Nuvia, but for data center usage. By targeting a processor market that typically uses power-hungry chips, the team are hoping their self-designed chip codenamed "Phoenix" will offer performance gains and lower energy usage, as well as more security than current server processors.

"We want to bring all these aspects that we have developed over time through our careers to this new market and really exploit them in this market, because it's an area ripe for innovation and advancement," Williams advised.

The effort puts them against industry giants like AMD and Intel who already make up the majority of server processors used today. A similar concept is also being made like other chip producers, such as Qualcomm and Marvell, who are keen to pivot their knowledge of mobile chip design towards server usage.

So far, the project has caught the attention of major server vendor Dell, who among with a number of other investors has put $53 million in funding into the startup. Dell is a major customer of Intel, so investing in potential alternatives offering power savings could be worth investigating, but the company advised it could not comment on whether Dell would use Nuvia's chips in its servers.

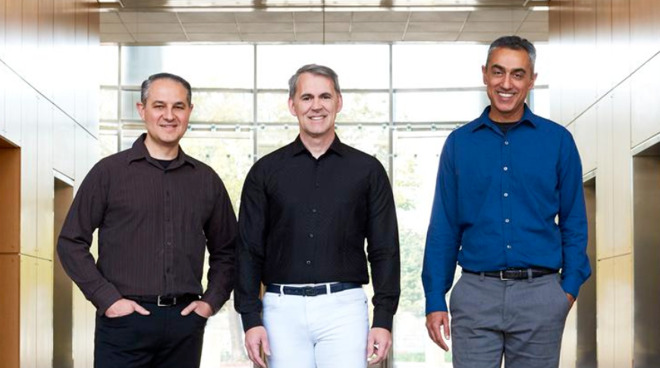

From left to right: John Bruno, Gerard Williams III, and Manu Gulati

The three founders of Nuvia are Gerard Williams III, Manu Gulati, and John Bruno, who all worked for Apple for multiple years. Williams left Apple earlier this year after spending nine years at the company, leaving his position as senior director of platform architecture, and having helped architect Apple's CPU and Systems-on-Chip development for Apple's self-designed A-series processors.

According to Williams' LinkedIn, he was the "Chief Architect for all Apple CPU and SOC development," including leading work on the Cyclone, Typhoon, Twister, Hurricane, Monsoon, and Vortex architectures.

Gulati worked on mobile SoC development for eight years at Apple, before being hired away by Google in 2017. Bruno worked on Apple's platform architecture group for five years after spending time at AMD, before making a similar exit to Google.

Reuters reports the trio are using their backgrounds in mobile chip development and the creation of power-efficient but powerful processors for the iPhone and other Apple products in Nuvia, but for data center usage. By targeting a processor market that typically uses power-hungry chips, the team are hoping their self-designed chip codenamed "Phoenix" will offer performance gains and lower energy usage, as well as more security than current server processors.

"We want to bring all these aspects that we have developed over time through our careers to this new market and really exploit them in this market, because it's an area ripe for innovation and advancement," Williams advised.

The effort puts them against industry giants like AMD and Intel who already make up the majority of server processors used today. A similar concept is also being made like other chip producers, such as Qualcomm and Marvell, who are keen to pivot their knowledge of mobile chip design towards server usage.

So far, the project has caught the attention of major server vendor Dell, who among with a number of other investors has put $53 million in funding into the startup. Dell is a major customer of Intel, so investing in potential alternatives offering power savings could be worth investigating, but the company advised it could not comment on whether Dell would use Nuvia's chips in its servers.

Comments

Samsung and Nvidia wound things down a few years ago in the ARM server space but new players have stepped in and it looks like the idea could take things up a notch again.

My guess is that Nuvia will use ARM based silicon but try to sell it to existing players instead of creating an in-house server solution. That would be biting off more than they could chew. Having Dell financing part of the initial round also points in that direction.

Taishan/Kunpeng setups and other systems are already using ARM based SoCs and hoping they will get a foothold in this space.

Whether Nuvia is ARM based or not, it should still lead to a product that serves the same goals if financing is solid.

Jim Keller obviously has been successful at moving to different companies and being successful, but even he would find it really hard to start from ground zero. If there was a person who could provide a good competitive chip product from ground zero, it’s him, but that’s like 25% of the business, whatever low number. There’s a huge skill to navigating the business side of things and there isn’t a magic bullet. It seems only the rare individual with the right personality trait like a Jobs or a Musk can do it, and they are [not] successful all the time.

These people can’t simply build an awesome server solution and buyers will come. They need to produce it on time, actively sell it, lock in big customers, continuous increment their product, and navigate a business field full of bombs.

Edit: I always forget my nots.

I suppose they can build a merchant support infrastructure for their own data centers, but you begin to see that it is a 10 year time line this way, and they say no to being a merchant ARM provider every time when they see this.

For their Macs, if it transitions to ARM, I’m still conflicted on whether they’ll go the AMD MCM route or the Intel monolithic route, though everyone is going MCM these days so perhaps moot. It seems they have no problems adding cores, be CPU or GPU or even memory channels, to their iPhone cores for iPad A-X style packages, and they only sell about 10m of those per year. If they are comfortable with that, I don’t see why they wouldn’t just add more cores, more memory channels and PCIe 4 for Macs, in a single monolithic chip and save themselves the integration work.